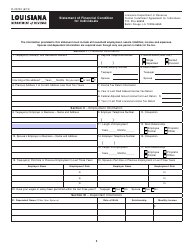

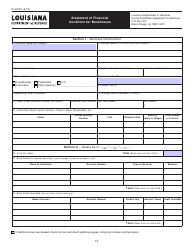

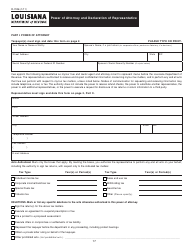

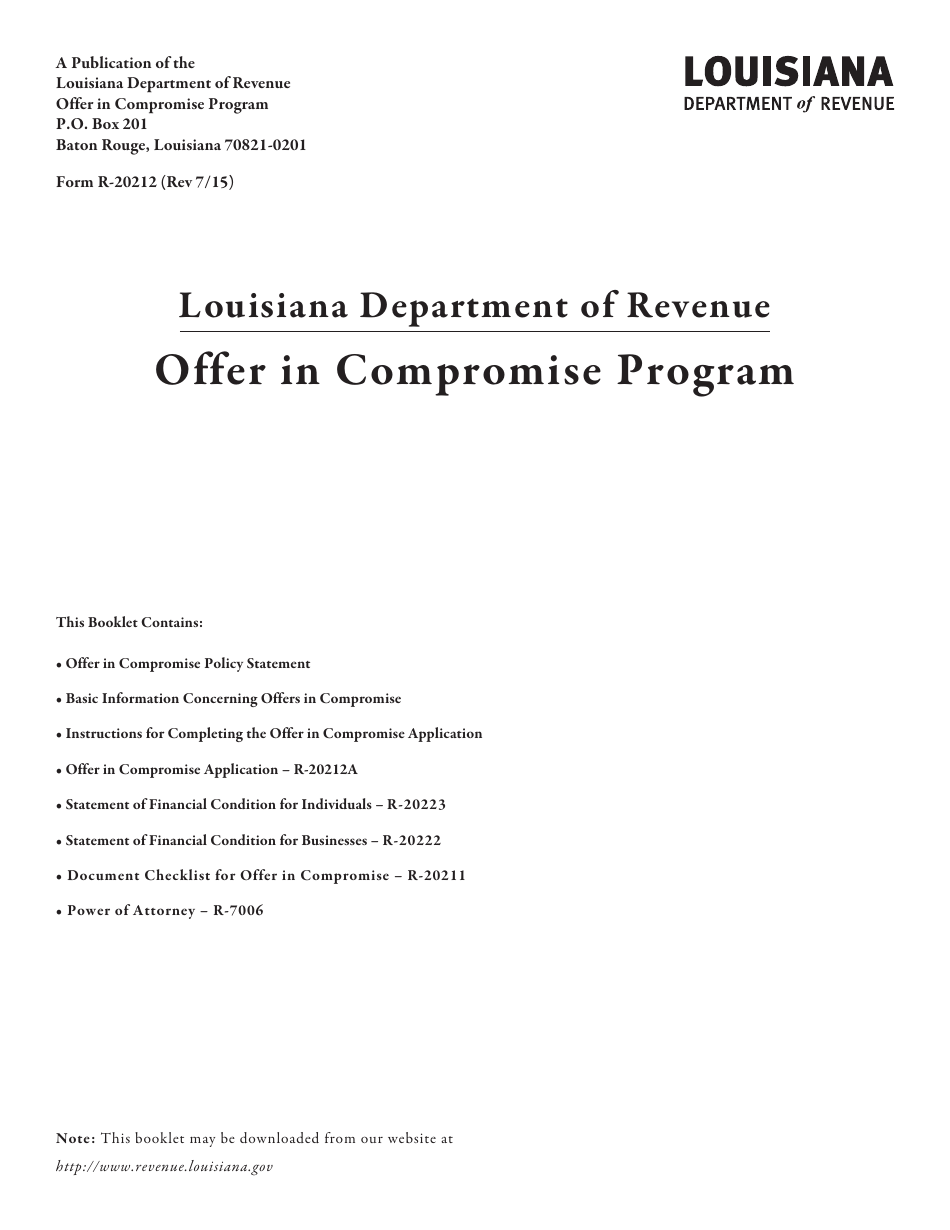

