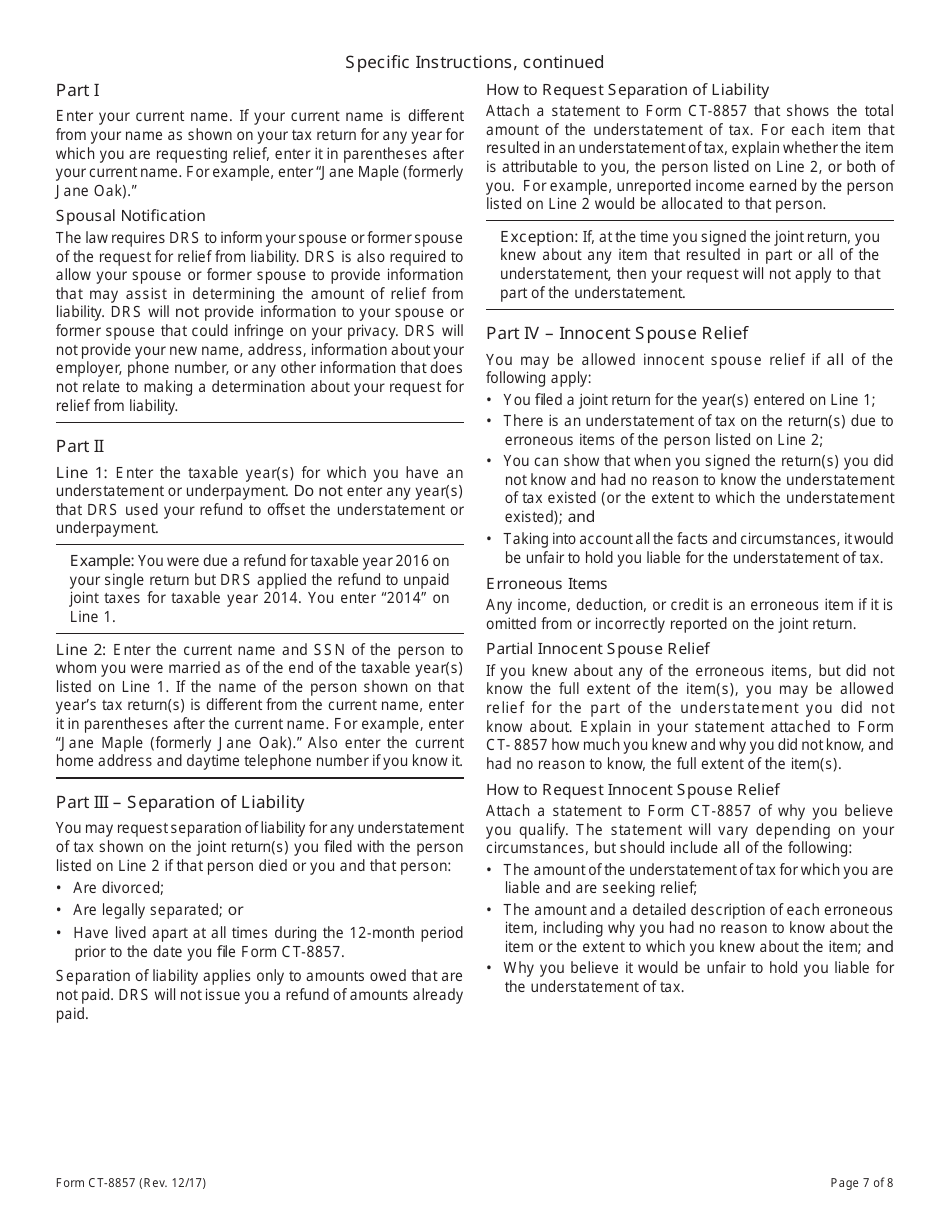

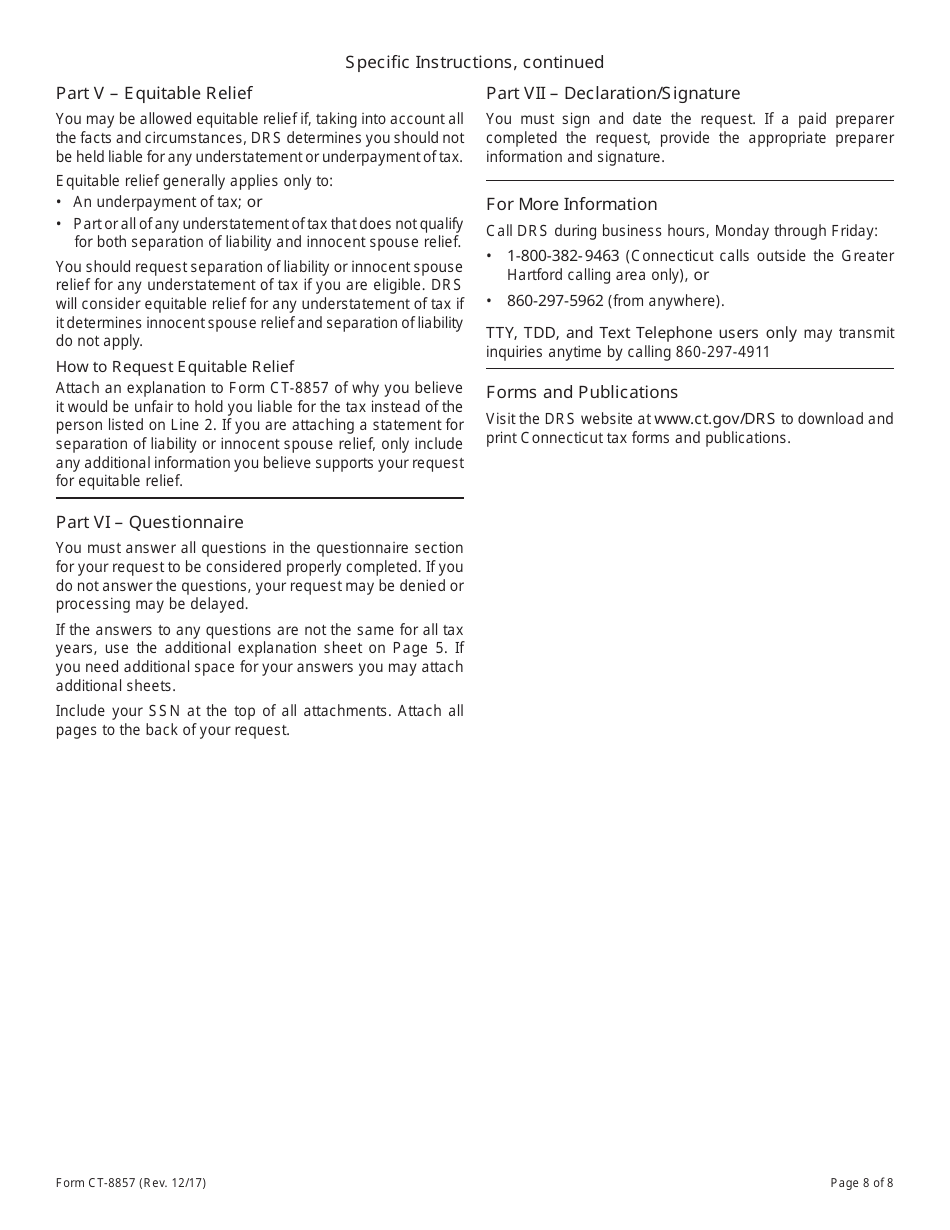

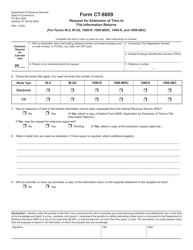

This version of the form is not currently in use and is provided for reference only. Download this version of

