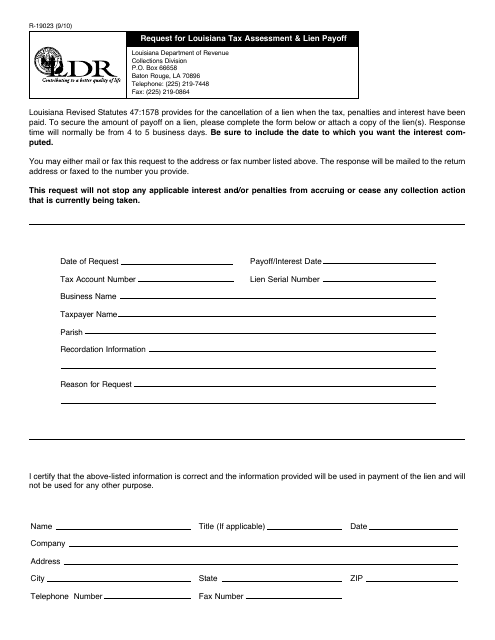

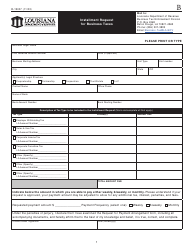

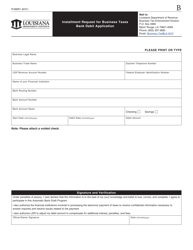

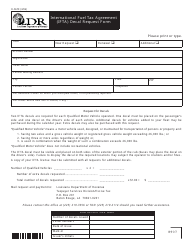

Form R-19023 Request for Louisiana Tax Assessment & Lien Payoff - Louisiana

What Is Form R-19023?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-19023?

A: Form R-19023 is a request form for Louisiana tax assessment and lien payoff.

Q: What is the purpose of Form R-19023?

A: The purpose of Form R-19023 is to request information regarding tax assessment and lien payoff in Louisiana.

Q: Who should use Form R-19023?

A: Form R-19023 should be used by individuals or organizations who need to obtain information about tax assessment and lien payoff in Louisiana.

Q: Is there a fee for submitting Form R-19023?

A: There is no fee for submitting Form R-19023.

Q: What information is required on Form R-19023?

A: The required information on Form R-19023 includes the taxpayer's name, social security number or tax identification number, contact information, and details about the requested tax assessment and lien payoff.

Q: How long does it take to get a response after submitting Form R-19023?

A: The response time may vary, but it typically takes several weeks to receive a response after submitting Form R-19023.

Q: Can Form R-19023 be submitted electronically?

A: No, Form R-19023 cannot be submitted electronically. It must be printed, filled out, and mailed or faxed to the Louisiana Department of Revenue.

Form Details:

- Released on September 1, 2010;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-19023 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.