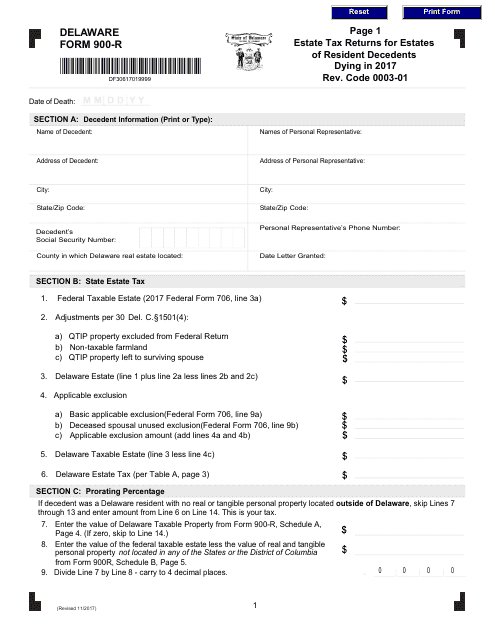

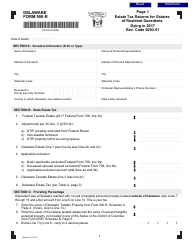

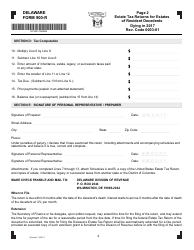

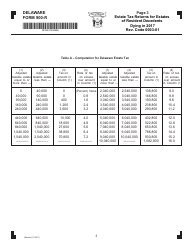

