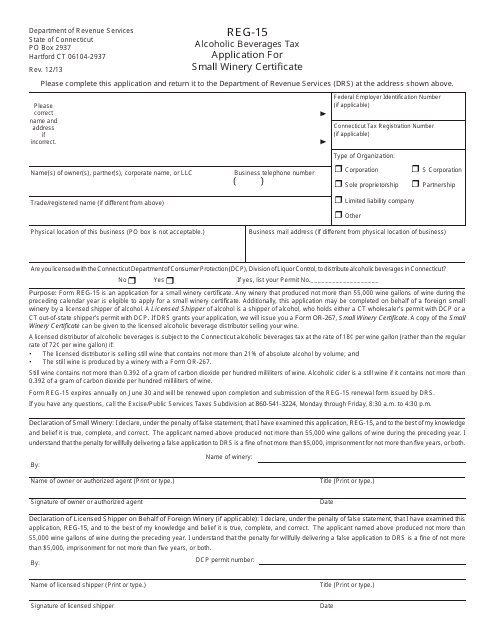

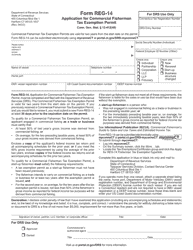

Form REG-15 Alcoholic Beverages Tax - Application for Small Winery Certifi Cate - Connecticut

What Is Form REG-15?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REG-15?

A: Form REG-15 is the Alcoholic Beverages Tax-Application for Small Winery Certificate in Connecticut.

Q: What is the purpose of Form REG-15?

A: The purpose of Form REG-15 is to apply for a Small Winery Certificate for the Alcoholic Beverages Tax in Connecticut.

Q: Who needs to fill out Form REG-15?

A: Small wineries in Connecticut need to fill out Form REG-15 to apply for a Small Winery Certificate for the Alcoholic Beverages Tax.

Q: Is there a fee to file Form REG-15?

A: No, there is no fee to file Form REG-15.

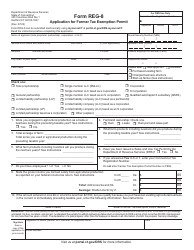

Q: What information is required on Form REG-15?

A: Form REG-15 requires information about the winery, its owners, and its business operations.

Q: Are there any additional documents required with Form REG-15?

A: Yes, you need to submit a copy of your federal basic permit and a floor plan of your winery with Form REG-15.

Q: How long does it take to process Form REG-15?

A: The processing time for Form REG-15 can vary, but you should receive a response within a few weeks.

Q: What happens after Form REG-15 is approved?

A: Once your Form REG-15 is approved, you will receive a Small Winery Certificate, which allows you to operate as a small winery in Connecticut.

Form Details:

- Released on December 1, 2013;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REG-15 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.