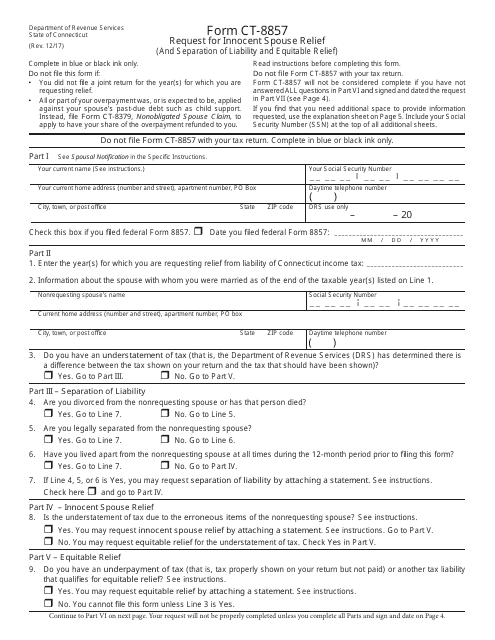

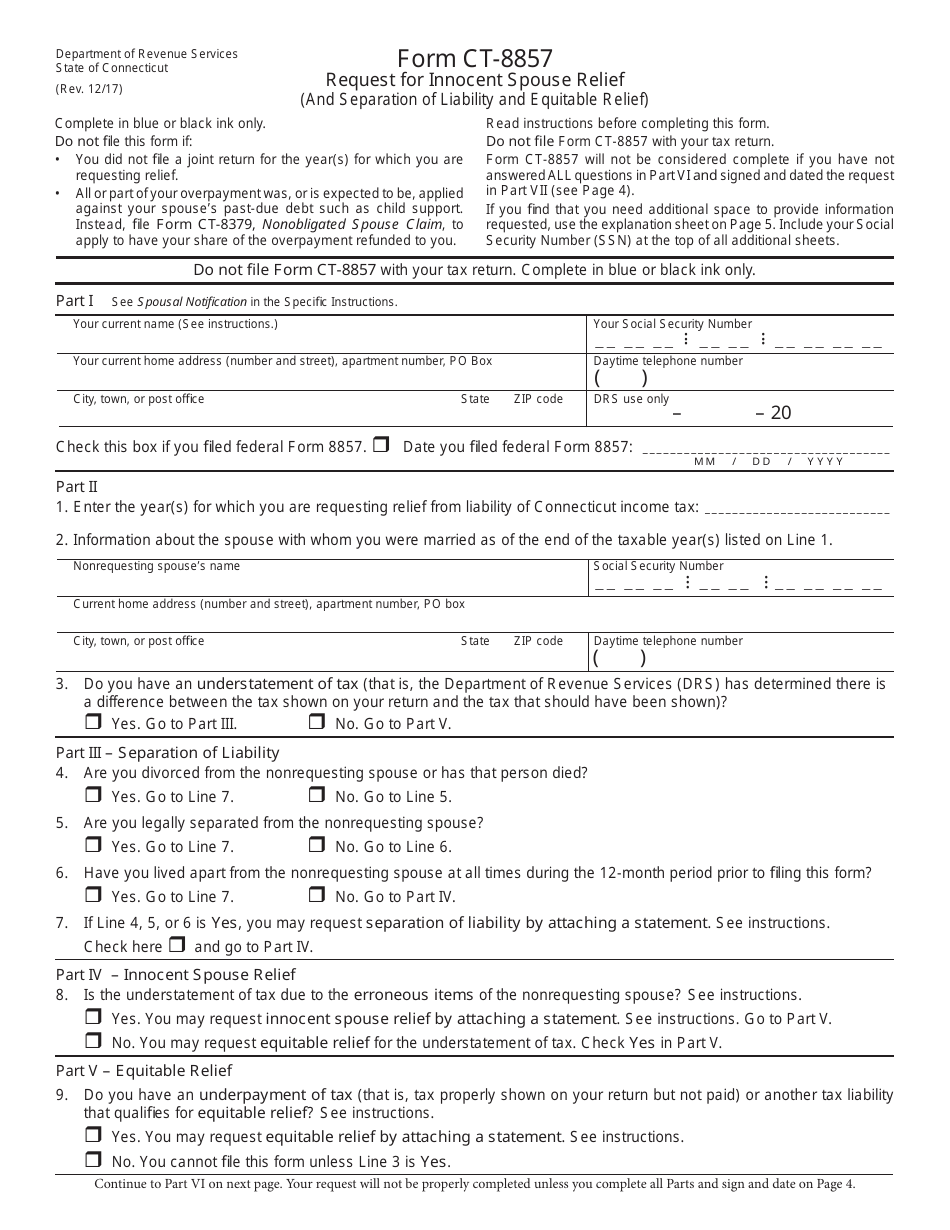

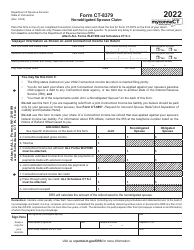

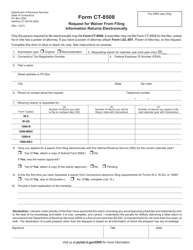

Form CT-8857

for the current year.