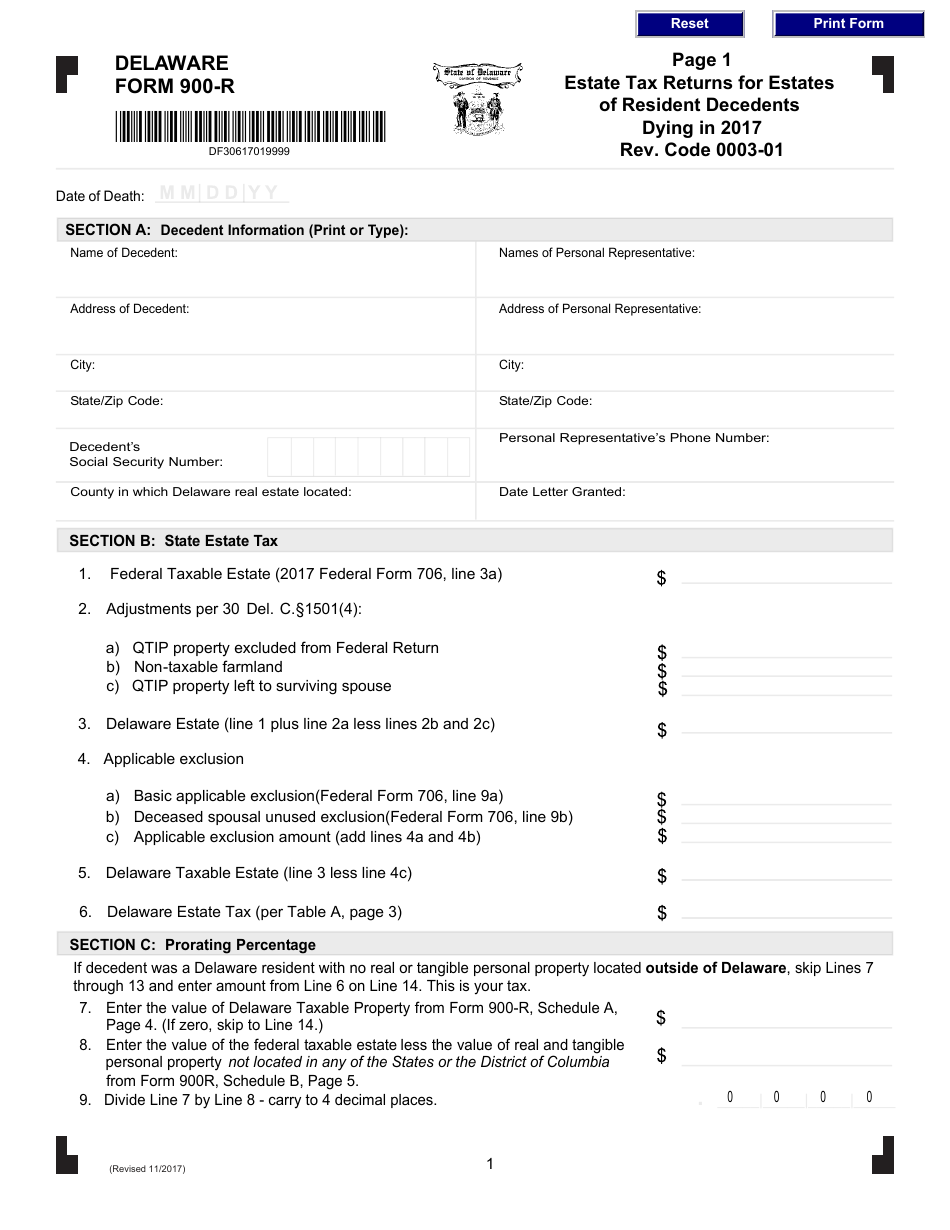

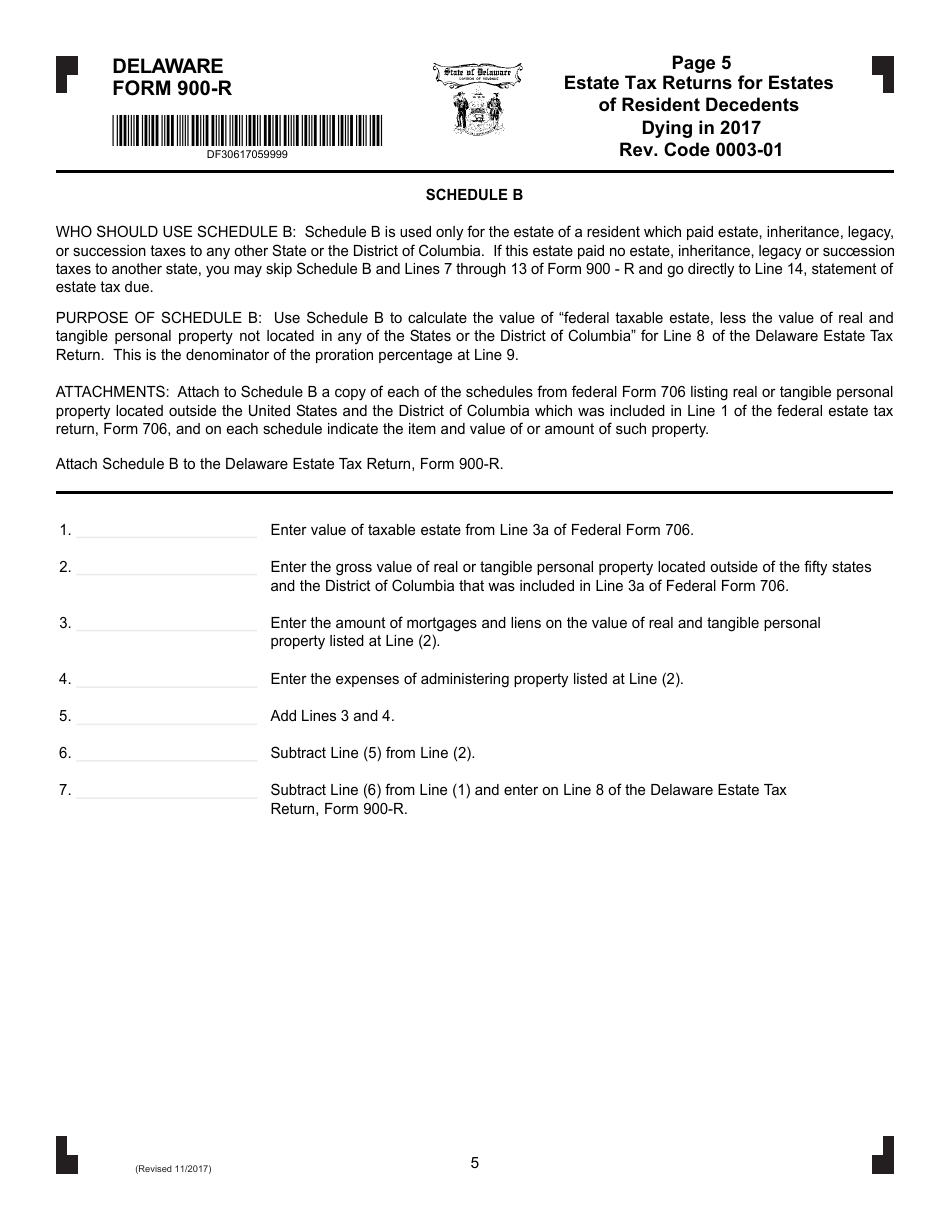

Form 900-R Estate Tax Returns for Estates of Resident Decedents Dying in 2017 - Delaware

What Is Form 900-R?

