This version of the form is not currently in use and is provided for reference only. Download this version of

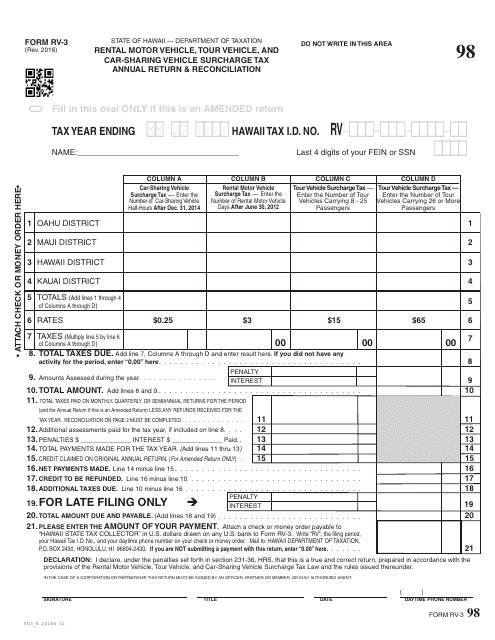

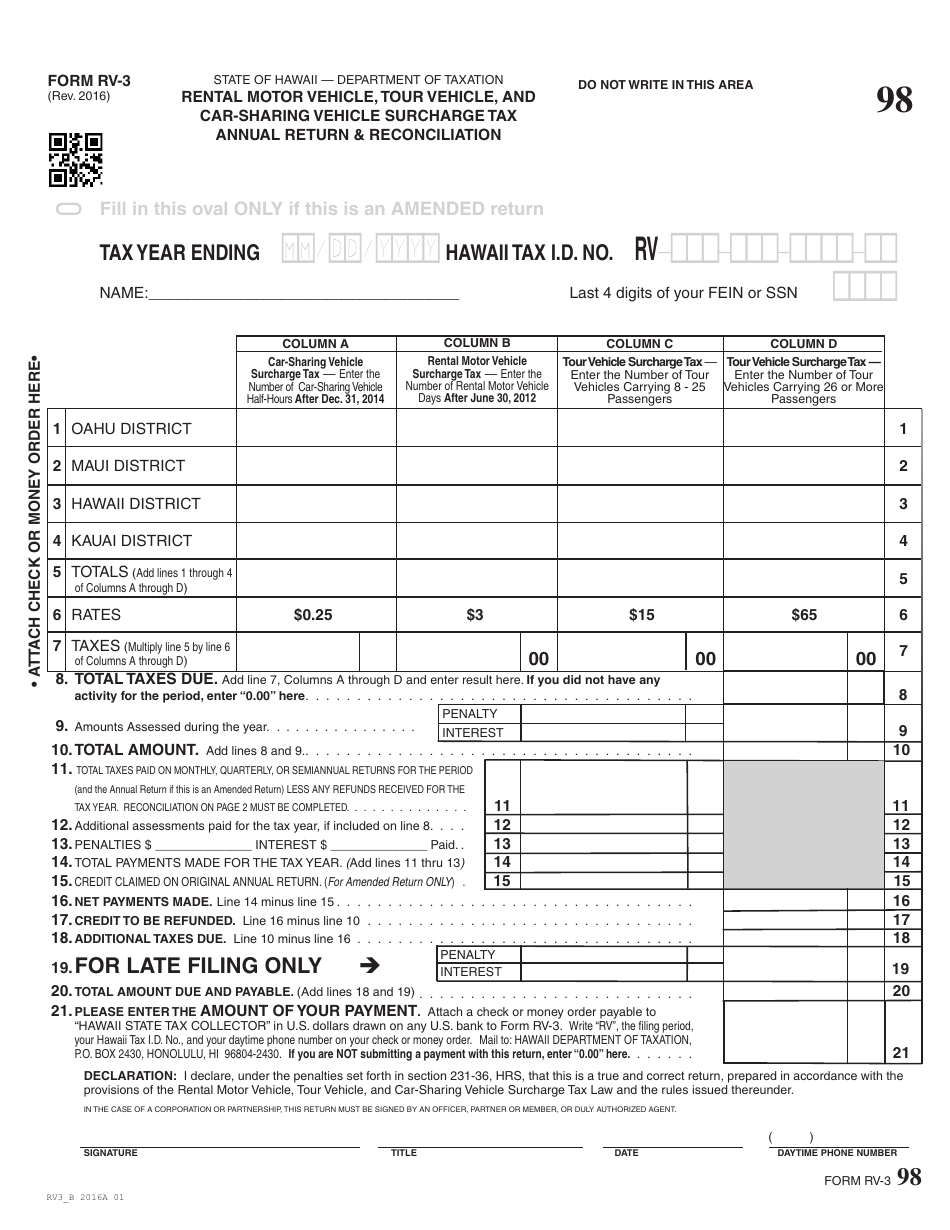

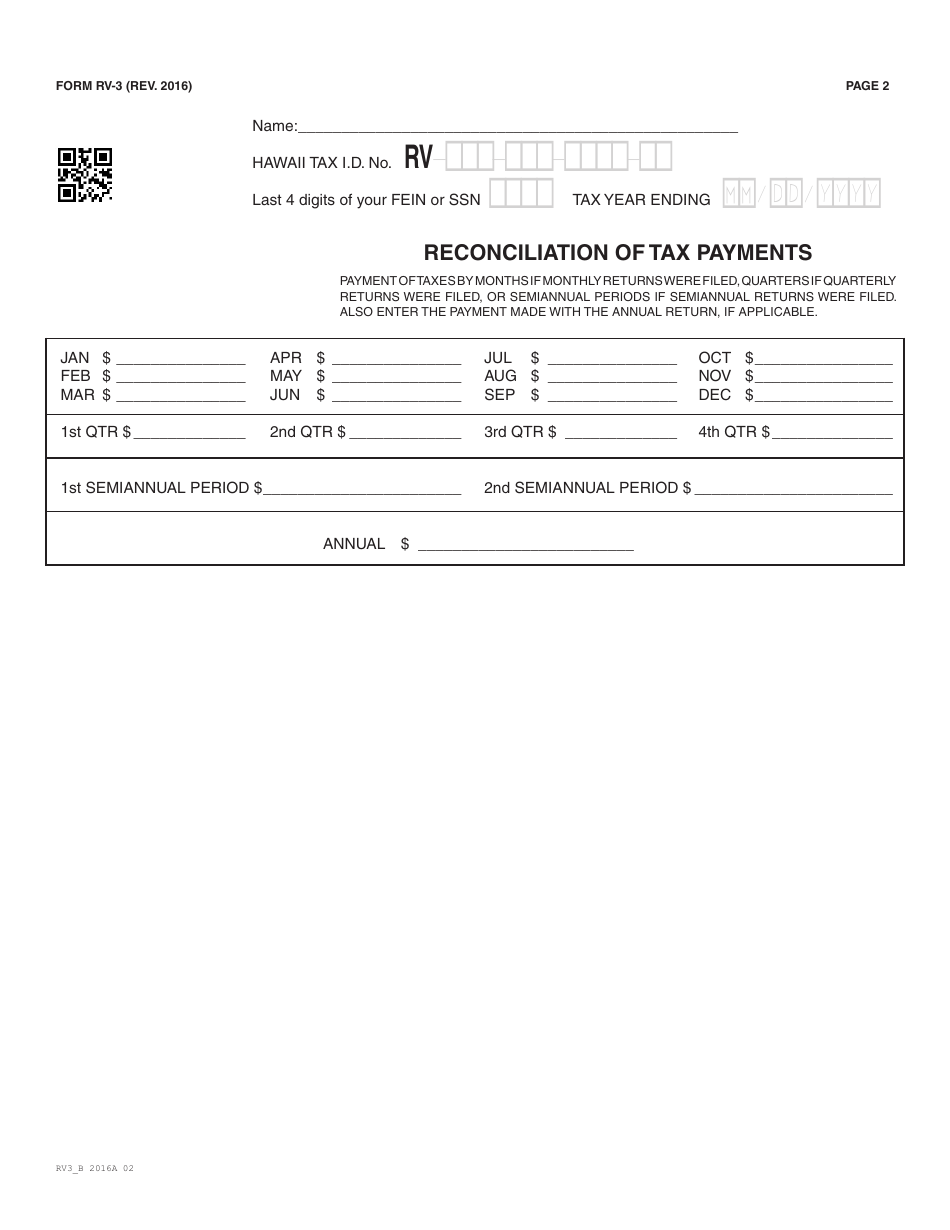

Form RV-3

for the current year.

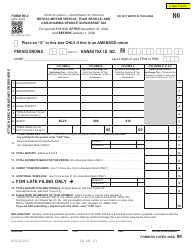

Form RV-3 Rental Motor Vehicle, Tour Vehicle, and Car-Sharing Vehicle Surcharge Tax Annual Return & Reconciliation - Hawaii

What Is Form RV-3?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RV-3?

A: Form RV-3 is a tax form used in Hawaii for reporting the Rental Motor Vehicle, Tour Vehicle, and Car-Sharing Vehicle Surcharge Tax.

Q: What is the purpose of Form RV-3?

A: The purpose of Form RV-3 is to report and reconcile the Rental Motor Vehicle, Tour Vehicle, and Car-Sharing Vehicle Surcharge Tax on an annual basis.

Q: Who needs to file Form RV-3?

A: Anyone who operates a rental motor vehicle, tour vehicle, or car-sharing vehicle in Hawaii and is subject to the surcharge tax needs to file Form RV-3.

Q: What is the surcharge tax?

A: The surcharge tax is a tax imposed on the rental of motor vehicles, tour vehicles, and car-sharing vehicles in Hawaii.

Q: How often do I need to file Form RV-3?

A: Form RV-3 needs to be filed annually.

Q: What information do I need to provide on Form RV-3?

A: You will need to provide information such as your business name, address, tax identification number, and the amount of surcharge tax collected.

Q: When is the deadline for filing Form RV-3?

A: The deadline for filing Form RV-3 is typically April 20th of the following year.

Q: Are there any penalties for late filing or non-filing of Form RV-3?

A: Yes, there may be penalties for late filing or non-filing of Form RV-3. It is important to file the form on time to avoid any penalties.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-3 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.