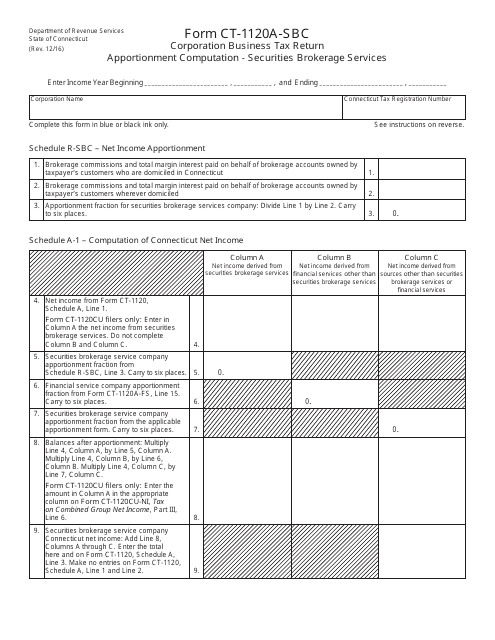

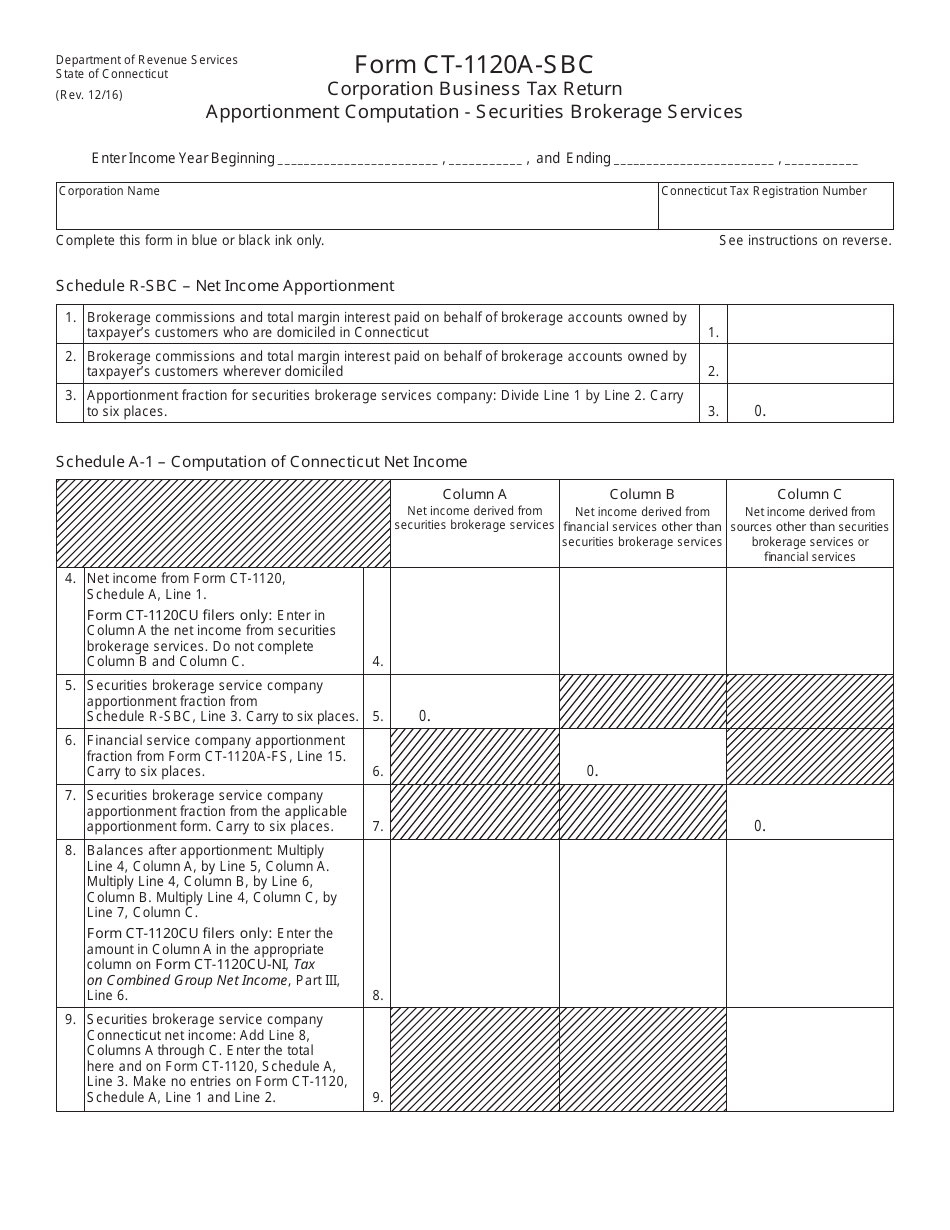

Form CT-1120A-SBC Corporation Business Tax Return - Apportionment Computation - Securities Brokerage Services - Connecticut

What Is Form CT-1120A-SBC?