This is a legal form that was released by the Delaware Department of Finance - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 900-R?

A: Form 900-R is the Estate Tax Return for Estates of Resident Decedents.

Q: Who needs to file Form 900-R?

A: Form 900-R must be filed by the executor or administrator of an estate of a resident decedent who passed away in 2017.

Q: What is the purpose of Form 900-R?

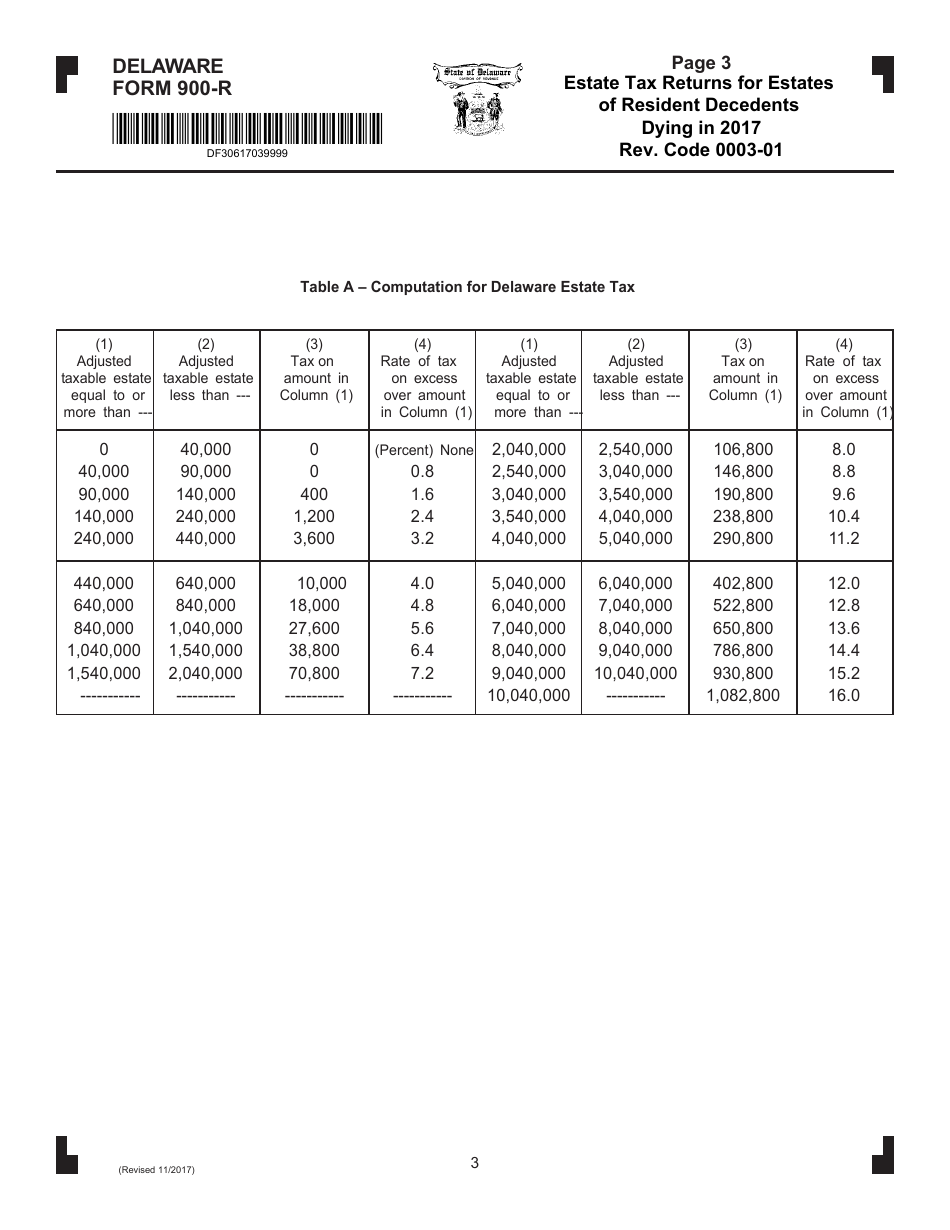