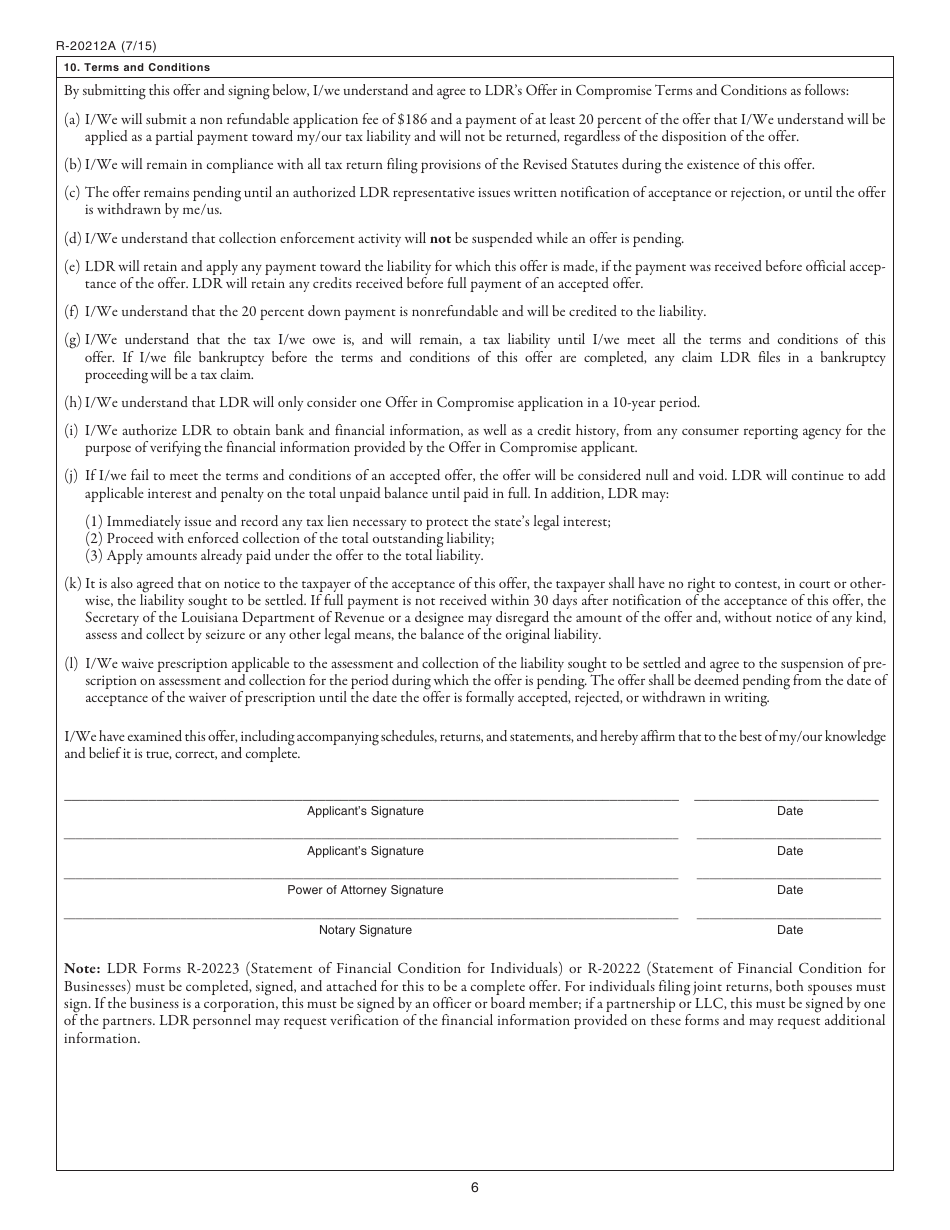

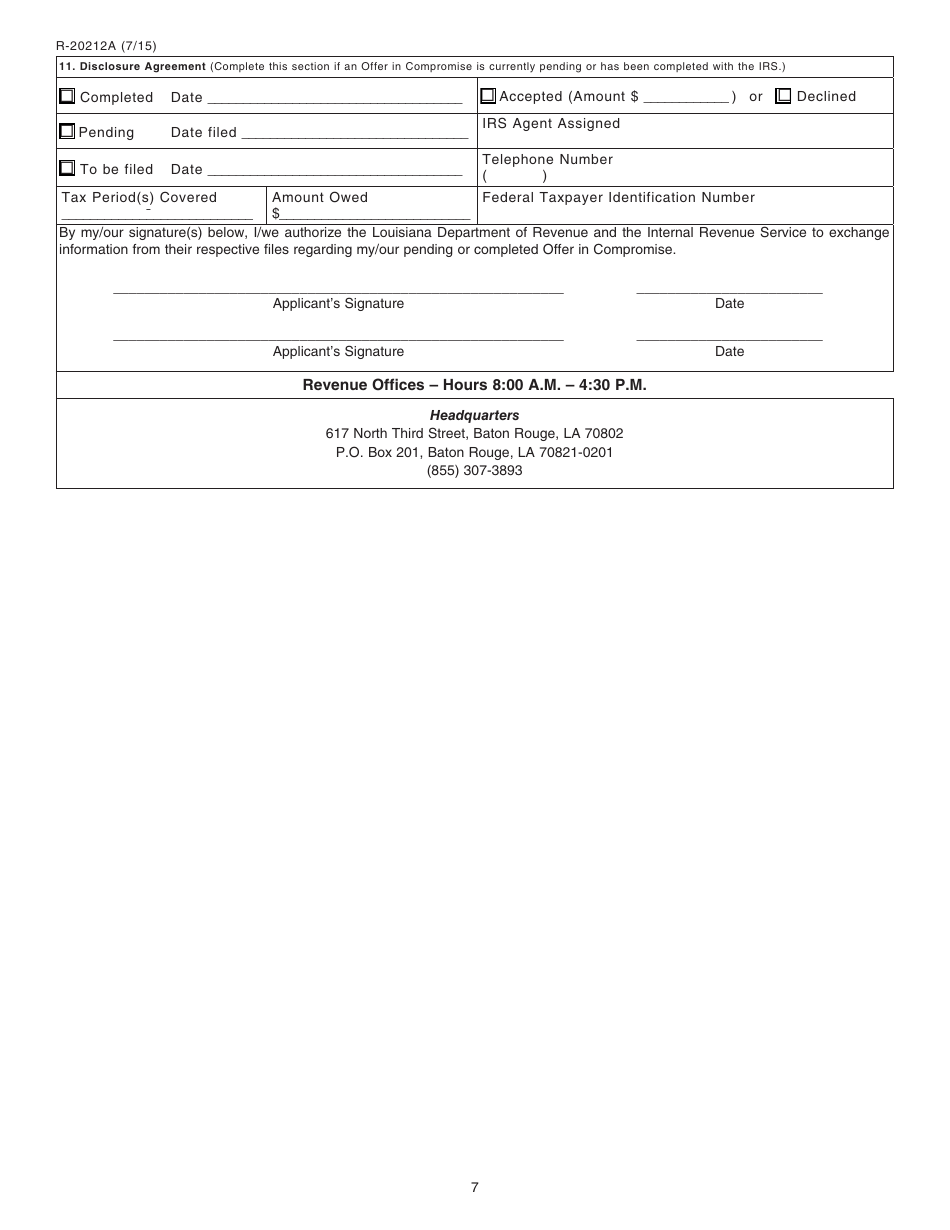

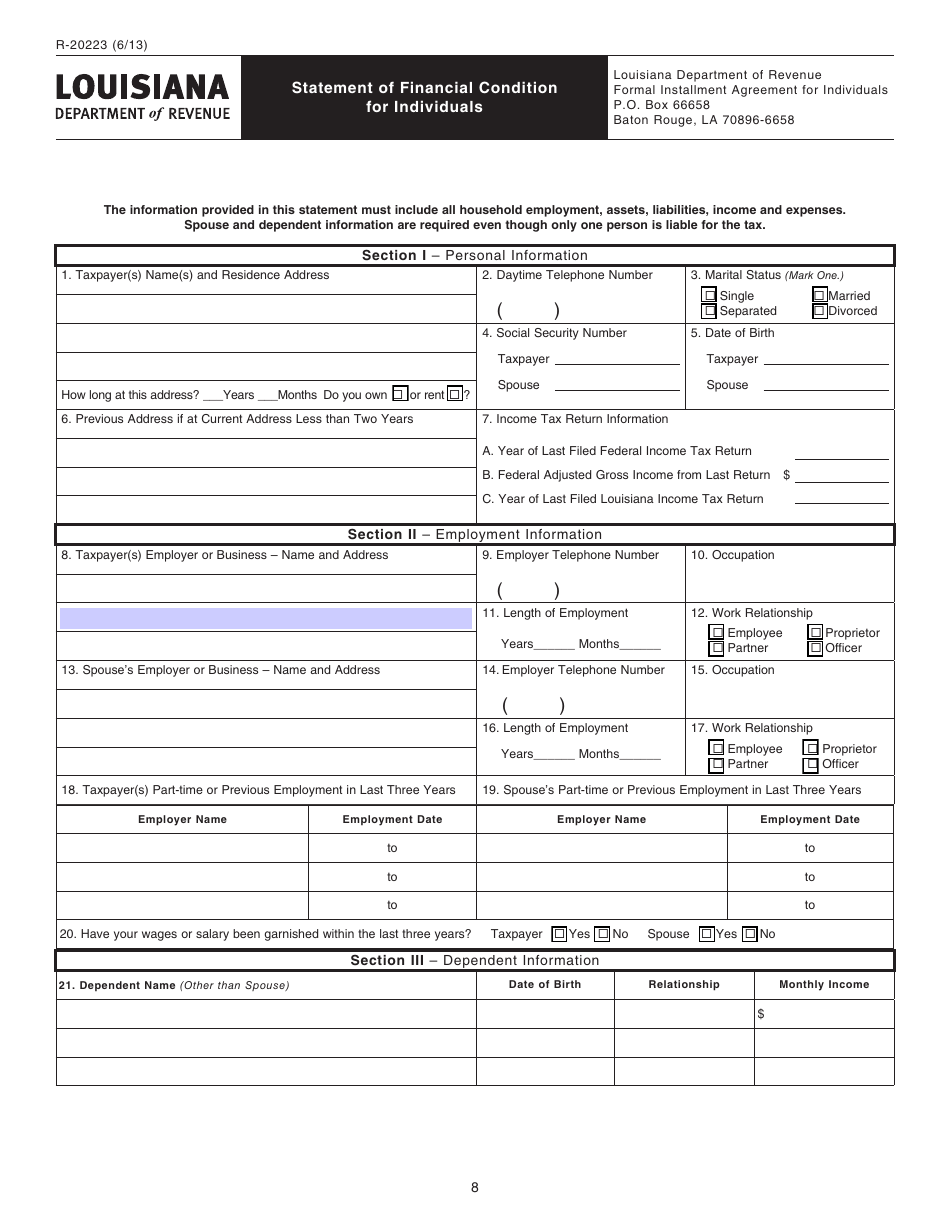

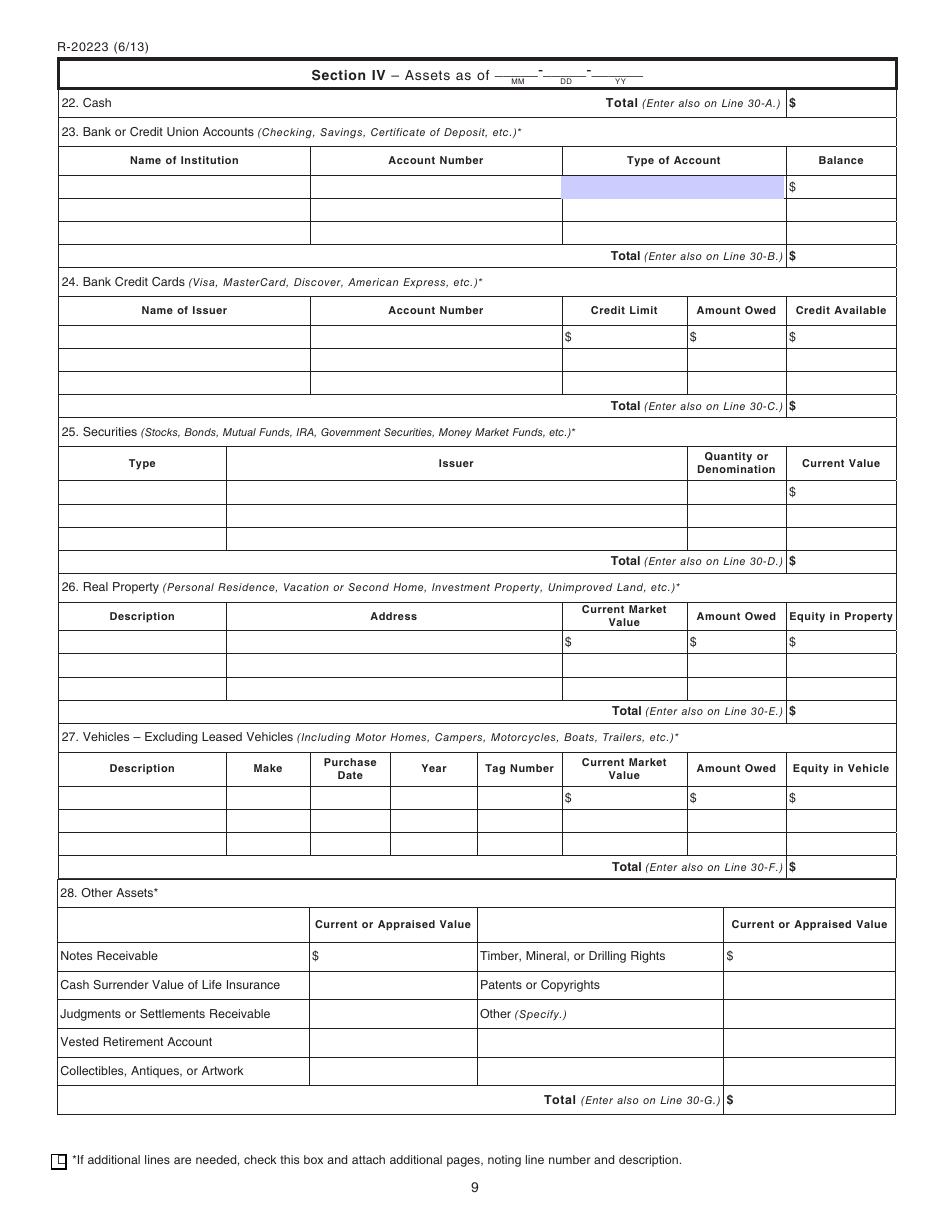

