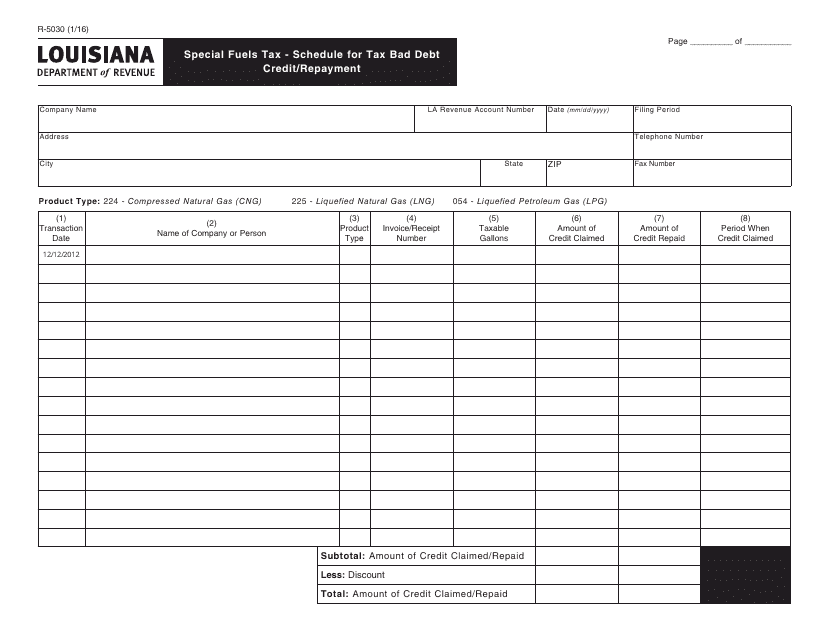

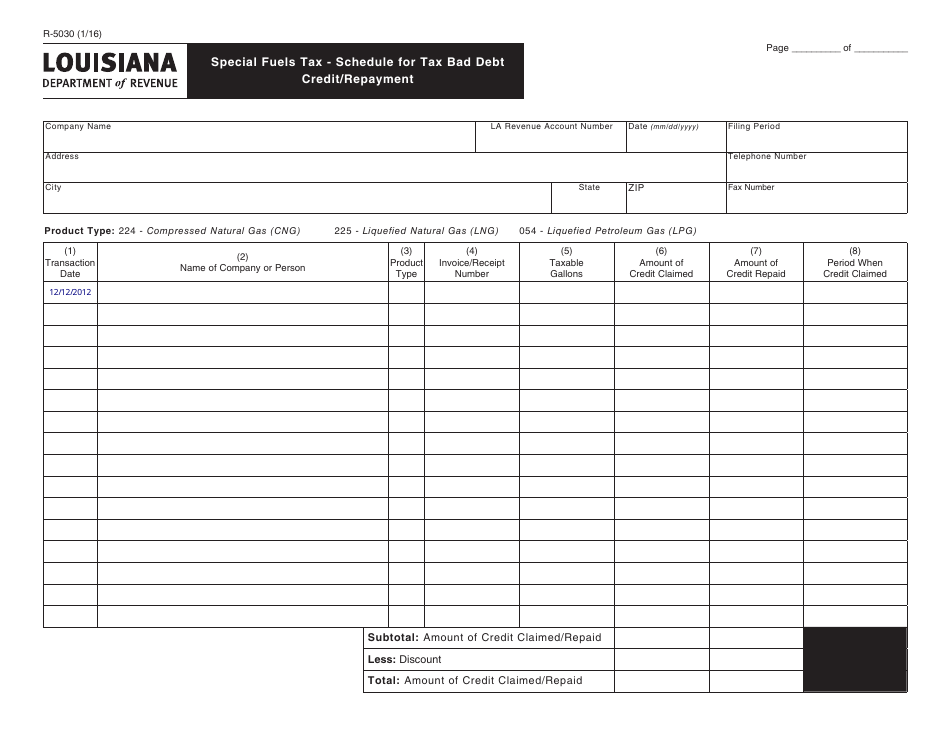

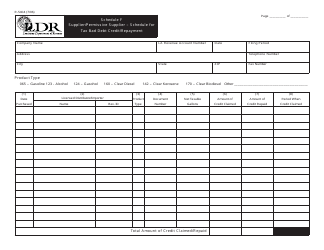

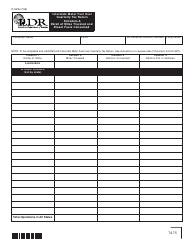

Form R-5030 Schedule for Tax Bad Debt Credit / Repayment - Special Fuels Tax - Louisiana

What Is Form R-5030?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-5030?