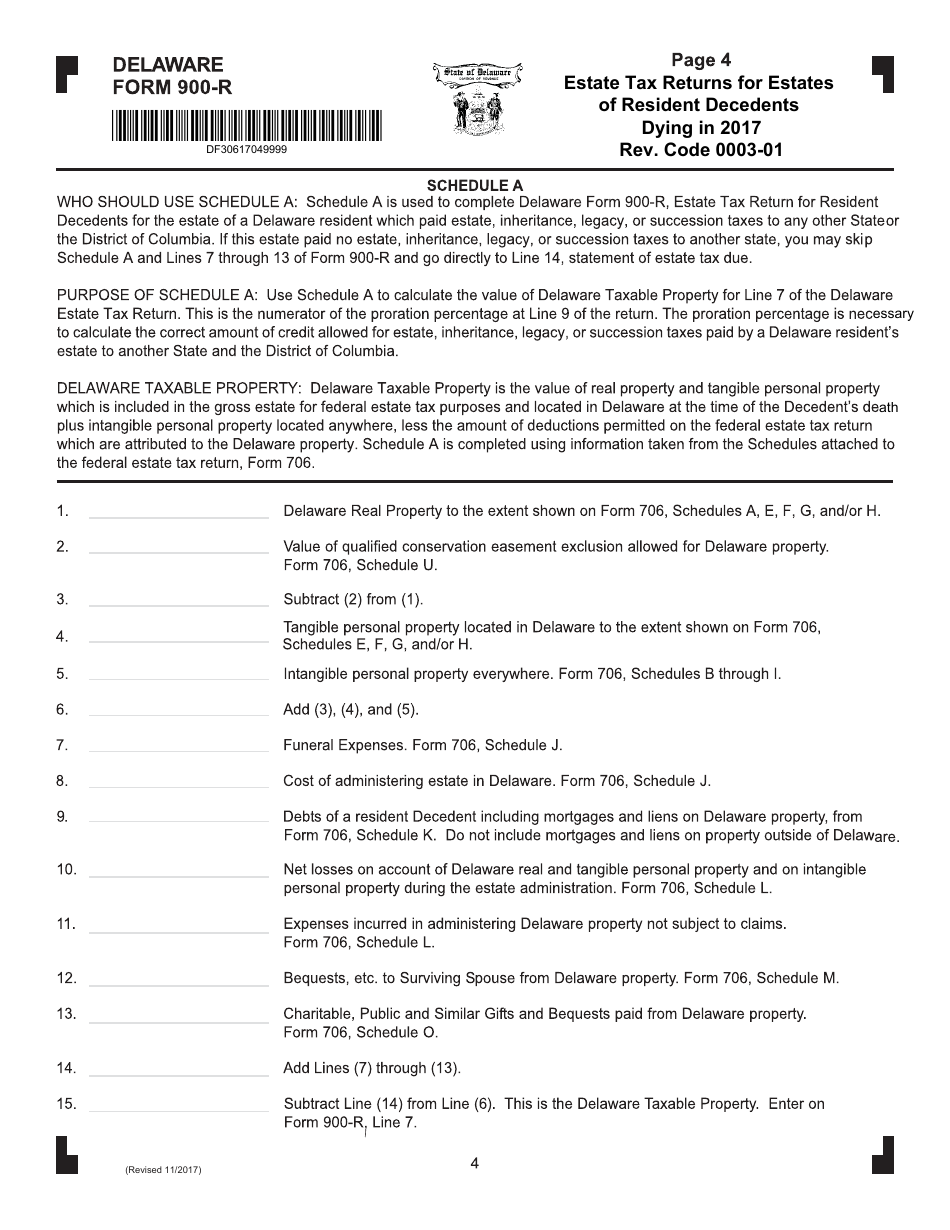

A: Form 900-R is used to calculate and report the estate tax liability for estates of resident decedents.

Q: Is Form 900-R specific to Delaware?

A: Yes, Form 900-R is specific to estates of resident decedents who passed away in Delaware in 2017.

Q: What information is required on Form 900-R?

A: Form 900-R requires information about the decedent, the estate assets and liabilities, and calculations of estate tax due.

