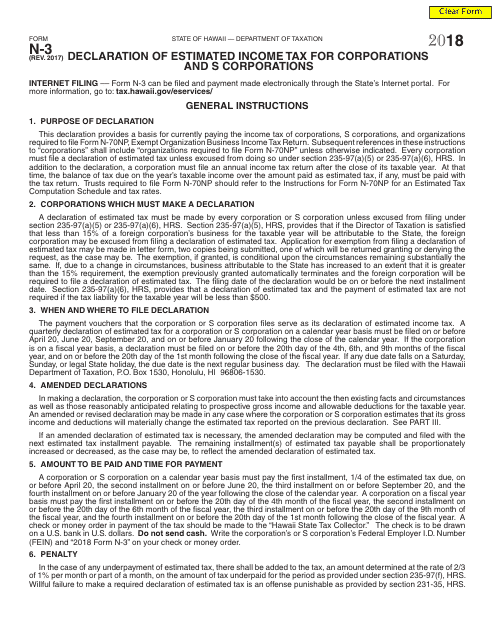

Form N-3 Declaration of Estimated Income Tax for Corporations and S Corporations - Hawaii

What Is Form N-3?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-3?

A: Form N-3 is the Declaration of Estimated Income Tax form for Corporations and S Corporations in Hawaii.

Q: Who is required to file Form N-3?

A: Corporations and S Corporations in Hawaii are required to file Form N-3 if they have estimated income tax liability.

Q: What is the purpose of Form N-3?

A: The purpose of Form N-3 is to report and pay estimated income tax for corporations and S corporations in Hawaii.

