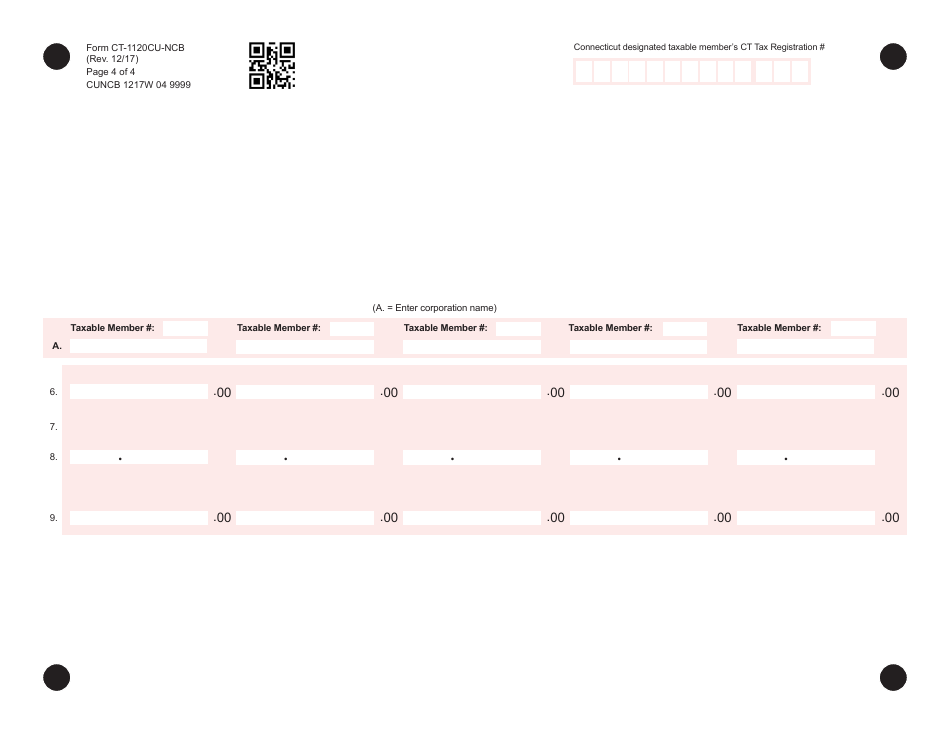

This version of the form is not currently in use and is provided for reference only. Download this version of

