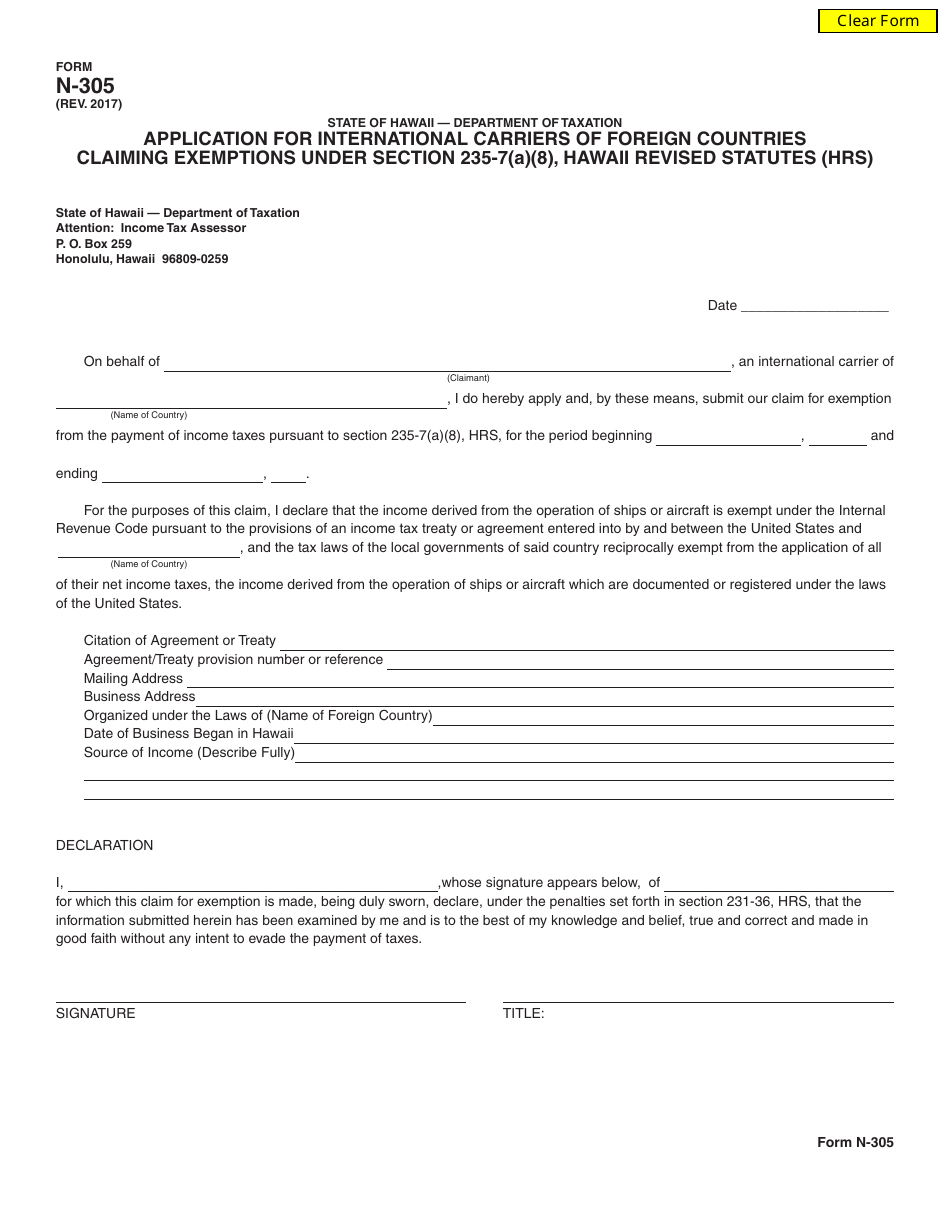

Form N-305 Application for International Carriers of Foreign Countries Claiming Exemptions Under Section 235-7(A)(8), Hawaii Revised Statutes (Hrs) - Hawaii

What Is Form N-305?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-305?

A: Form N-305 is an application for international carriers of foreign countries.

Q: Who can use Form N-305?

A: International carriers of foreign countriesclaiming exemptions under Section 235-7(A)(8), Hawaii Revised Statutes (HRS) can use Form N-305.

Q: What is the purpose of Form N-305?

A: The purpose of Form N-305 is to claim exemptions under Section 235-7(A)(8), HRS in Hawaii.

