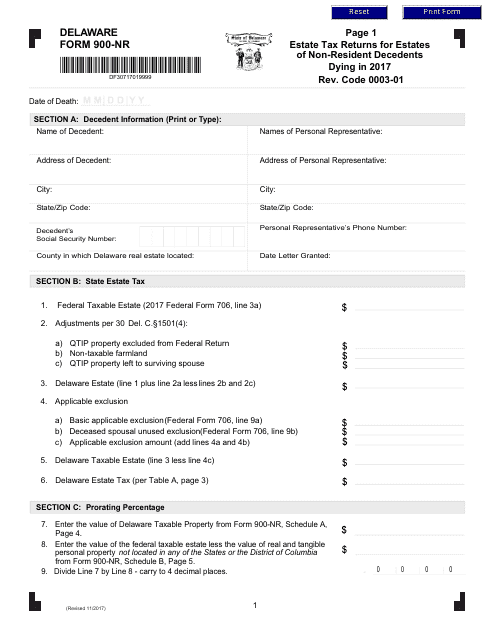

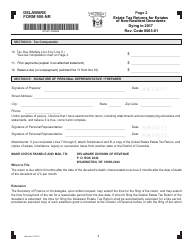

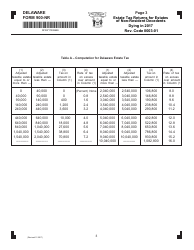

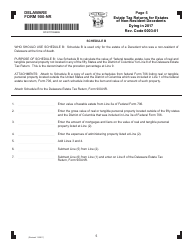

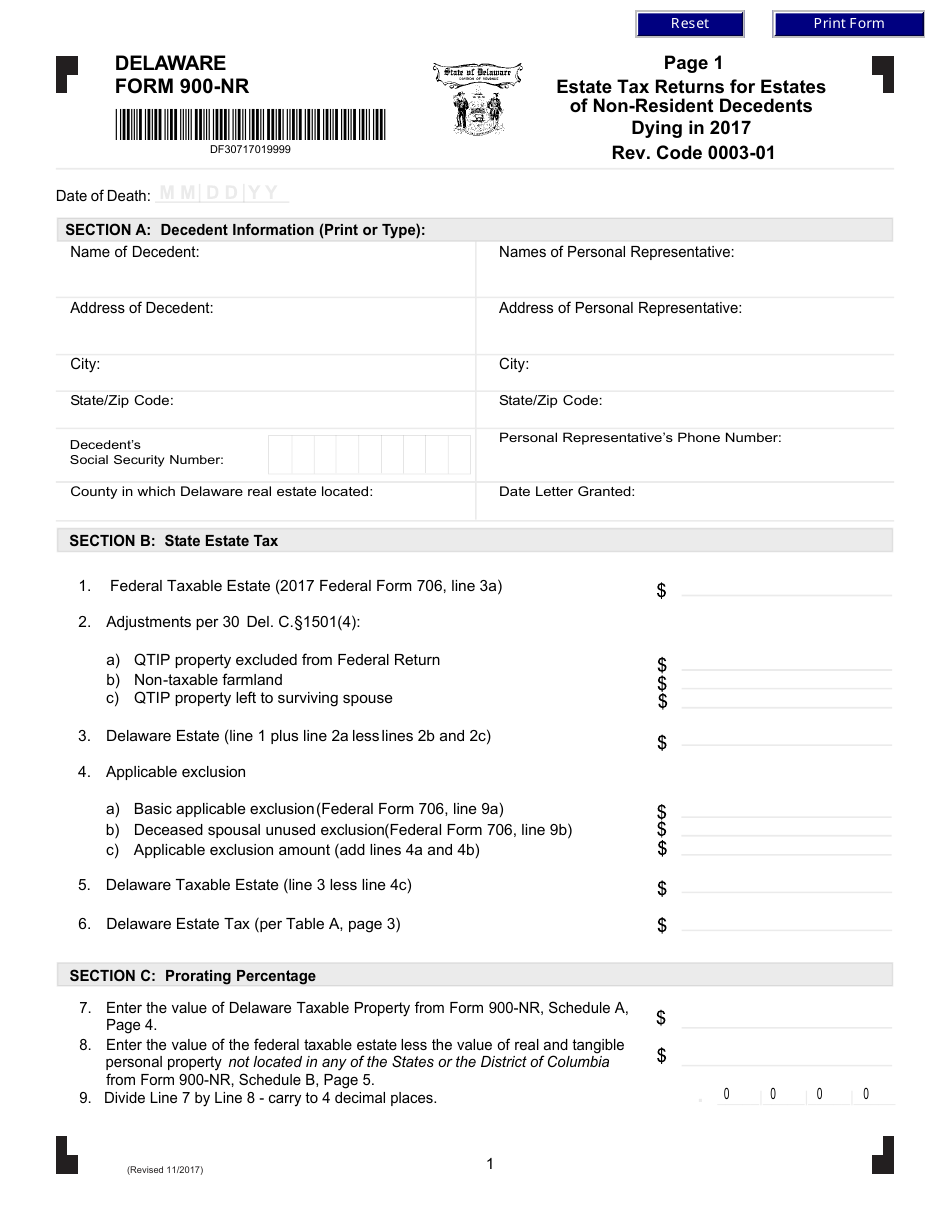