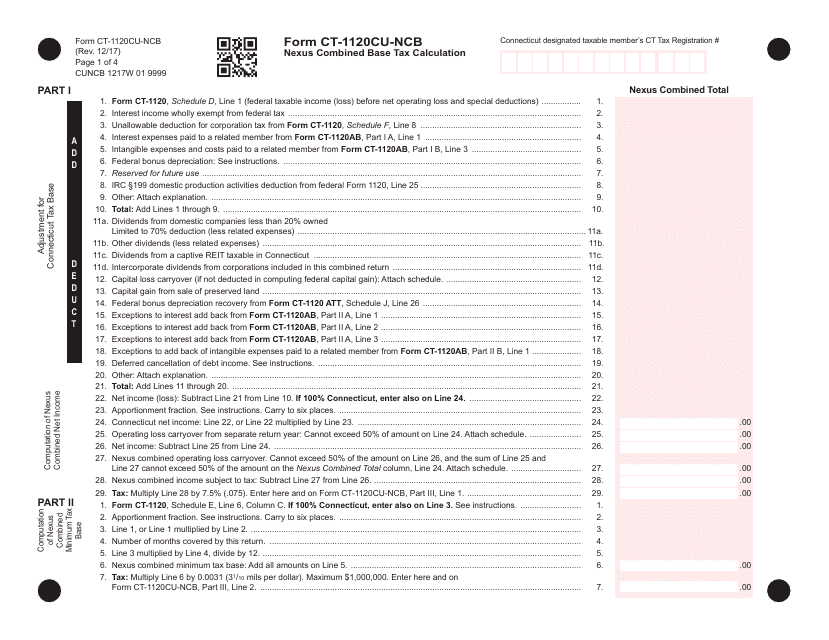

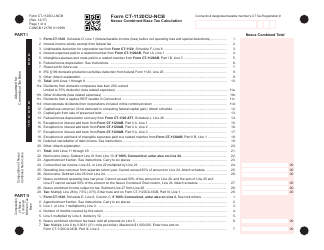

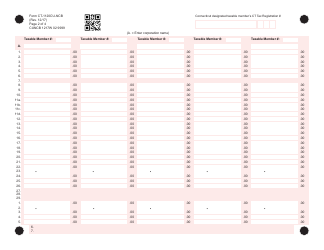

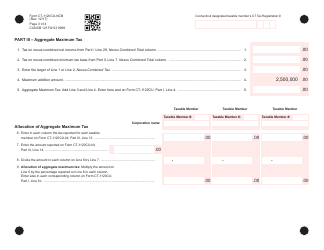

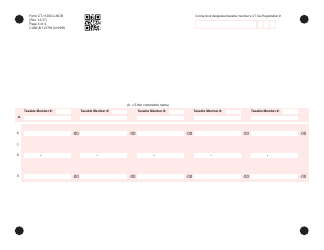

Form CT-1120CU-NCB

for the current year.

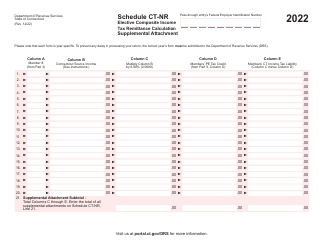

Form CT-1120CU-NCB Nexus Combined Base Tax Calculation - Connecticut

What Is Form CT-1120CU-NCB?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120CU-NCB?

A: Form CT-1120CU-NCB is a tax form used for calculating the combined base tax for entities with nexus in Connecticut.

Q: Who needs to file Form CT-1120CU-NCB?

A: Entities that have nexus in Connecticut and need to calculate their combined base tax should file Form CT-1120CU-NCB.

Q: What is the purpose of Form CT-1120CU-NCB?

A: The purpose of this form is to determine the combined base tax for entities with nexus in Connecticut.

