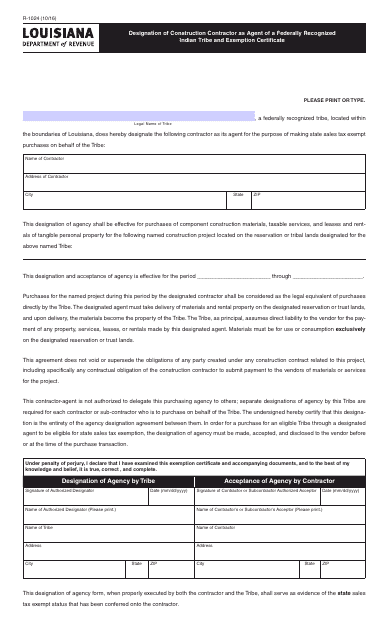

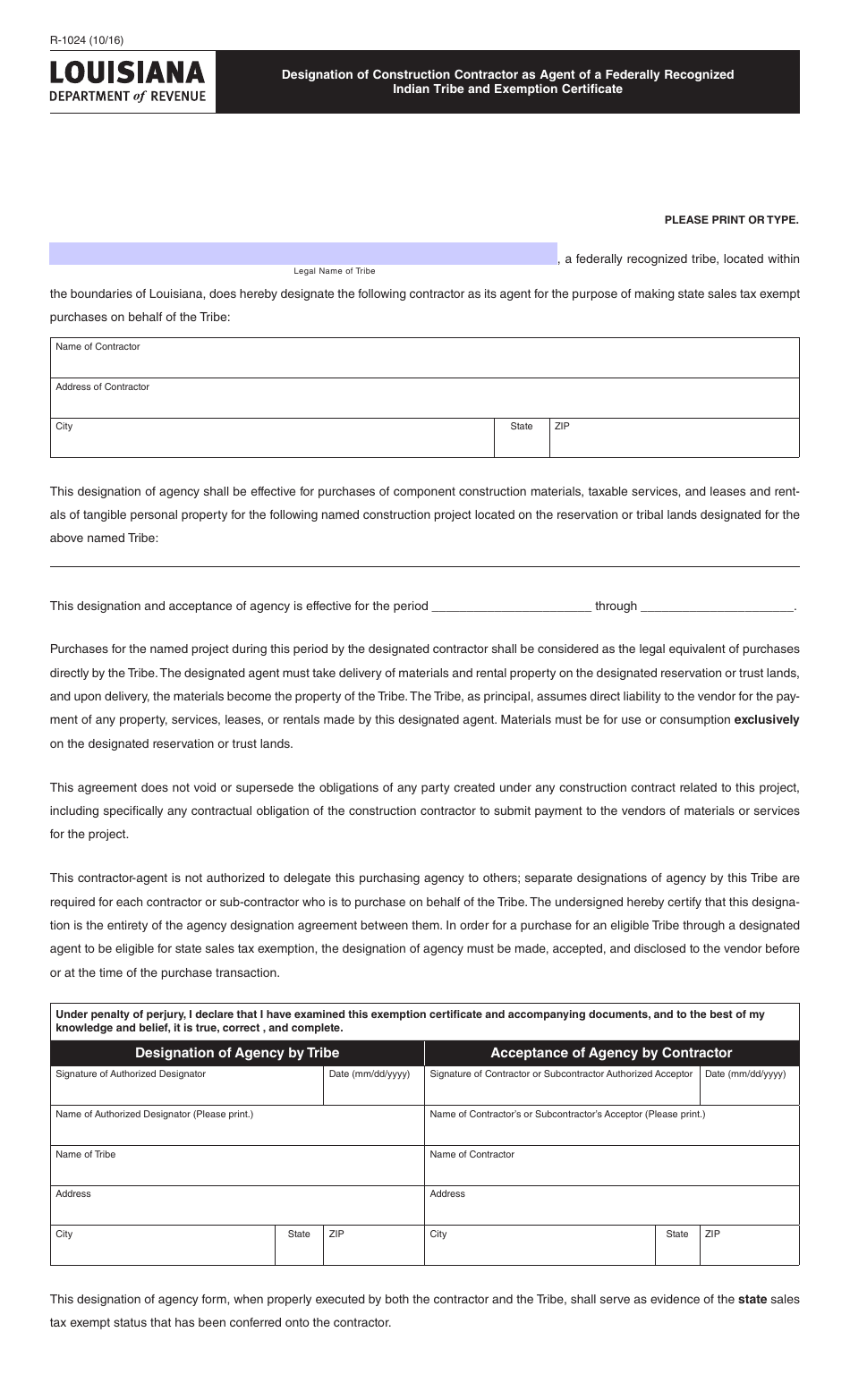

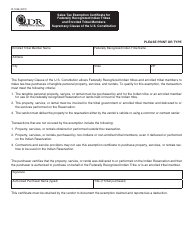

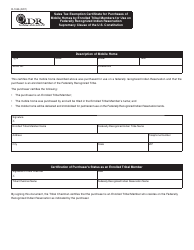

Form R-1024 Designation of Construction Contractor as Agent of a Federally Recognized Indian Tribe and Exemption Certificate - Louisiana

What Is Form R-1024?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1024?

A: Form R-1024 is a document used in Louisiana to designate a construction contractor as an agent of a federally recognized Indian tribe and to claim exemption from certain taxes.

Q: Who uses Form R-1024?

A: Construction contractors operating on behalf of a federally recognized Indian tribe in Louisiana use Form R-1024.

Q: What is the purpose of Form R-1024?

A: The purpose of Form R-1024 is to designate a construction contractor as an agent of a federally recognized Indian tribe and to claim exemption from state taxes on materials, supplies, and equipment used in the construction projects.

Q: What taxes can be exempted with Form R-1024?

A: Form R-1024 can be used to claim exemption from sales tax, use tax, and state income tax for materials, supplies, and equipment used in the construction projects.

Q: How can a construction contractor claim exemption with Form R-1024?

A: To claim exemption, a construction contractor must complete Form R-1024 and submit it to the Louisiana Department of Revenue.

Q: Are there any eligibility requirements to use Form R-1024?

A: Yes, to use Form R-1024, the construction contractor must be operating on behalf of a federally recognized Indian tribe.

Q: Is Form R-1024 specific to Louisiana?

A: Yes, Form R-1024 is specific to Louisiana and cannot be used in other states.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1024 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.