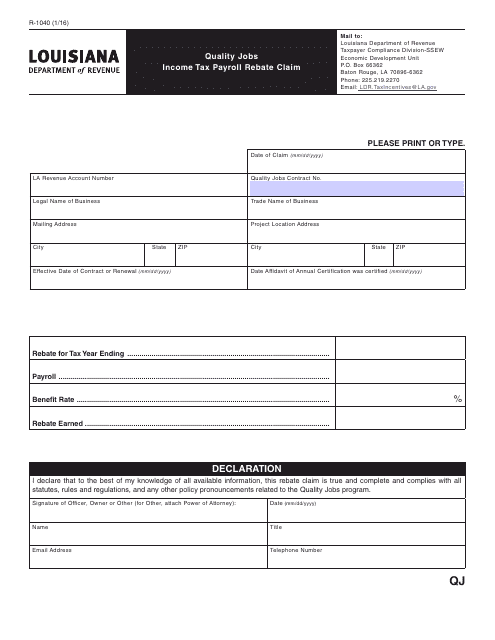

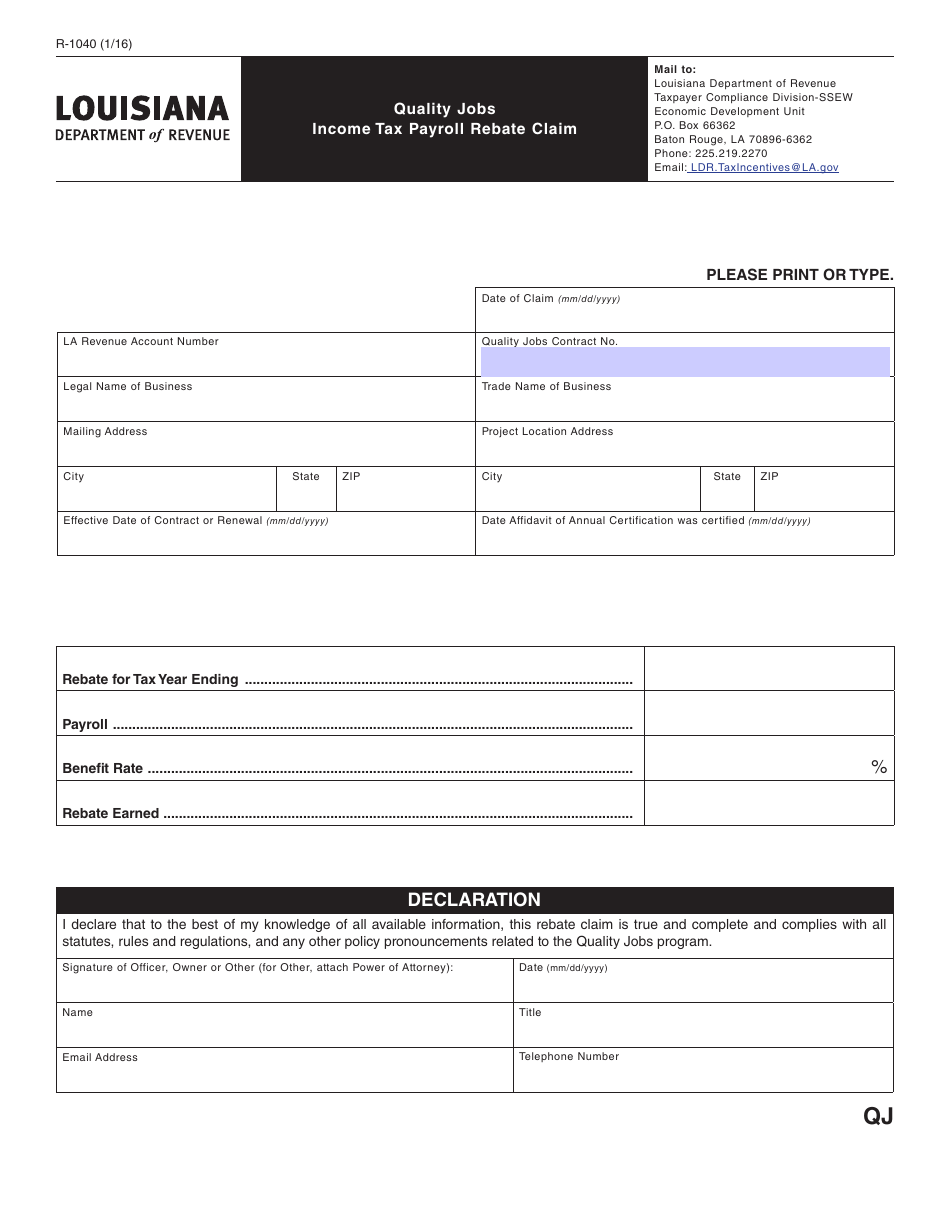

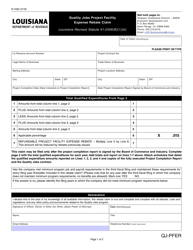

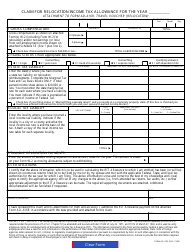

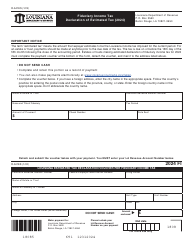

Form R-1040 Quality Jobs Income Tax Payroll Rebate Claim - Louisiana

What Is Form R-1040?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1040?

A: Form R-1040 is the Quality Jobs Income Tax Payroll Rebate Claim form in Louisiana.

Q: What is the purpose of Form R-1040?

A: The purpose of Form R-1040 is to claim the Quality Jobs Income Tax Payroll Rebate in Louisiana.

Q: Who can use Form R-1040?

A: Any taxpayer who is eligible for the Quality Jobs Income Tax Payroll Rebate in Louisiana can use Form R-1040.

Q: What is the Quality Jobs Income Tax Payroll Rebate?

A: The Quality Jobs Income Tax Payroll Rebate is a tax incentive program in Louisiana that provides rebates for eligible employers.

Q: How do you fill out Form R-1040?

A: To fill out Form R-1040, you need to provide information about your business, the number of quality jobs created, and the amount of wages paid to those jobs.

Q: Are there any deadlines for filing Form R-1040?

A: Yes, the deadline for filing Form R-1040 is the same as the deadline for filing your Louisiana income tax return.

Q: Do I need to attach any additional documents with Form R-1040?

A: Yes, you need to attach copies of payroll records and other supporting documents to substantiate your claim.

Q: Can I file Form R-1040 electronically?

A: Yes, you can file Form R-1040 electronically using the Louisiana Department of Revenue's electronic filing system.

Q: What happens after I submit Form R-1040?

A: After you submit Form R-1040, the Louisiana Department of Revenue will review your claim and determine if you are eligible for the rebate.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1040 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.