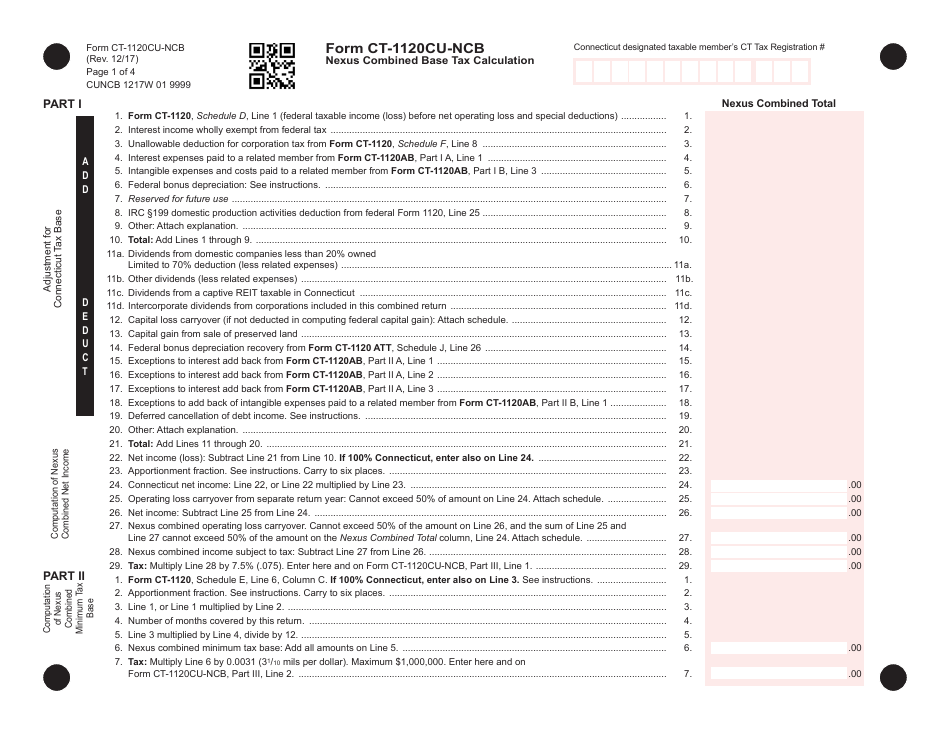

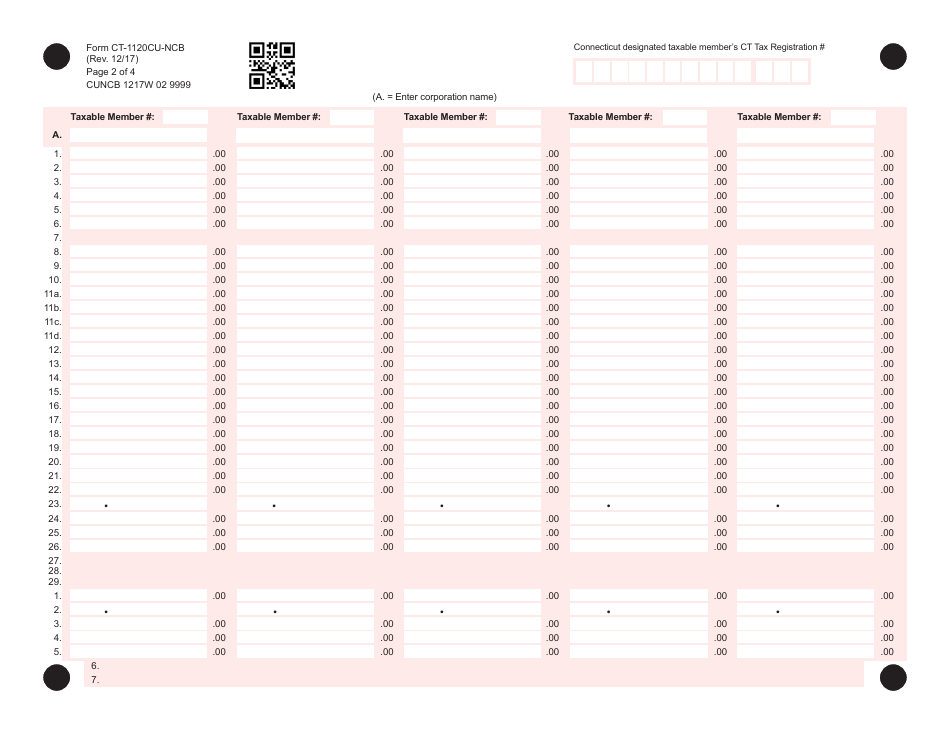

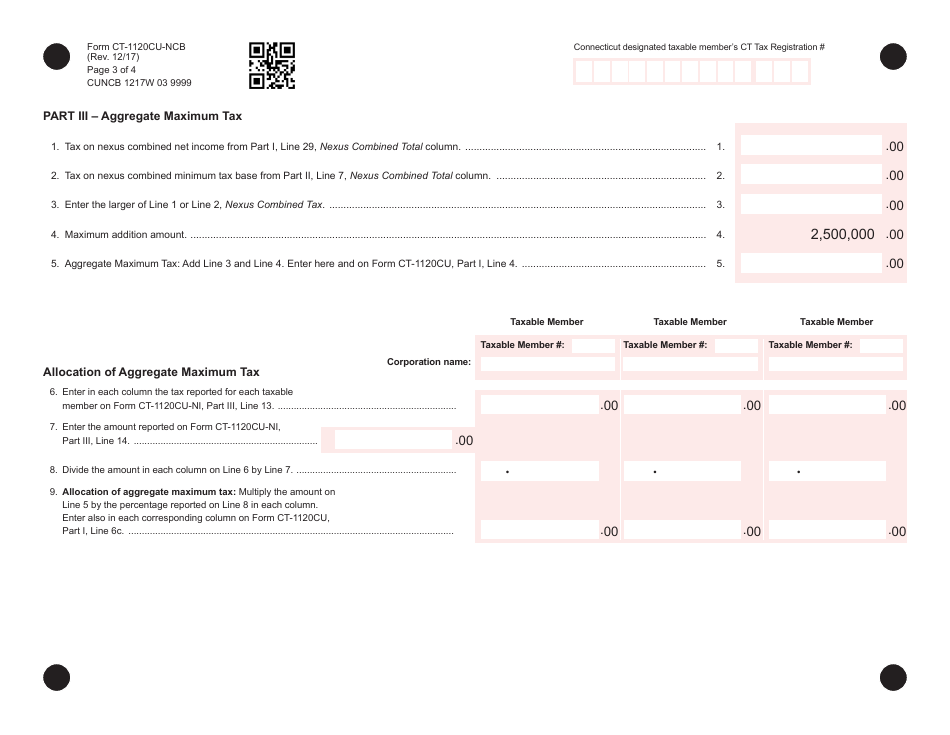

Q: What information is required to complete Form CT-1120CU-NCB?

A: To complete this form, you will need information about your entity's income, deductions, Connecticut apportionment factors, and the applicable tax rates.

Q: When is Form CT-1120CU-NCB due?

A: The due date for filing Form CT-1120CU-NCB varies and is typically based on the entity's tax year.

Q: Are there any penalties for not filing Form CT-1120CU-NCB?

A: Yes, failure to file Form CT-1120CU-NCB or filing it late can result in penalties and interest charges.

Q: Can Form CT-1120CU-NCB be filed electronically?

A: Yes, Connecticut allows electronic filing of Form CT-1120CU-NCB.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120CU-NCB by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.