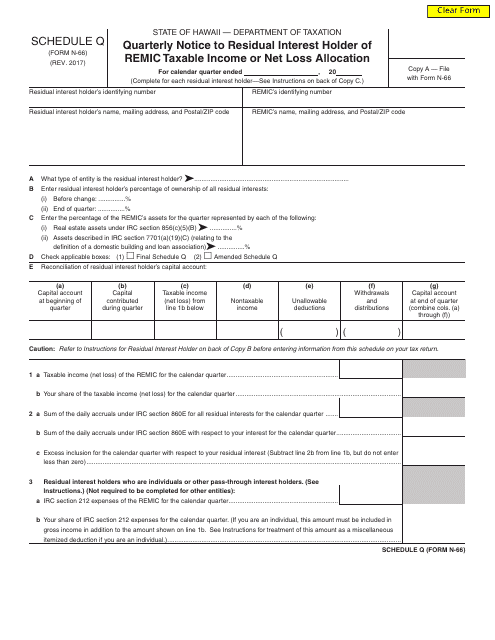

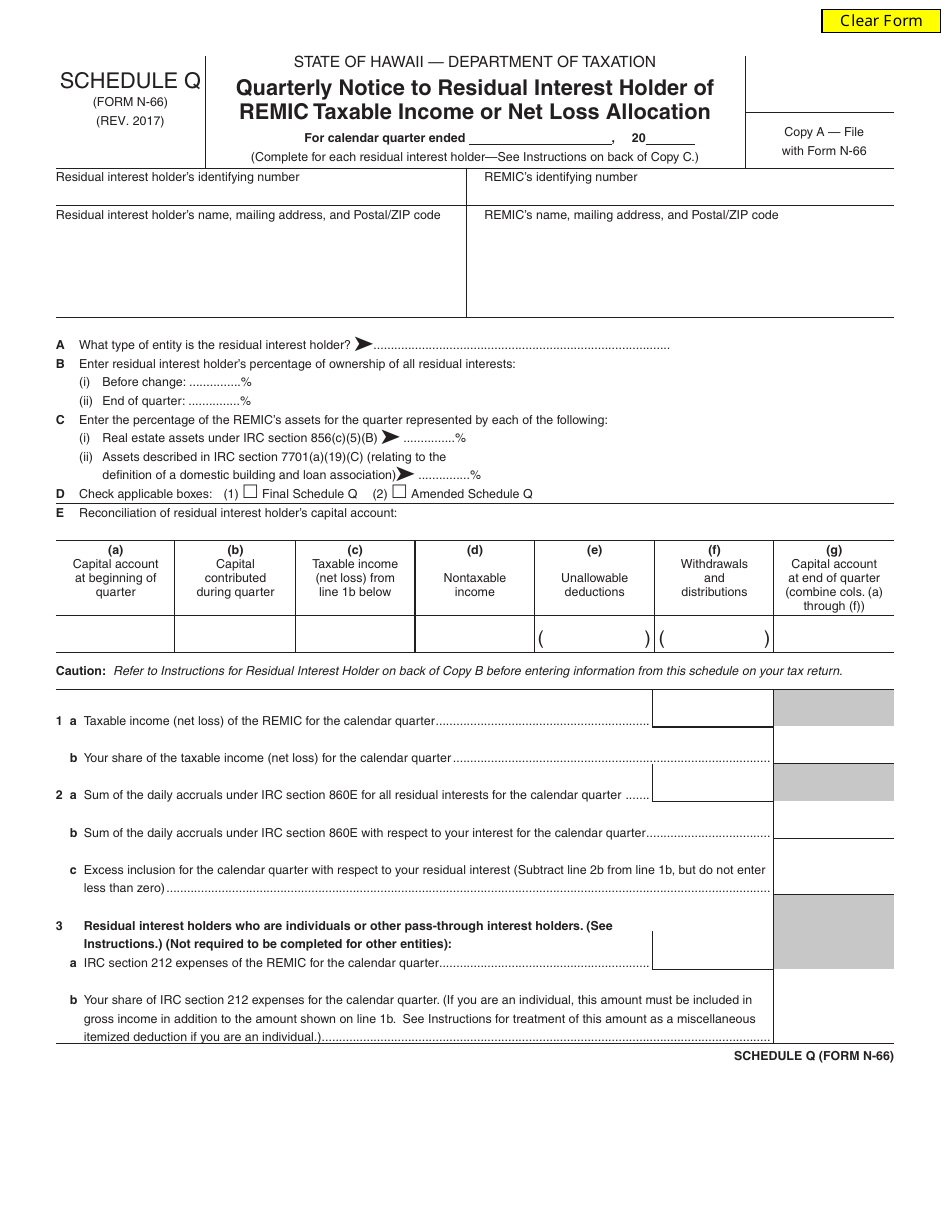

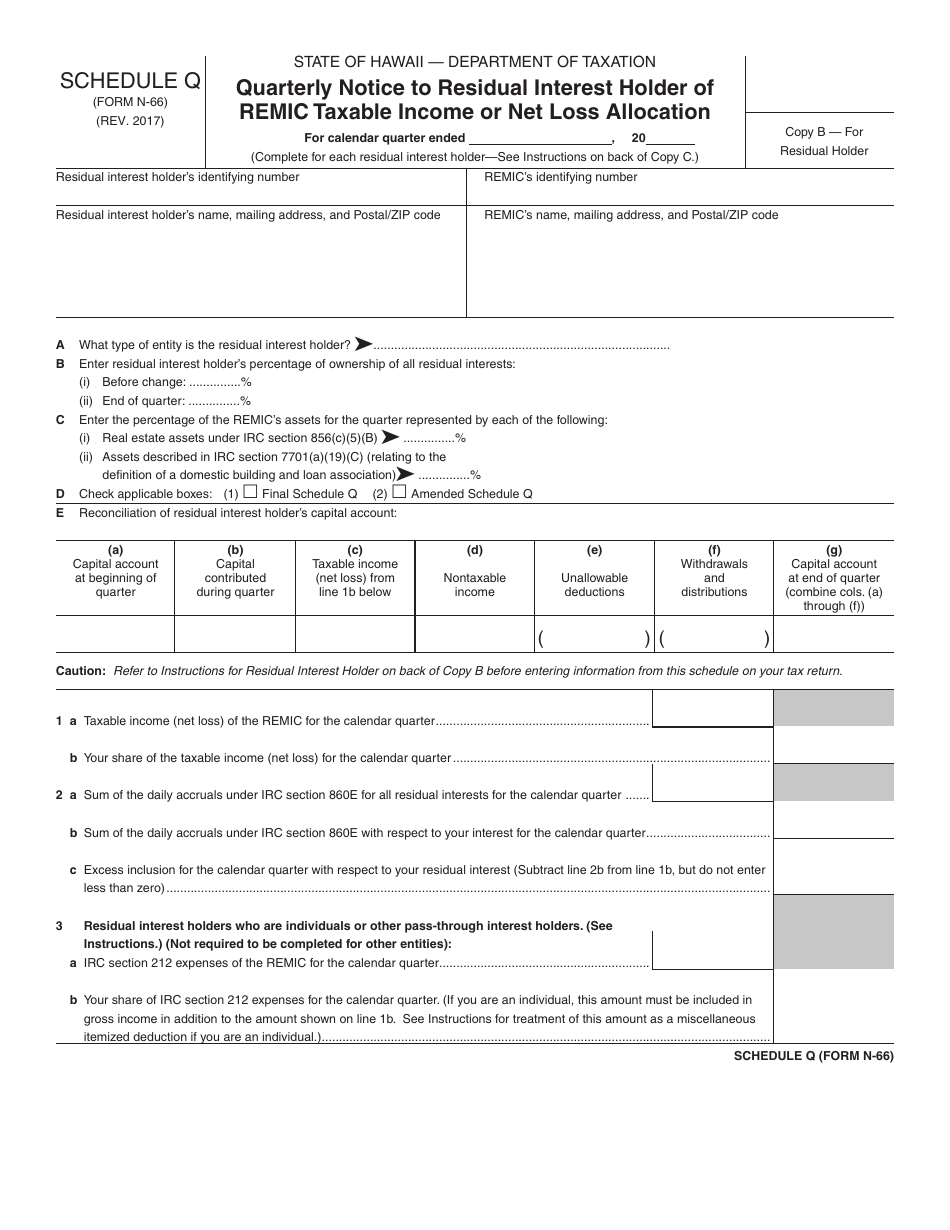

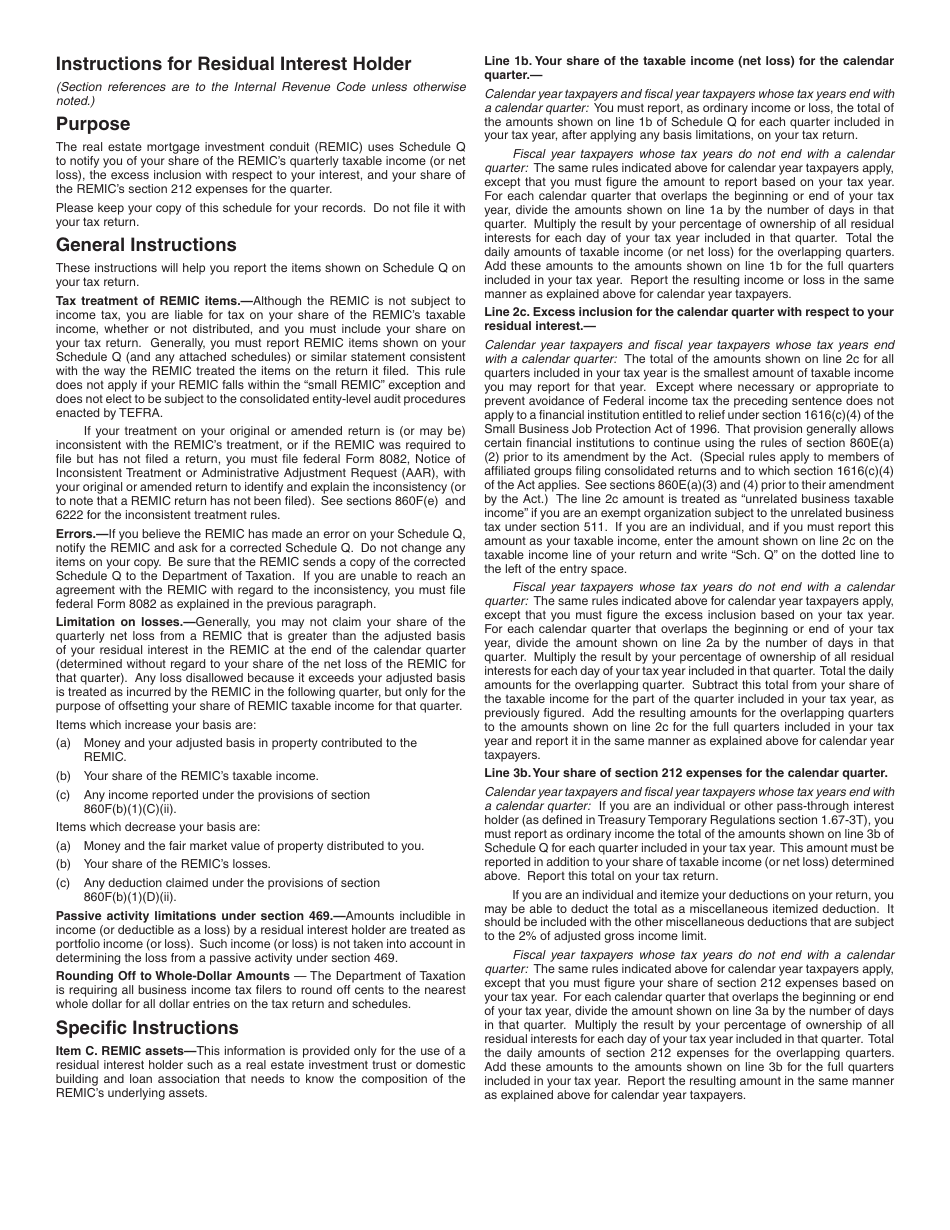

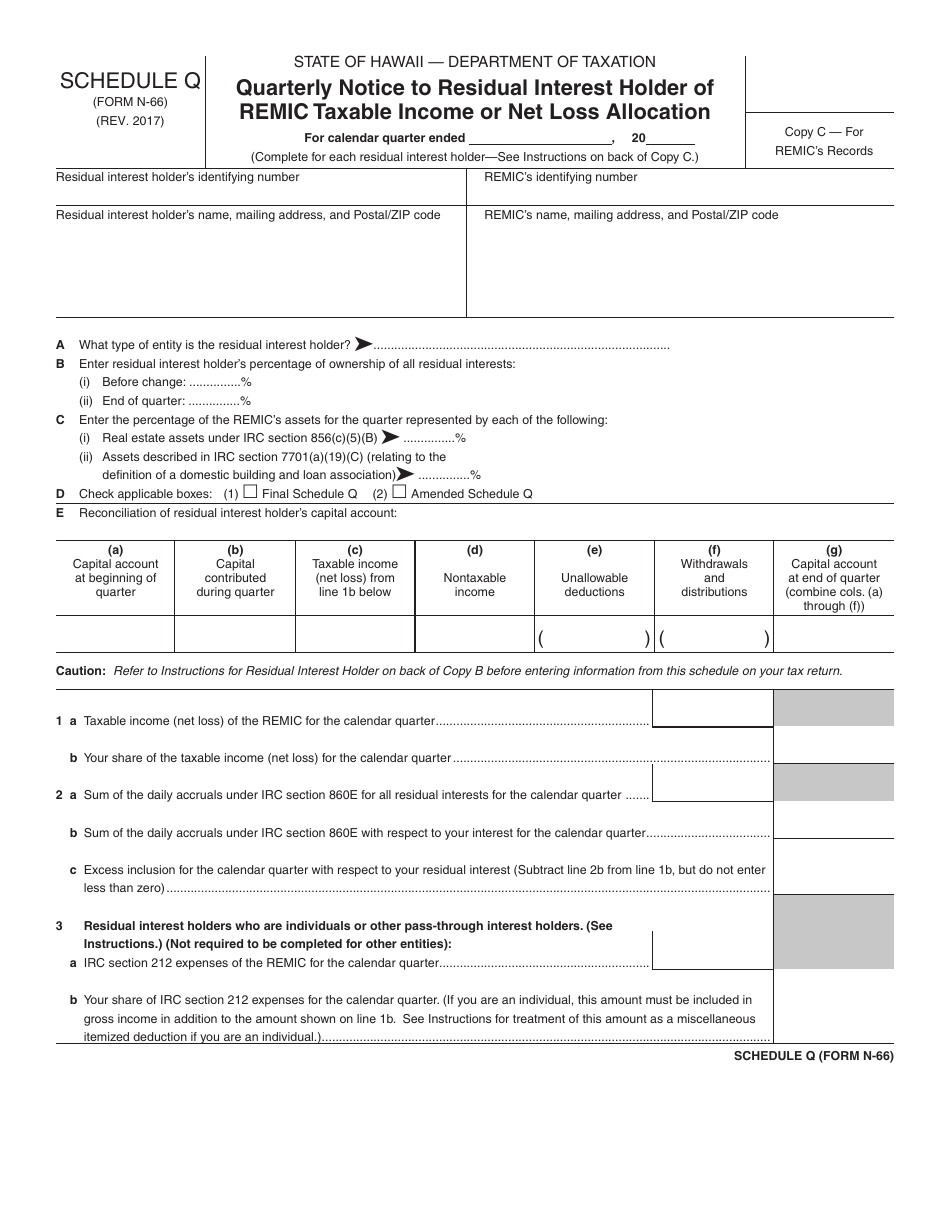

Form N-66 Schedule Q Quarterly Notice to Residual Interest Holder of REMIC Taxable Income or Net Loss Allocation - Hawaii

What Is Form N-66 Schedule Q?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-66?

A: Form N-66 is a Schedule Q, which is used to provide quarterly notice to the residual interest holder of a REMIC (Real Estate Mortgage Investment Conduit) regarding taxable income or net loss allocation.

Q: What is a REMIC?

A: REMIC stands for Real Estate Mortgage Investment Conduit. It is a type of entity that holds a pool of mortgages and issues securities backed by those mortgages.

Q: Who needs to file Form N-66?

A: The issuer or nominee of a REMIC is required to file Form N-66 to provide quarterly notice to the residual interest holder.

Q: What information is included in Form N-66?

A: Form N-66 includes information about the allocation of taxable income or net loss to the residual interest holder of a REMIC.

Q: Do I need to file Form N-66 in Hawaii?

A: Yes, Form N-66 is specific to Hawaii and is used to report taxable income or net loss allocation for REMICs located in Hawaii.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-66 Schedule Q by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.