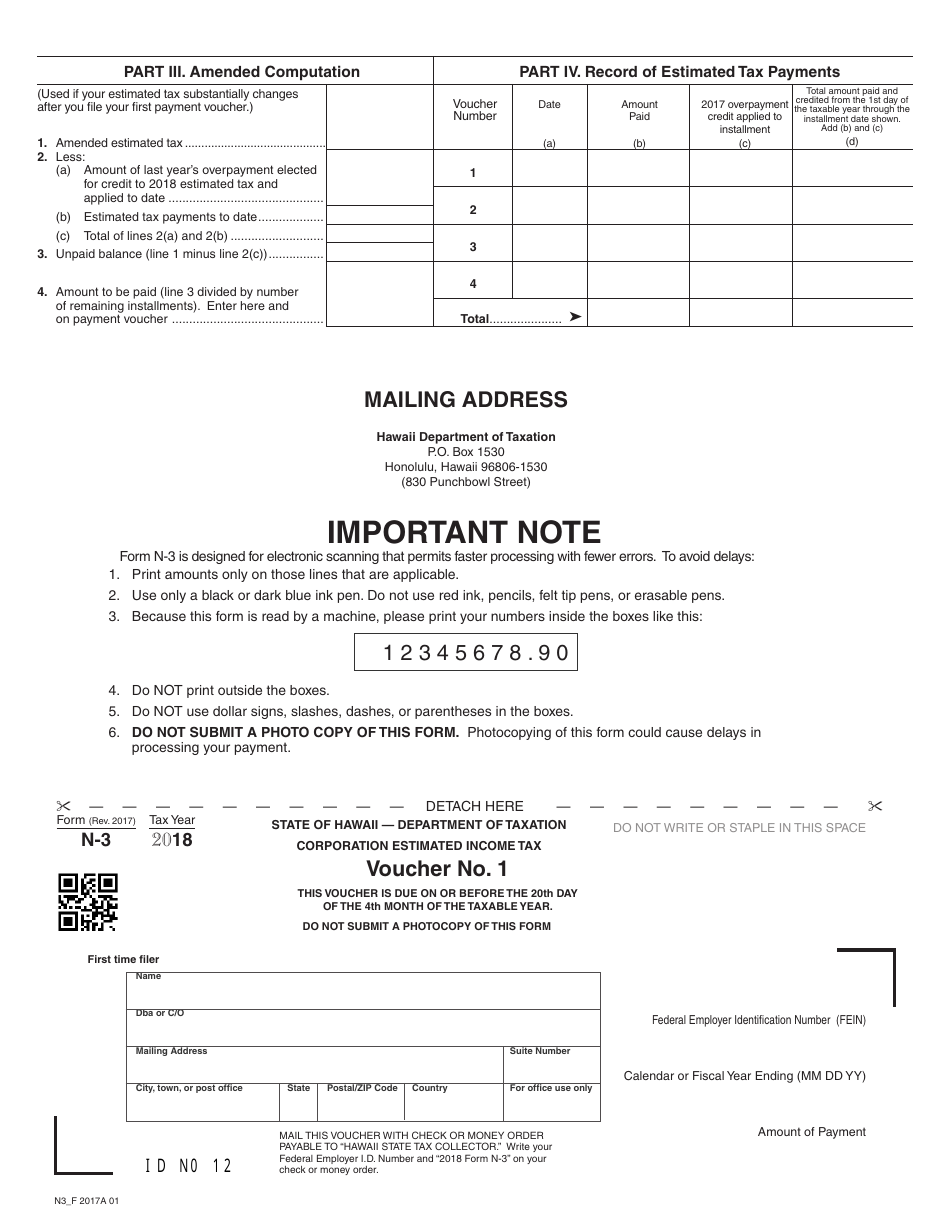

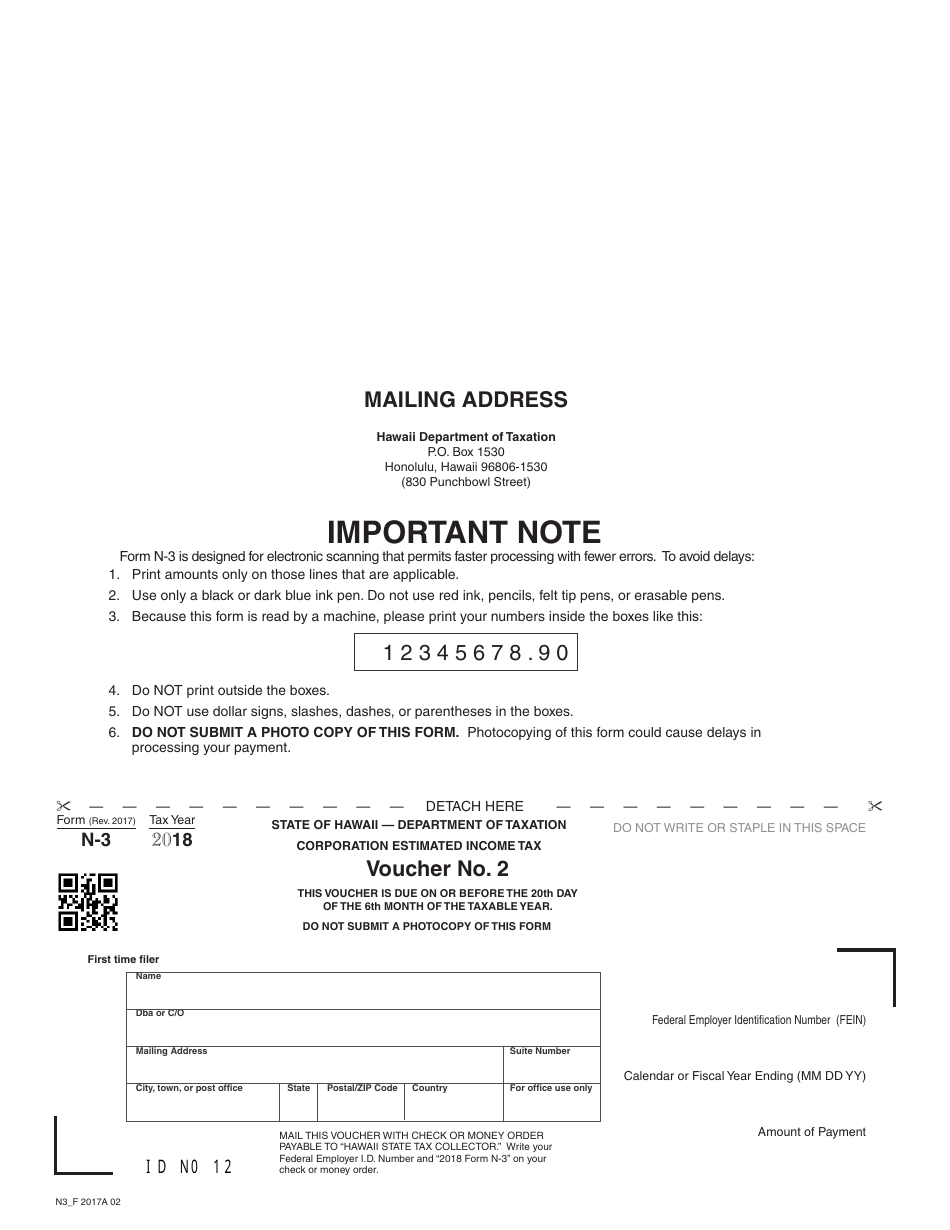

