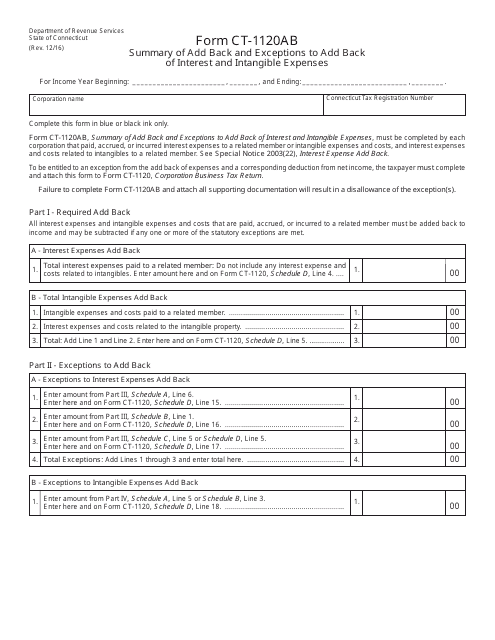

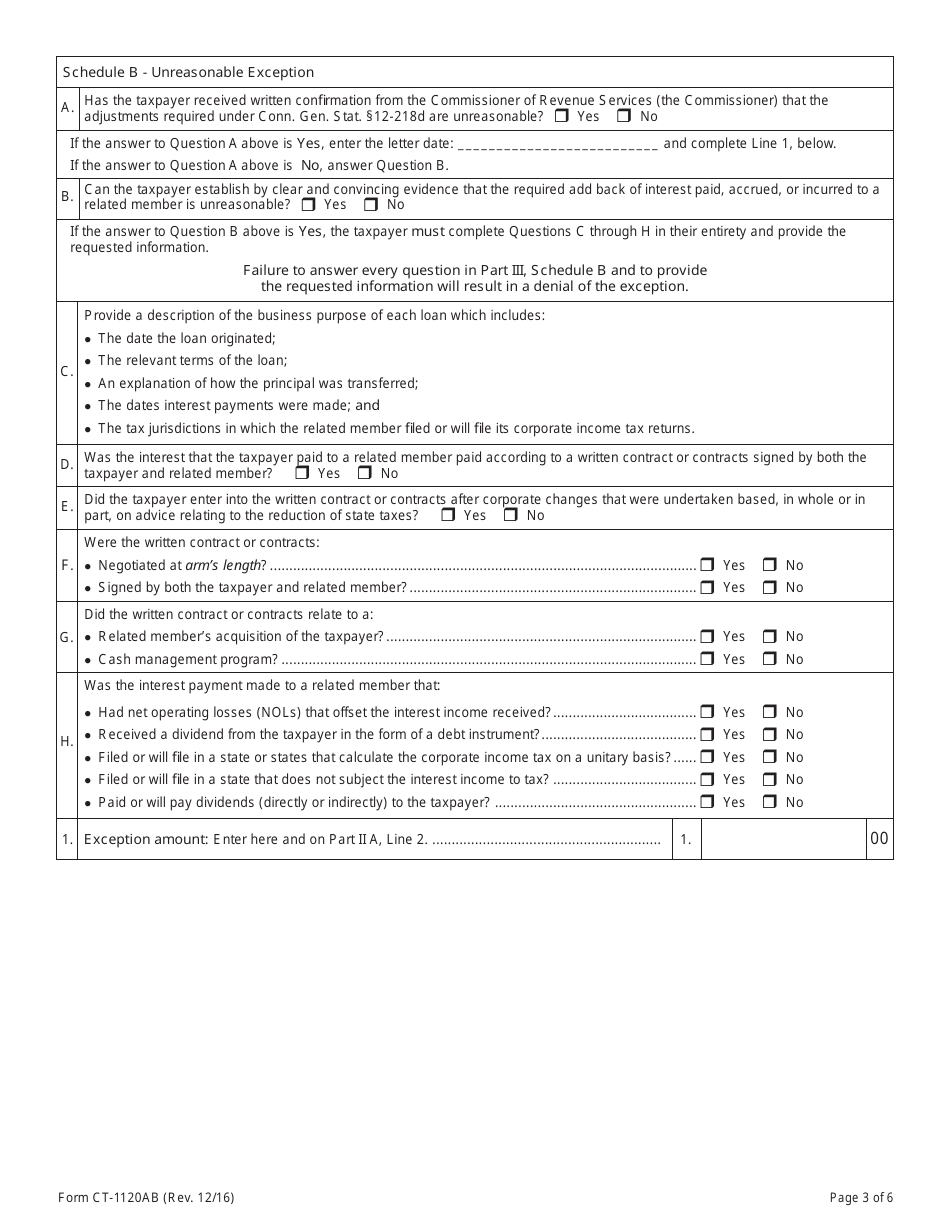