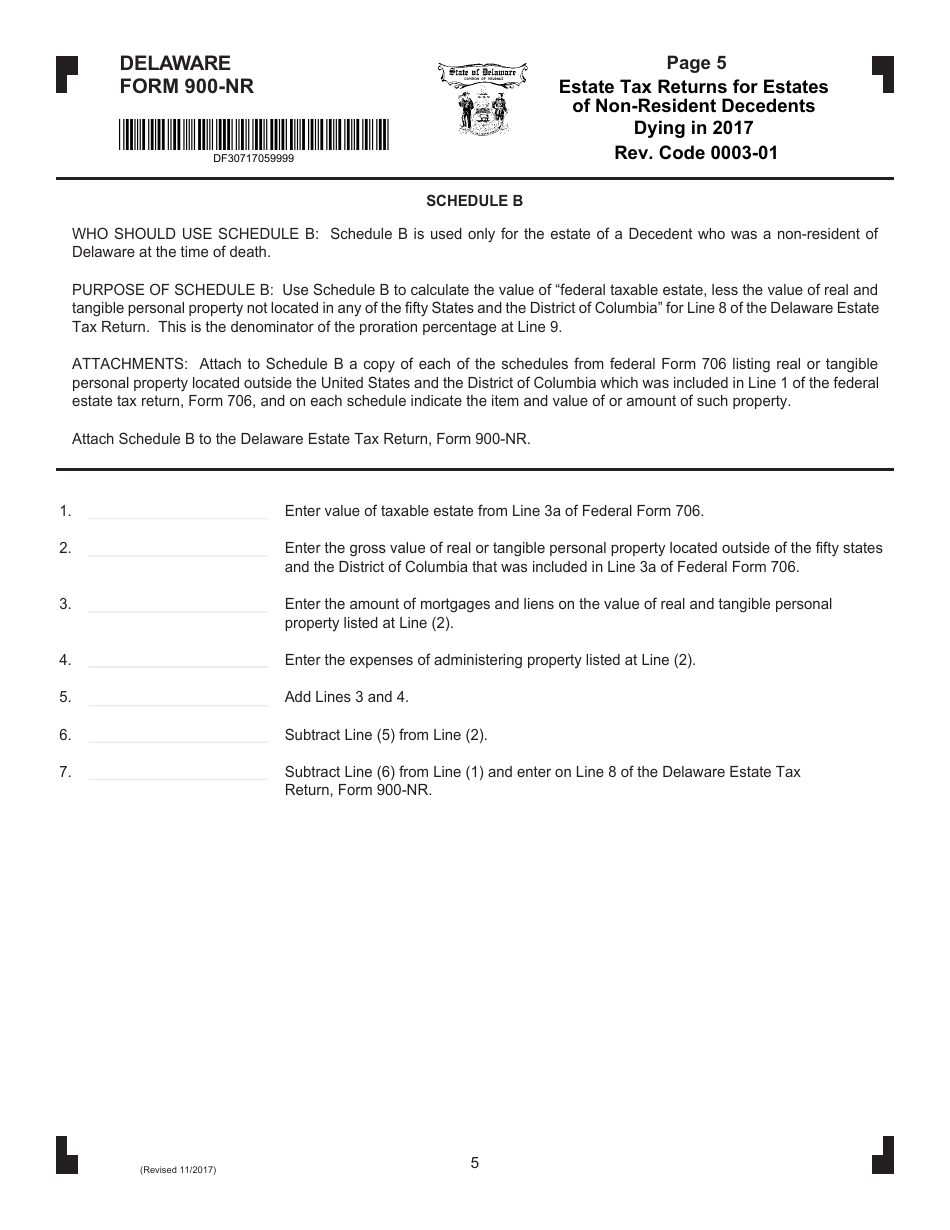

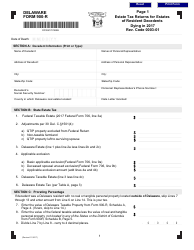

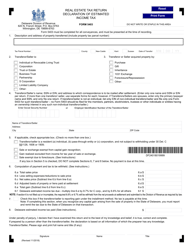

Form 900-NR Estate Tax Returns for Estates of Non-resident Decedents Dying in 2017 - Delaware

What Is Form 900-NR?