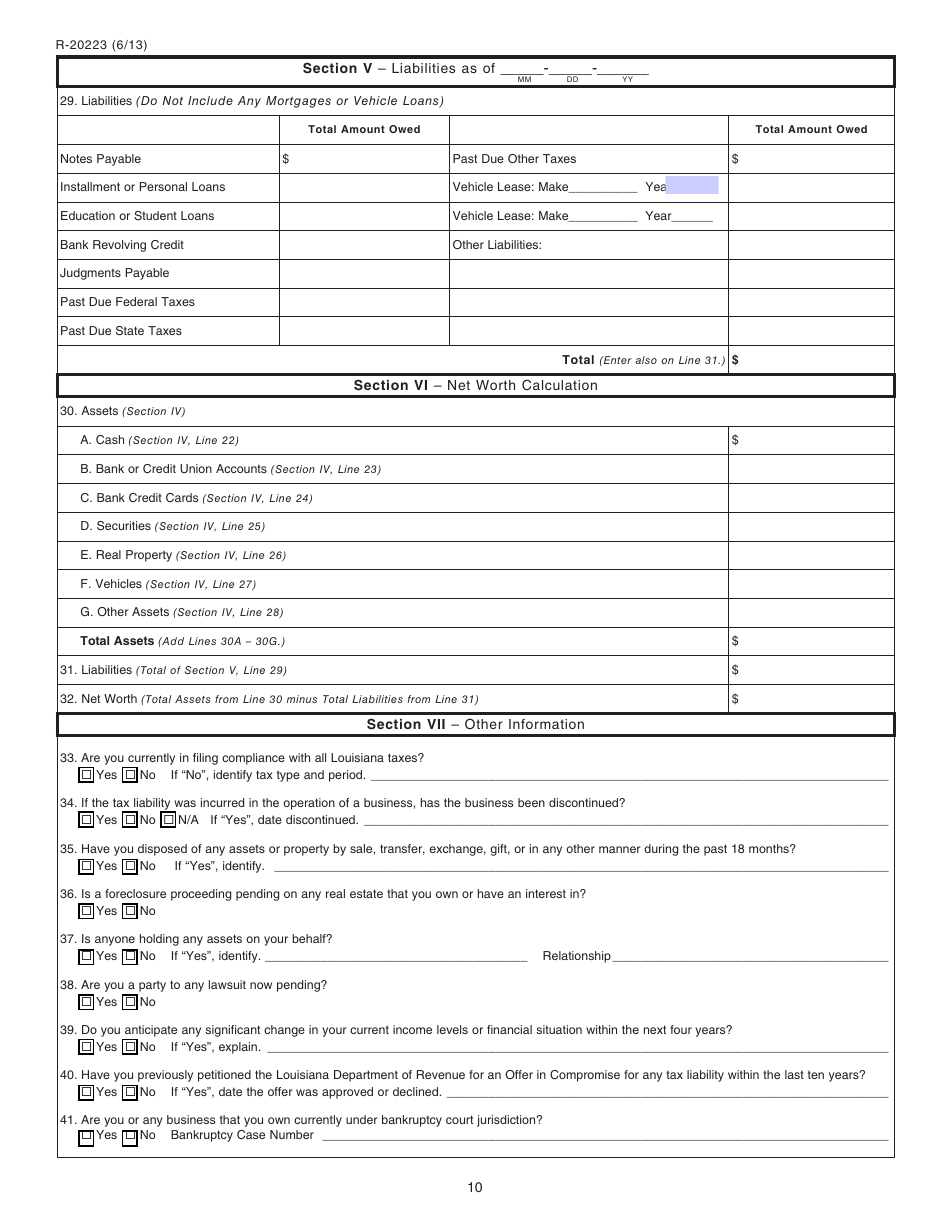

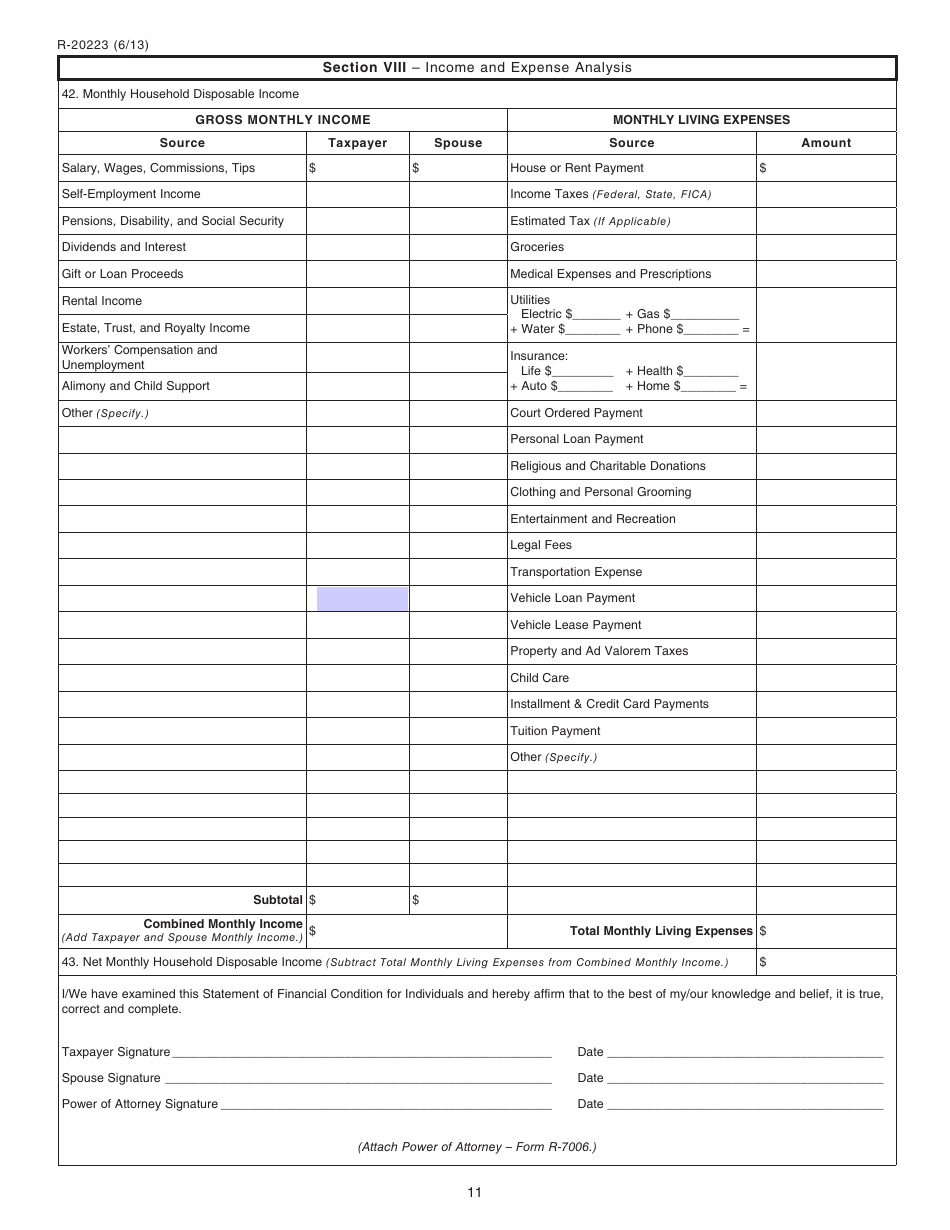

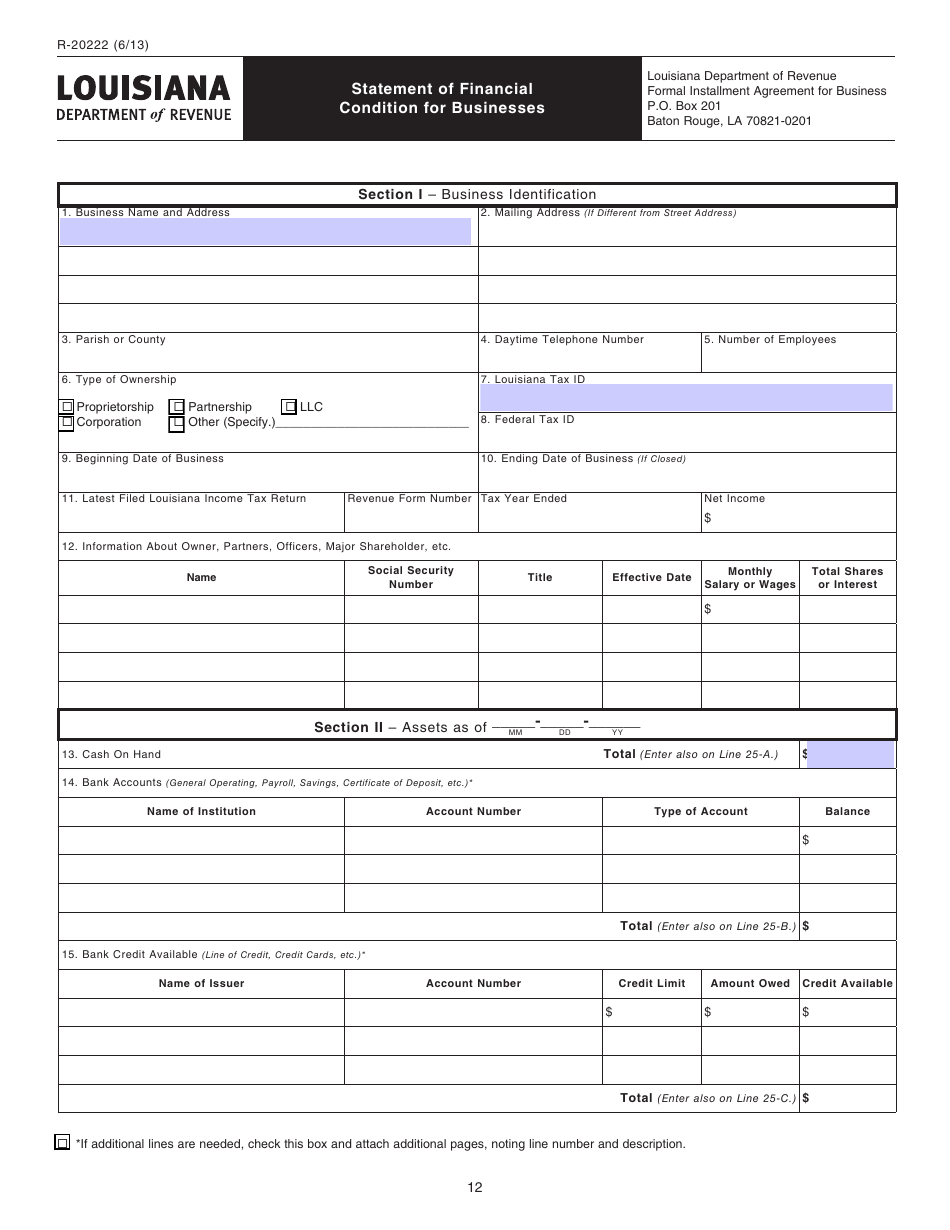

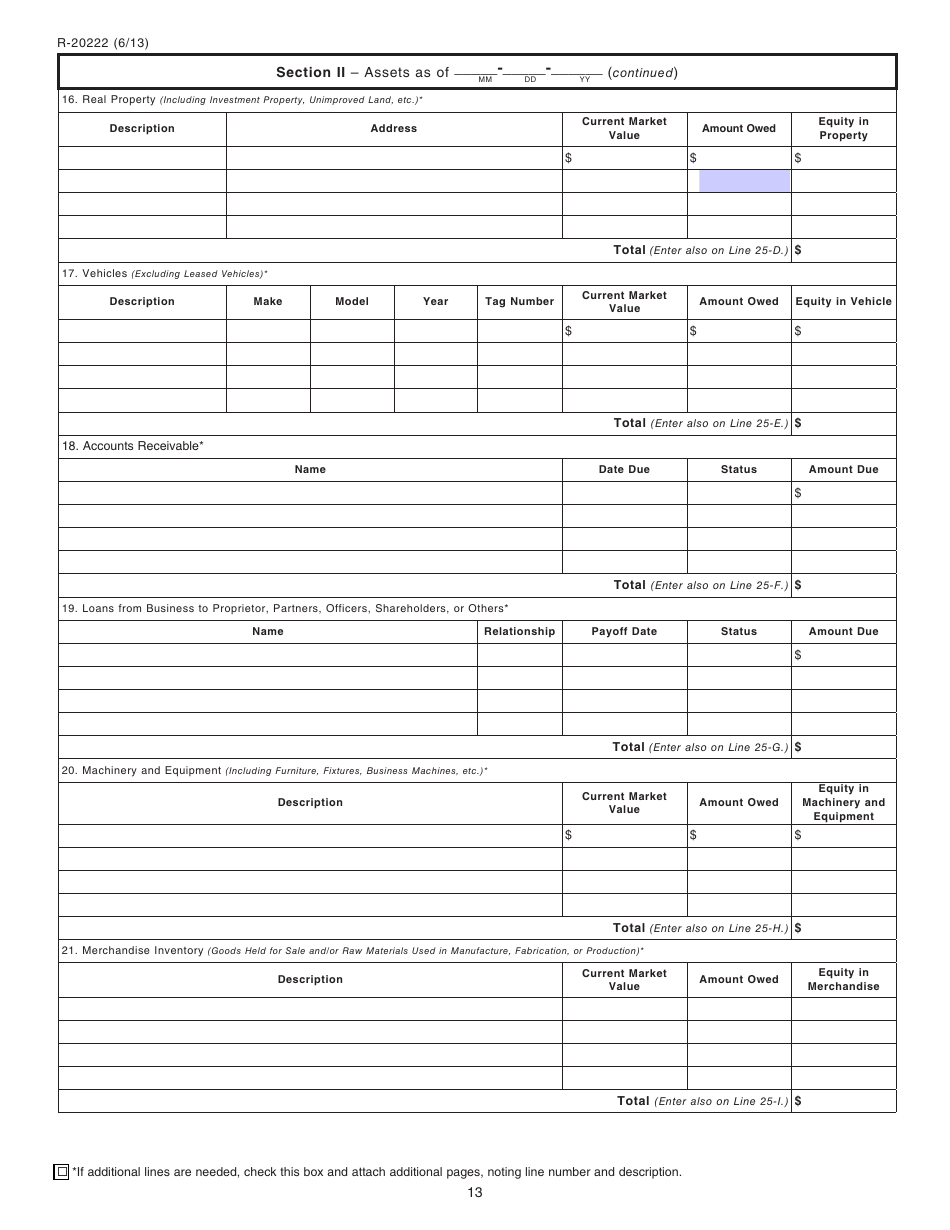

