This version of the form is not currently in use and is provided for reference only. Download this version of

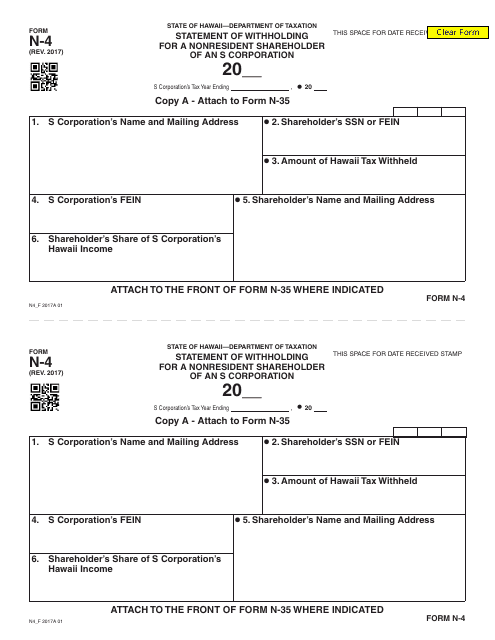

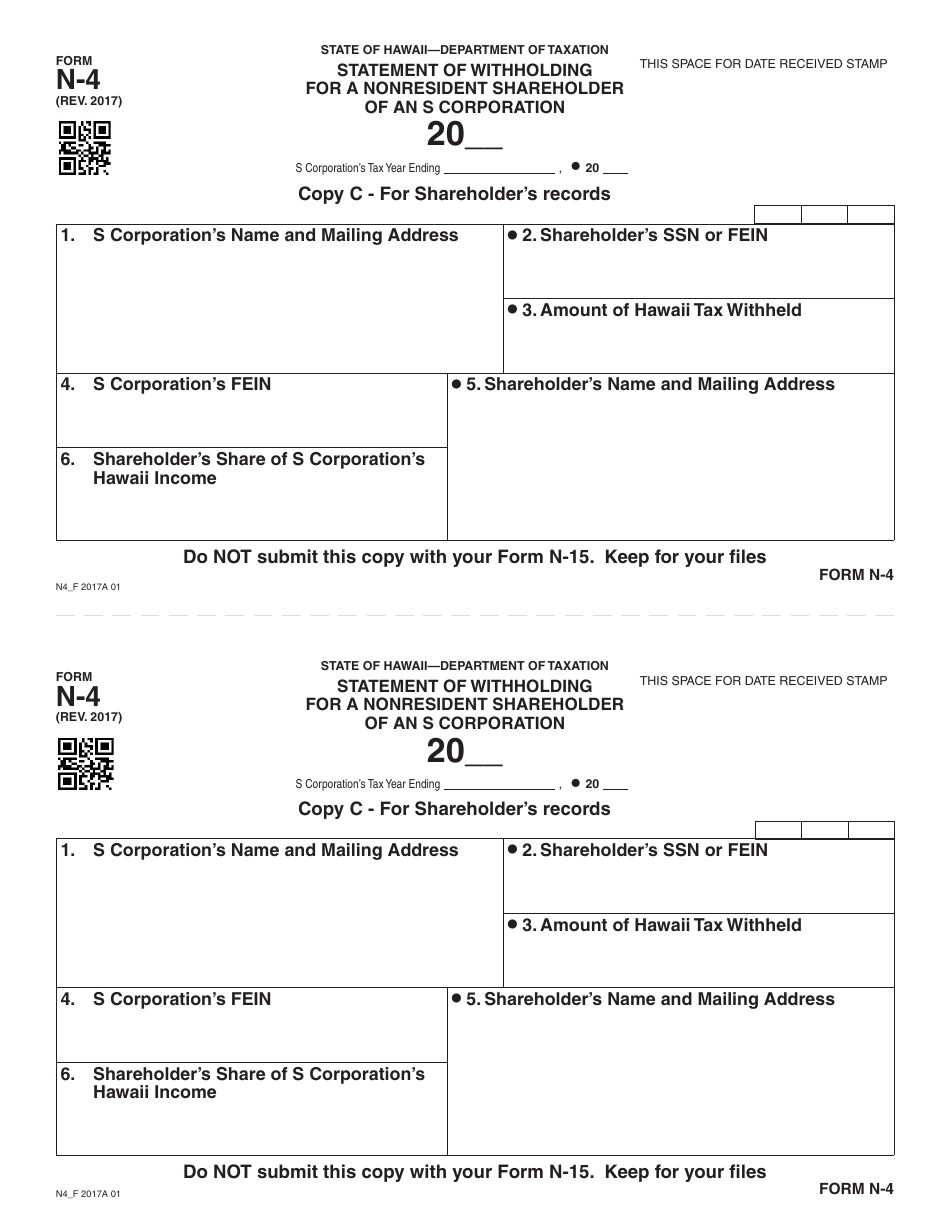

Form N-4

for the current year.