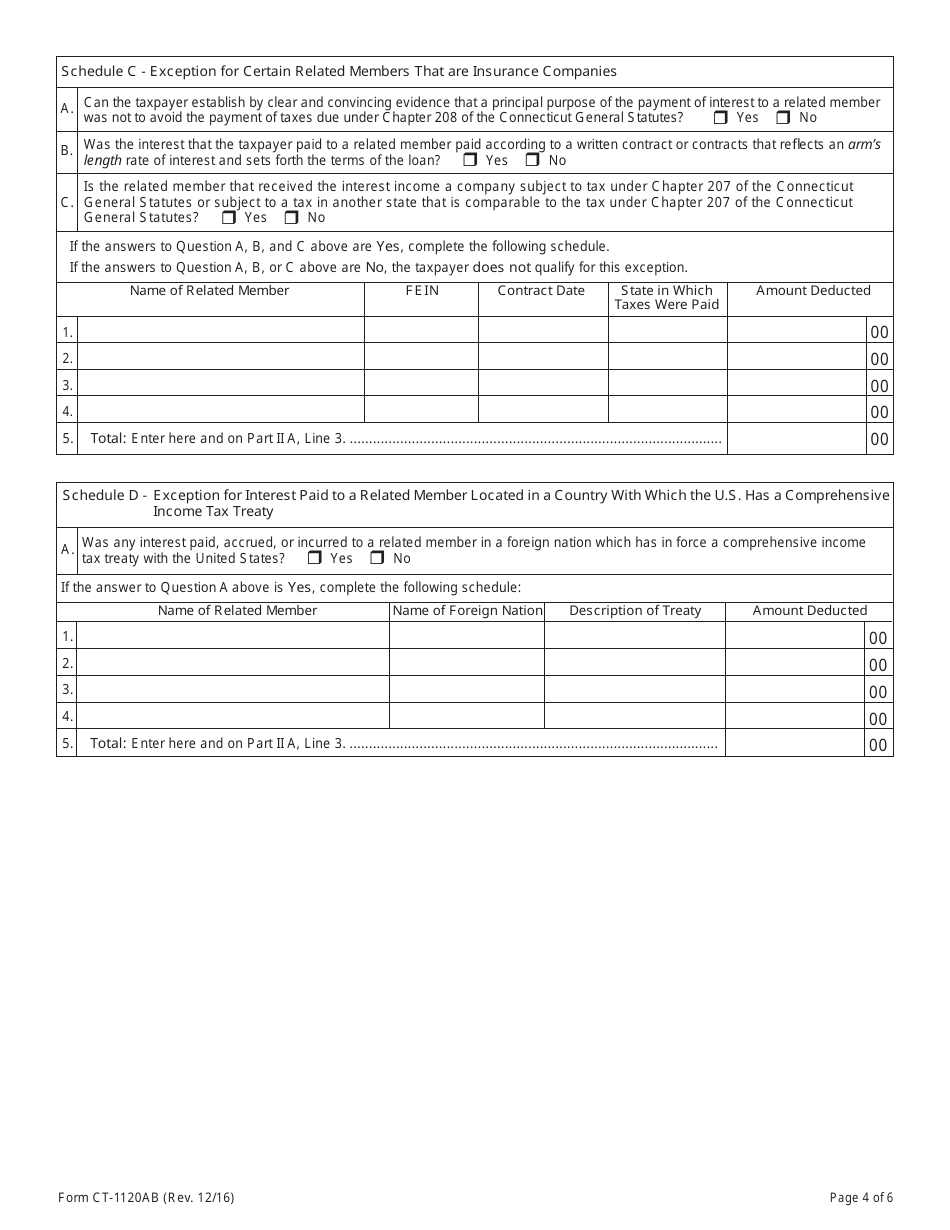

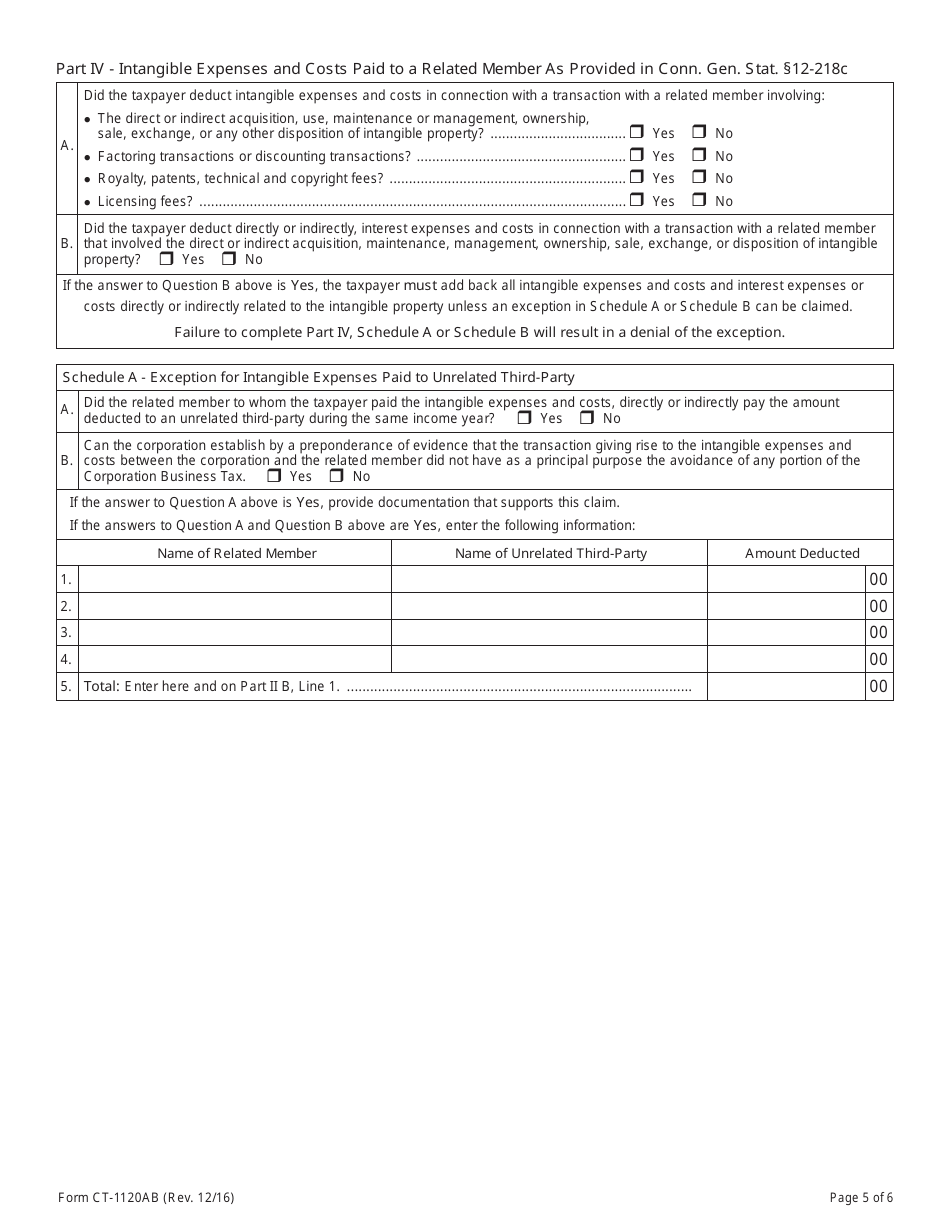