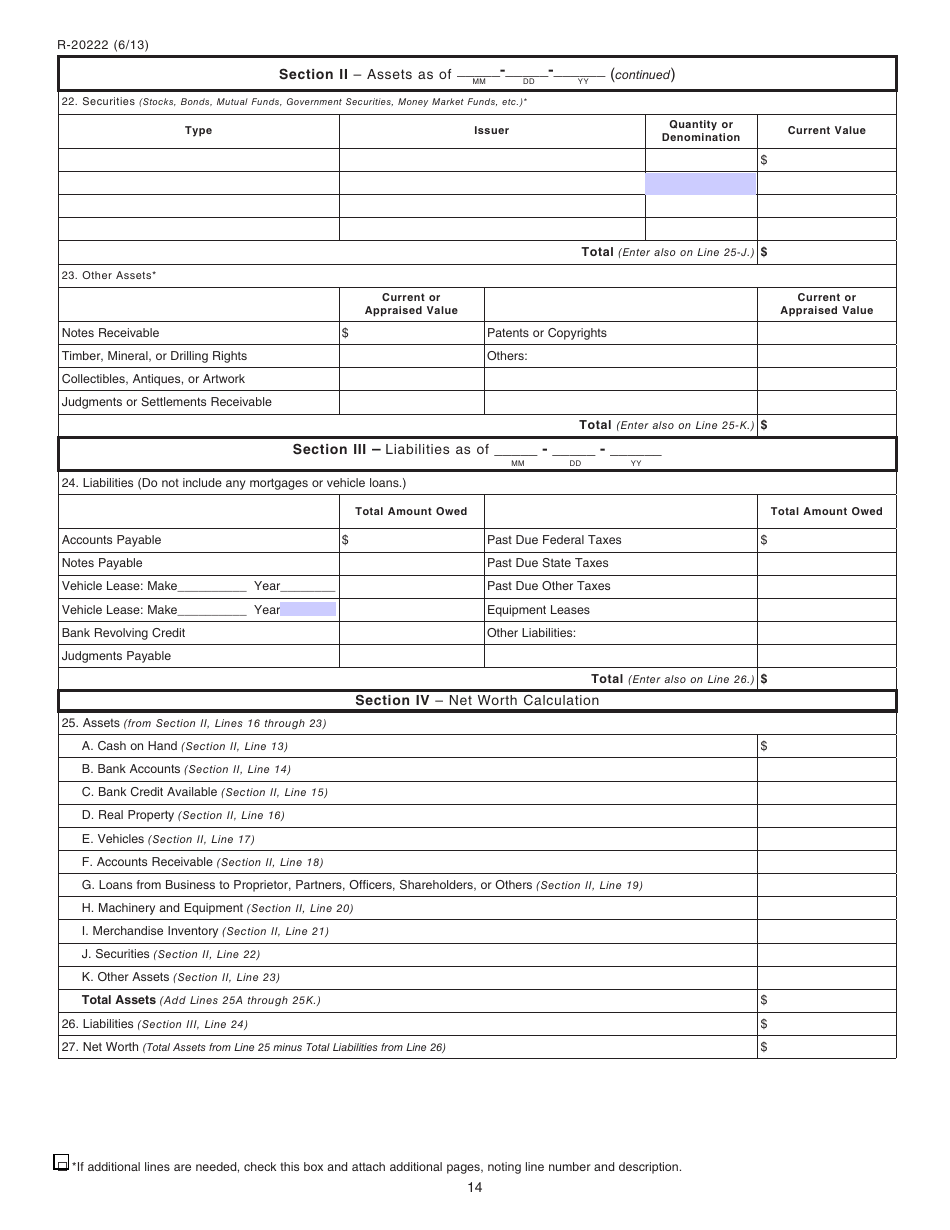

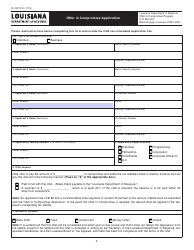

Form R-20212 Offer in Compromise Program - Louisiana

What Is Form R-20212?

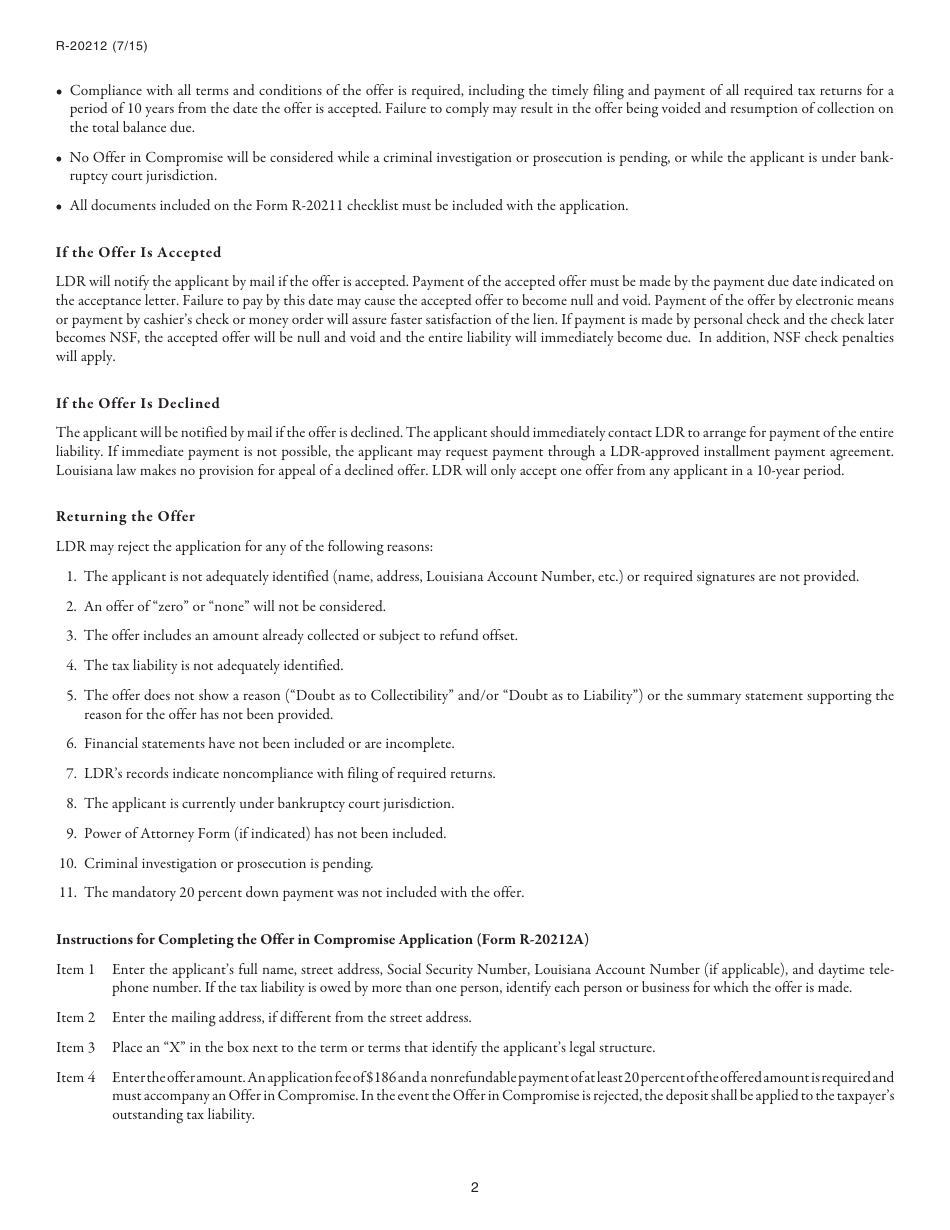

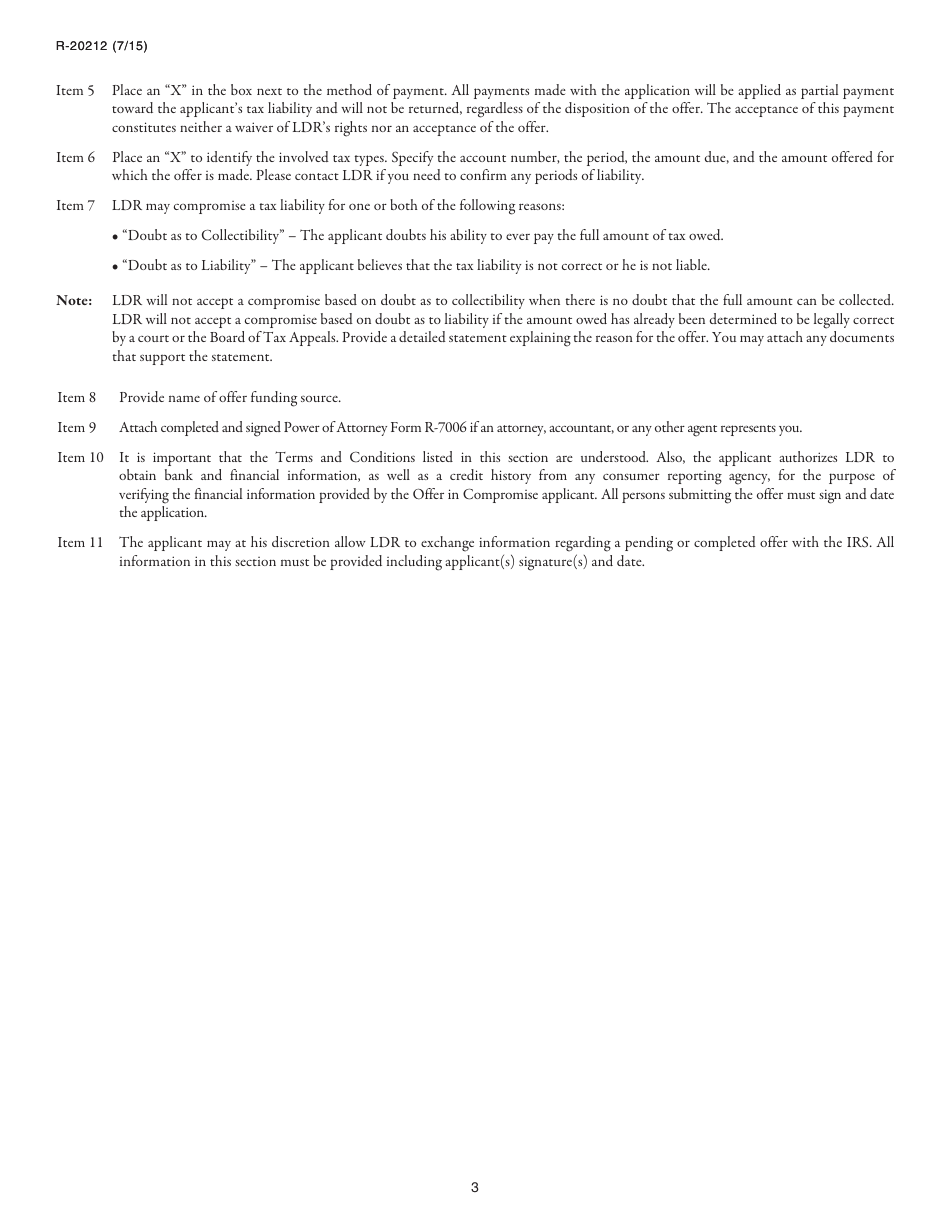

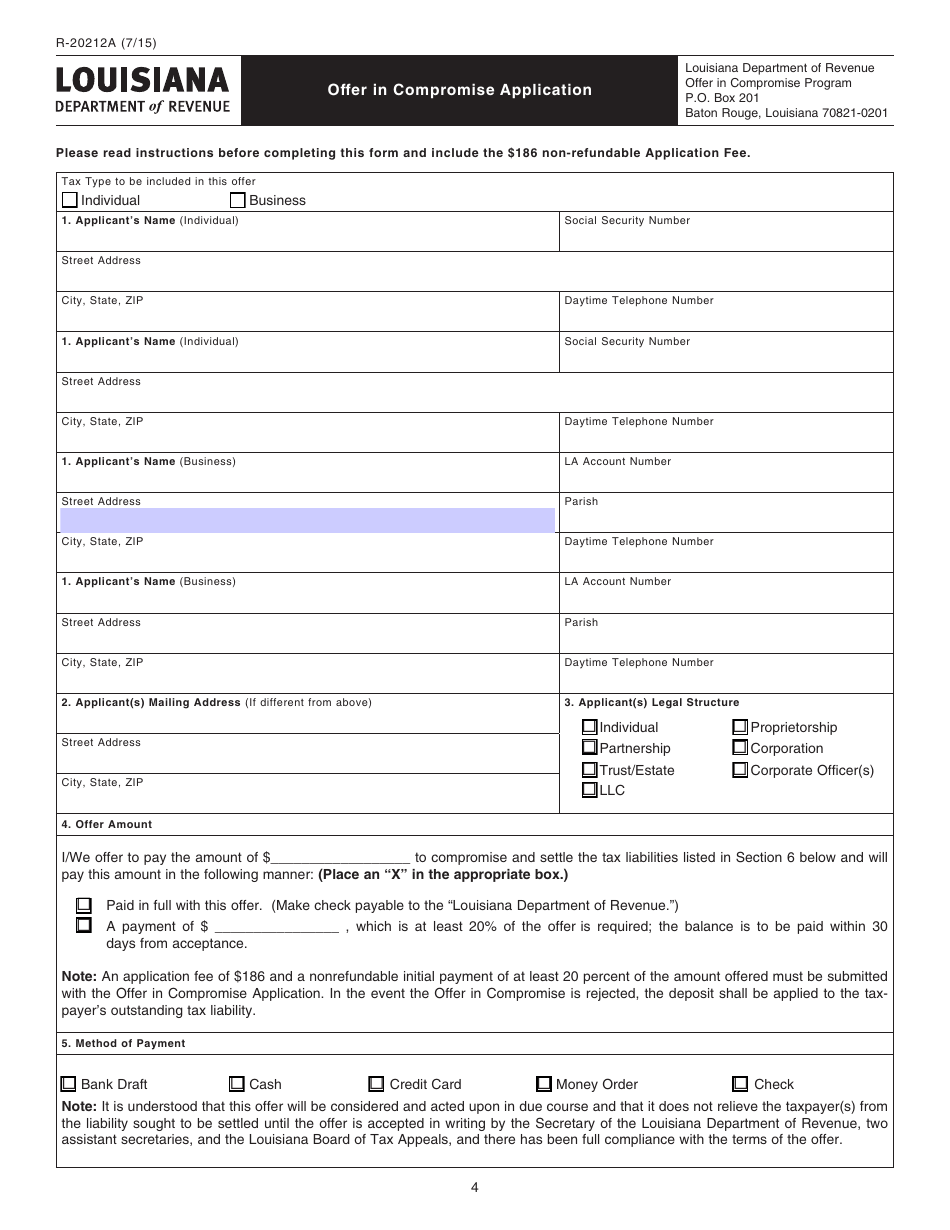

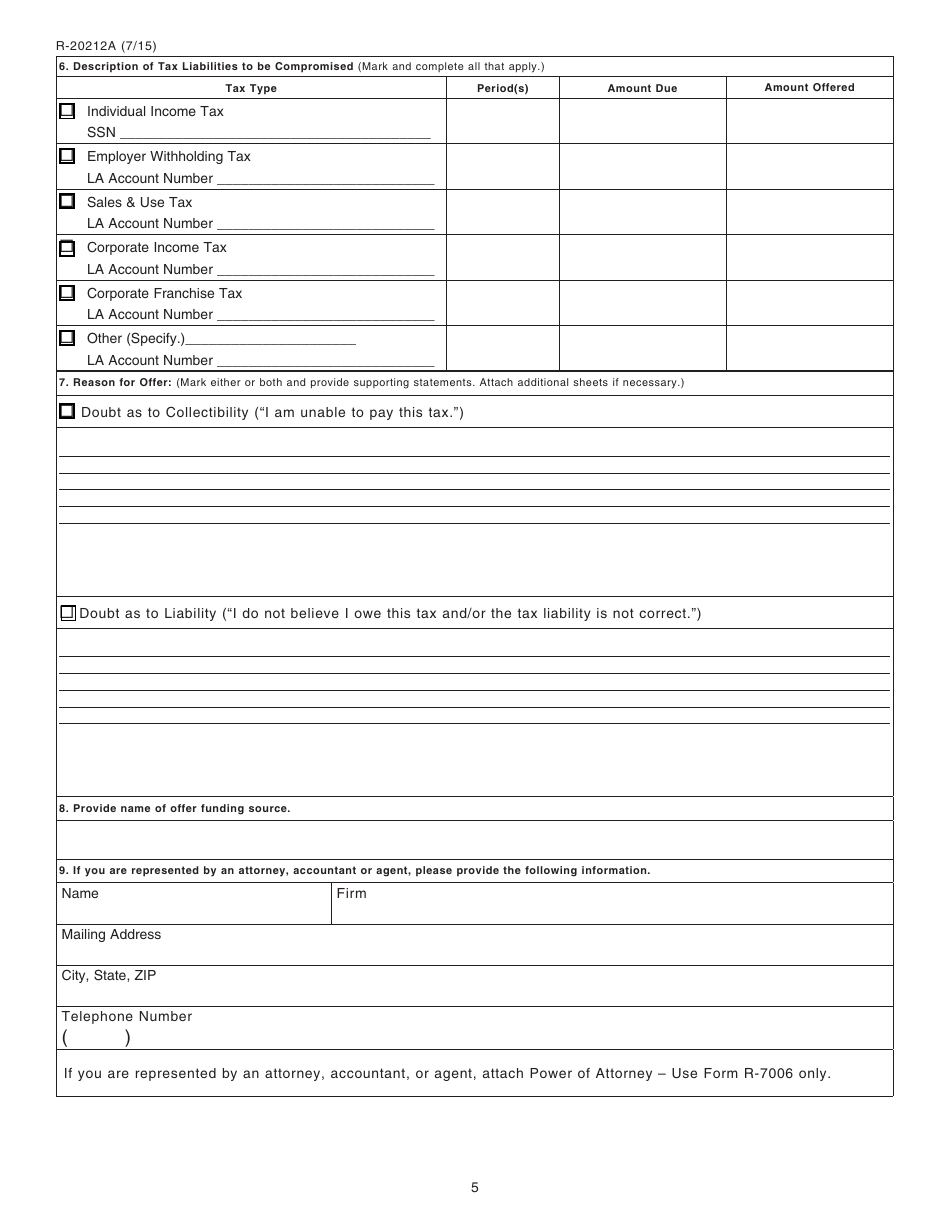

