This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form N-344

for the current year.

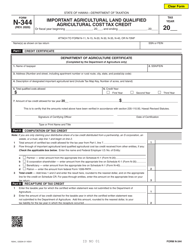

Instructions for Form N-344 Important Agricultural Land Qualified Agricultural Cost Tax Credit - Hawaii

This document contains official instructions for Form N-344 , Important Agricultural Land Qualified Agricultural Cost Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-344 is available for download through this link.

FAQ

Q: What is Form N-344?

A: Form N-344 is a tax form used in Hawaii for claiming the Important Agricultural Land Qualified Agricultural Cost Tax Credit.

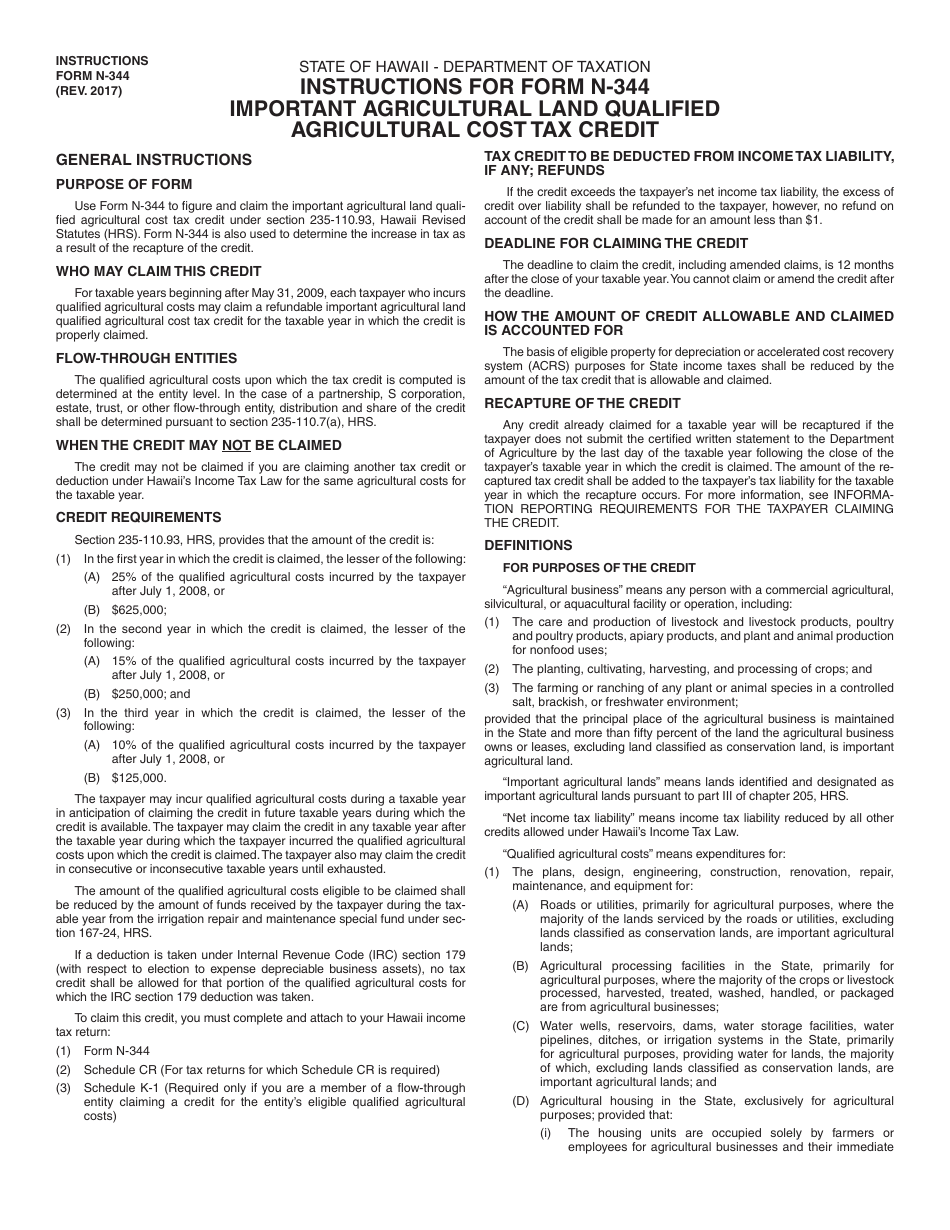

Q: What is the Important Agricultural Land Qualified Agricultural Cost Tax Credit?

A: The Important Agricultural Land Qualified Agricultural Cost Tax Credit is a tax credit provided to individuals or businesses in Hawaii who invest in qualified agricultural costs on important agricultural lands.

Q: Who can claim the Important Agricultural Land Qualified Agricultural Cost Tax Credit?

A: Individuals or businesses who meet the requirements and have invested in qualified agricultural costs on important agricultural lands in Hawaii can claim the tax credit.

Q: What are qualified agricultural costs?