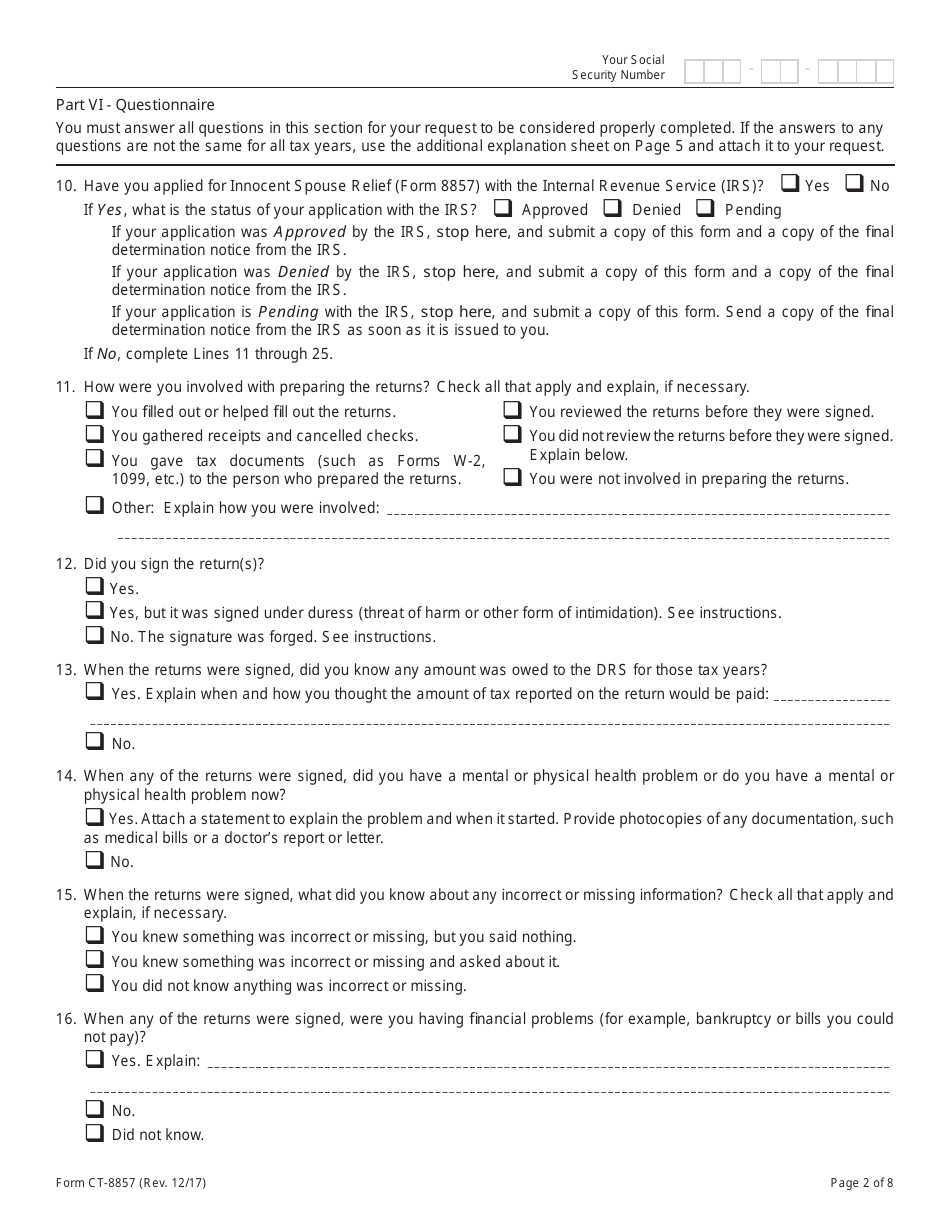

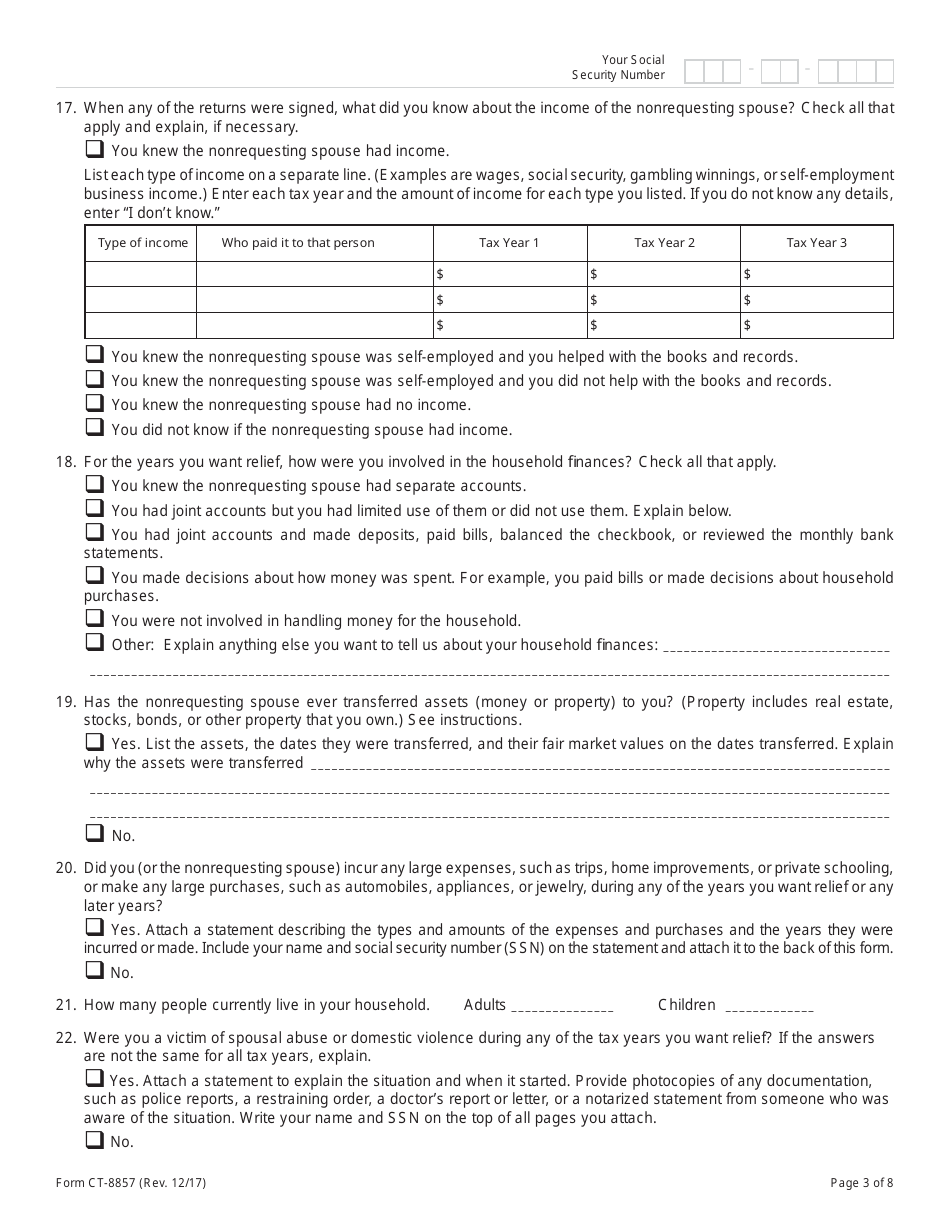

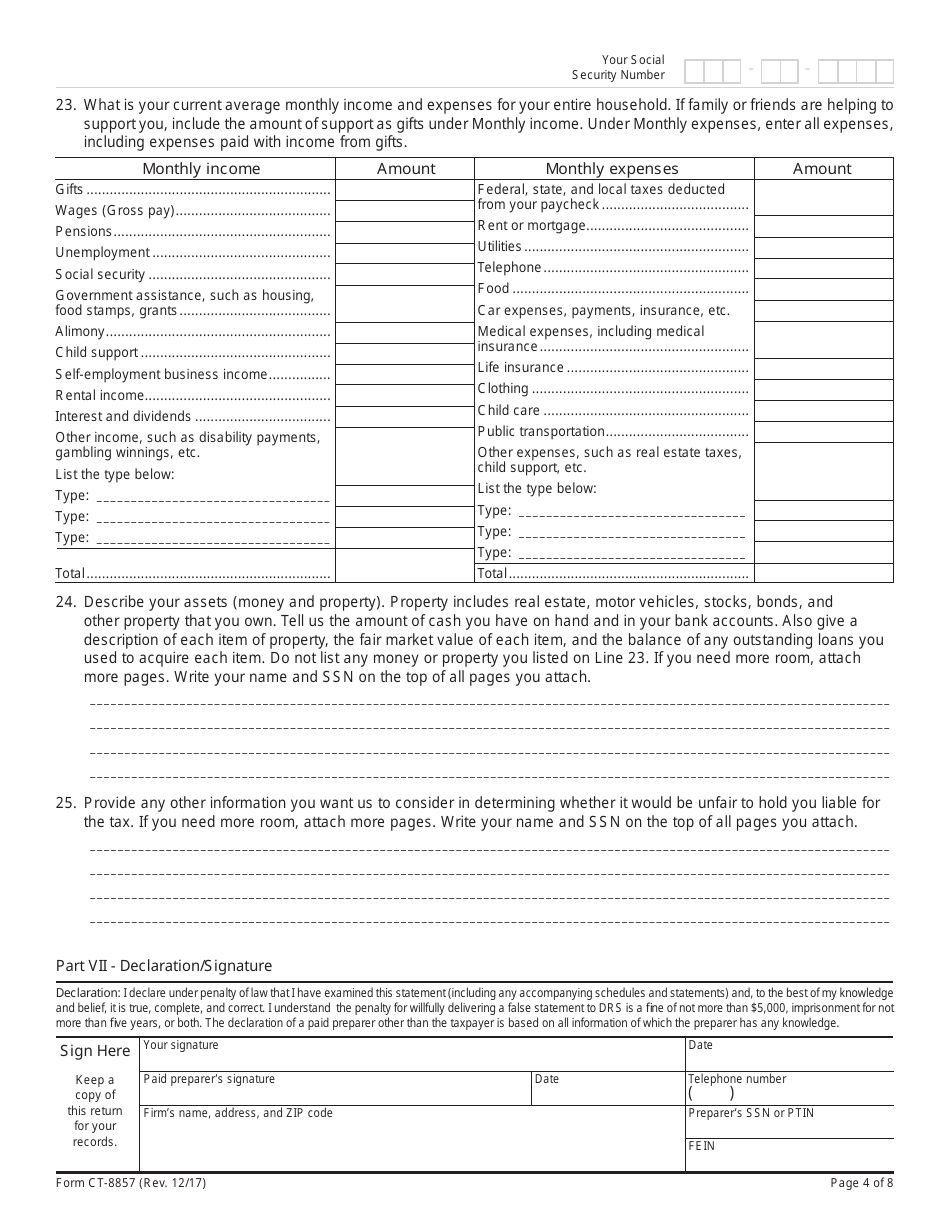

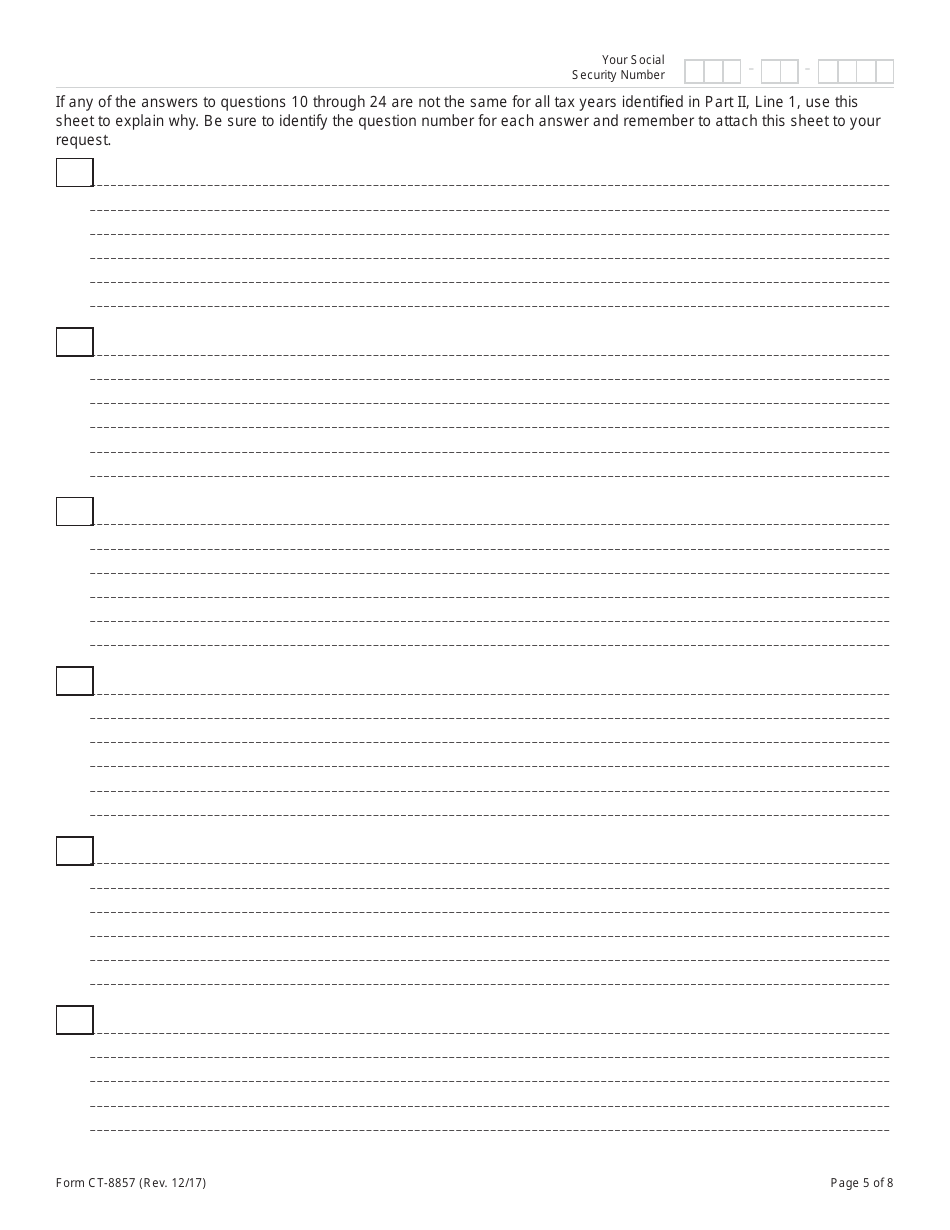

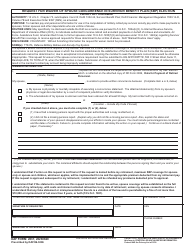

Form CT-8857 Request for Innocent Spouse Relief (And Separation of Liability and Equitable Relief) - Connecticut

What Is Form CT-8857?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

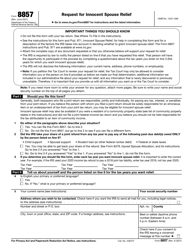

Q: What is Form CT-8857?

A: Form CT-8857 is a request forinnocent spouse relief, separation of liability, and equitable relief in Connecticut.

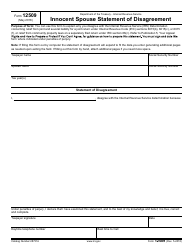