Q: Are there any fees associated with Form N-305?

A: There are no fees associated with filing Form N-305.

Q: What should I do with Form N-305 after filling it out?

A: After filling out Form N-305, you should submit it to the Hawaii Department of Taxation.

Q: Are there any supporting documents required with Form N-305?

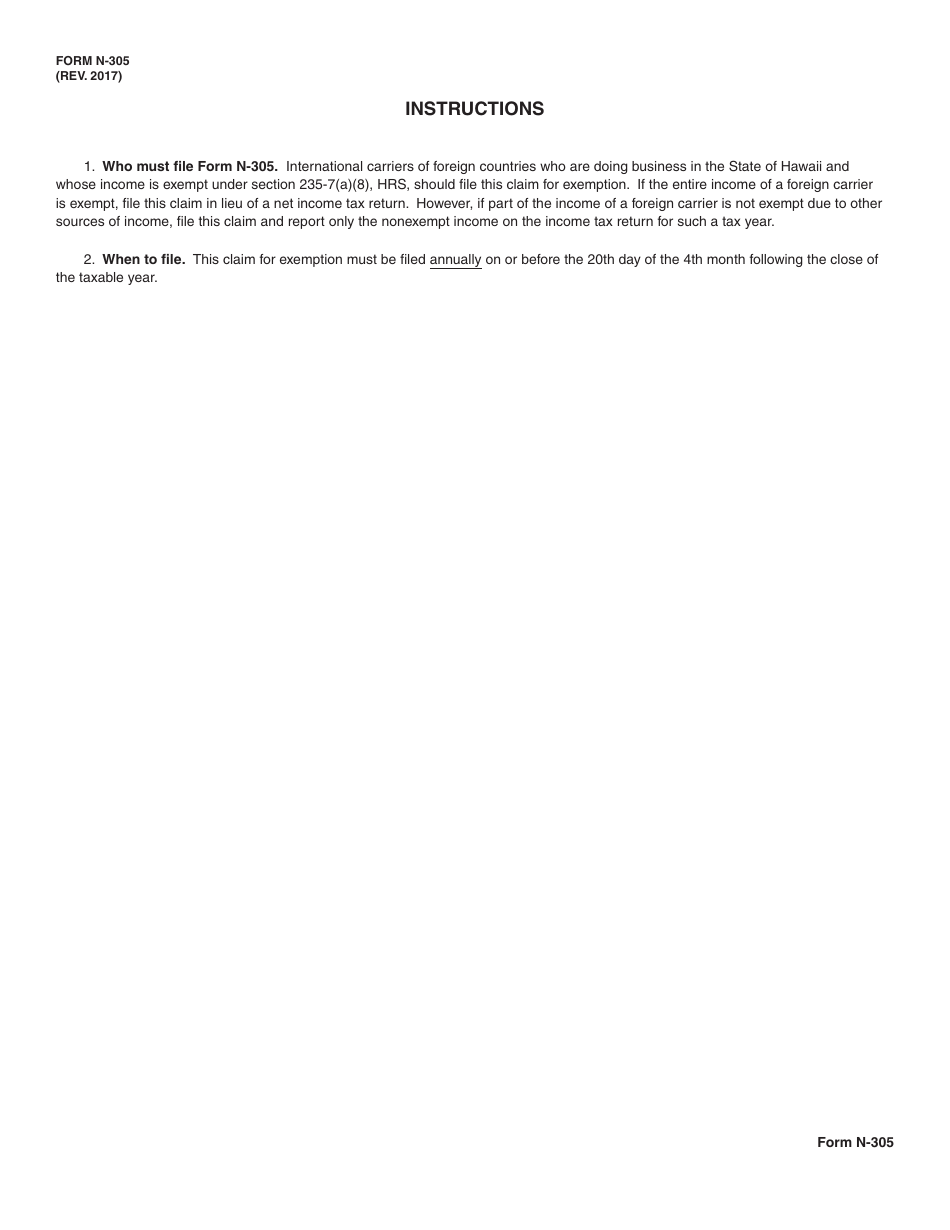

A: Yes, you may need to submit supporting documents depending on your specific situation. Please review the instructions provided with the form.

Q: What is Section 235-7(A)(8), HRS?

A: Section 235-7(A)(8), HRS is a specific section of the Hawaii Revised Statutes that pertains to exemptions for international carriers of foreign countries.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-305 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.