Q: When is the deadline to file Form 900-R?

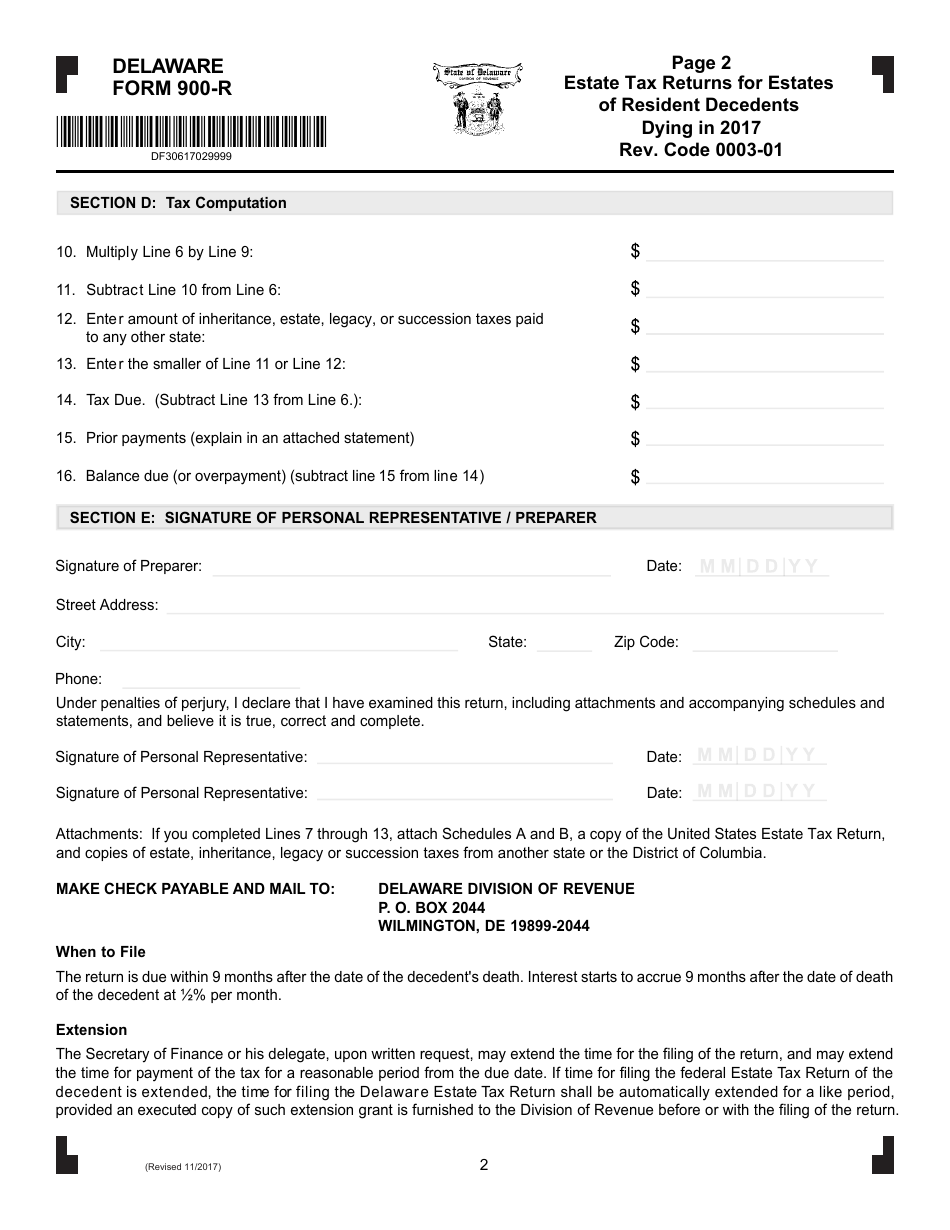

A: Form 900-R must be filed within 9 months of the decedent's date of death.

Q: Are there any extensions available for filing Form 900-R?

A: Yes, an extension of time to file Form 900-R may be granted upon request.

Q: What happens if Form 900-R is filed late?

A: Late filing of Form 900-R may result in penalties and interest being assessed on the estate tax due.

Q: Who should I contact for assistance with Form 900-R?

A: For assistance with Form 900-R, you can contact the Delaware Division of Revenue or consult with a tax professional.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Delaware Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 900-R by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance.