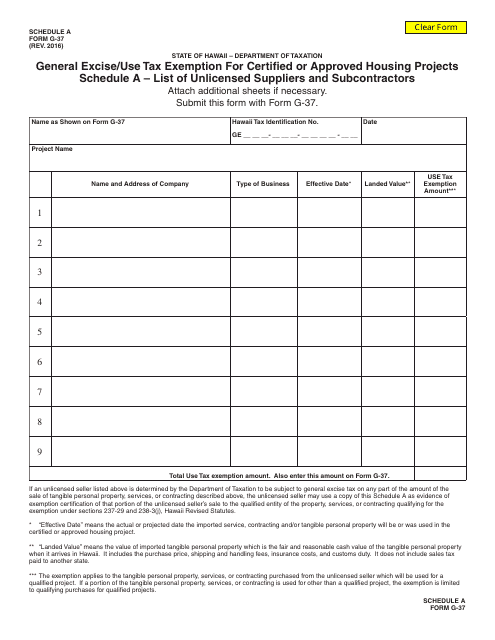

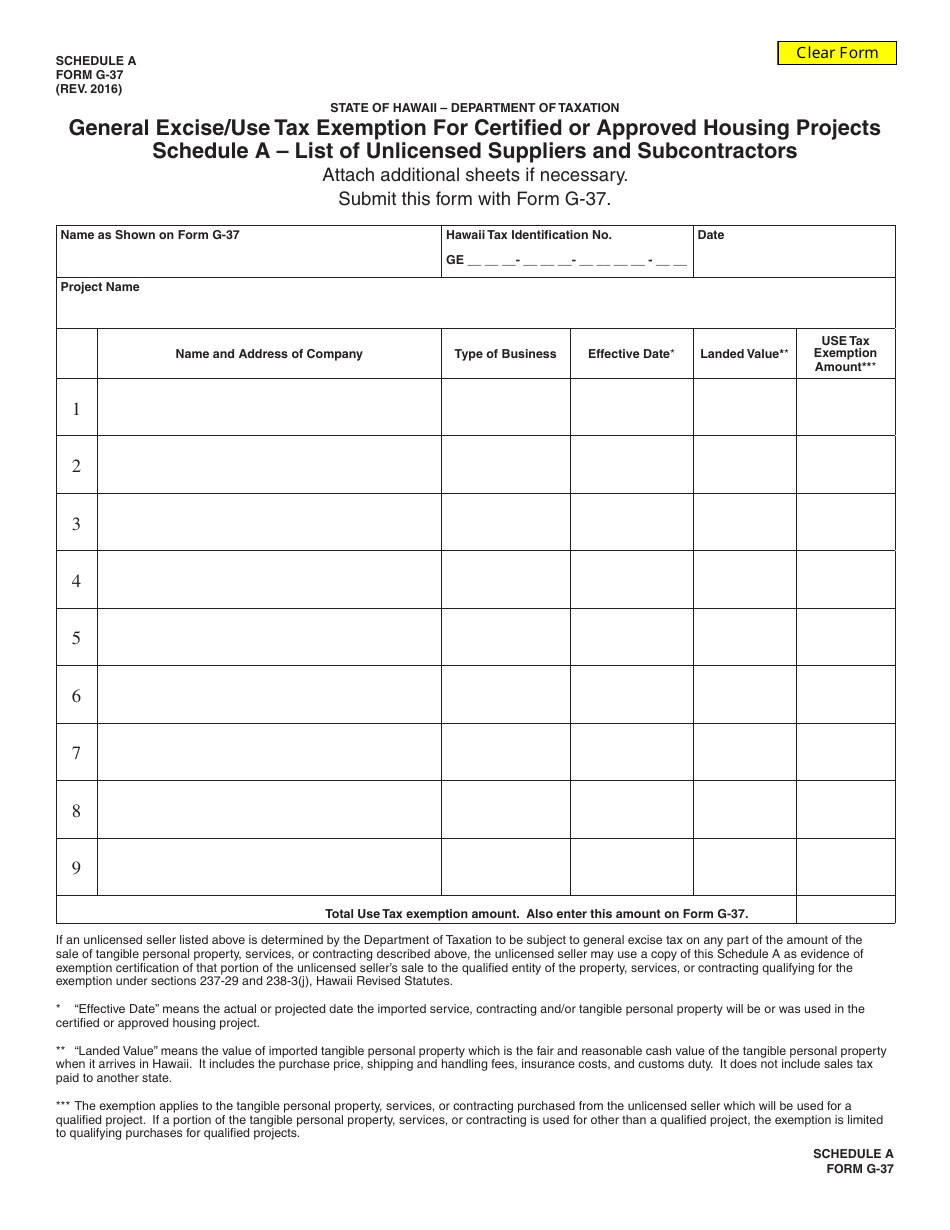

Form G-37 Schedule A List of Unlicensed Suppliers and Subcontractors - General Excise / Use Tax Exemption for Certified or Approved Housing Projects - Hawaii

What Is Form G-37 Schedule A?

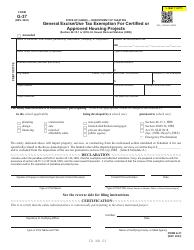

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii.The document is a supplement to Form G-37, General Excise/Use Tax Exemption for Certified or Approved Housing Projects. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-37 Schedule A?

A: Form G-37 Schedule A is a document used in Hawaii to list unlicensed suppliers and subcontractors for a general excise/use tax exemption for certified or approved housing projects.

Q: What is the purpose of Form G-37 Schedule A?

A: The purpose of Form G-37 Schedule A is to provide a list of unlicensed suppliers and subcontractors for the purpose of claiming a general excise/use tax exemption for certified or approved housing projects in Hawaii.

Q: What is a general excise/use tax exemption for certified or approved housing projects?

A: A general excise/use tax exemption for certified or approved housing projects is a tax exemption provided in Hawaii to qualifying housing projects.

Q: Who needs to fill out Form G-37 Schedule A?

A: Developers or contractors who are claiming a general excise/use tax exemption for certified or approved housing projects in Hawaii need to fill out Form G-37 Schedule A.

Q: What information is required in Form G-37 Schedule A?

A: Form G-37 Schedule A requires the listing of unlicensed suppliers and subcontractors involved in the certified or approved housing project, including their names, addresses, and amounts claimed.

Q: Are there any deadlines for submitting Form G-37 Schedule A?

A: The deadline for submitting Form G-37 Schedule A is typically specified by the Hawaii Department of Taxation and should be followed accordingly.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-37 Schedule A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.