This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-30 Schedule P

for the current year.

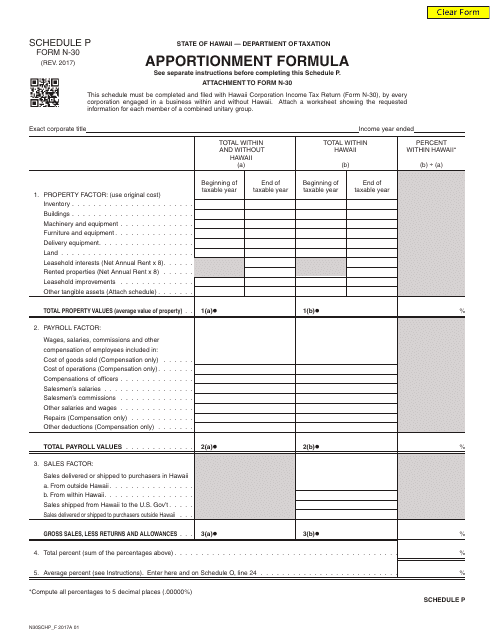

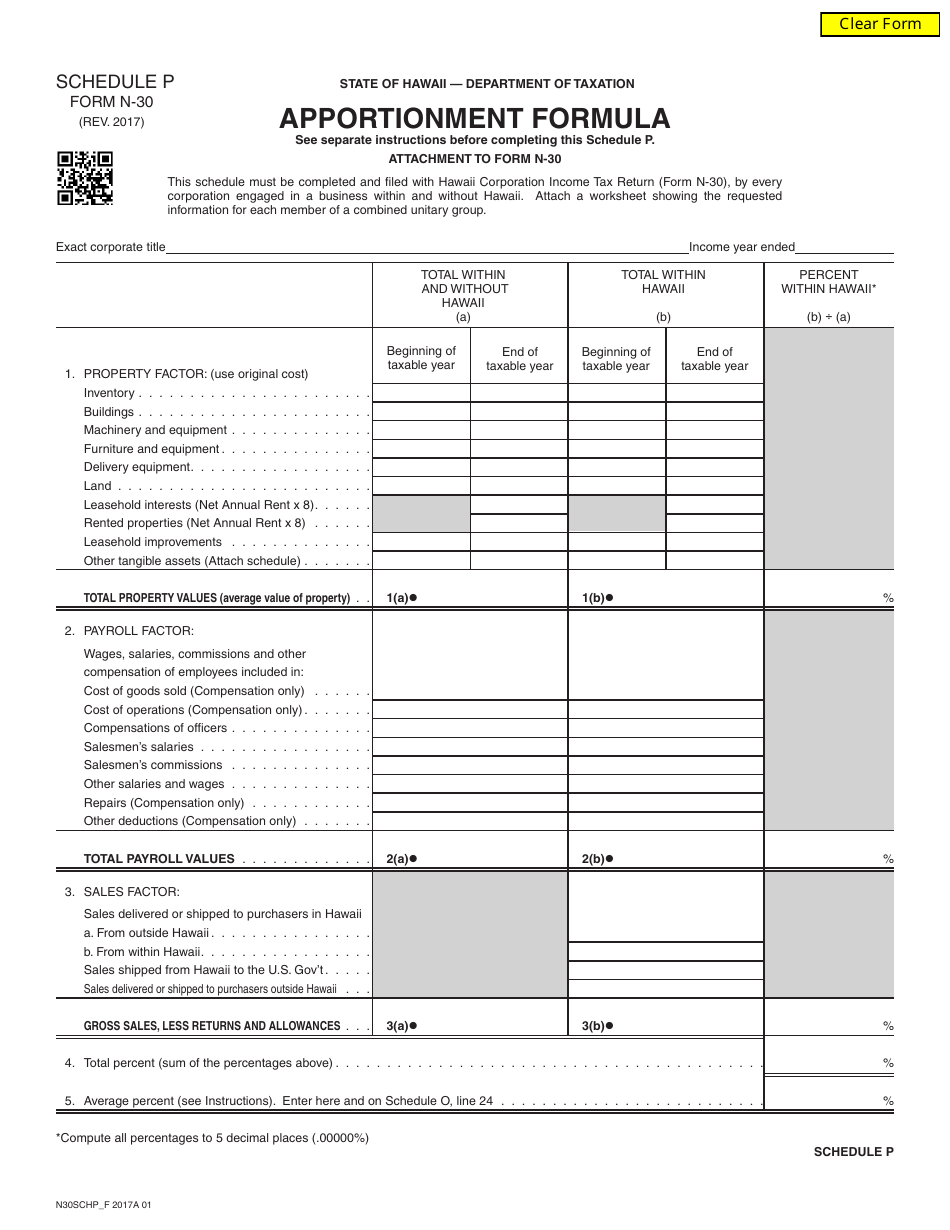

Form N-30 Schedule P Apportionment Formula - Hawaii

What Is Form N-30 Schedule P?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-30 Schedule P?

A: Form N-30 Schedule P is a tax form used in Hawaii to determine the apportionment formula for calculating the state tax liability of multi-state corporations.

Q: What is apportionment formula?

A: Apportionment formula is a method used to determine the percentage of a multi-state corporation's income that is subject to taxation in a particular state, based on the corporation's business activities and presence in that state.

Q: Why is apportionment formula important?

A: Apportionment formula is important because it ensures that multi-state corporations are taxed fairly based on their actual business activities and presence in each state.

Q: How is the apportionment formula determined for Hawaii?

A: The apportionment formula for Hawaii is determined using multiple factors, including the percentage of the corporation's sales, property, and payroll in the state, as well as a weighting factor assigned to each factor.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-30 Schedule P by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.