A: Qualified agricultural costs are expenses related to agricultural operations on important agricultural lands, such as the purchase of farming equipment or the construction of agricultural structures.

Q: What are important agricultural lands?

A: Important agricultural lands are defined as designated agricultural lands in Hawaii that are considered essential for the long-term viability of Hawaii's agricultural industry.

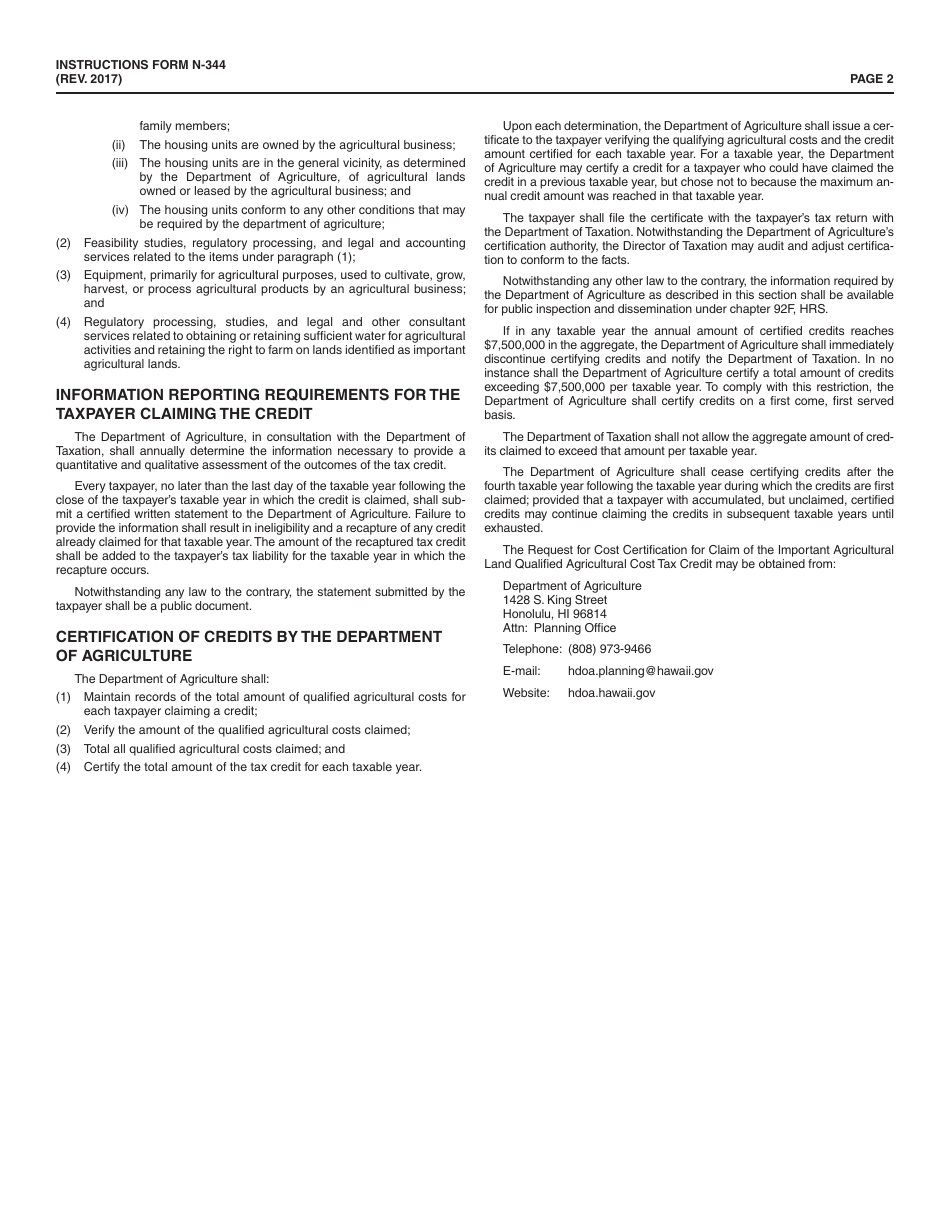

Q: How do I claim the tax credit?

A: To claim the Important Agricultural Land Qualified Agricultural Cost Tax Credit, you need to complete and file Form N-344 with the Hawaii Department of Taxation.

Q: What documents do I need to include with Form N-344?

A: You will need to include documentation to support your claimed qualified agricultural costs on important agricultural lands, such as receipts, invoices, or other relevant records.

Q: Are there any limitations to the tax credit?

A: Yes, there are limitations to the Important Agricultural Land Qualified Agricultural Cost Tax Credit. The credit is subject to a cap and may be reduced if the total amount claimed by all taxpayers exceeds the available funds.

Q: Is the tax credit refundable?

A: No, the Important Agricultural Land Qualified Agricultural Cost Tax Credit is non-refundable. It can only be used to offset your Hawaii state tax liability.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.