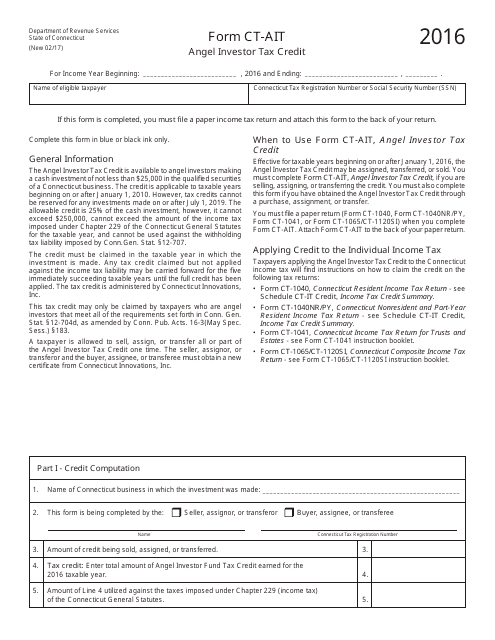

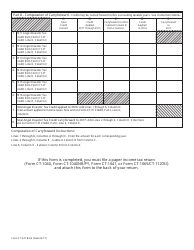

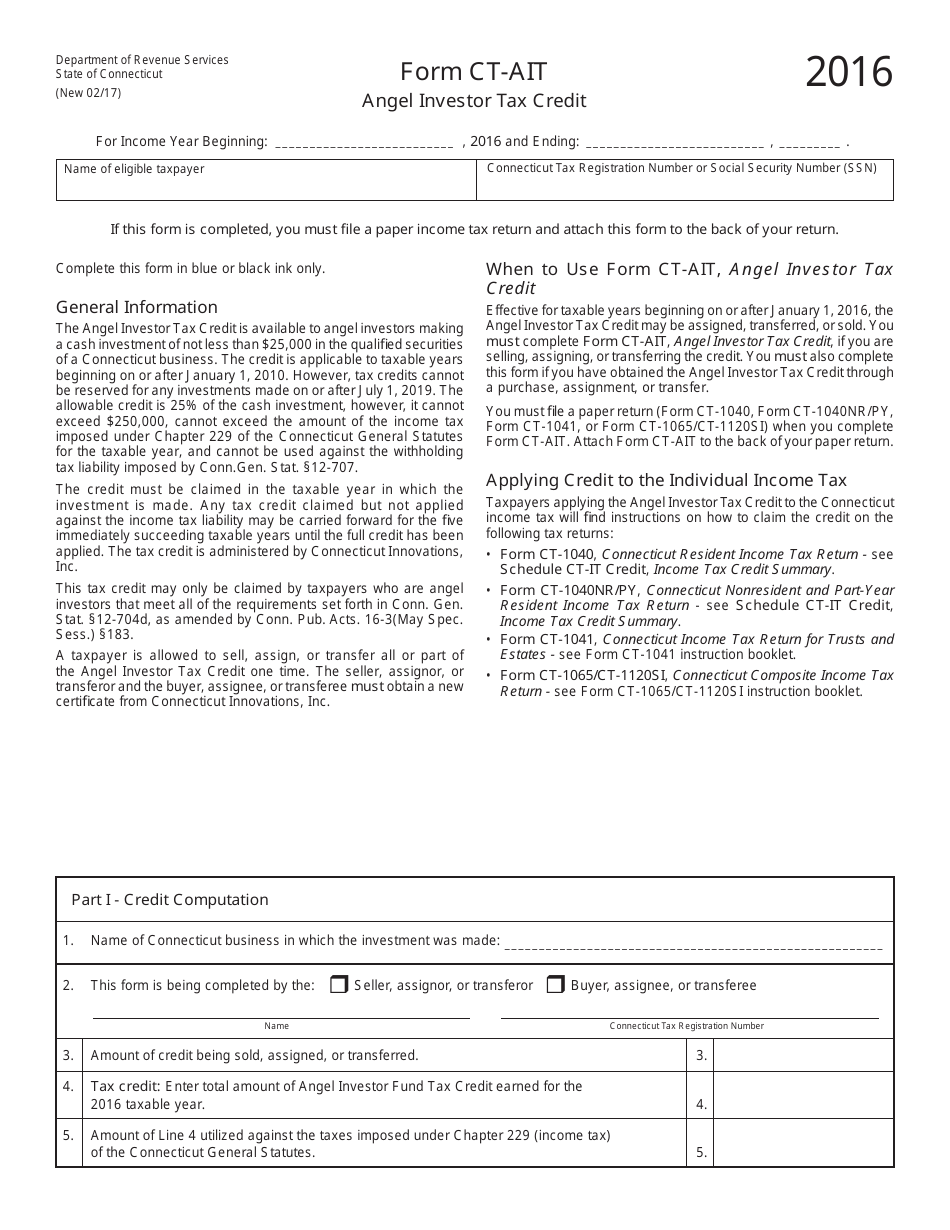

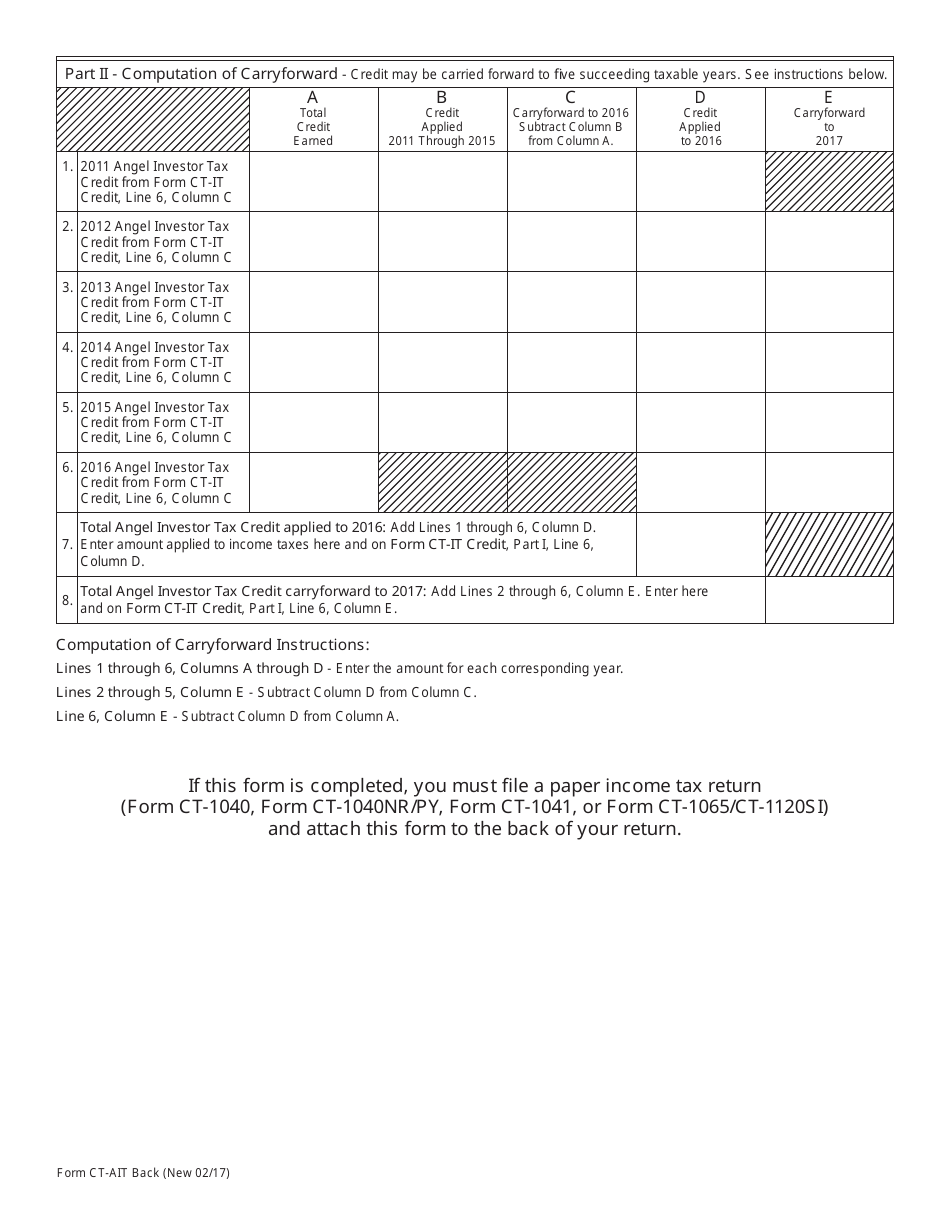

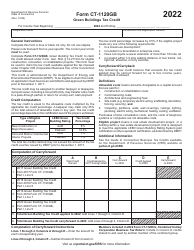

Form CT-AIT Angel Investor Tax Credit - Connecticut

What Is Form CT-AIT?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CT-AIT Angel Investor Tax Credit?

A: The CT-AIT Angel Investor Tax Credit is a tax credit program offered in Connecticut to encourage investments in eligible startup businesses.

Q: Who is eligible for the CT-AIT Angel Investor Tax Credit?

A: Individuals or entities making qualified investments in eligible startup businesses in Connecticut may be eligible for the CT-AIT Angel Investor Tax Credit.

Q: How much is the CT-AIT Angel Investor Tax Credit?

A: The tax credit is equal to 25% of the amount invested in a Qualified Small Business, up to a maximum credit of $250,000 per year.

Q: What is a Qualified Small Business?

A: A Qualified Small Business is a business that is engaged in advanced technology, bioscience, information technology, green technology, or photonics and meets certain criteria specified by the program.

Q: How can I apply for the CT-AIT Angel Investor Tax Credit?

A: You can apply for the CT-AIT Angel Investor Tax Credit by submitting an application to the Department of Economic and Community Development.

Q: Are there any restrictions on the CT-AIT Angel Investor Tax Credit?

A: Yes, there are certain restrictions on the tax credit, including limits on the total amount of tax credits available and the number of tax credits that can be claimed per year.

Q: Is the CT-AIT Angel Investor Tax Credit refundable?

A: No, the CT-AIT Angel Investor Tax Credit is not refundable. It can only be used to offset your state tax liability.

Q: Are there any reporting requirements for the CT-AIT Angel Investor Tax Credit?

A: Yes, if you claim the tax credit, you are required to report certain information about the investment on your state tax return.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-AIT by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.