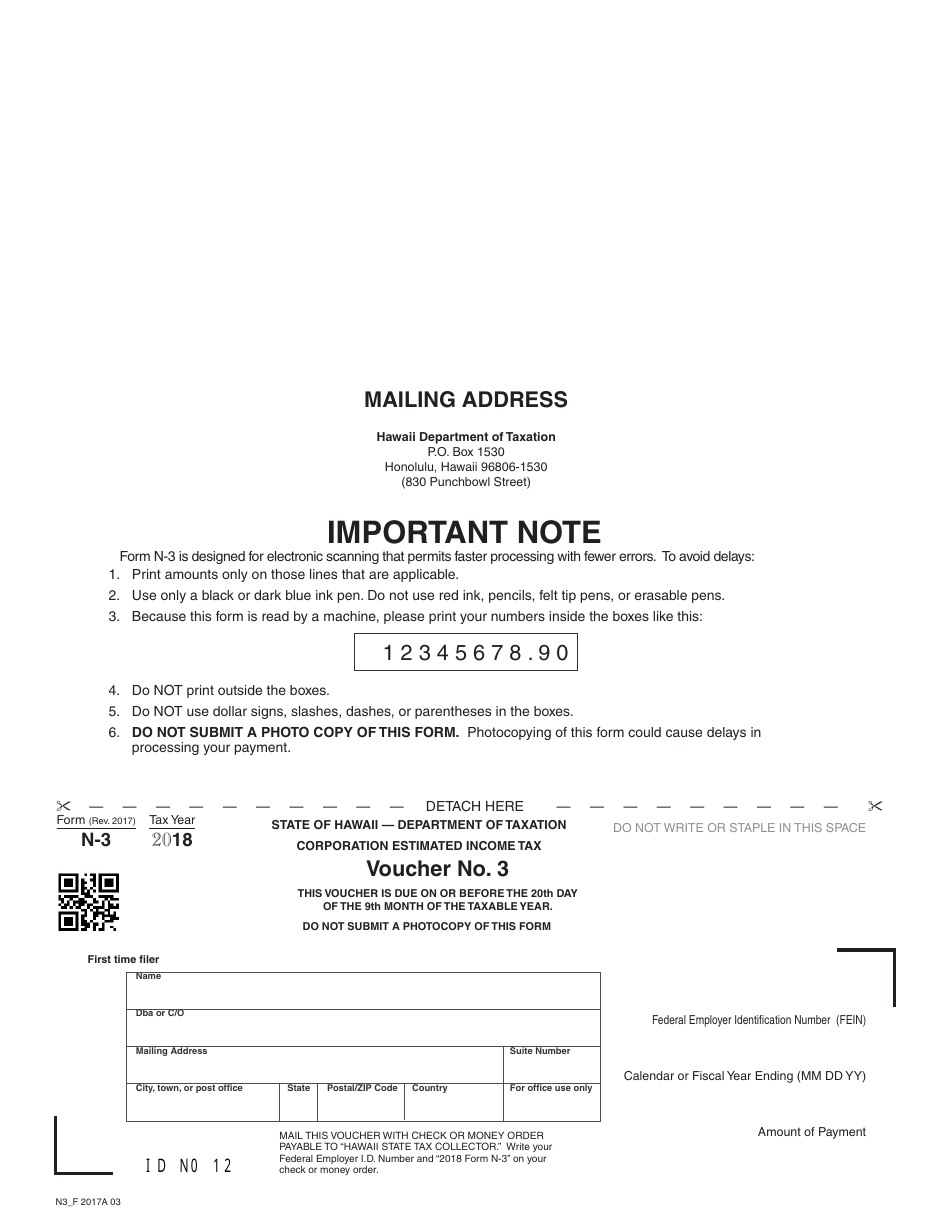

