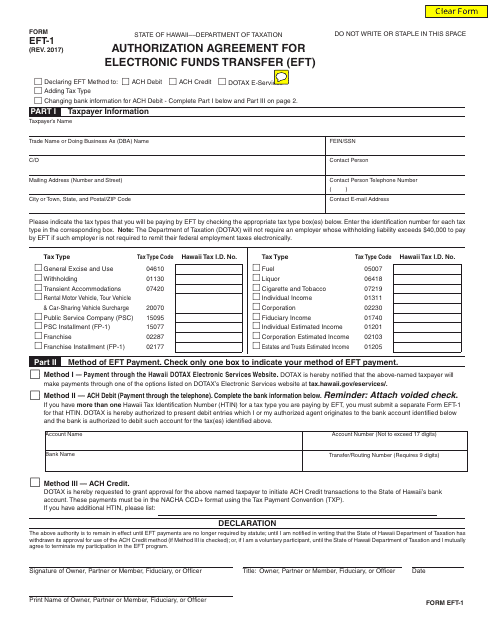

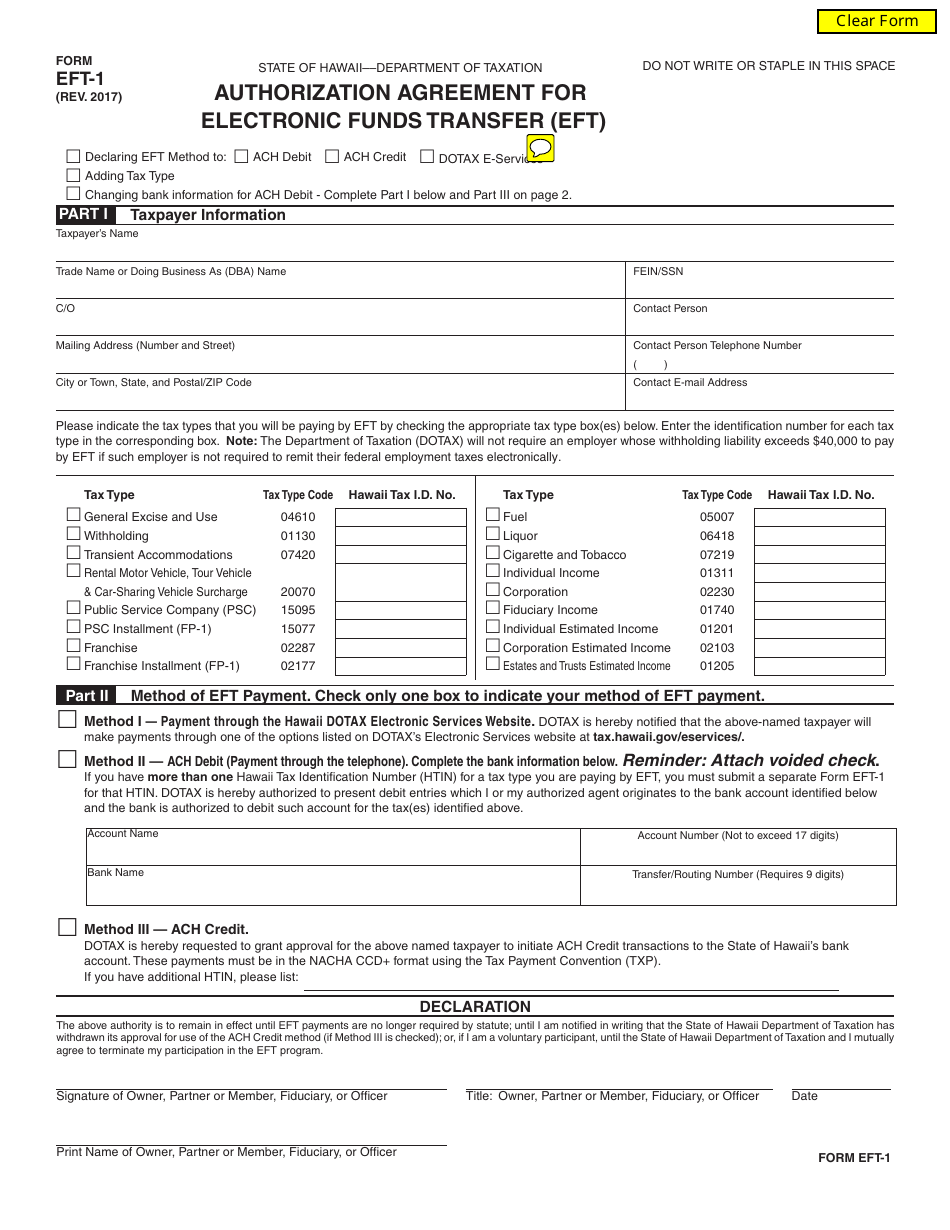

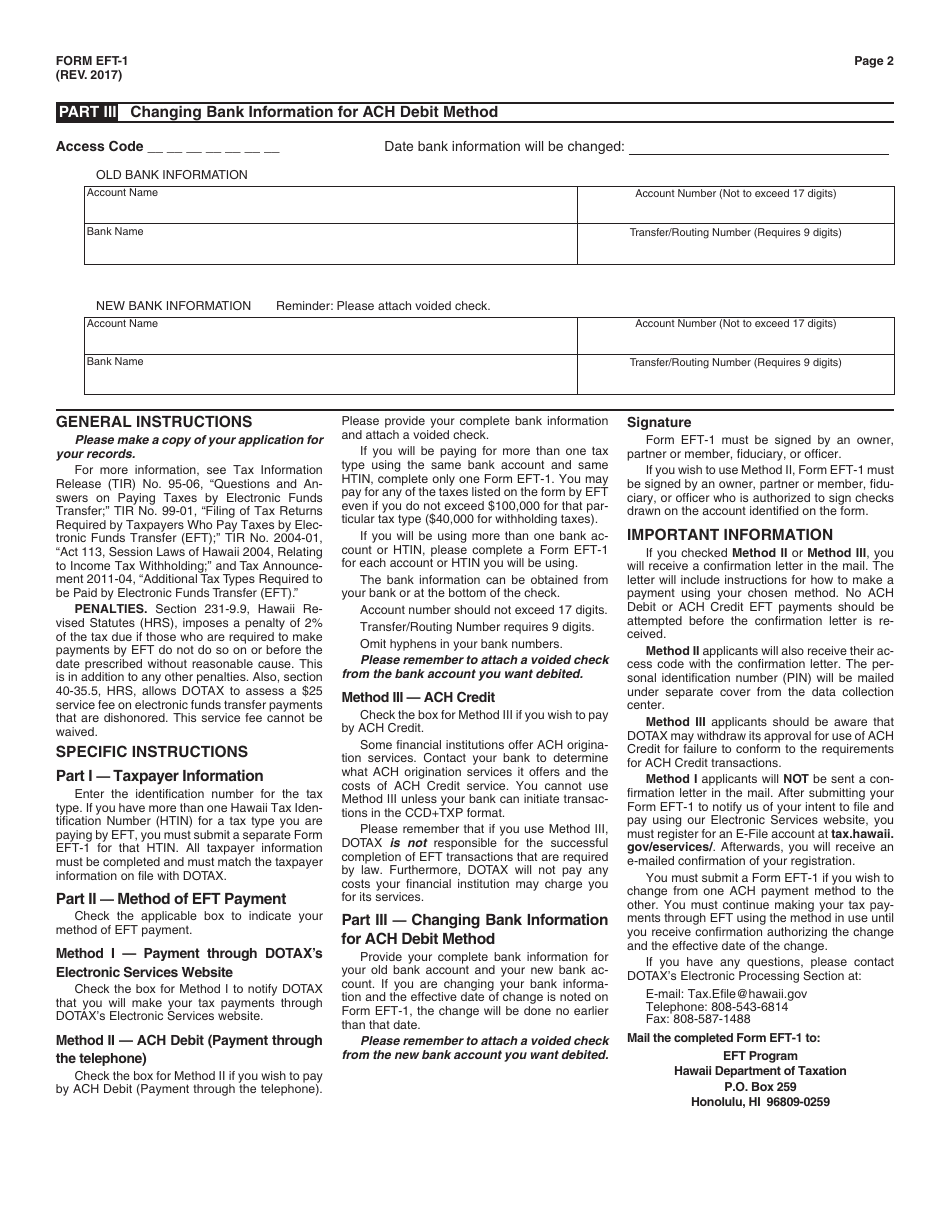

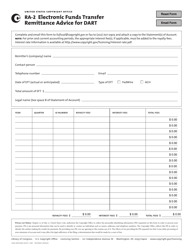

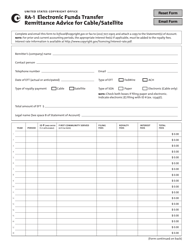

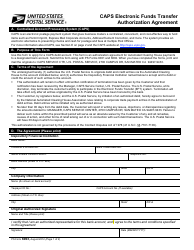

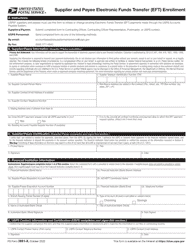

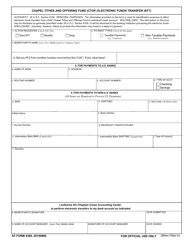

Form EFT-1 Authorization Agreement for Electronic Funds Transfer (Eft) - Hawaii

What Is Form EFT-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EFT-1?

A: Form EFT-1 is an Authorization Agreement for Electronic Funds Transfer (EFT) used in Hawaii.

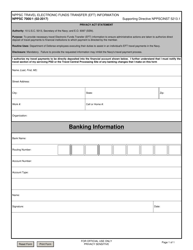

Q: What is Electronic Funds Transfer (EFT)?

A: Electronic Funds Transfer (EFT) is a method of transferring money electronically from one bank account to another.

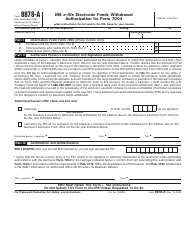

Q: Who uses Form EFT-1?

A: Form EFT-1 is used by individuals or businesses in Hawaii who want to authorize electronic funds transfers.

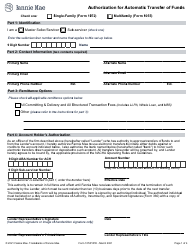

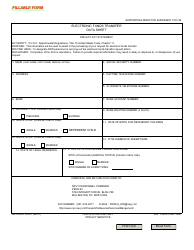

Q: What information is required on Form EFT-1?

A: Form EFT-1 requires information such as the bank account number, bank routing number, and authorization details.

Q: Is there a fee for using EFT?

A: Fees for using Electronic Funds Transfer (EFT) can vary depending on the financial institution or company.

Q: Can Form EFT-1 be used for international transfers?

A: Form EFT-1 is generally used for domestic transfers within the United States and may not be suitable for international transfers.

Q: Are there any restrictions on using EFT?

A: There may be restrictions on using Electronic Funds Transfer (EFT), such as transaction limits or certain eligibility criteria set by the financial institution.

Q: What should I do if I want to cancel or change my EFT authorization?

A: To cancel or change your EFT authorization, you should contact your financial institution or the company handling the electronic funds transfer.

Q: Is Form EFT-1 specific to Hawaii?

A: Form EFT-1 is specific to Hawaii, and other states may have their own forms or agreements for electronic funds transfers.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EFT-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.