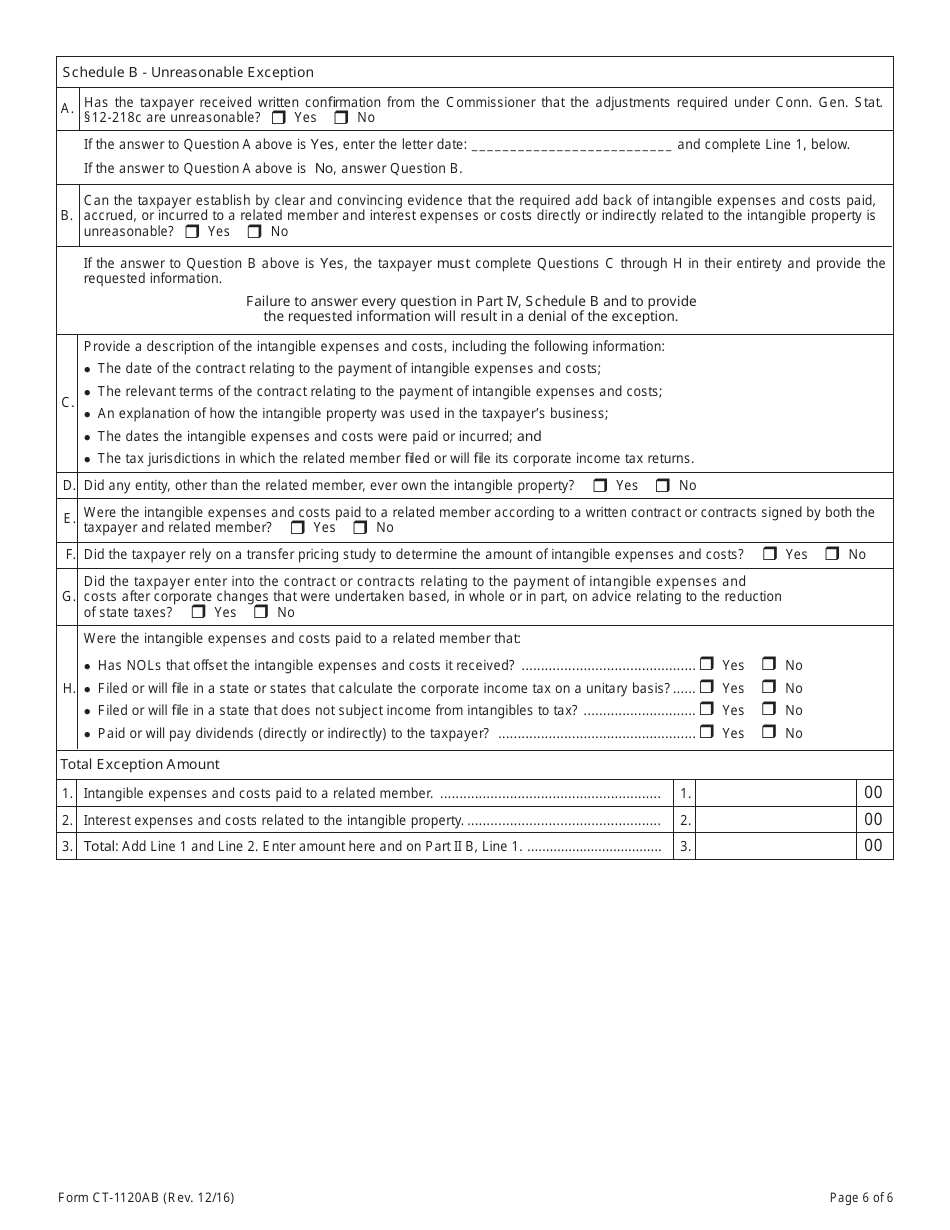

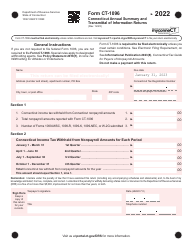

Form CT-1120AB Summary of Add Back and Exceptions to Add Back of Interest and Intangible Expenses - Connecticut

