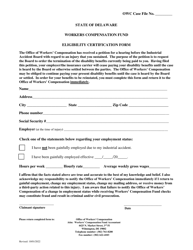

457(B) Double-Limit Catch-Up Certification of Eligibility Form - Delaware

457(B) Double-Limit Catch-Up Certification of Eligibility Form is a legal document that was released by the Delaware Office of the State Treasurer - a government authority operating within Delaware.

FAQ

Q: What is the 457(B) Double-Limit Catch-Up Certification of Eligibility Form?

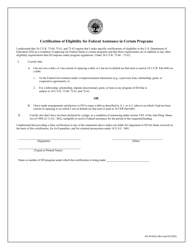

A: The 457(B) Double-Limit Catch-Up Certification of Eligibility Form is a document used in Delaware to certify eligibility for double-limit catch-up contributions to a 457(B) retirement plan.

Q: What are double-limit catch-up contributions?

A: Double-limit catch-up contributions are additional contributions that can be made to a 457(B) retirement plan by participants within three years of the normal retirement age.

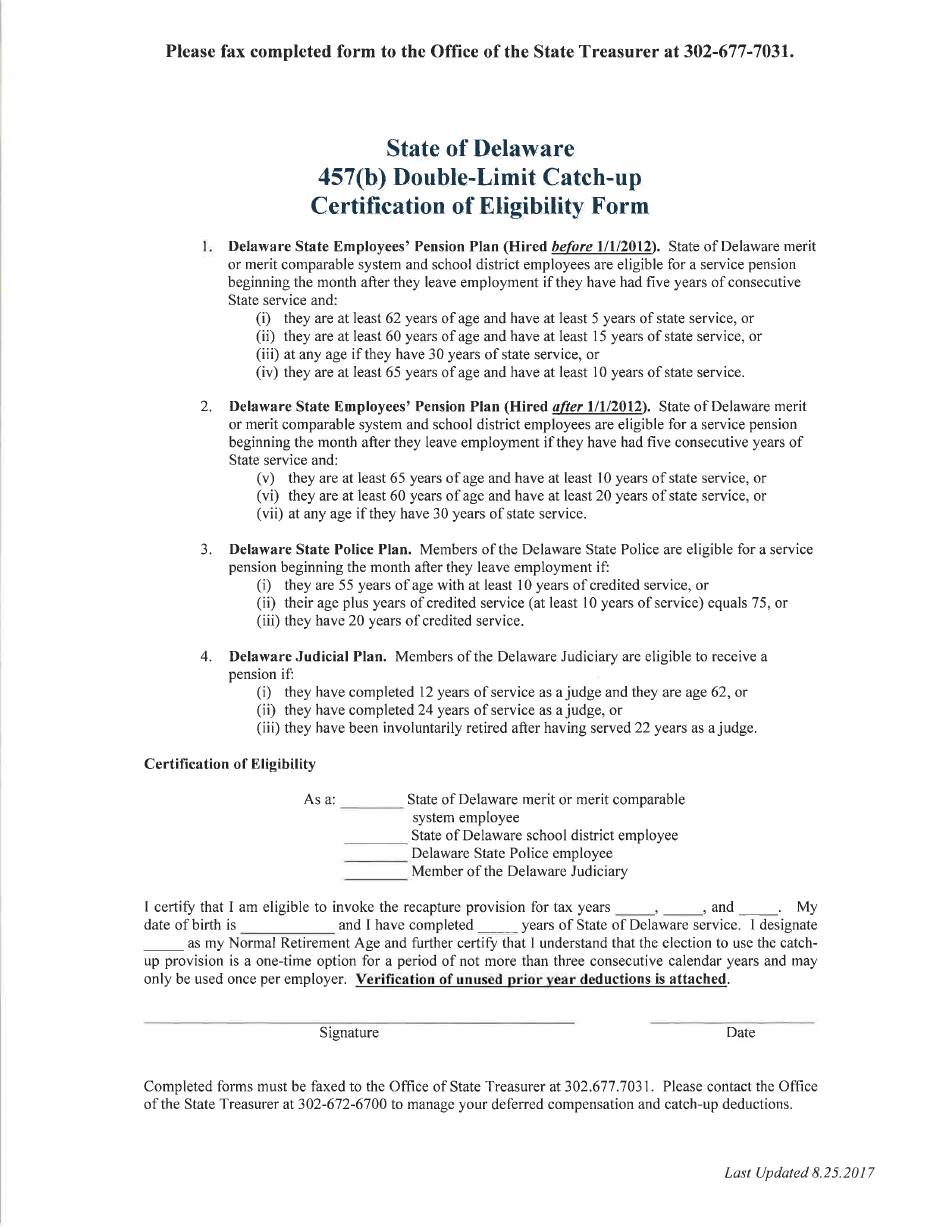

Q: Who can use the 457(B) Double-Limit Catch-Up Certification of Eligibility Form?

A: Individuals who are eligible to make double-limit catch-up contributions to a 457(B) retirement plan in Delaware can use this form.

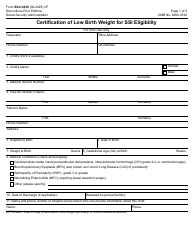

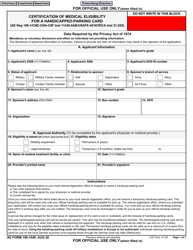

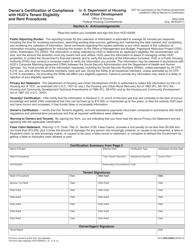

Q: How do I fill out the form?

A: You will need to provide your personal information, such as your name, address, and Social Security number, as well as information about your retirement plan and eligibility for double-limit catch-up contributions.

Q: Are there any fees associated with the form?

A: There may be administrative fees associated with submitting the form, depending on the requirements of your retirement plan.

Q: What should I do with the completed form?

A: Once you have completed the form, you should submit it to the entity administering your 457(B) retirement plan according to their instructions.

Q: Is the form specific to Delaware?

A: Yes, the 457(B) Double-Limit Catch-Up Certification of Eligibility Form is specific to Delaware and is used to certify eligibility for double-limit catch-up contributions in the state.

Form Details:

- Released on August 25, 2017;

- The latest edition currently provided by the Delaware Office of the State Treasurer;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Office of the State Treasurer.