This version of the form is not currently in use and is provided for reference only. Download this version of

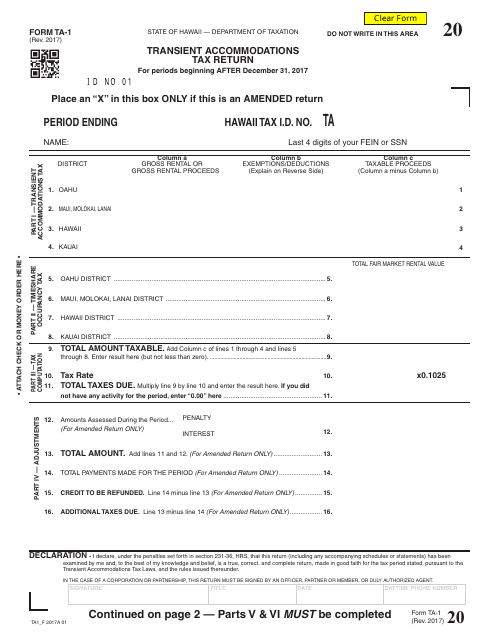

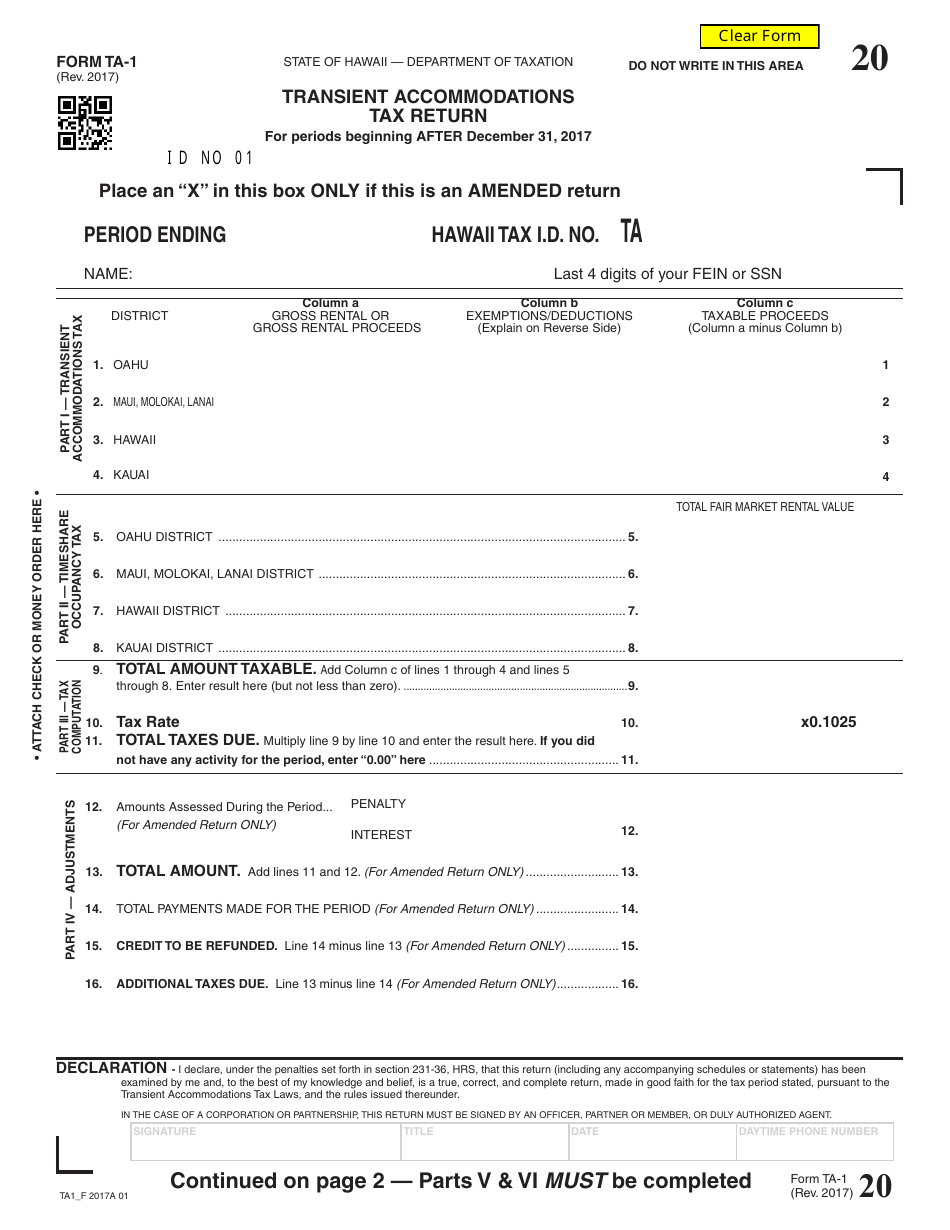

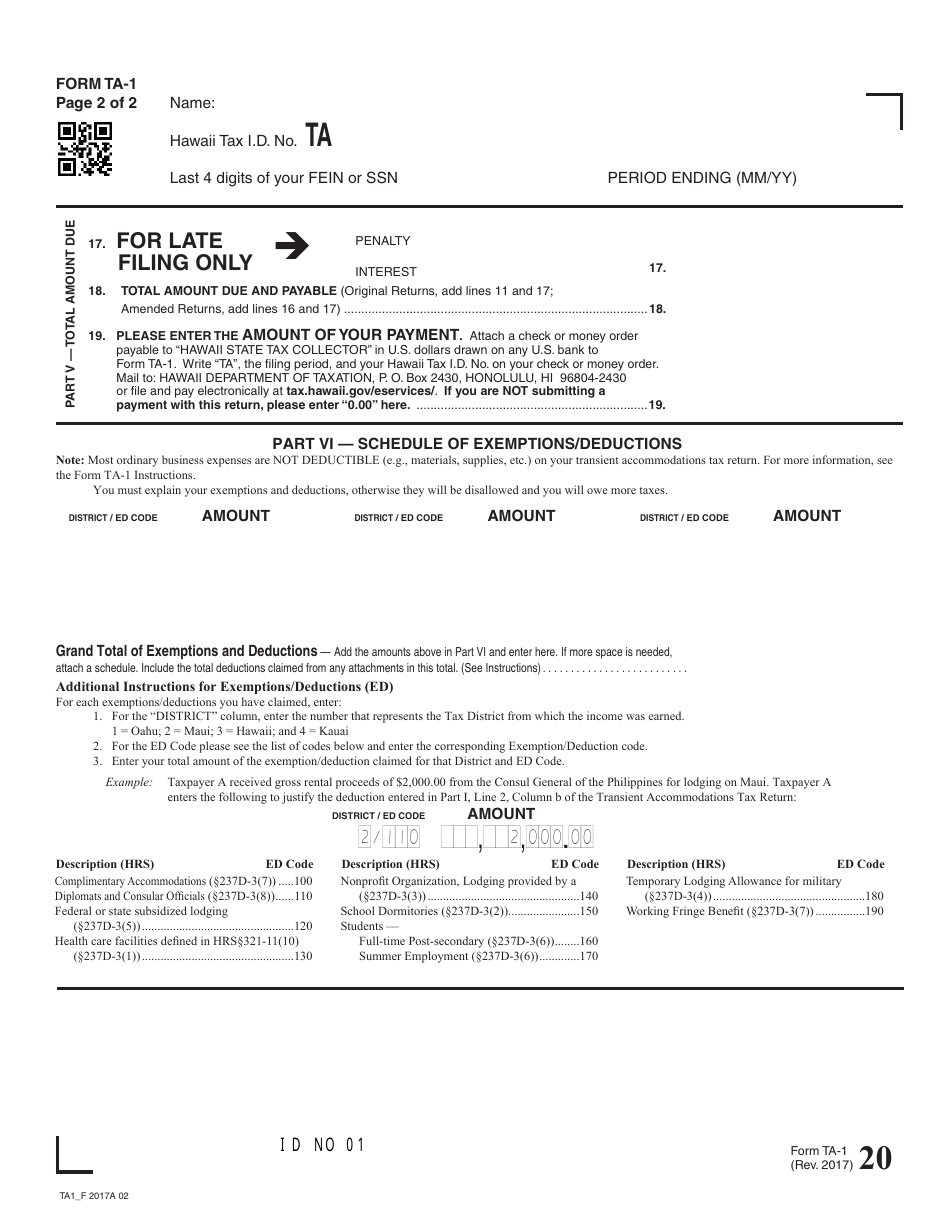

Form TA-1

for the current year.

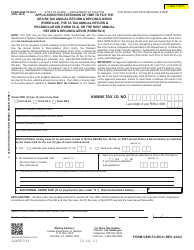

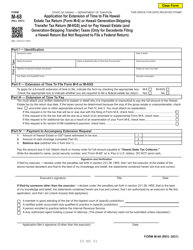

Form TA-1 Transient Accommodations Tax Return - Hawaii

What Is Form TA-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form TA-1?

A: Form TA-1 is the Transient Accommodations Tax Return used in Hawaii.

Q: What is the Transient Accommodations Tax?

A: The Transient Accommodations Tax is a tax on the gross rental income derived from transient accommodations in Hawaii.

Q: Who needs to file Form TA-1?

A: Anyone who operates a transient accommodation in Hawaii and meets the filing requirements must file Form TA-1.

Q: What information is required on Form TA-1?

A: Form TA-1 requires information such as the taxpayer's name, business information, rental income, and tax due.

Q: When is Form TA-1 due?

A: Form TA-1 is due on the 20th day of the month following the end of the taxable period.

Q: Are there any penalties for late or non-filing of Form TA-1?

A: Yes, there are penalties for late or non-filing of Form TA-1, including interest charges and possible enforcement actions.

Q: Is there a fee for filing Form TA-1?

A: No, there is no fee for filing Form TA-1.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TA-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.