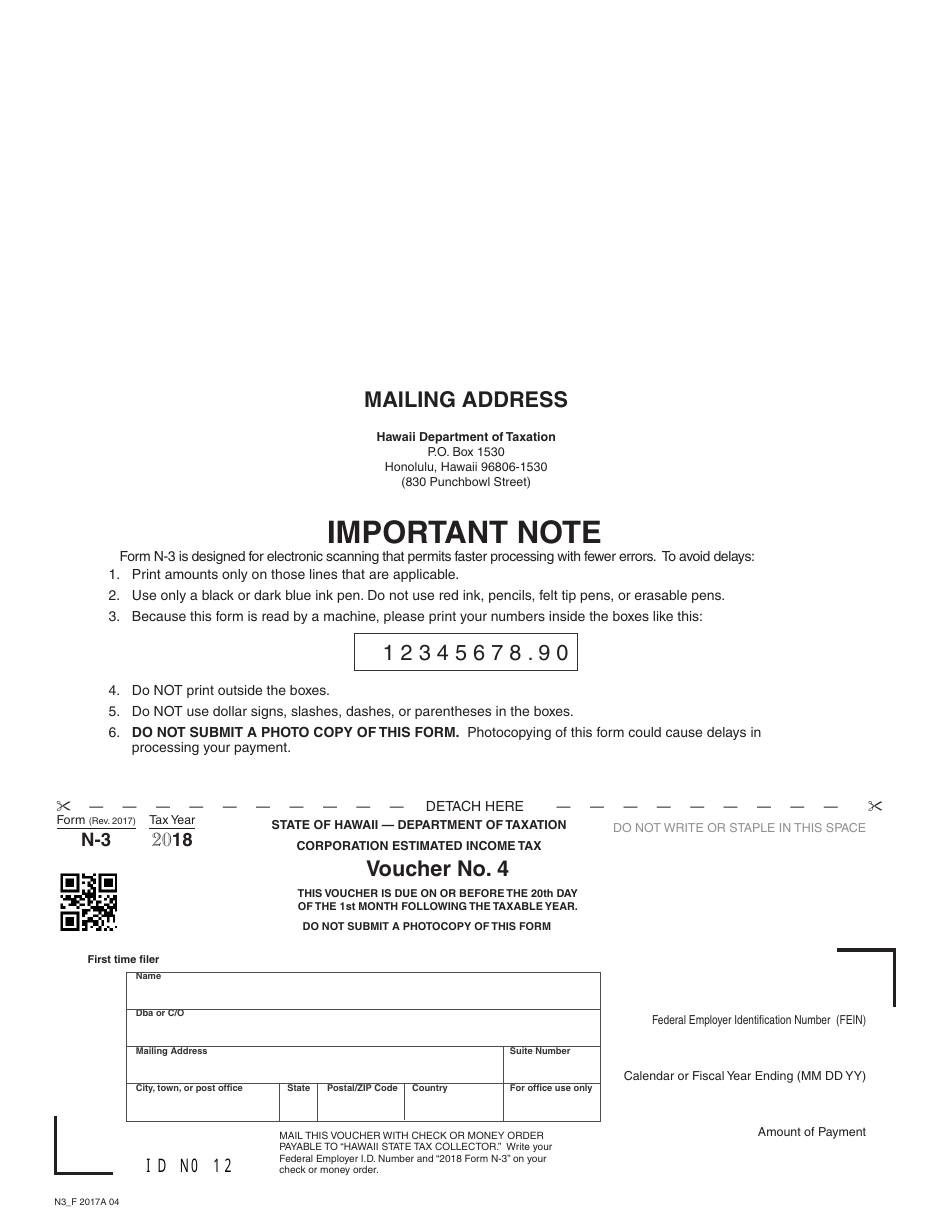

Q: When is Form N-3 due?

