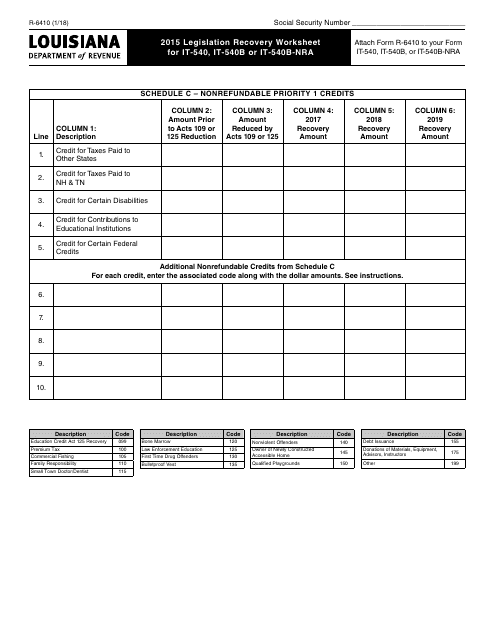

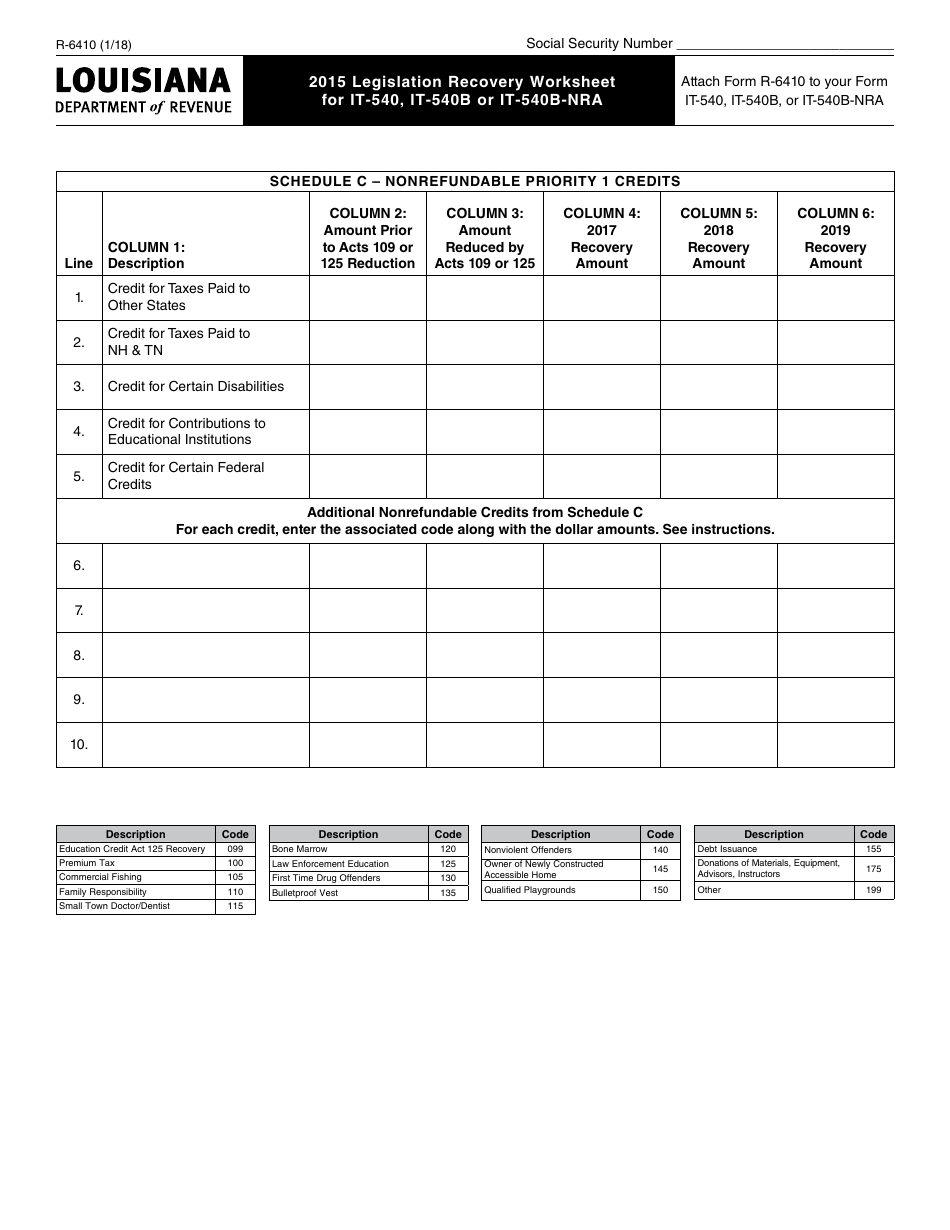

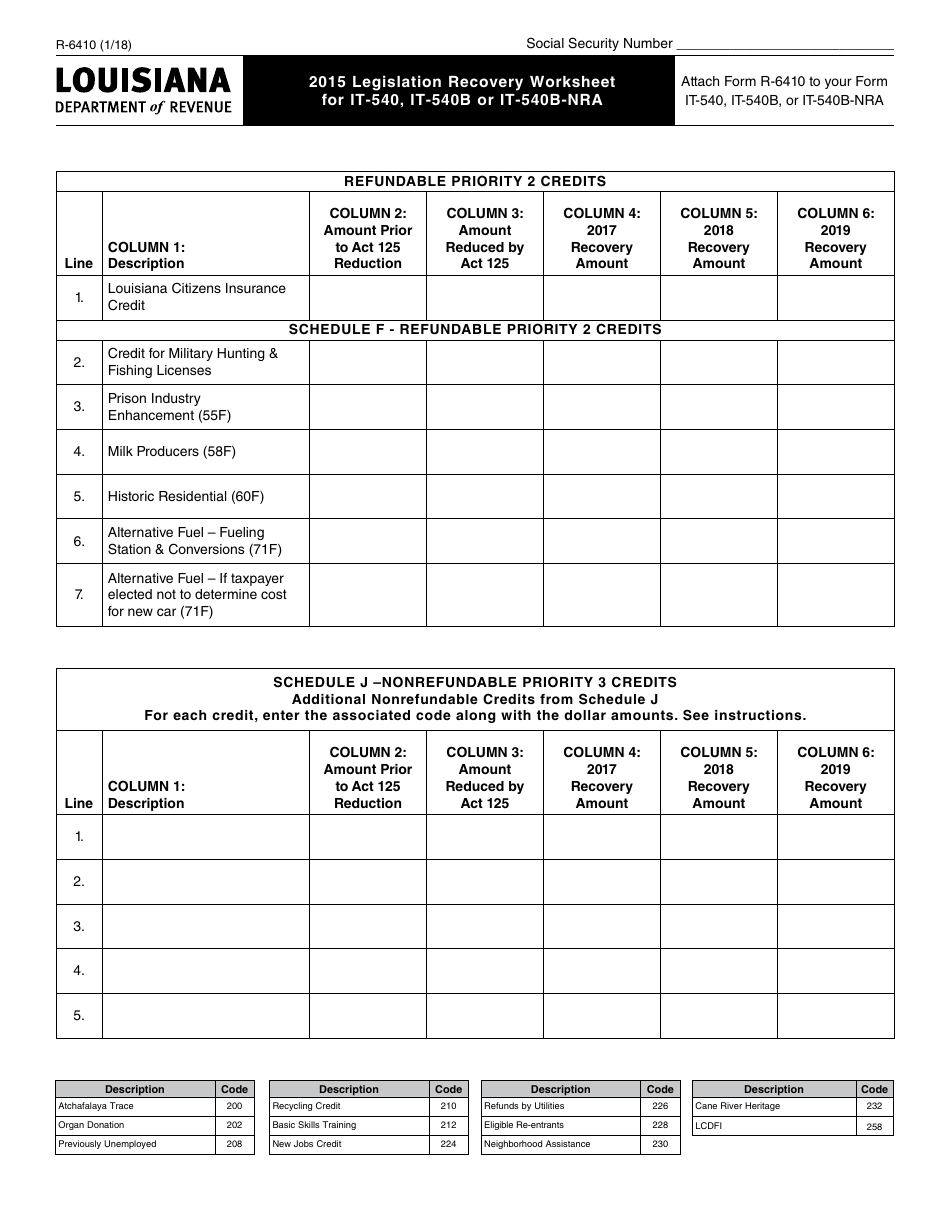

Form R-6410 2015 Legislation Recovery Worksheet for It-540, It-540b or It-540b-Nra - Louisiana

What Is Form R-6410?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6410?

A: Form R-6410 is the Legislation Recovery Worksheet for Louisiana State Tax Forms IT-540, IT-540B, or IT-540B-NRA.

Q: What is the purpose of Form R-6410?

A: The purpose of Form R-6410 is to calculate the legislation recovery credits for Louisiana state tax forms IT-540, IT-540B, or IT-540B-NRA.

Q: Which state tax forms require Form R-6410?

A: Form R-6410 is required for Louisiana state tax forms IT-540, IT-540B, or IT-540B-NRA.

Q: What year is Form R-6410 for?

A: Form R-6410 is for the year 2015.

Q: What does the Legislation Recovery Worksheet calculate?

A: The Legislation Recovery Worksheet calculates the credits for various legislative acts that may impact your Louisiana state taxes.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6410 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.