This version of the form is not currently in use and is provided for reference only. Download this version of

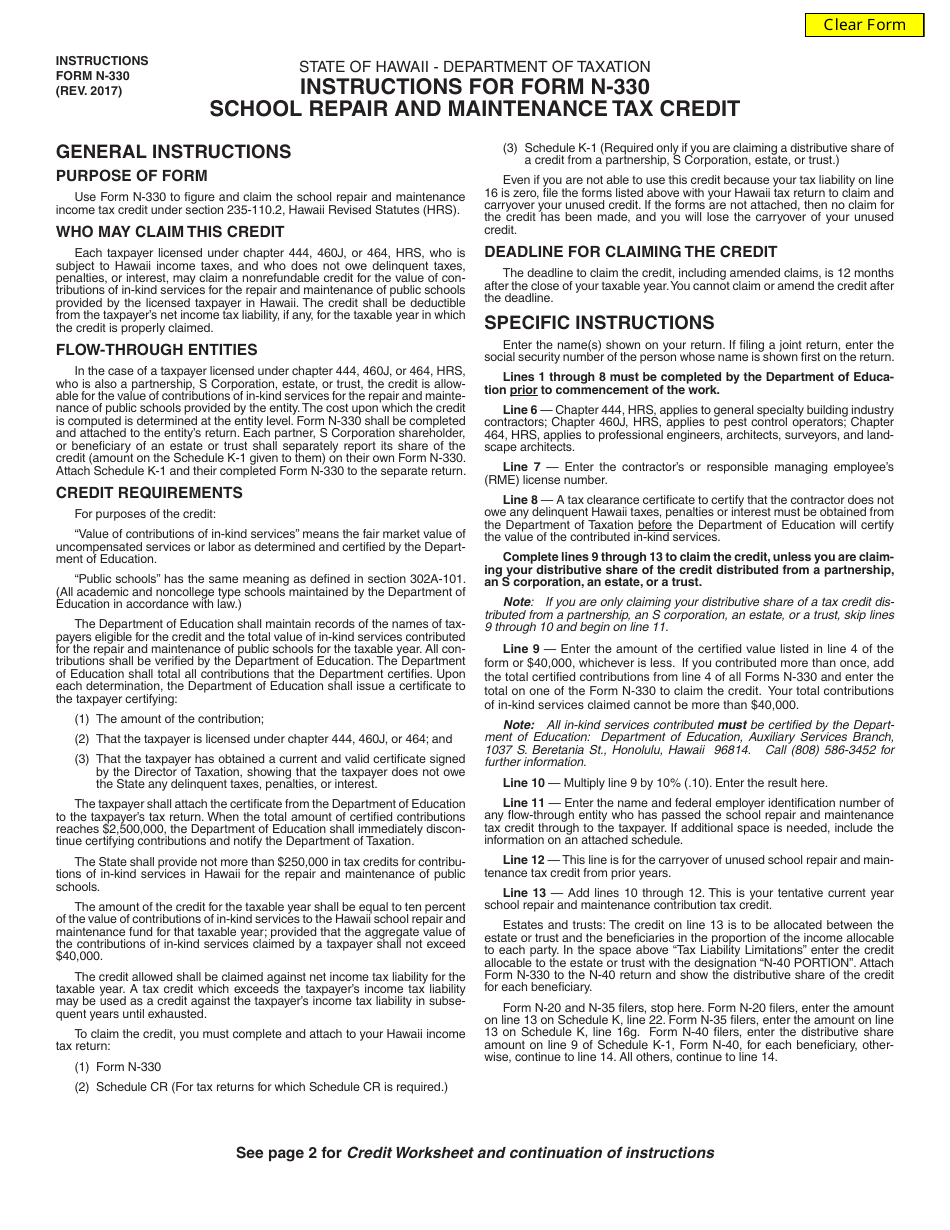

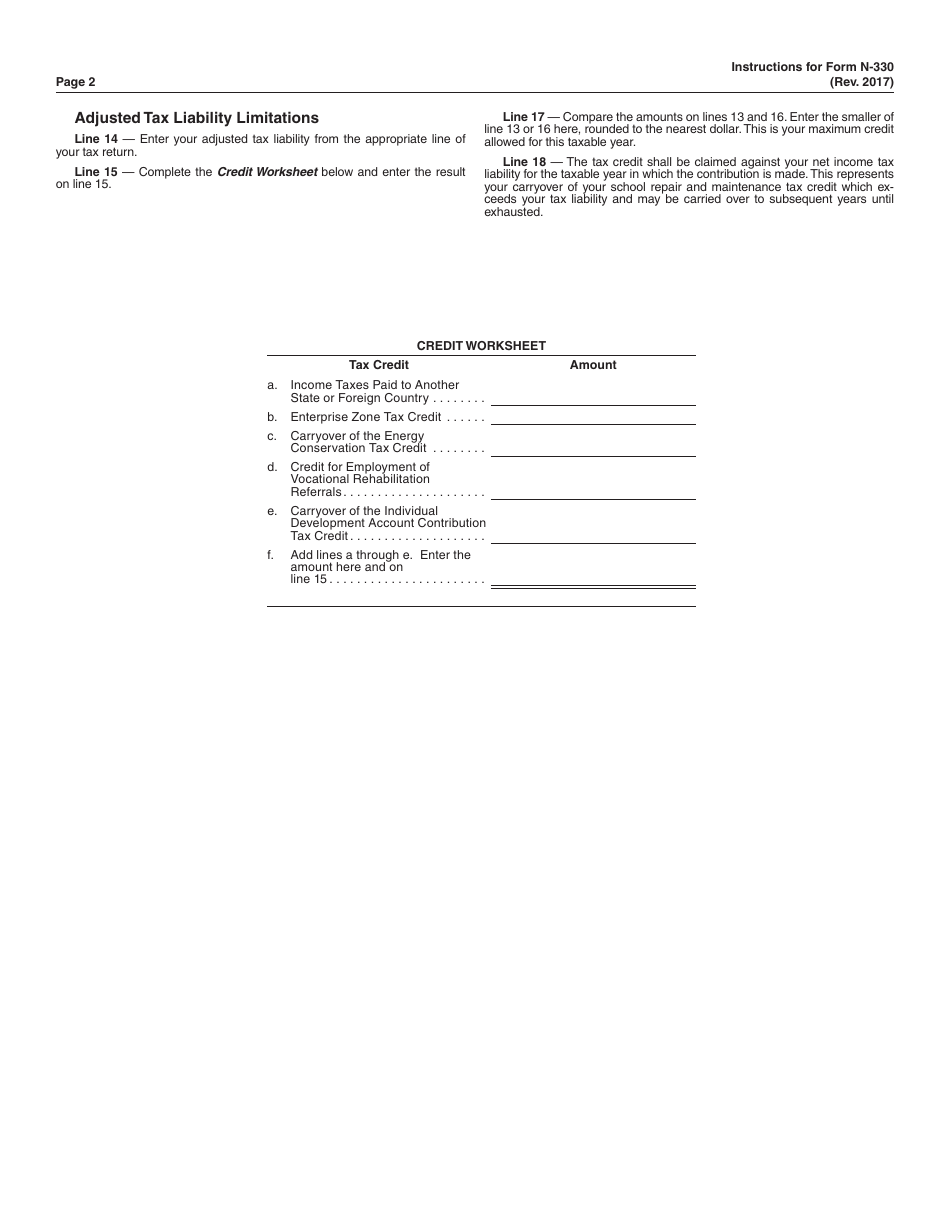

Instructions for Form N-330

for the current year.

Instructions for Form N-330 School Repair and Maintenance Tax Credit - Hawaii

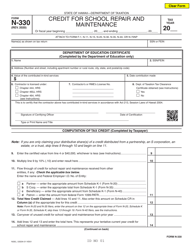

This document contains official instructions for Form N-330 , School Repair and Maintenance Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-330 is available for download through this link.

FAQ

Q: What is Form N-330?

A: Form N-330 is the School Repair and Maintenance Tax Credit form in Hawaii.

Q: What is the purpose of Form N-330?

A: The purpose of Form N-330 is to claim a tax credit for expenses incurred for school repair and maintenance in Hawaii.

Q: Who is eligible to file Form N-330?

A: Individual taxpayers or corporate taxpayers who have made eligible expenses for school repair and maintenance in Hawaii are eligible to file Form N-330.

Q: What expenses can be claimed on Form N-330?

A: Expenses for repair and maintenance projects in Hawaii schools, including materials, labor, and equipment, can be claimed on Form N-330.

Q: What is the deadline for filing Form N-330?

A: Form N-330 must be filed by the due date of the taxpayer's income tax return in Hawaii, which is generally April 20th.

Q: Are there any limitations on the amount of tax credit that can be claimed?

A: Yes, the tax credit for school repair and maintenance in Hawaii is limited to $150,000 per taxpayer per year.

Q: Are there any supporting documents required to be submitted with Form N-330?

A: Yes, taxpayers must provide documentation and receipts for the expenses claimed on Form N-330.

Q: Can Form N-330 be filed electronically?

A: No, currently Form N-330 cannot be filed electronically and must be filed by mail.

Q: Who can I contact for further assistance?

A: For further assistance or questions regarding Form N-330, you can contact the Hawaii Department of Taxation.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.