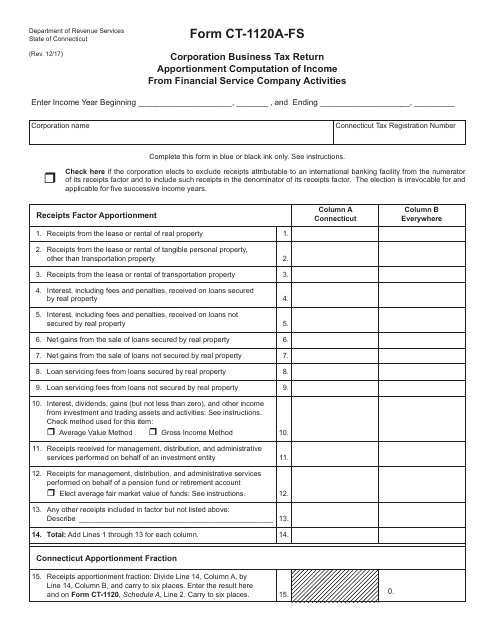

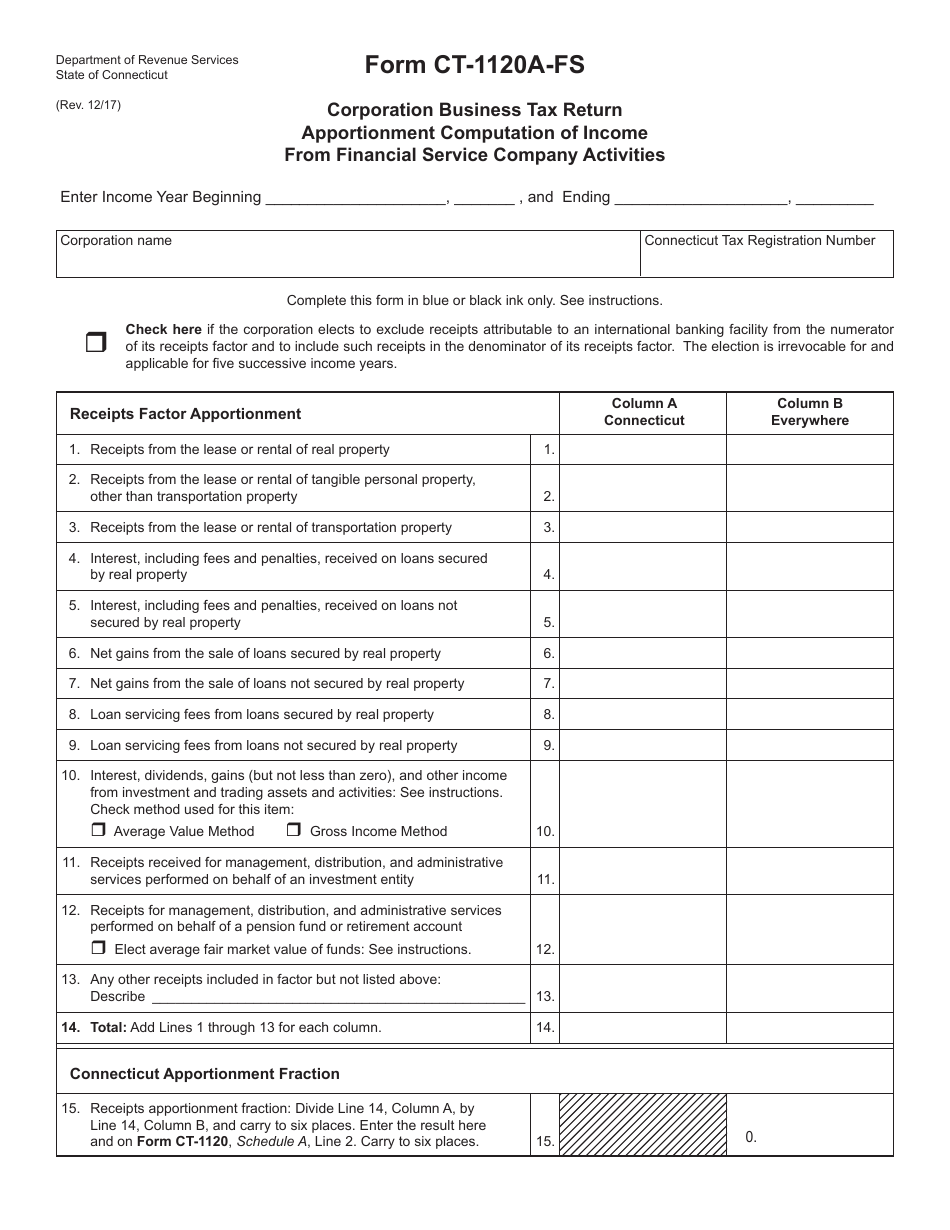

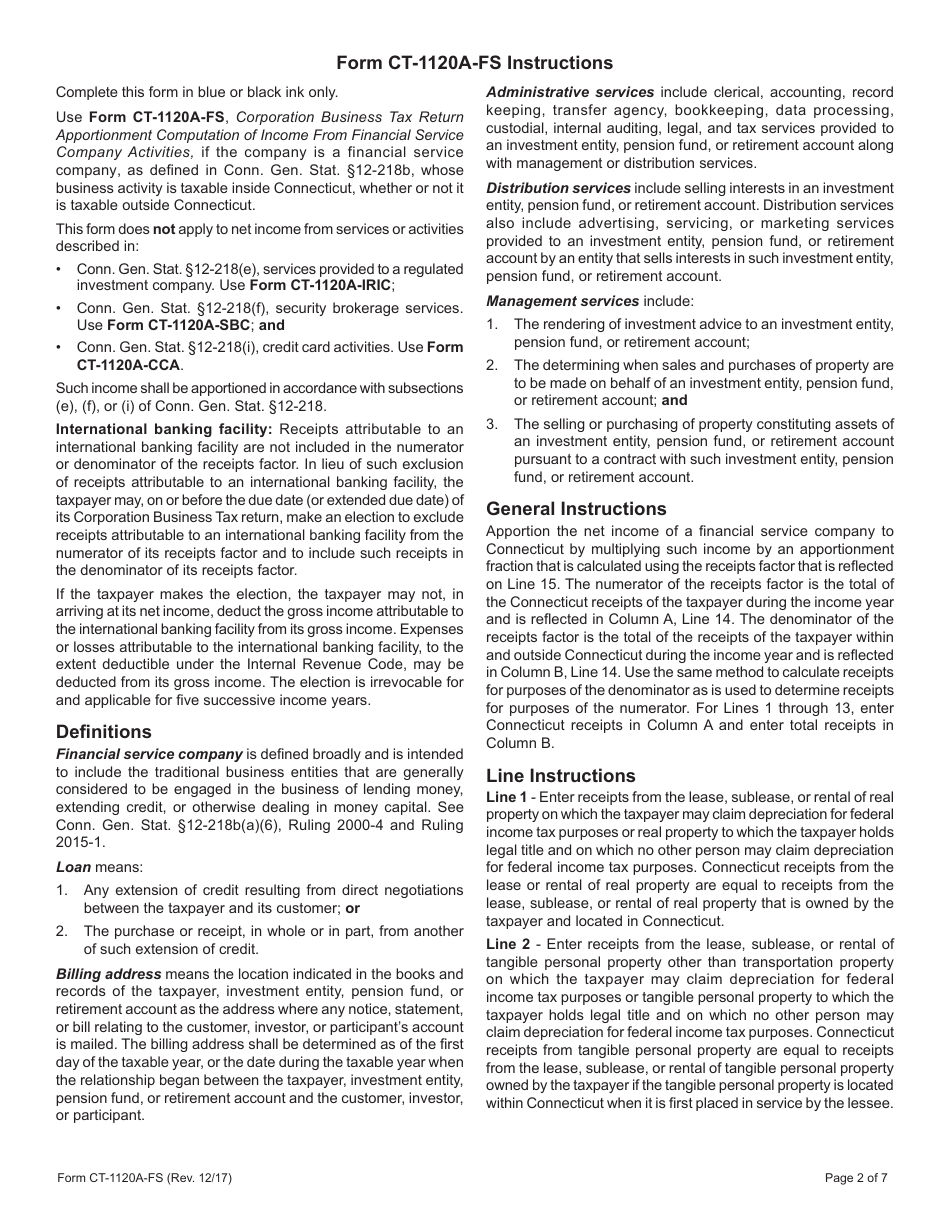

Form CT-1120A-FS Corporation Business Tax Return - Apportionment Computation of Income From Financial Service Company Activities - Connecticut

What Is Form CT-1120A-FS?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120A-FS?

A: Form CT-1120A-FS is the Corporation Business Tax Return for the Apportionment Computation of Income From Financial Service Company Activities in Connecticut.

Q: Who needs to file Form CT-1120A-FS?

A: Corporations engaged in financial service activities in Connecticut need to file Form CT-1120A-FS.

Q: What is the purpose of Form CT-1120A-FS?

A: The purpose of Form CT-1120A-FS is to calculate the apportionment of income from financial service company activities in Connecticut for tax purposes.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120A-FS by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.