This is a legal form that was released by the Delaware Department of Finance - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 900-NR?

A: Form 900-NR is used to file estate tax returns for the estates of non-resident decedents.

Q: Who needs to file Form 900-NR?

A: Form 900-NR must be filed by the estates of non-resident decedents who died in 2017.

Q: Which state is Form 900-NR specific to?

A: Form 900-NR is specific to the state of Delaware.

Q: What is the purpose of Form 900-NR?

A: The purpose of Form 900-NR is to report and pay estate tax for non-resident decedents' estates.

Q: When should Form 900-NR be filed?

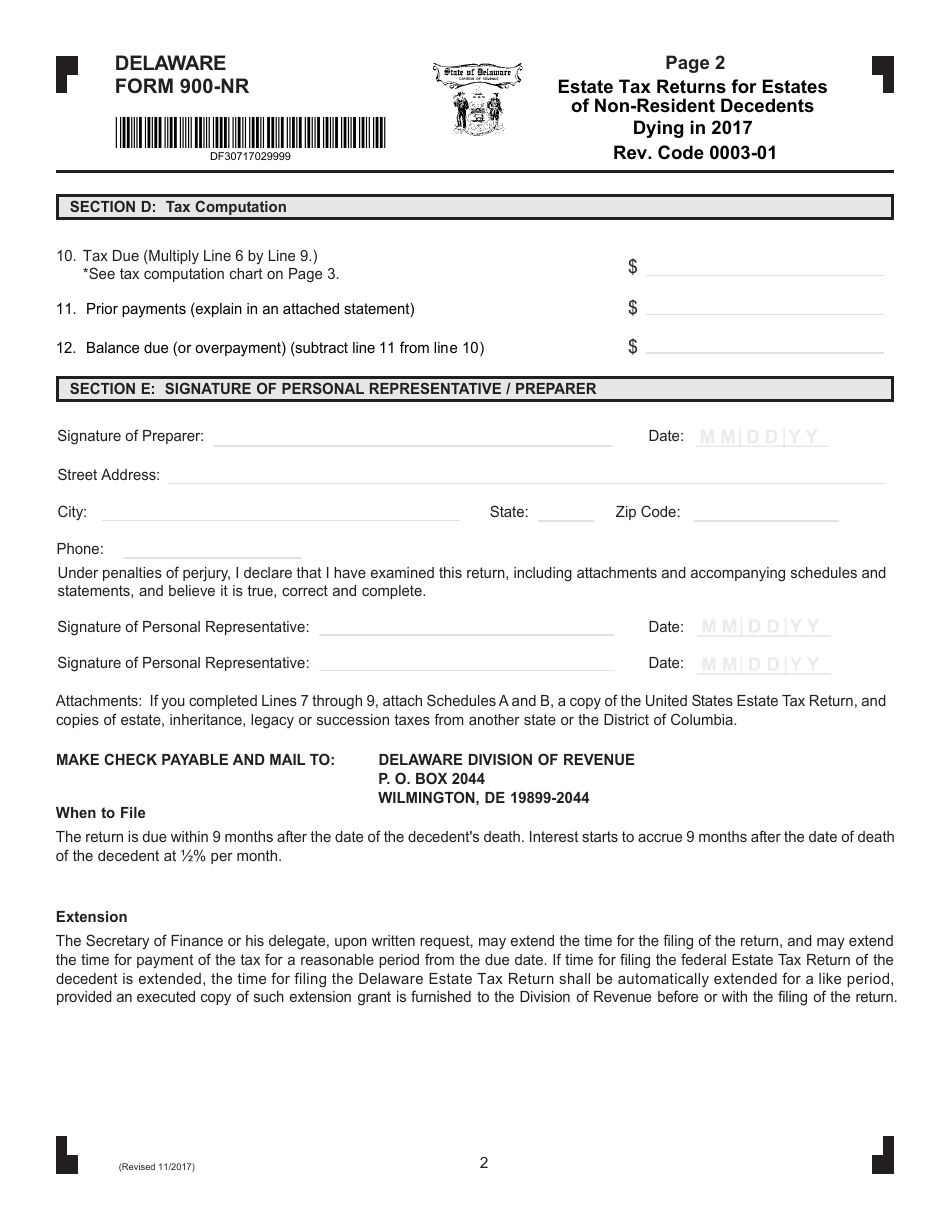

A: Form 900-NR should be filed within 9 months after the date of death.

Q: Are extensions available for filing Form 900-NR?

A: Yes, extensions are available, but any tax owed must still be paid by the original due date.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Delaware Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 900-NR by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance.