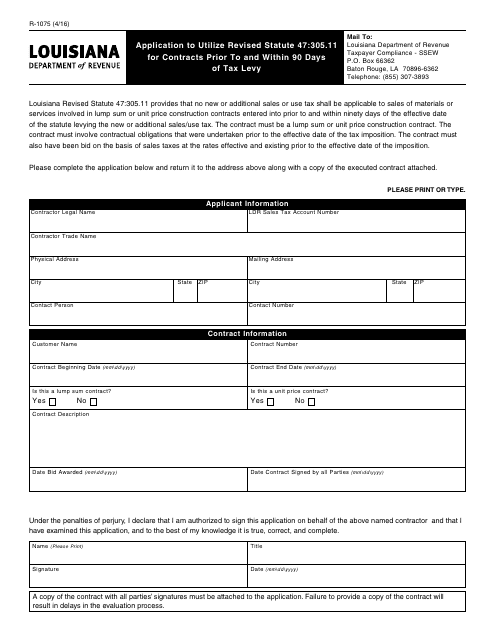

Form R-1075 Application to Utilize Revised Statute 47:305.11 for Contracts Prior to and Within 90 Days of Tax Levy - Louisiana

What Is Form R-1075?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1075?

A: Form R-1075 is an application that allows individuals or businesses in Louisiana to utilize Revised Statute 47:305.11 for contracts prior to and within 90 days of a tax levy.

Q: What does Revised Statute 47:305.11 refer to?

A: Revised Statute 47:305.11 is a statute in Louisiana that allows for certain contracts to be made prior to and within 90 days of a tax levy.

Q: Who can use Form R-1075?

A: Individuals or businesses in Louisiana can use Form R-1075 if they want to take advantage of Revised Statute 47:305.11 for contracts made before and within 90 days of a tax levy.

Q: What is the purpose of Form R-1075?

A: The purpose of Form R-1075 is to provide a formal application for individuals or businesses in Louisiana to request the utilization of Revised Statute 47:305.11 for contracts made prior to and within 90 days of a tax levy.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1075 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.