What Is Form CT-1120AB?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

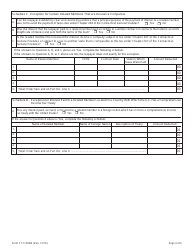

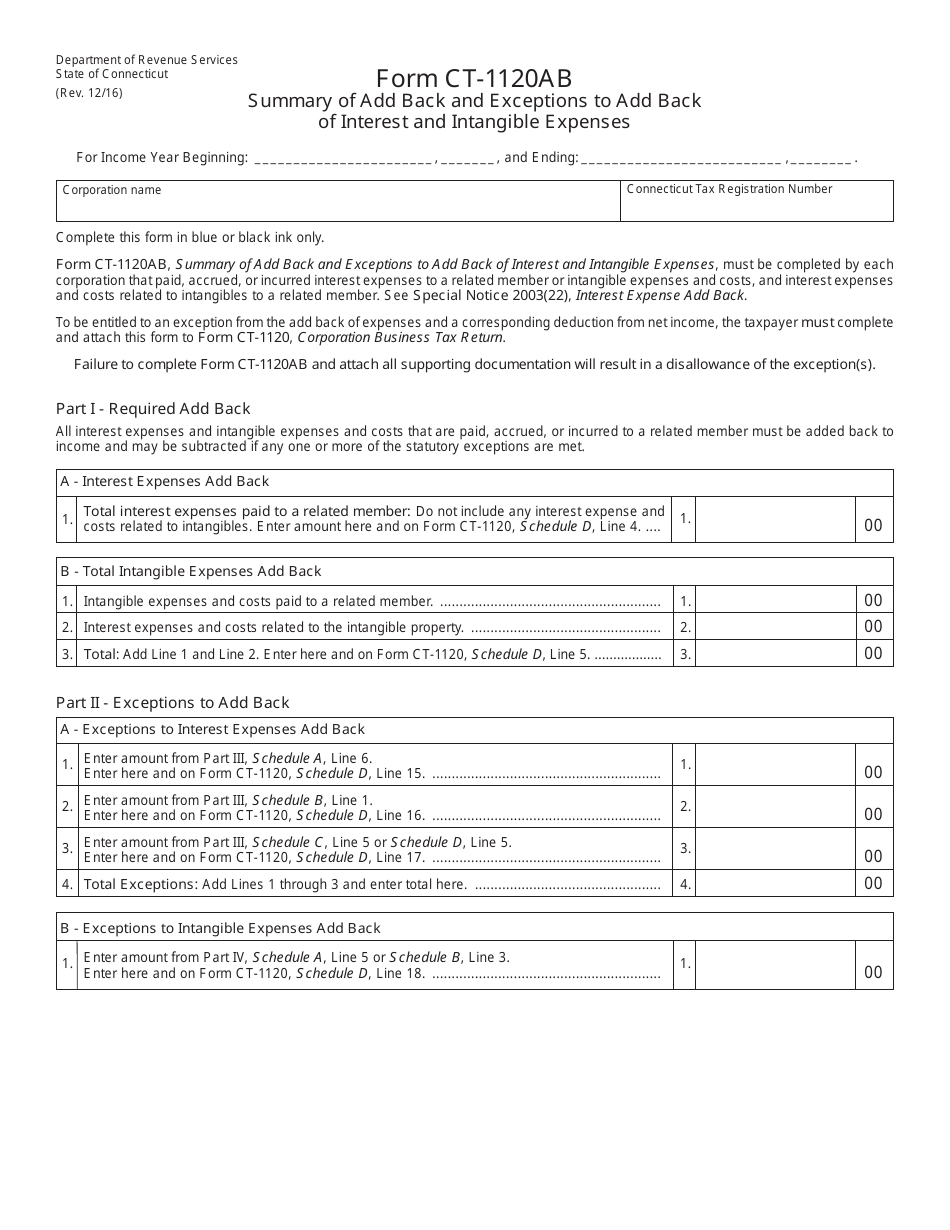

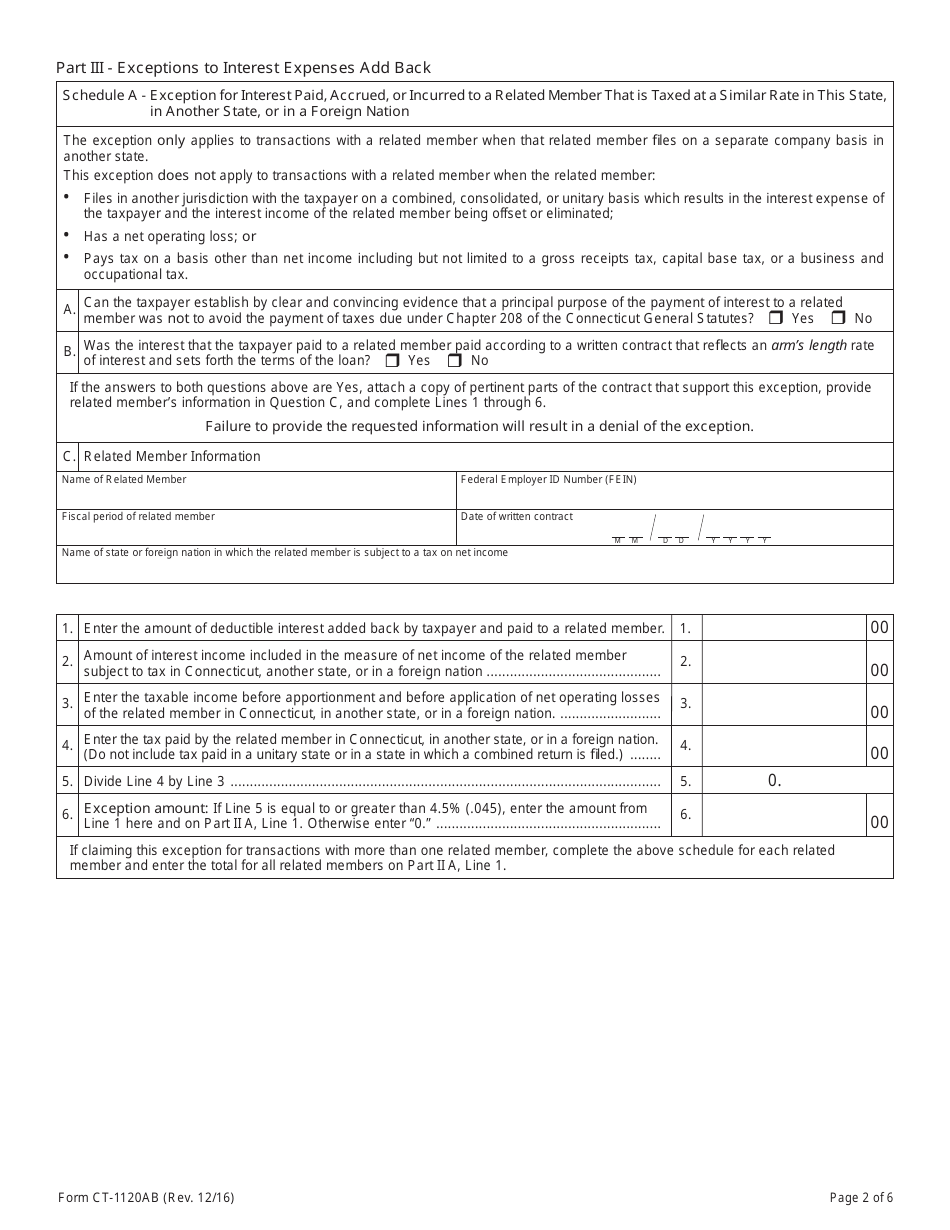

Q: What is Form CT-1120AB?

A: Form CT-1120AB is a summary of add back and exceptions to add back of interest and intangible expenses in Connecticut.

Q: What does Form CT-1120AB summarize?

A: Form CT-1120AB summarizes add back and exceptions to add back of interest and intangible expenses.

Q: Why do I need to file Form CT-1120AB?

A: You need to file Form CT-1120AB to report and calculate the add back and exceptions to add back of interest and intangible expenses for Connecticut tax purposes.

Q: Is Form CT-1120AB only for businesses?

A: Yes, Form CT-1120AB is specifically for businesses.

Q: What types of expenses are included in Form CT-1120AB?

A: Form CT-1120AB includes add back and exceptions to add back of interest and intangible expenses.

Q: Do I need to file Form CT-1120AB every year?

A: Yes, you need to file Form CT-1120AB every year if you have add back and exceptions to add back of interest and intangible expenses for Connecticut tax purposes.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120AB by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.