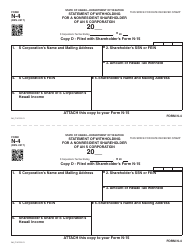

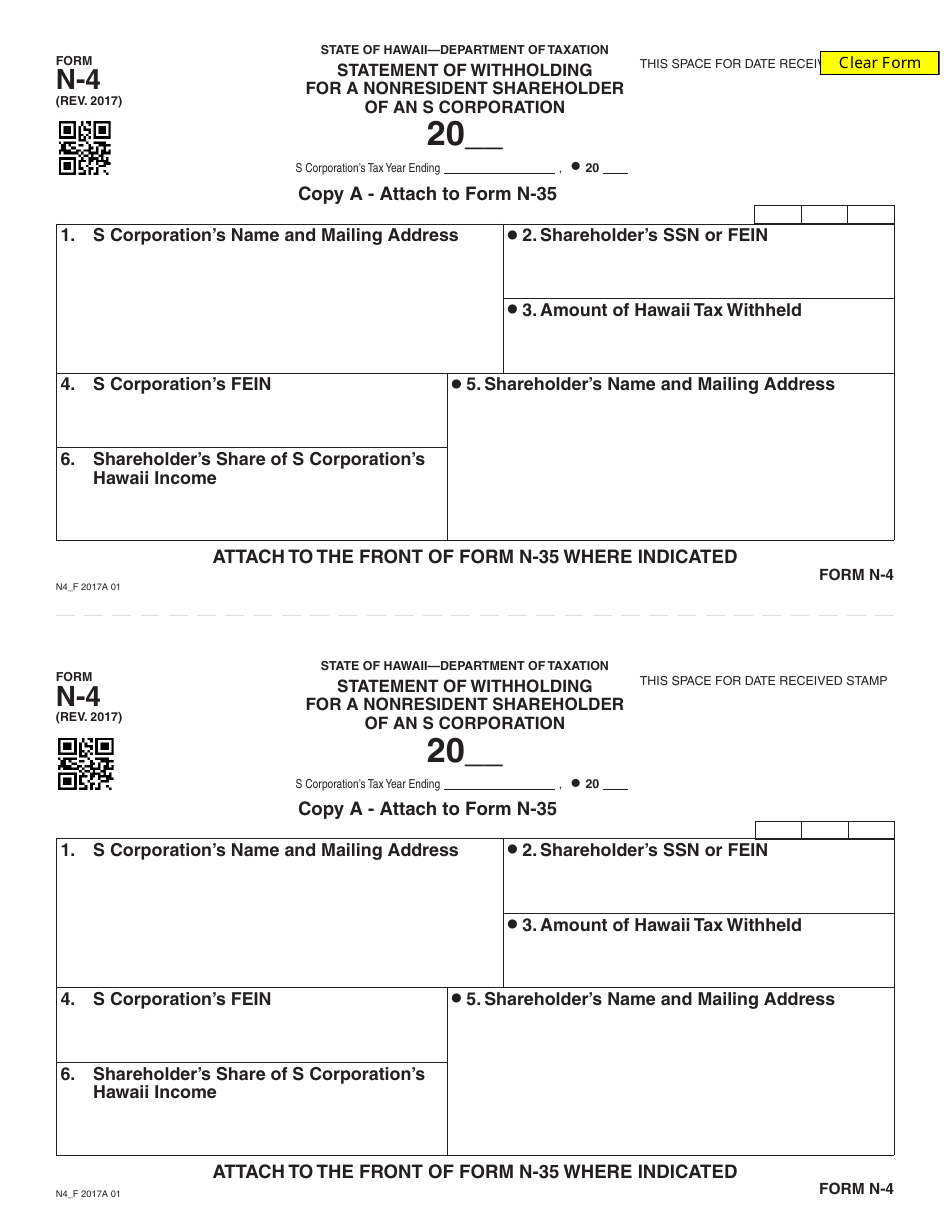

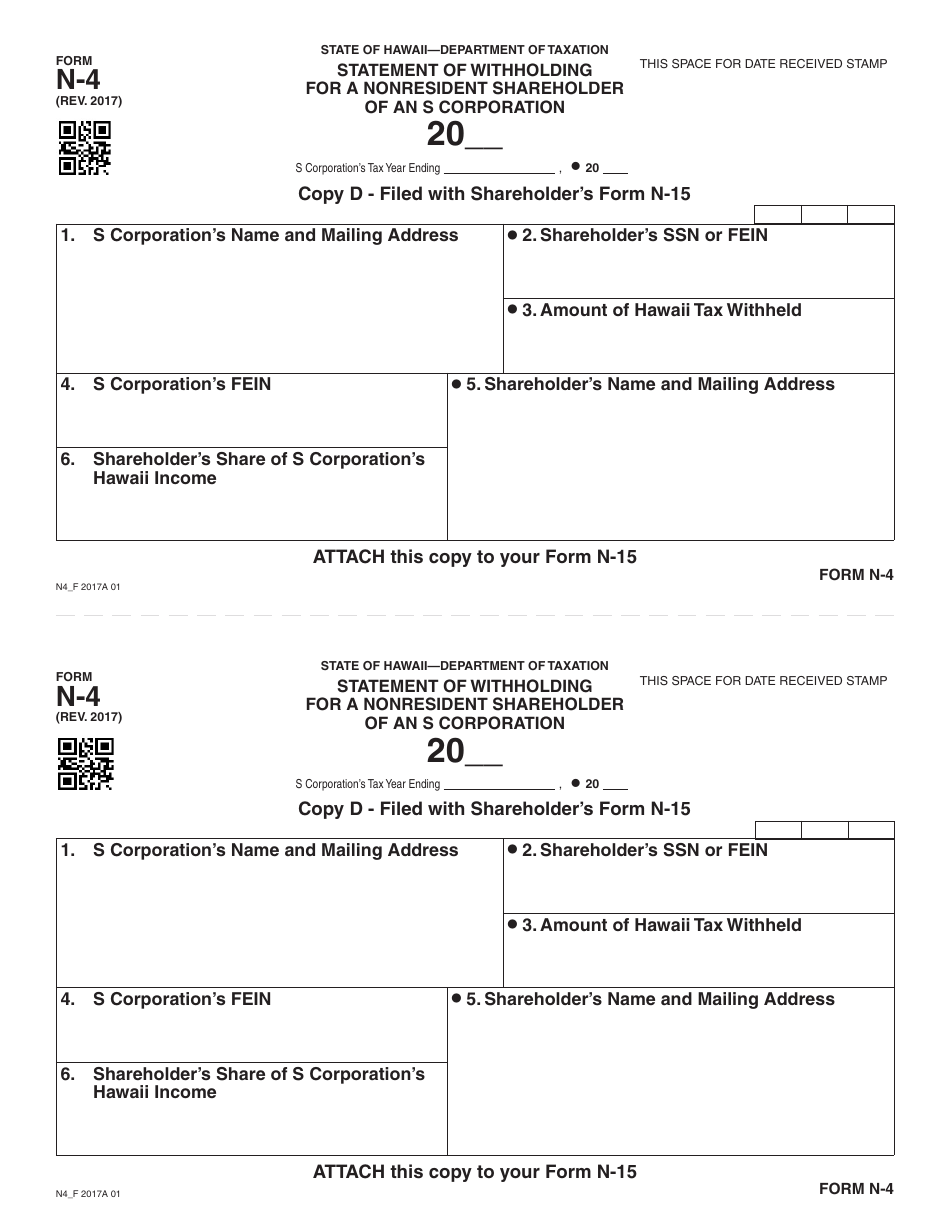

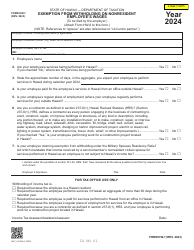

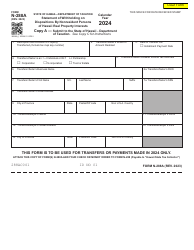

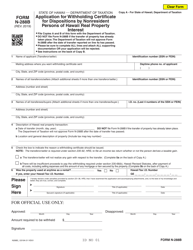

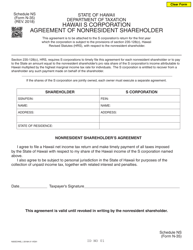

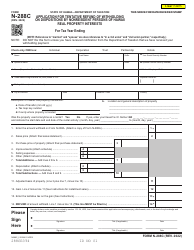

Form N-4 Statement of Withholding for a Nonresident Shareholder of an S Corporation - Hawaii

What Is Form N-4?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-4?

A: Form N-4 is the Statement of Withholding for a Nonresident Shareholder of an S Corporation - Hawaii.

Q: Who needs to file Form N-4?

A: Nonresident shareholders of an S Corporation in Hawaii need to file Form N-4.

Q: What is the purpose of Form N-4?

A: The purpose of Form N-4 is to report and withhold income tax from payments made to nonresident shareholders of an S Corporation in Hawaii.

Q: When is Form N-4 due?

A: Form N-4 is due on or before the 20th day of the month following the close of the calendar quarter.

Q: Is Form N-4 the same as federal withholding forms?

A: No, Form N-4 is specific to the state of Hawaii and is used for withholding state income tax.

Q: Are there any penalties for not filing Form N-4?

A: Yes, there may be penalties for failure to file Form N-4 or for filing an incorrect or incomplete form.

Q: Is Form N-4 required for nonresident shareholders of C Corporations?

A: No, Form N-4 is specifically for nonresident shareholders of S Corporations in Hawaii.

Q: Can I file Form N-4 electronically?

A: Yes, you may be able to file Form N-4 electronically depending on the options provided by the Hawaii Department of Taxation.

Q: Is Form N-4 the only form I need to file as a nonresident shareholder of an S Corporation in Hawaii?

A: No, in addition to Form N-4, you may also need to file other forms for federal and state income tax purposes.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-4 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.