A: Form N-3 is due on the 20th day of the 4th, 6th, 9th, and 12th month of the taxable year.

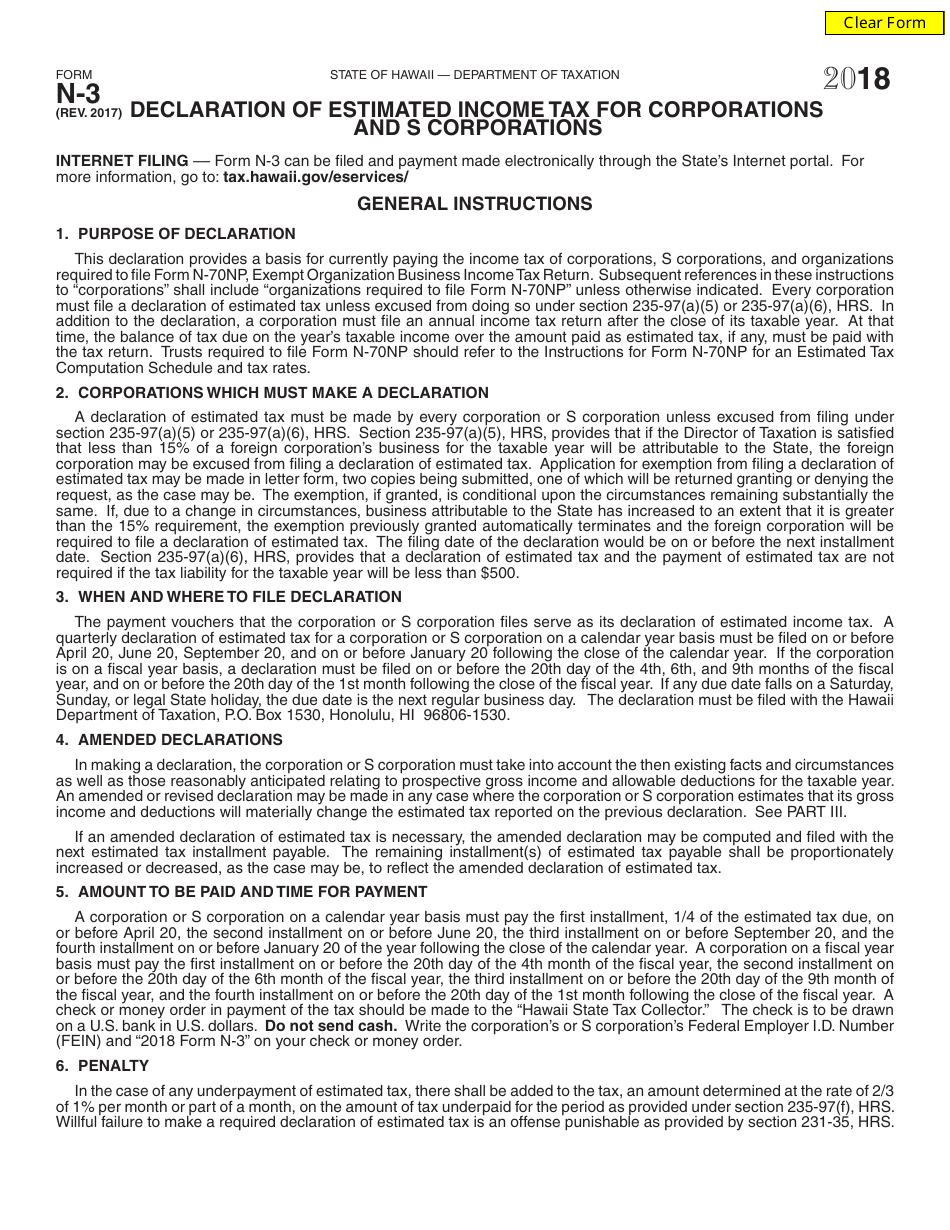

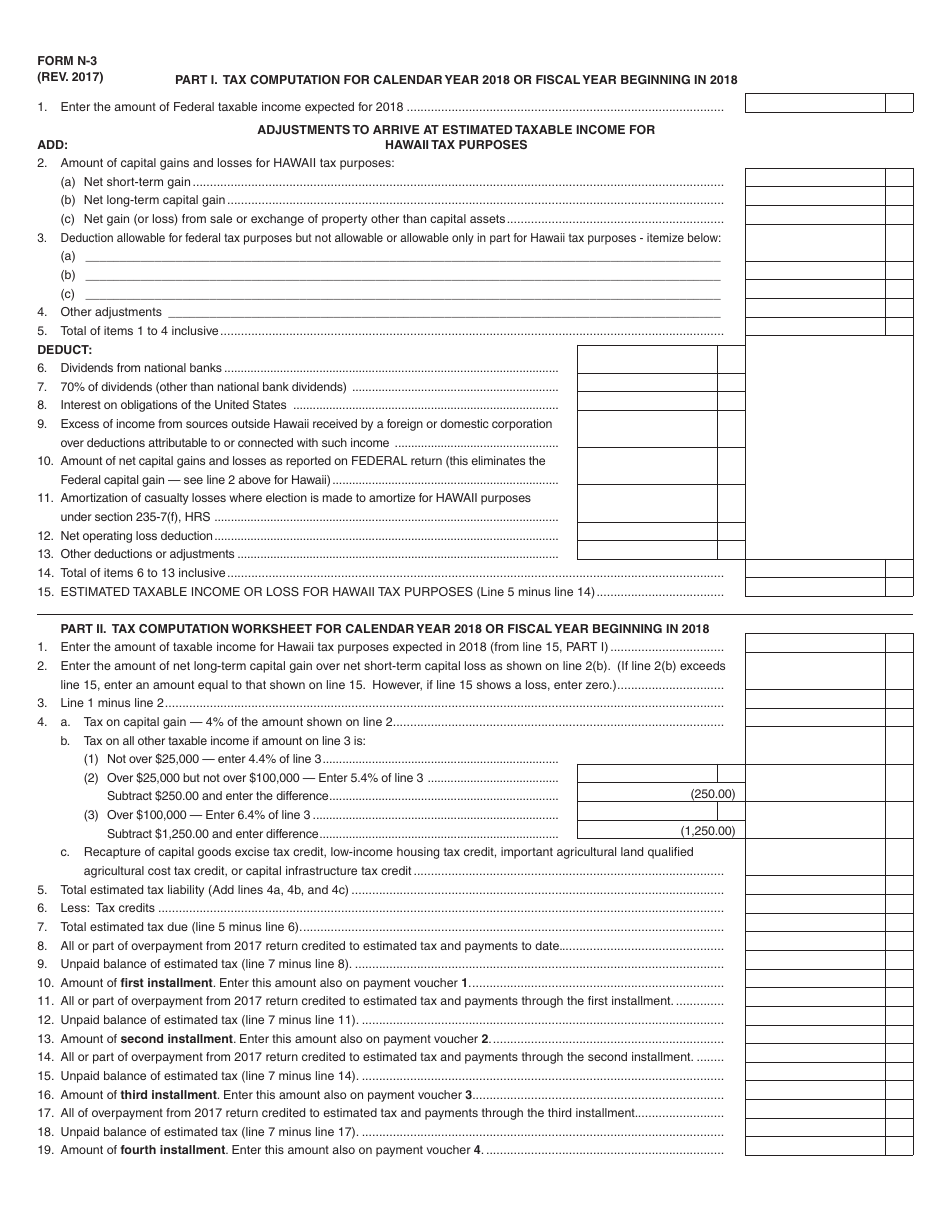

Q: What information is required on Form N-3?

A: Form N-3 requires information such as the taxpayer's name, address, federal employer identification number, estimated tax liability, and payment details.

Q: Is there a penalty for late filing of Form N-3?

A: Yes, there is a penalty for late filing of Form N-3. It is important to file the form on time to avoid penalties and interest.

Q: Are estimated tax payments required for corporations and S corporations in Hawaii?

A: Yes, corporations and S corporations in Hawaii are required to make estimated tax payments throughout the year.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-3 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.