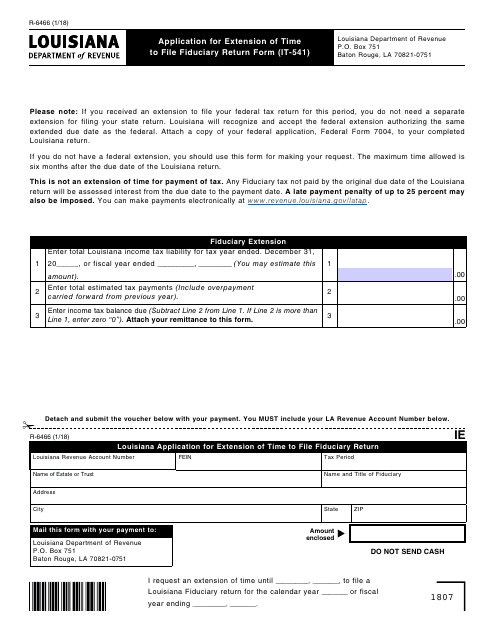

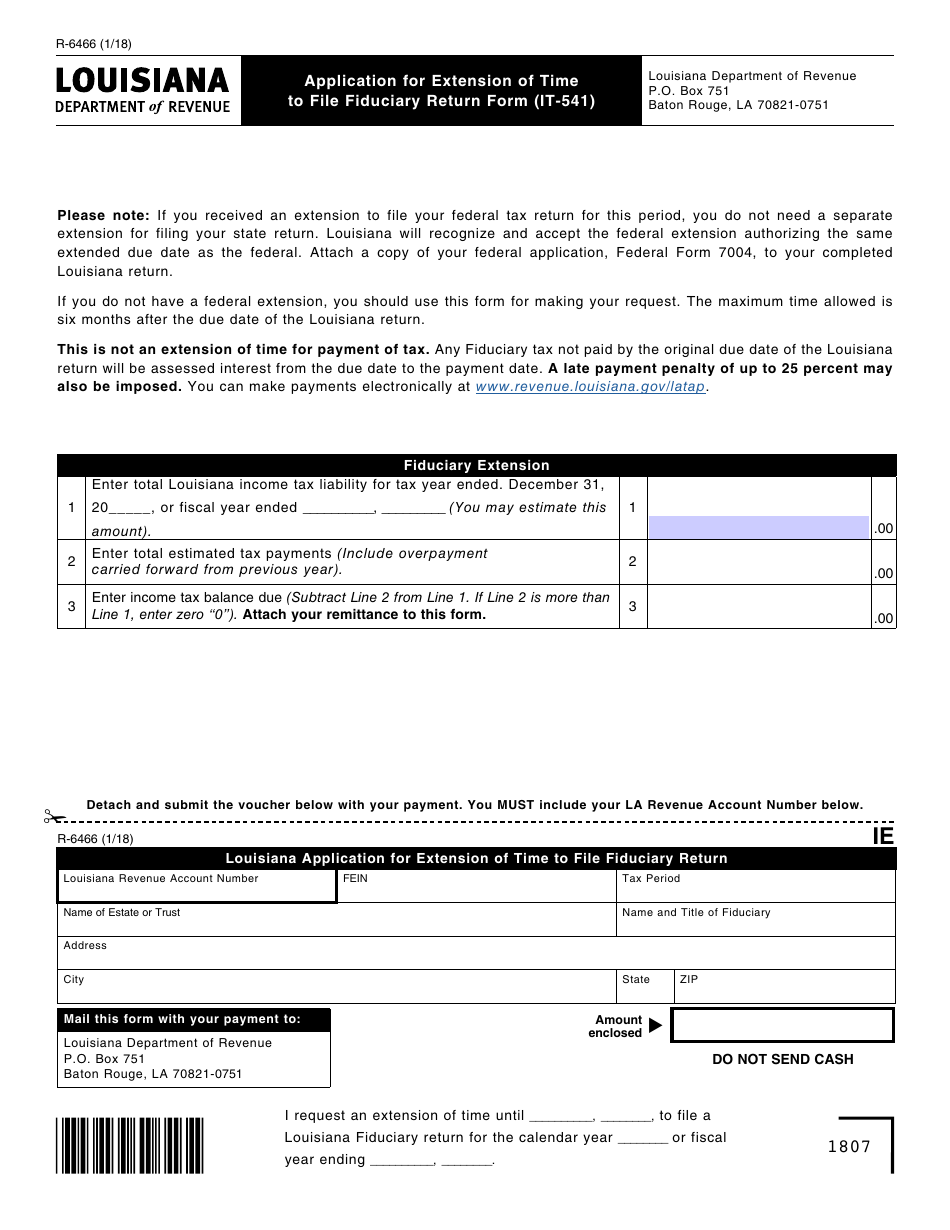

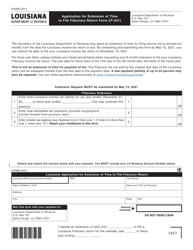

Form R-6466 Application for Extension of Time to File Fiduciary Return Form (It-541) - Louisiana

What Is Form R-6466?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6466?

A: Form R-6466 is the Application for Extension of Time to File Fiduciary Return Form (It-541) in Louisiana.

Q: What is the purpose of Form R-6466?

A: The purpose of Form R-6466 is to request an extension of time to file the Fiduciary Return Form (It-541) in Louisiana.

Q: How do I use Form R-6466?

A: To use Form R-6466, you need to fill out the required information, such as the taxpayer's name, address, and tax year, and submit it to the Louisiana Department of Revenue.

Q: What is the deadline for filing Form R-6466?

A: The deadline for filing Form R-6466 is the same as the deadline for filing the Fiduciary Return Form (It-541), which is generally due on the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing of Form R-6466?

A: Yes, there may be penalties for late filing of Form R-6466. It is important to file the form on time to avoid any potential penalties.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6466 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.