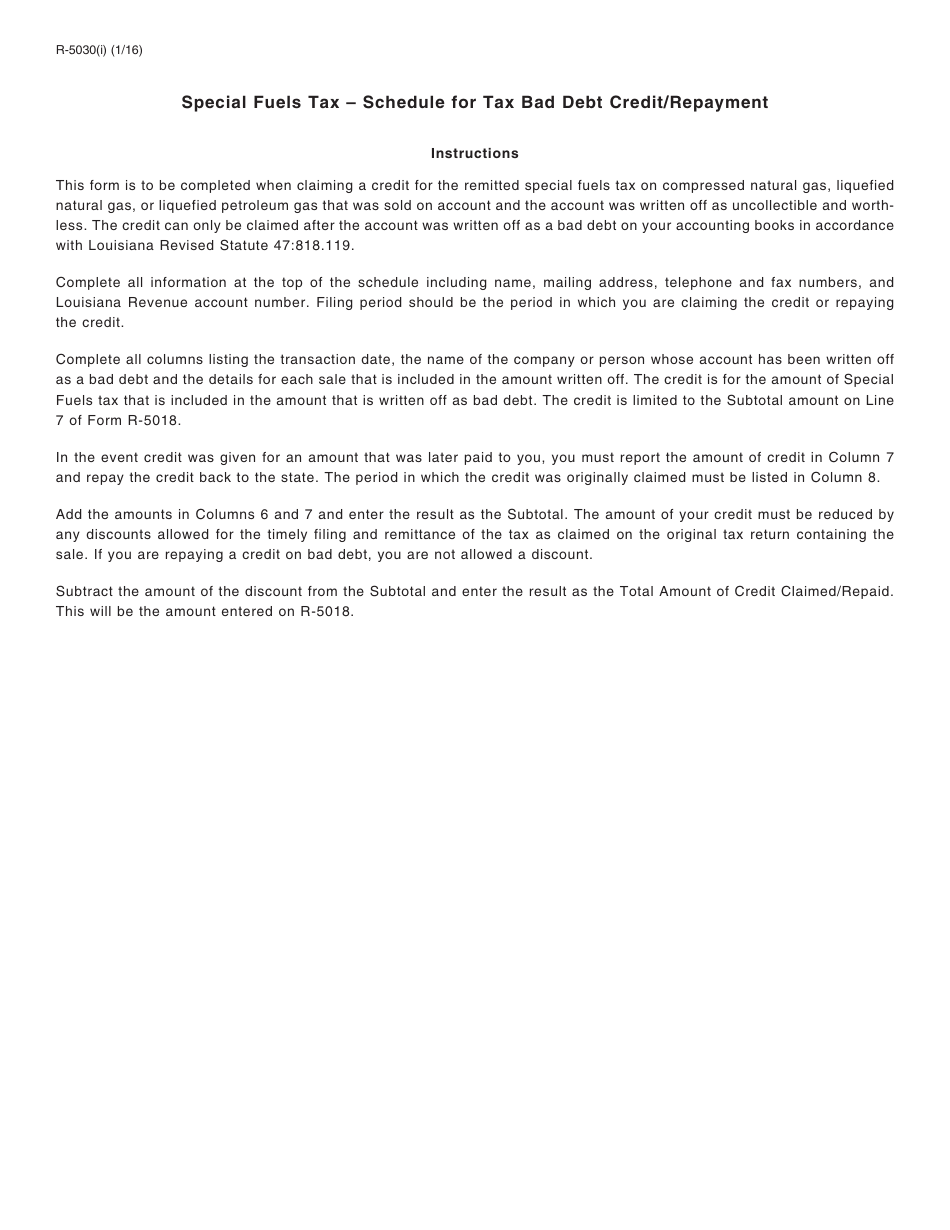

A: Form R-5030 is a schedule used to claim tax bad debt credit or repayment for special fuels tax in Louisiana.

Q: What is tax bad debt credit?

A: Tax bad debt credit allows taxpayers to claim a credit for unpaid taxes that are considered uncollectible.

Q: Who can use Form R-5030?

A: Form R-5030 is used by taxpayers who want to claim tax bad debt credit or repayment for special fuels tax in Louisiana.

Q: What is special fuels tax in Louisiana?

A: Special fuels tax in Louisiana is a tax imposed on the sale or use of special fuels such as gasoline, diesel, and aviation fuel.

Q: How can I claim tax bad debt credit or repayment using Form R-5030?

A: To claim tax bad debt credit or repayment, taxpayers must complete and file Form R-5030 along with supporting documentation.

Q: Are there any deadlines for filing Form R-5030?

A: Yes, taxpayers must file Form R-5030 within the specified time limits set by the Louisiana Department of Revenue.

Q: Can I claim tax bad debt credit for any type of taxes using Form R-5030?

A: No, Form R-5030 is specifically for claiming tax bad debt credit or repayment for special fuels tax in Louisiana.

Q: Is there any fee associated with filing Form R-5030?

A: No, there is no fee associated with filing Form R-5030.

Q: What should I do if I have further questions about Form R-5030?

A: If you have further questions about Form R-5030, you should contact the Louisiana Department of Revenue for assistance.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5030 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.