Q: What is innocent spouse relief?

A: Innocent spouse relief is a provision that allows a spouse to be relieved from joint tax liability if their partner improperly reported or omitted income on their tax return.

Q: What is separation of liability relief?

A: Separation of liability relief allows a spouse to allocate understated or unpaid taxes owed on a joint return between them and their spouse.

Q: What is equitable relief?

A: Equitable relief is another type of relief available to a spouse who does not qualify for innocent spouse relief or separation of liability relief.

Q: Who can file Form CT-8857?

A: Form CT-8857 can be filed by an innocent spouse, a separated spouse claiming separation of liability, or an individual seeking equitable relief.

Q: What is the purpose of Form CT-8857?

A: The purpose of Form CT-8857 is to request relief from joint tax liability in Connecticut.

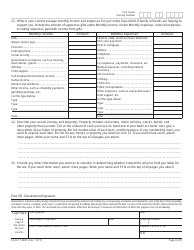

Q: What supporting documentation is required for Form CT-8857?

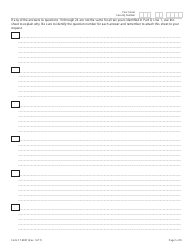

A: The specific documentation required may vary, but generally, you will need to provide evidence to support your request for relief.

Q: Is there a deadline for filing Form CT-8857?

A: Yes, there is a deadline for filing Form CT-8857. It should be filed within two years from the date the Department initially attempts to collect the tax.

Q: Can I file Form CT-8857 electronically?

A: No, Form CT-8857 cannot be filed electronically. It must be mailed to the Connecticut Department of Revenue Services.

Q: What happens after filing Form CT-8857?

A: After filing Form CT-8857, the Connecticut Department of Revenue Services will review your request and supporting documentation to determine if you qualify for relief.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-8857 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.