This version of the form is not currently in use and is provided for reference only. Download this version of

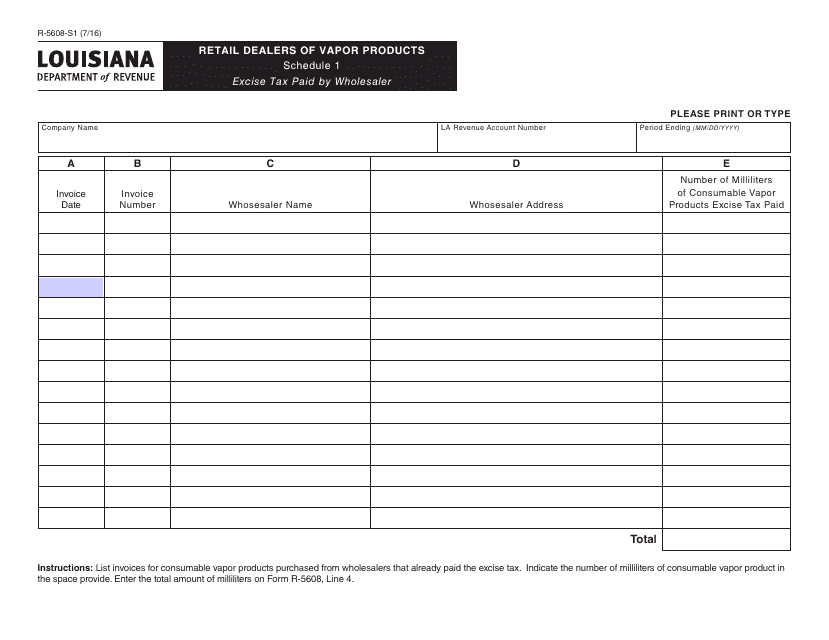

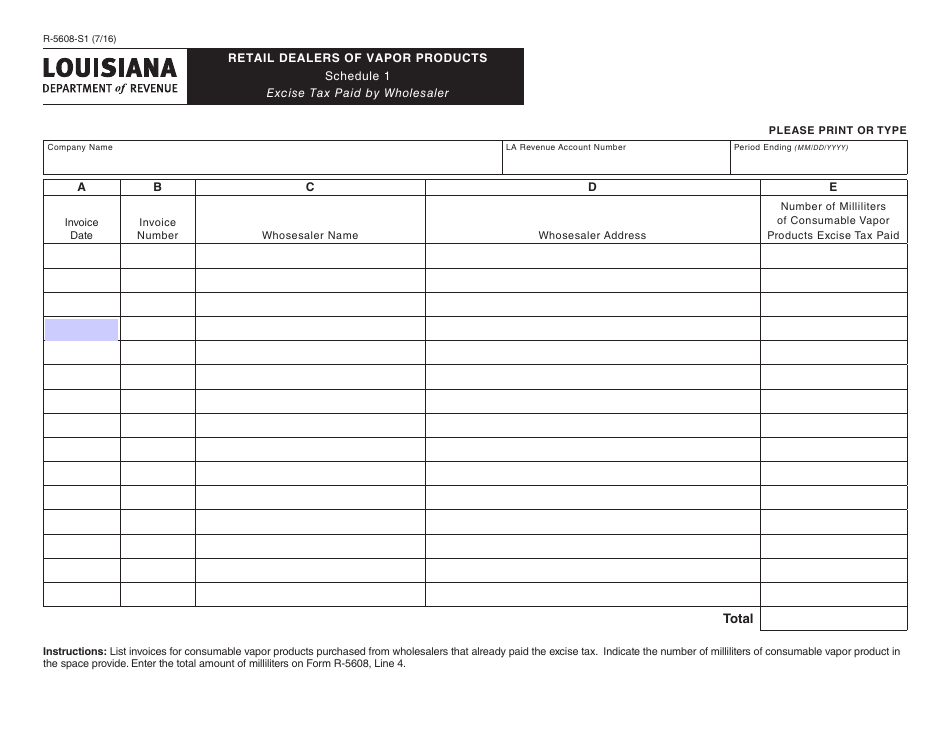

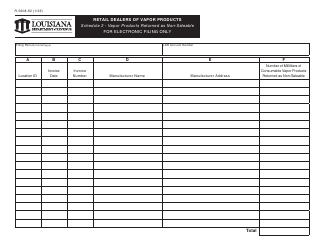

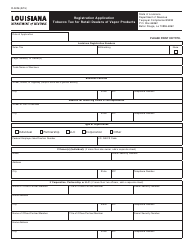

Form R-5608-S1 Schedule 1

for the current year.

Form R-5608-S1 Schedule 1 Excise Tax Paid by Wholesaler - Retail Dealers of Vapor Products - Louisiana

What Is Form R-5608-S1 Schedule 1?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-5608-S1?

A: Form R-5608-S1 is a schedule for reporting excise tax paid by wholesaler - retail dealers of vapor products in Louisiana.

Q: Who needs to file Form R-5608-S1?

A: Wholesaler - retail dealers of vapor products in Louisiana need to file Form R-5608-S1.

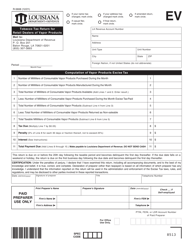

Q: What is the purpose of Form R-5608-S1?

A: The purpose of Form R-5608-S1 is to report and pay excise tax on vapor products in Louisiana.

Q: What information is required on Form R-5608-S1?

A: Form R-5608-S1 requires information such as sales and purchases of vapor products, tax liability, and any credits or refunds.

Q: When is the deadline for filing Form R-5608-S1?

A: The deadline for filing Form R-5608-S1 is determined by the Louisiana Department of Revenue and may vary.

Q: Are there any penalties for late filing of Form R-5608-S1?

A: Yes, there may be penalties for late filing of Form R-5608-S1 as determined by the Louisiana Department of Revenue.

Q: Do I need to include payment with Form R-5608-S1?

A: Yes, you need to include payment for the excise tax owed along with Form R-5608-S1.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5608-S1 Schedule 1 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.