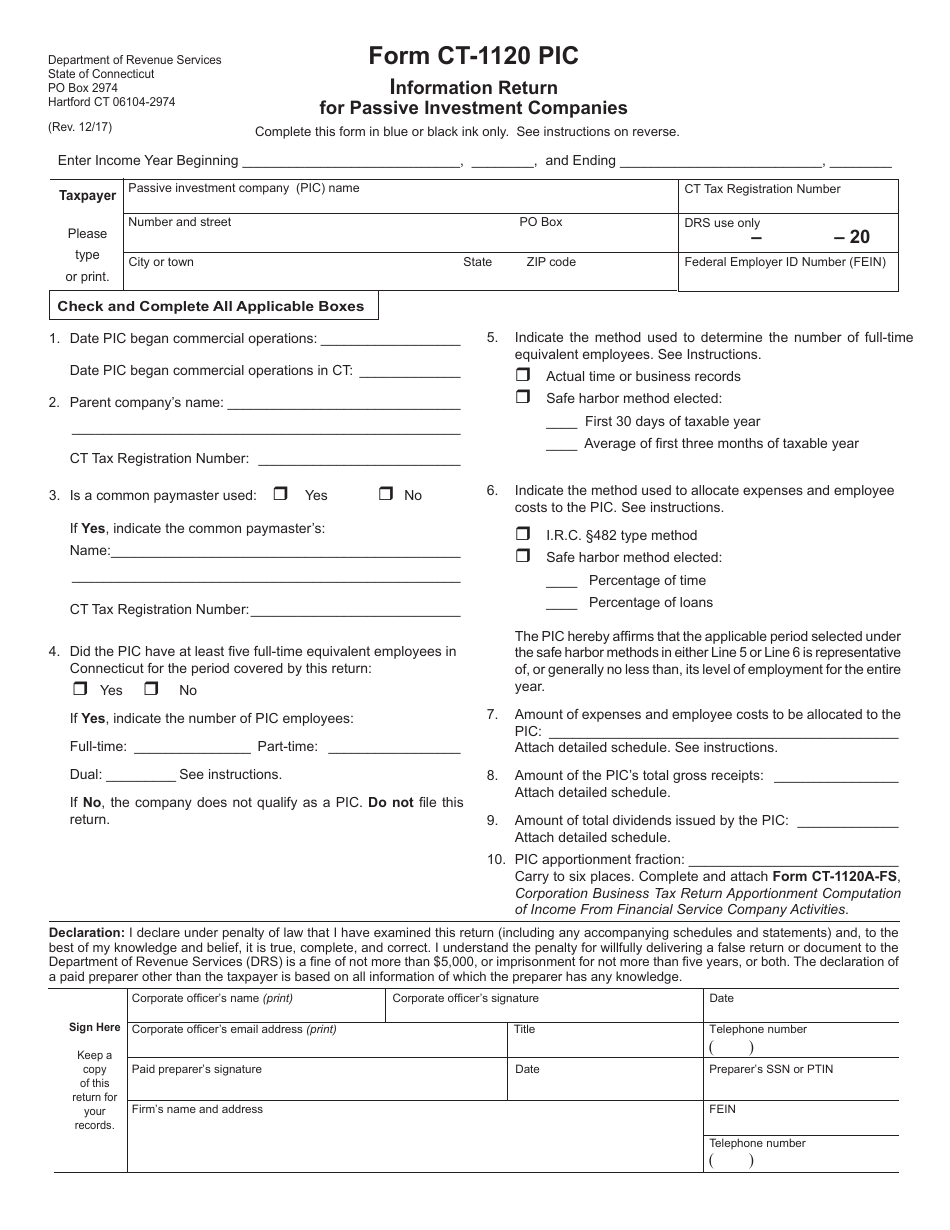

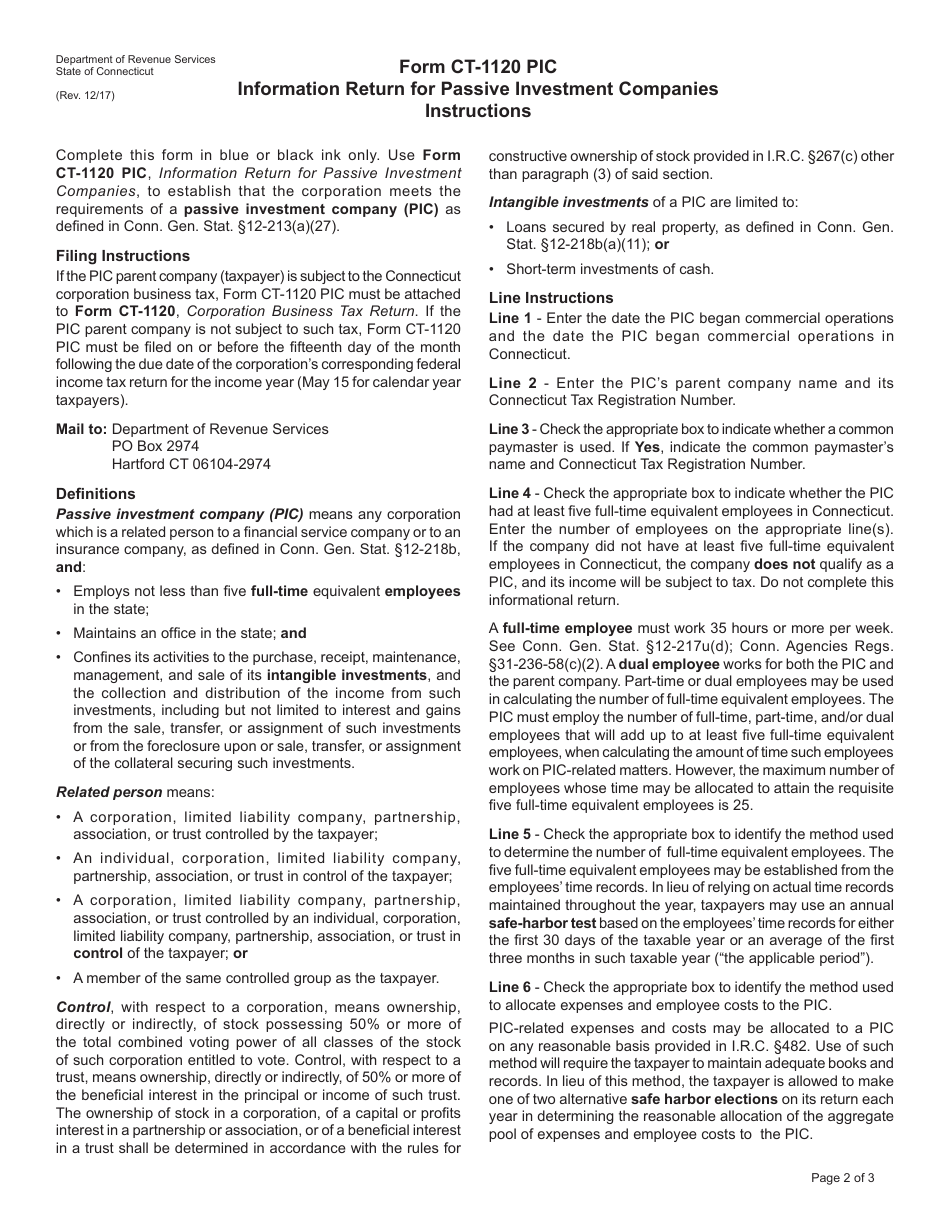

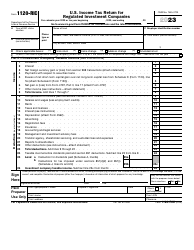

Form CT-1120 PIC Information Return for Passive Investment Companies - Connecticut

What Is Form CT-1120 PIC?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CT-1120 PIC?

A: The Form CT-1120 PIC is the Information Return for Passive Investment Companies in Connecticut.

Q: Who needs to file Form CT-1120 PIC?

A: Passive Investment Companies in Connecticut need to file Form CT-1120 PIC.

Q: What is a Passive Investment Company?

A: A Passive Investment Company is a company that primarily earns income from investments like stocks, bonds, and other passive activities.

Q: What information is required on Form CT-1120 PIC?

A: Form CT-1120 PIC requires information about the company's income, expenses, deductions, and credits related to passive investments.

Q: When is the deadline to file Form CT-1120 PIC?

A: The deadline to file Form CT-1120 PIC is the same as the company's federal income tax deadline, usually on April 15th.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 PIC by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.