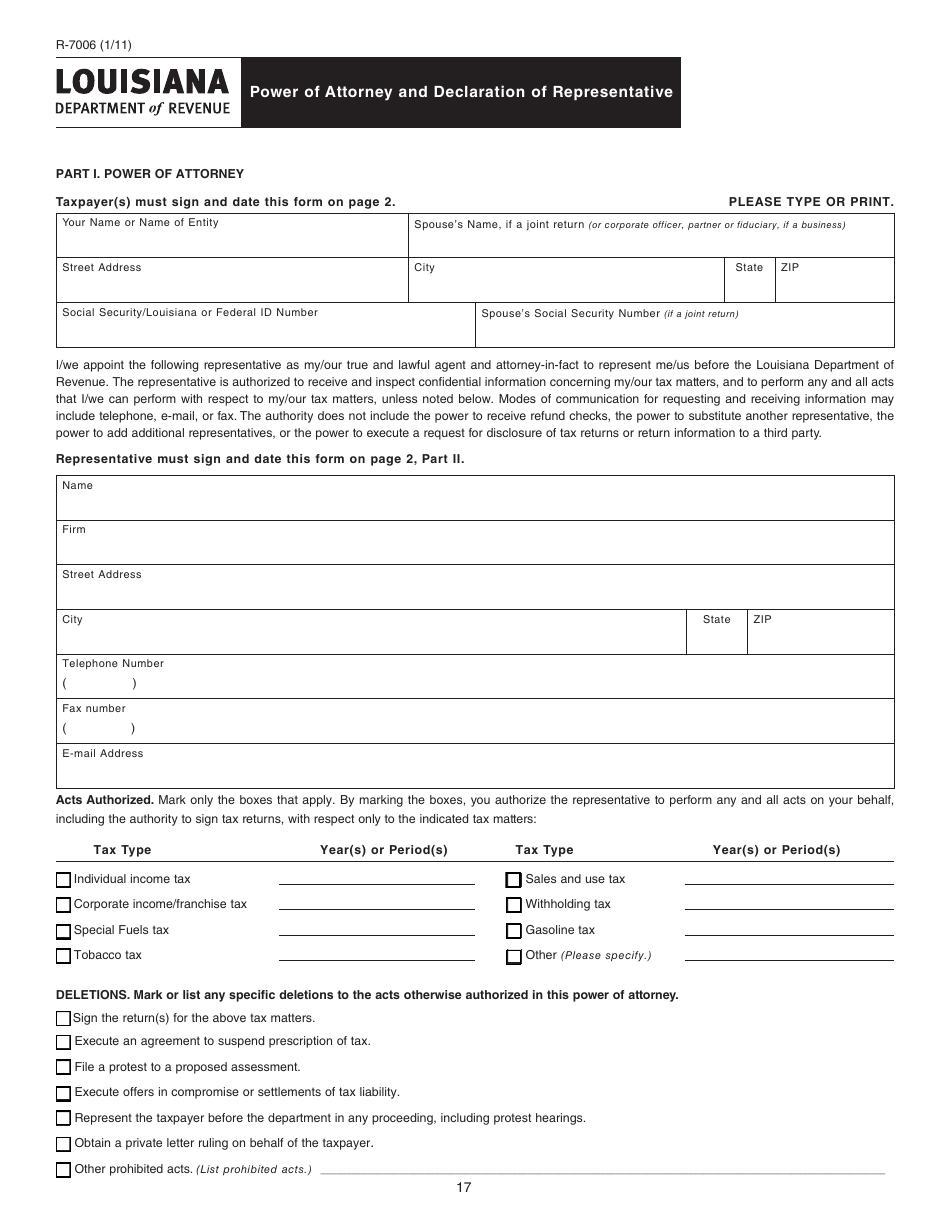

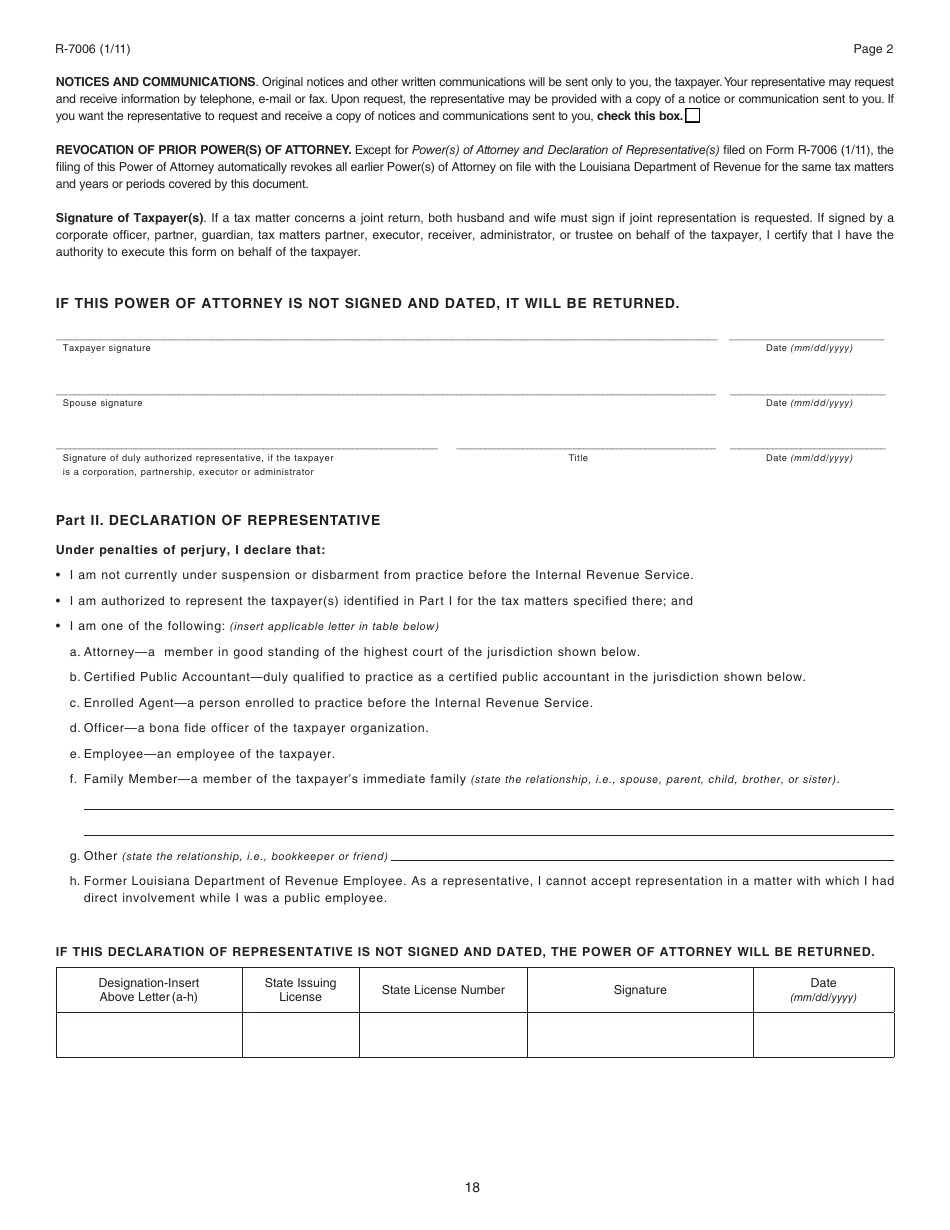

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

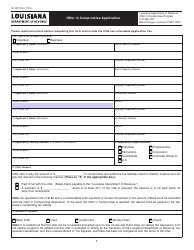

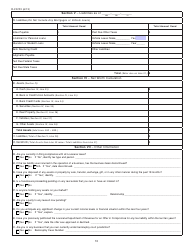

Q: What is Form R-20212?

A: Form R-20212 is the Offer in Compromise Program in Louisiana.