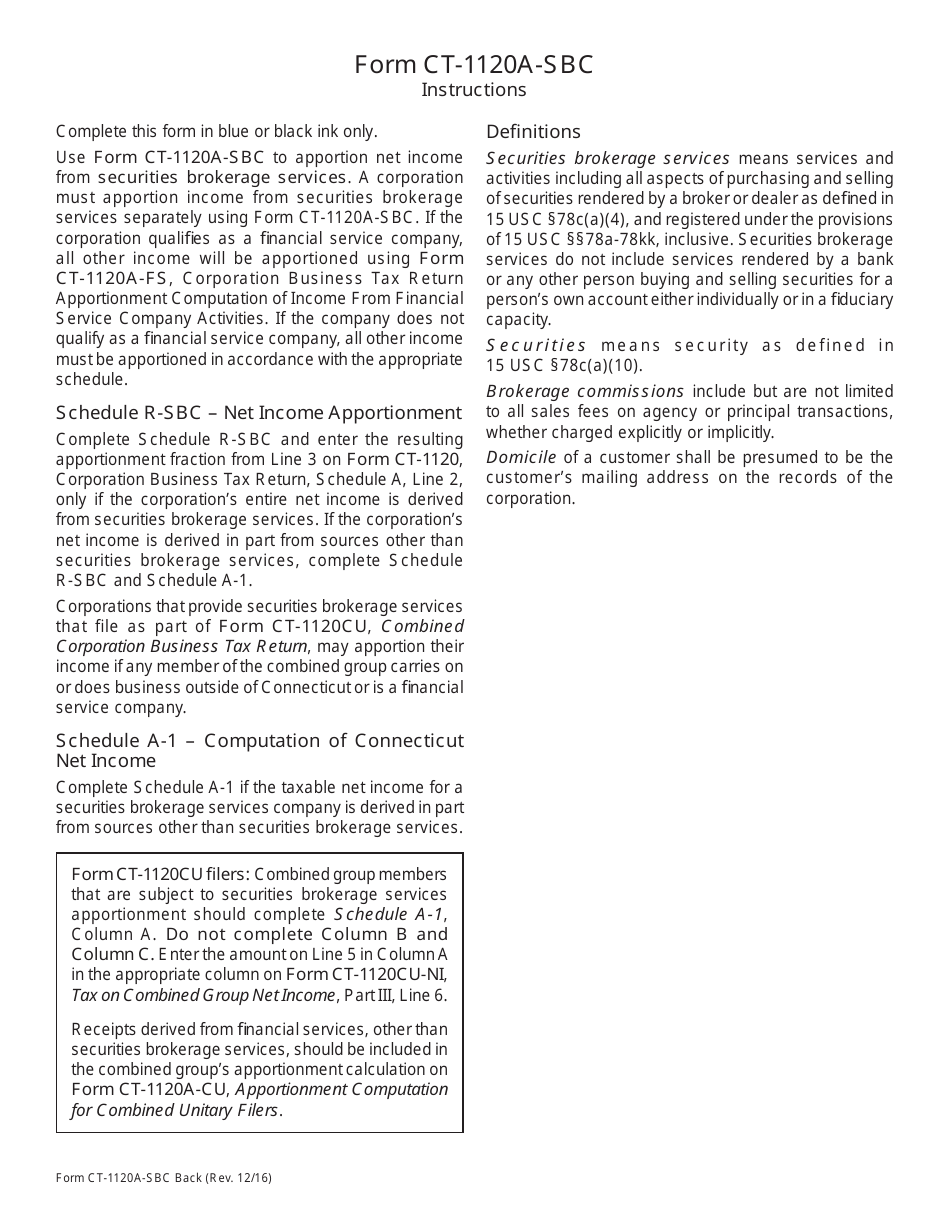

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120A-SBC?

A: Form CT-1120A-SBC is a Corporation Business Tax Return used to calculate the apportionment of income for securities brokerage services in Connecticut.

Q: What is apportionment?

A: Apportionment is the process of allocating income to different states based on the proportion of business activity conducted in each state.

Q: What are securities brokerage services?

A: Securities brokerage services involve buying and selling securities, such as stocks, bonds, and mutual funds, on behalf of clients.

Q: Why is apportionment important for securities brokerage services in Connecticut?

A: Apportionment is important for securities brokerage services in Connecticut because it determines the portion of income that is subject to state taxation.

Q: Are there specific rules or formulas used for apportionment?

A: Yes, there are specific rules and formulas provided by the Connecticut Department of Revenue Services that must be followed for apportionment calculations.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120A-SBC by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.