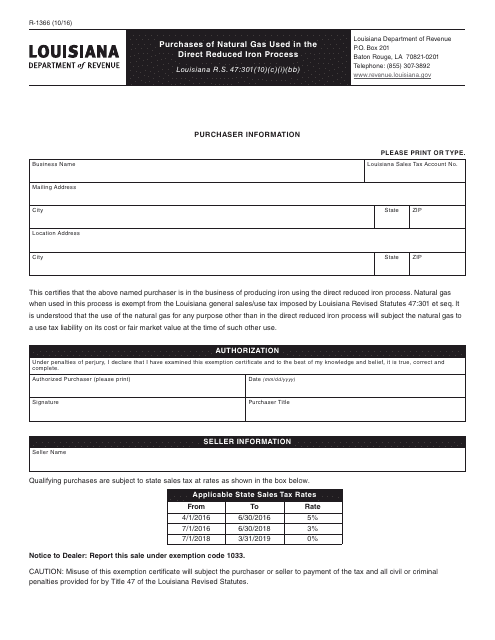

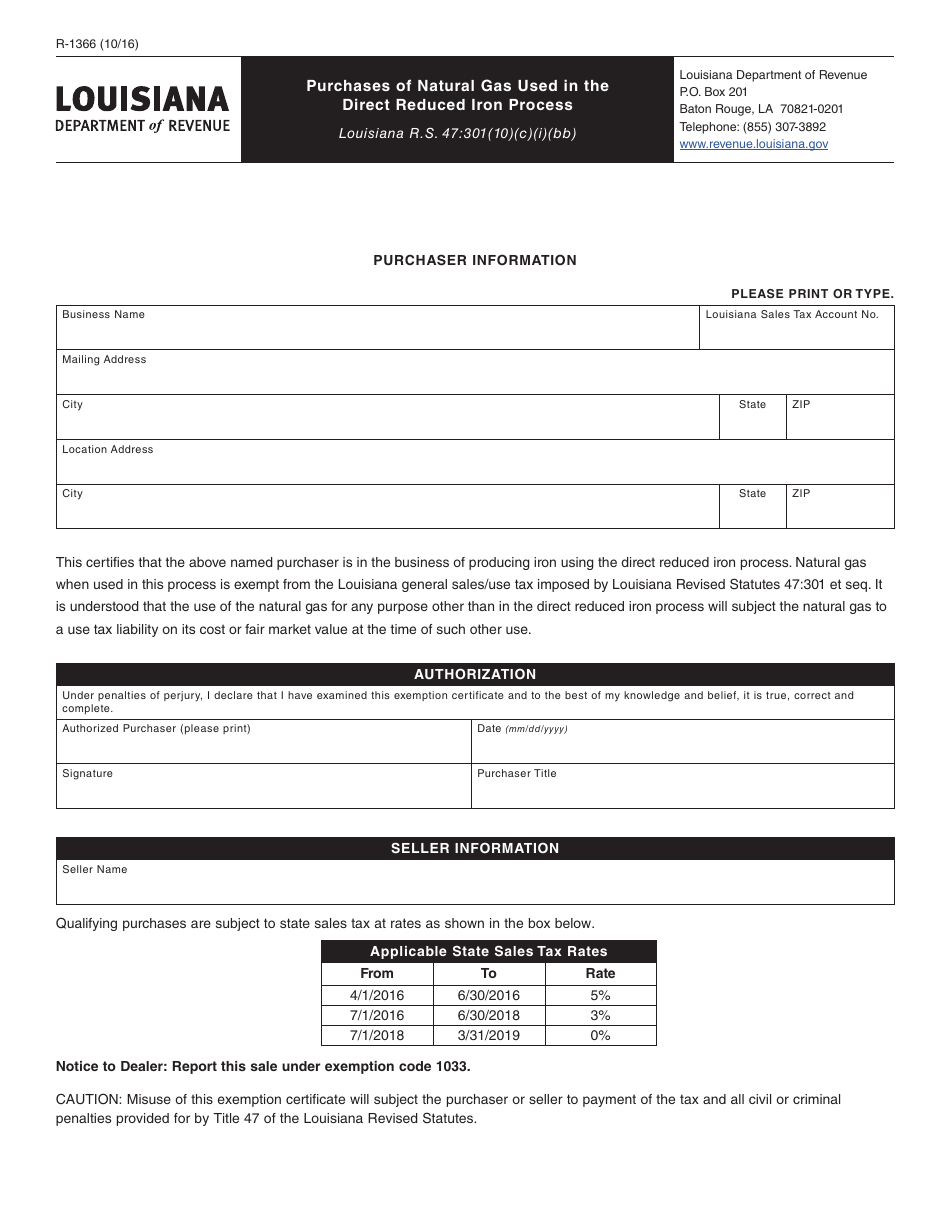

Form R-1366 Purchases of Natural Gas Used in the Direct Reduced Iron Process - Louisiana

What Is Form R-1366?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1366?

A: Form R-1366 is a form used to report purchases of natural gas used in the direct reduced iron process in Louisiana.

Q: Who needs to file Form R-1366?

A: Businesses or individuals that have purchased natural gas for use in the direct reduced iron process in Louisiana need to file Form R-1366.

Q: What is the purpose of Form R-1366?

A: The purpose of Form R-1366 is to report and track the purchases of natural gas for the direct reduced iron process in Louisiana.

Q: When is Form R-1366 due?

A: Form R-1366 is due on a quarterly basis, with the deadline falling on the 20th day of the month following the end of the quarter.

Q: Are there any penalties for not filing Form R-1366?

A: Yes, there are penalties for not filing Form R-1366, including late filing penalties and potential interest charges on unpaid amounts.

Q: Is Form R-1366 applicable only to businesses?

A: No, Form R-1366 is applicable to both businesses and individuals who have purchased natural gas for the direct reduced iron process in Louisiana.

Q: What should I do if I have questions or need assistance with Form R-1366?

A: If you have questions or need assistance with Form R-1366, you should reach out to the Louisiana Department of Revenue for guidance.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1366 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.