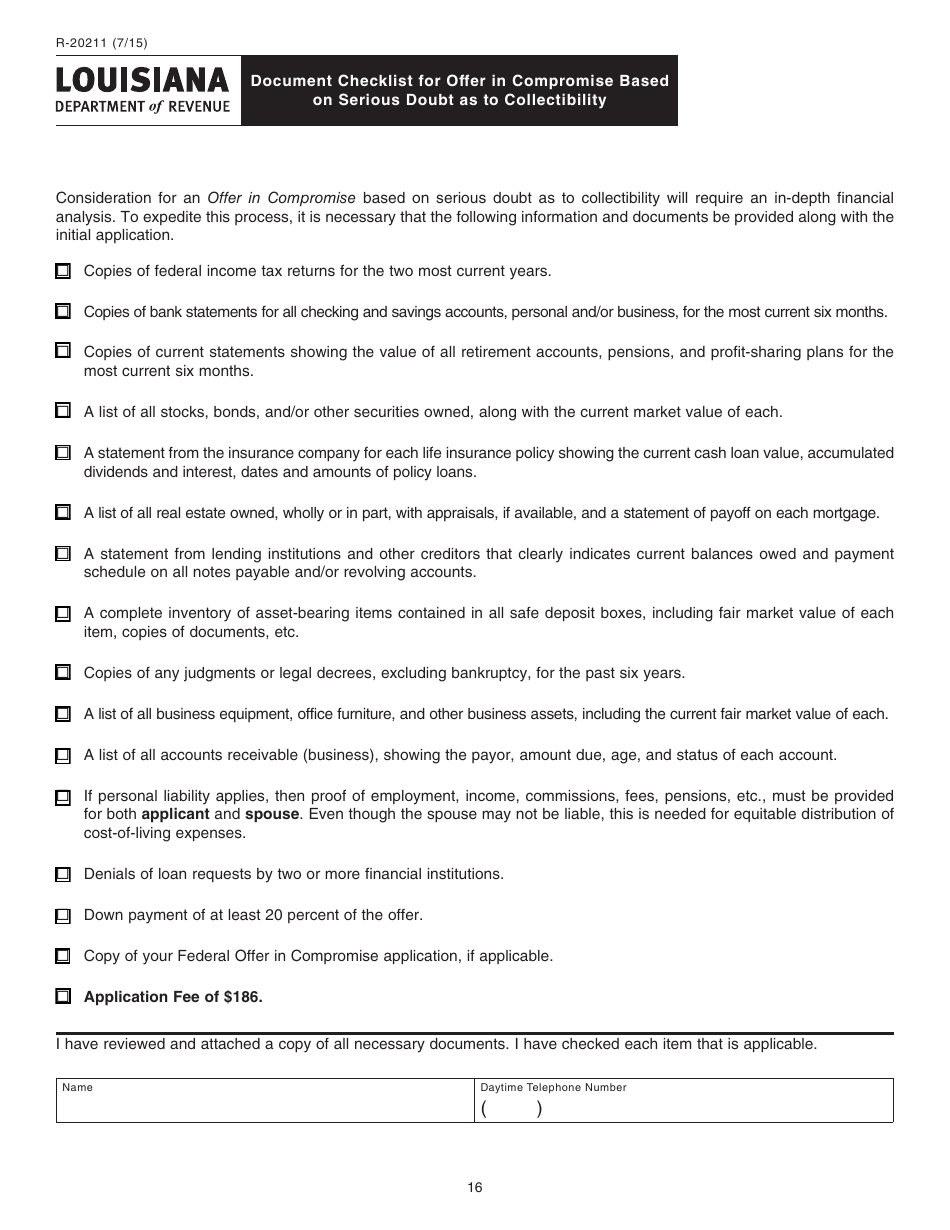

Q: What is the Offer in Compromise Program?

A: The Offer in Compromise Program is a program that allows taxpayers to settle their tax debt for less than the full amount.

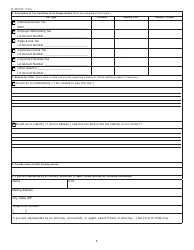

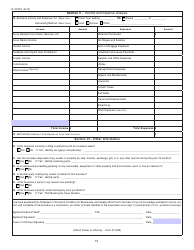

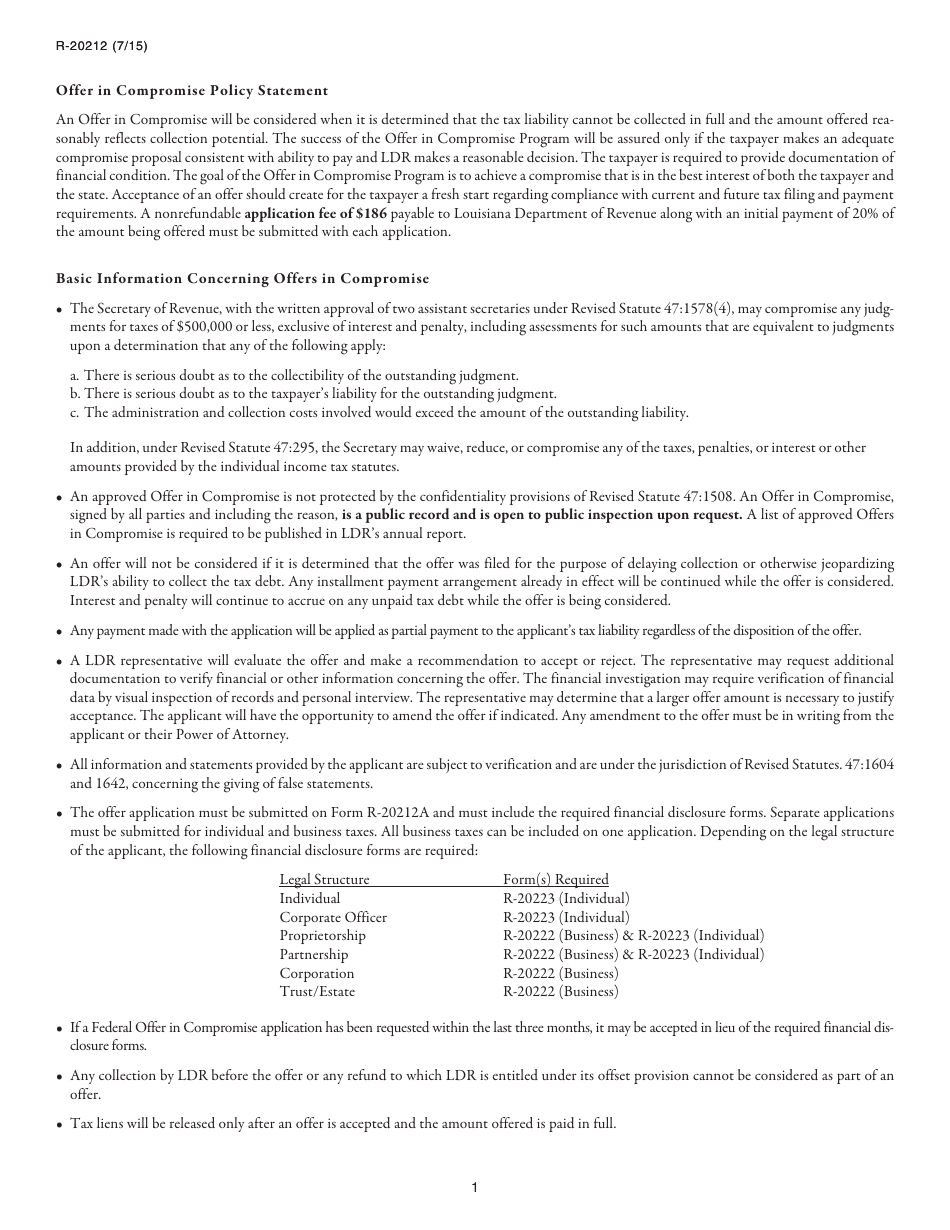

Q: Who is eligible for the Offer in Compromise Program in Louisiana?

A: Individuals and businesses who owe delinquent taxes to the state of Louisiana may be eligible for the Offer in Compromise Program.

Q: How does the Offer in Compromise Program work?

A: Taxpayers submit an offer to the Louisiana Department of Revenue to settle their tax debt. If the offer is accepted, they can pay the agreed-upon amount and have the remaining debt forgiven.

Q: Is there a fee to participate in the Offer in Compromise Program?

A: Yes, there is a non-refundable $100 application fee to participate in the Offer in Compromise Program.

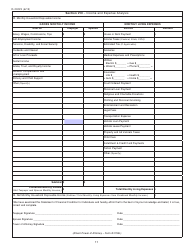

Q: What are the benefits of participating in the Offer in Compromise Program?

A: The benefits of participating in the Offer in Compromise Program include resolving your tax debt for less than the full amount and avoiding additional penalties and interest.

Q: How long does it take to process an Offer in Compromise?

A: The processing time for an Offer in Compromise can vary, but it typically takes several months for the Louisiana Department of Revenue to review and make a decision on the offer.

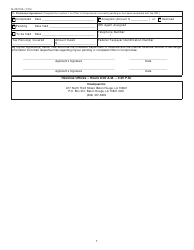

Q: Can I appeal a rejected Offer in Compromise?

A: Yes, if your offer is rejected, you have the right to appeal the decision within 30 days.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-20212 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.