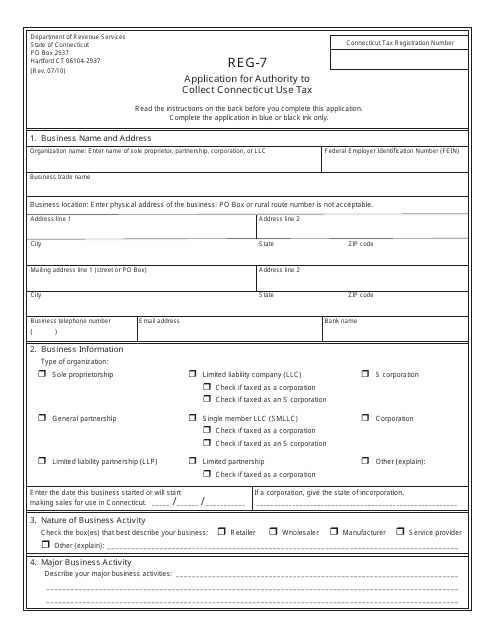

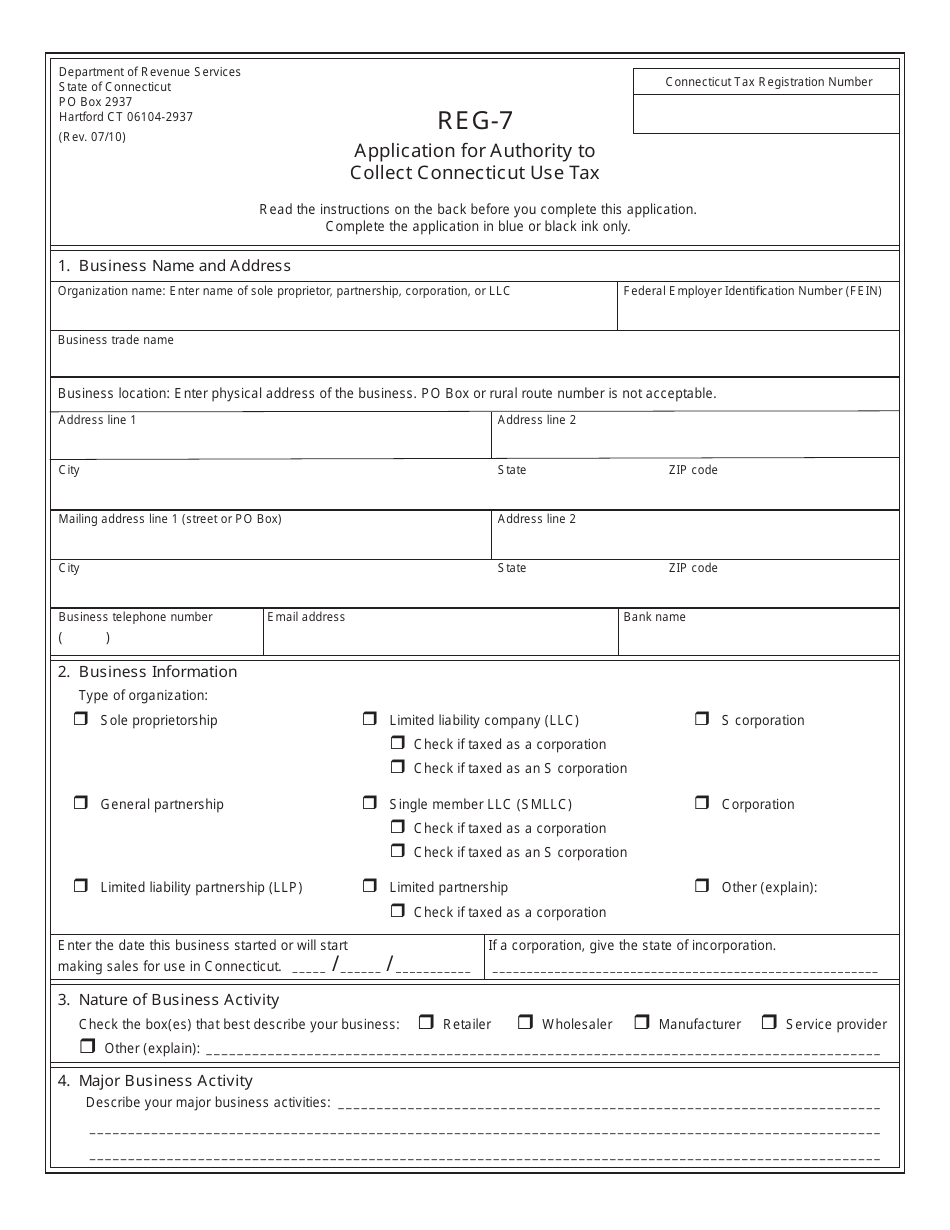

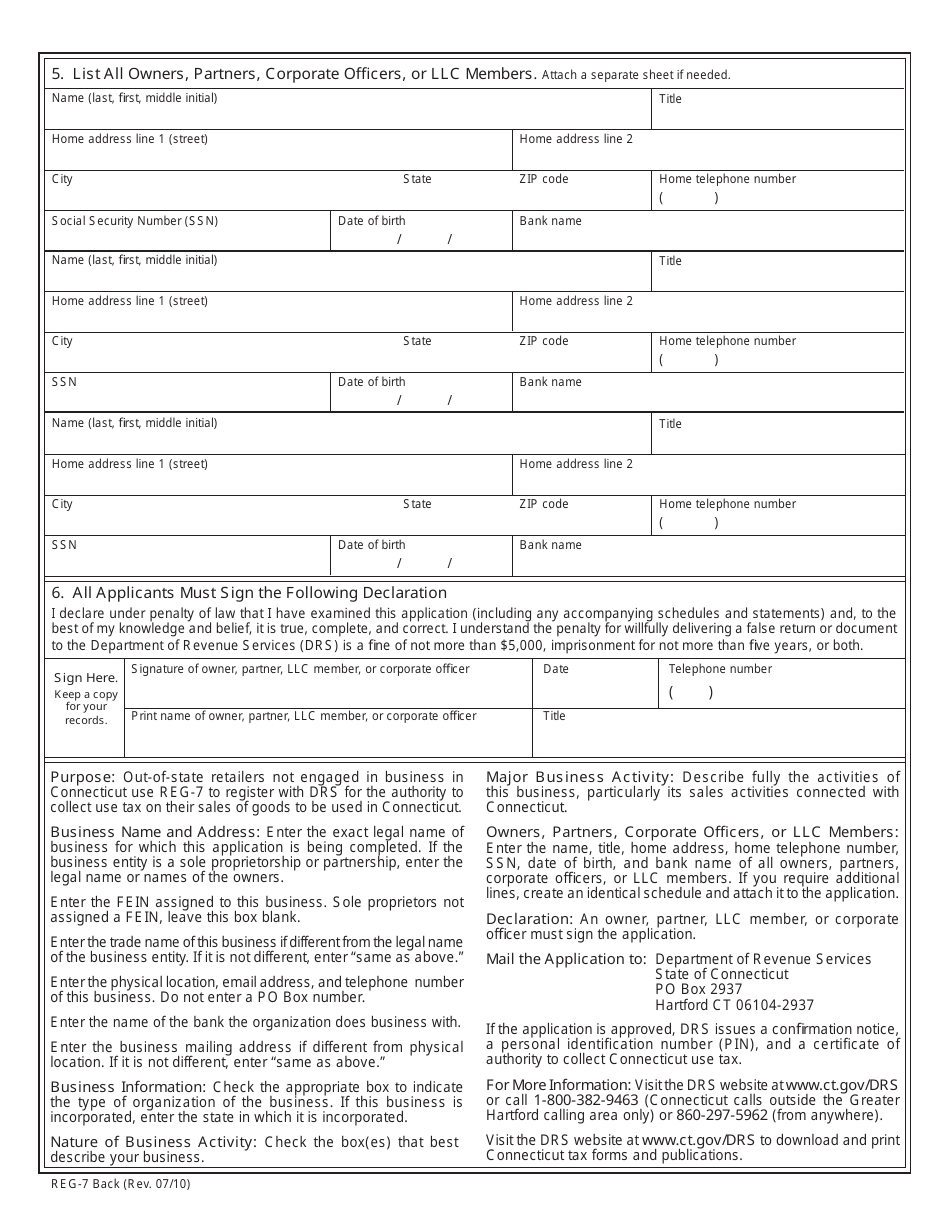

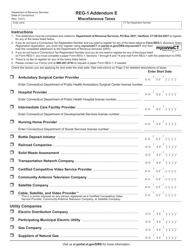

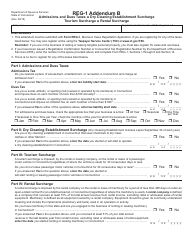

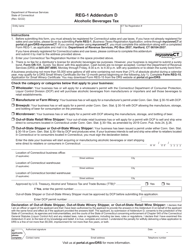

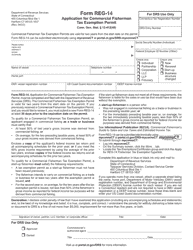

Form REG-7 Application for Authority to Collect Connecticut Use Tax - Connecticut

What Is Form REG-7?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REG-7?

A: Form REG-7 is the application for authority to collect Connecticut Use Tax.

Q: What is Connecticut Use Tax?

A: Connecticut Use Tax is a tax on purchases made outside of Connecticut but used within the state.

Q: Who needs to file Form REG-7?

A: Businesses that sell taxable goods or services and are located outside of Connecticut but have nexus in the state must file Form REG-7.

Q: What is nexus?

A: Nexus refers to a connection or presence in a state that triggers the obligation to collect and remit sales or use tax.

Q: Do all businesses need to register for Connecticut Use Tax?

A: No, only businesses with nexus in Connecticut and selling taxable goods or services need to register.

Q: Is there a fee to file Form REG-7?

A: No, there is no fee to file Form REG-7.

Q: What information is required on Form REG-7?

A: Form REG-7 requires information about the business, such as its name, address, Federal Employer Identification Number (FEIN), and a description of its activities.

Q: When is Form REG-7 due?

A: Form REG-7 should be filed within 30 days of the business beginning to make sales in Connecticut.

Q: What happens after filing Form REG-7?

A: Once Form REG-7 is filed and approved, the business will receive a Certificate of Authority to Collect Connecticut Use Tax.

Form Details:

- Released on July 1, 2010;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REG-7 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.