This version of the form is not currently in use and is provided for reference only. Download this version of

Form R-1353

for the current year.

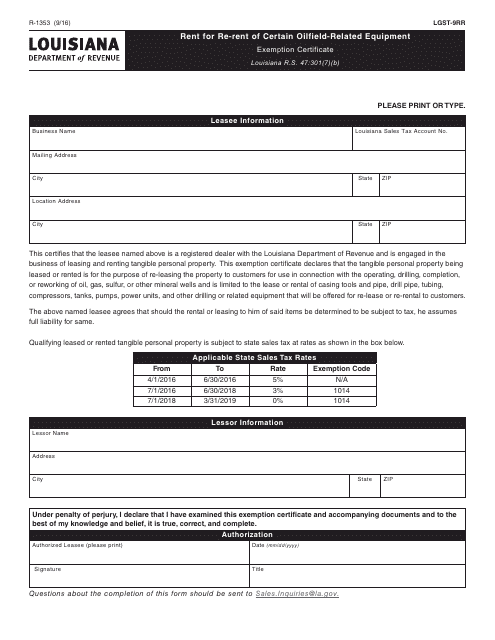

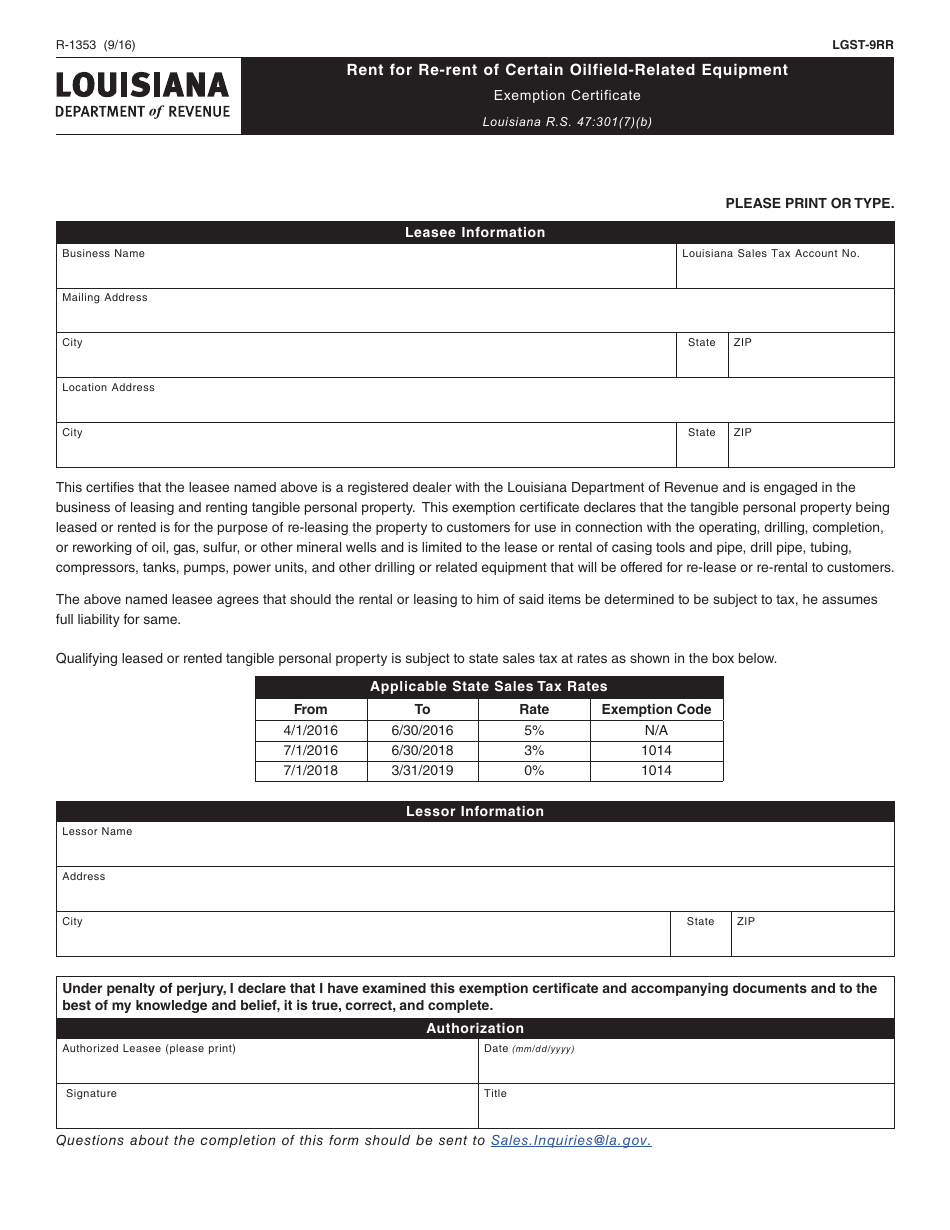

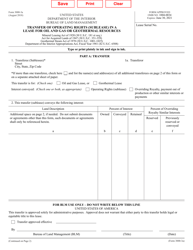

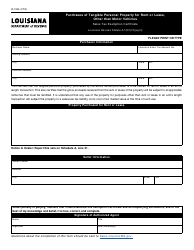

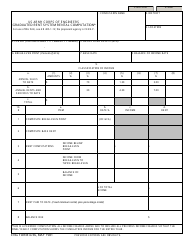

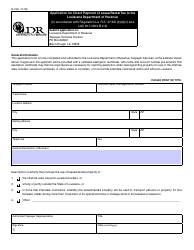

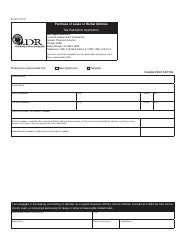

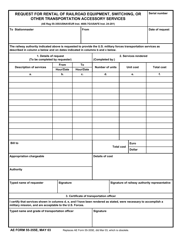

Form R-1353 Rent for Re-rent of Certain Oilfield-Related Equipment - Louisiana

What Is Form R-1353?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

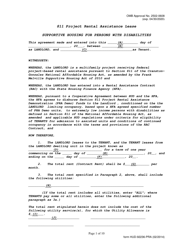

Q: What is Form R-1353?

A: Form R-1353 is a form used for reporting the rent for re-rent of certain oilfield-related equipment in Louisiana.

Q: Who should file Form R-1353?

A: Anyone who rents out certain oilfield-related equipment for re-rent in Louisiana should file Form R-1353.

Q: What is the purpose of Form R-1353?

A: The purpose of Form R-1353 is to report the rent received from the re-rental of certain oilfield-related equipment in Louisiana.

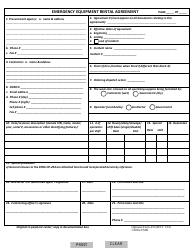

Q: What information is required on Form R-1353?

A: Form R-1353 requires information such as the taxpayer's identification number, the rent received from the re-rental of the equipment, and the date of the rental transaction.

Q: When is Form R-1353 due?

A: Form R-1353 is generally due on the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form R-1353?

A: Yes, there may be penalties for failing to file Form R-1353 or for filing it late.

Q: Do I need to keep a copy of Form R-1353 for my records?

A: Yes, it is recommended to keep a copy of Form R-1353 for your records.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1353 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.