This version of the form is not currently in use and is provided for reference only. Download this version of

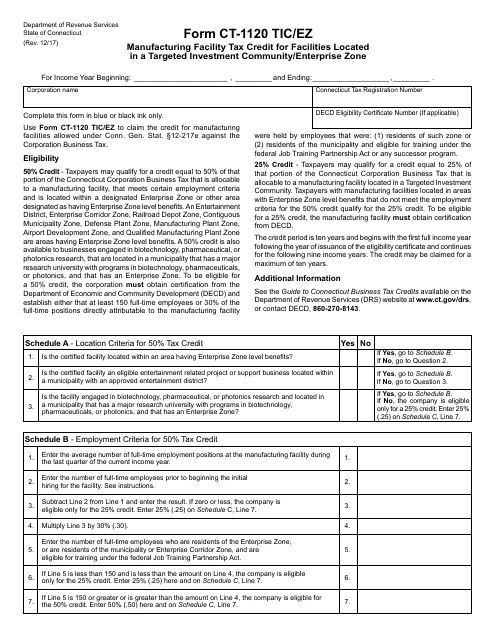

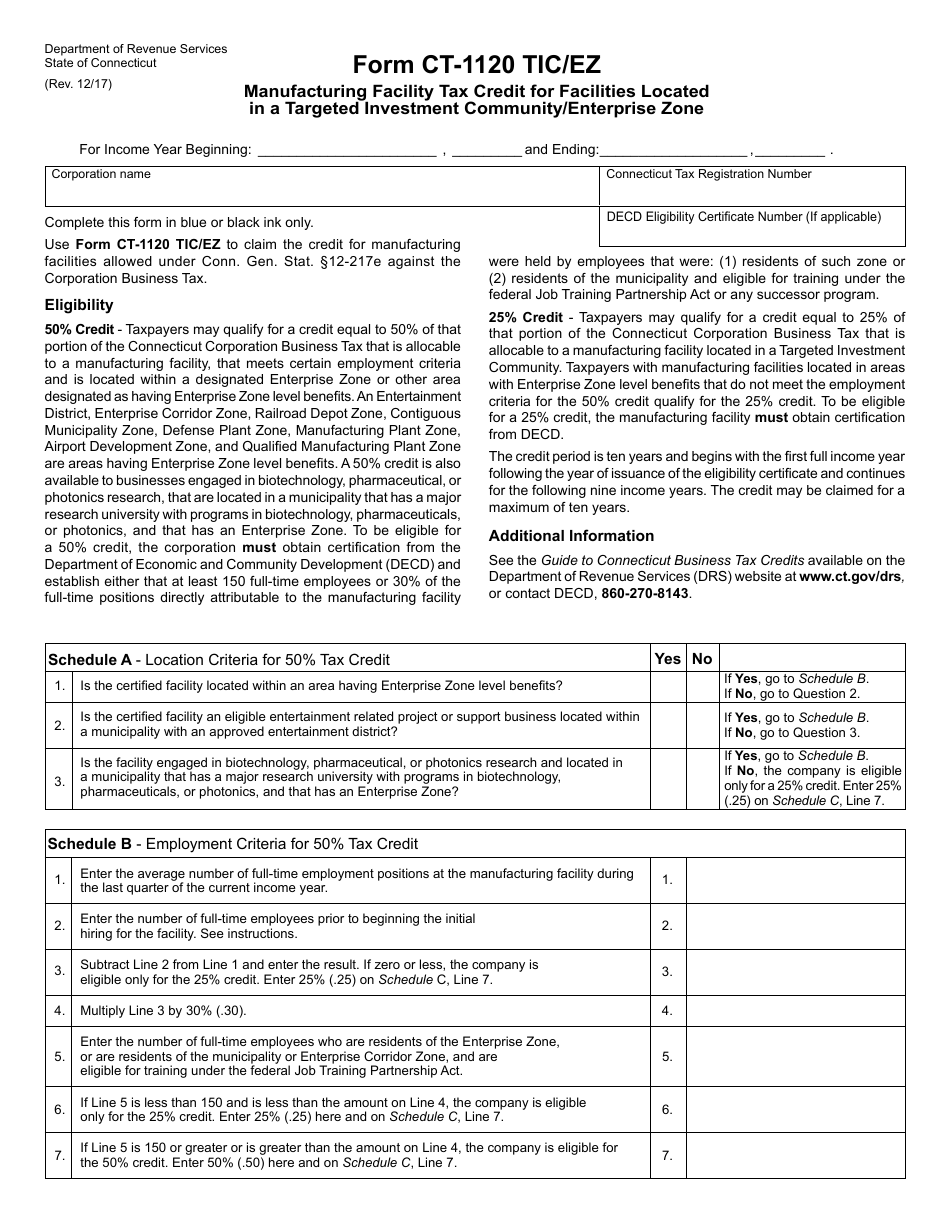

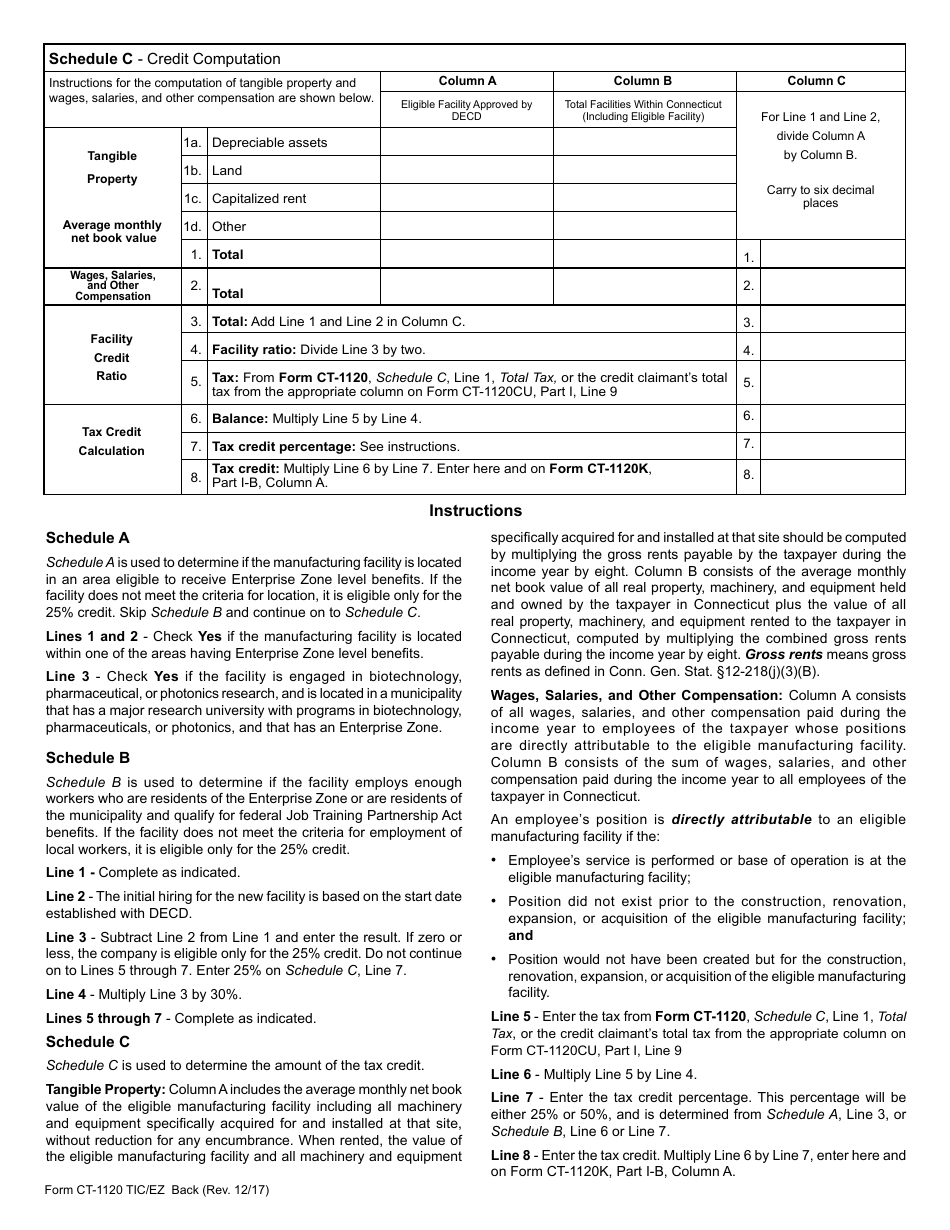

Form CT-1120 TIC/EZ

for the current year.

Form CT-1120 TIC / EZ Manufacturing Facility Tax Credit for Facilities Located in a Targeted Investment Community / Enterprise Zone - Connecticut

What Is Form CT-1120 TIC/EZ?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120 TIC/EZ?

A: Form CT-1120 TIC/EZ is a tax form for claiming the Manufacturing Facility Tax Credit for Facilities Located in a Targeted Investment Community/Enterprise Zone.

Q: What is the Manufacturing Facility Tax Credit?

A: The Manufacturing Facility Tax Credit is a credit available to businesses that operate manufacturing facilities in a Targeted Investment Community/Enterprise Zone.

Q: What is a Targeted Investment Community?

A: A Targeted Investment Community is a designated area where the state encourages economic development and investment.

Q: What is an Enterprise Zone?

A: An Enterprise Zone is a designated area where the state encourages economic development and investment.

Q: Who is eligible to claim this tax credit?

A: Businesses that operate manufacturing facilities in a Targeted Investment Community/Enterprise Zone are eligible to claim this tax credit.

Q: What is the purpose of this tax credit?

A: The purpose of this tax credit is to incentivize businesses to invest in manufacturing facilities in designated areas to promote economic development.

Q: How much is the tax credit?

A: The amount of the tax credit varies and is based on factors such as the size of the facility, the amount of investment, and the number of jobs created.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 TIC/EZ by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.