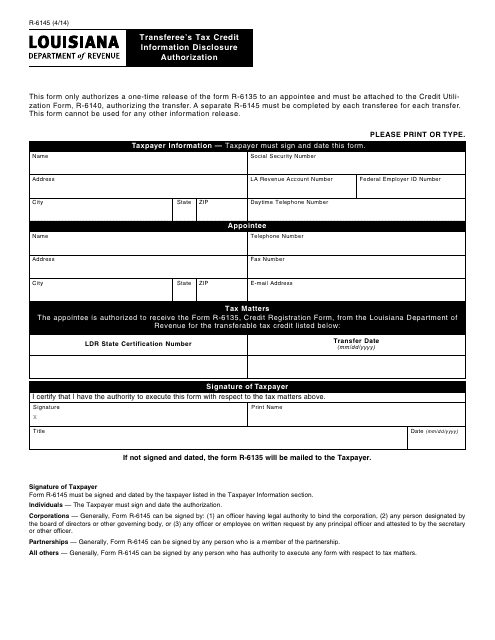

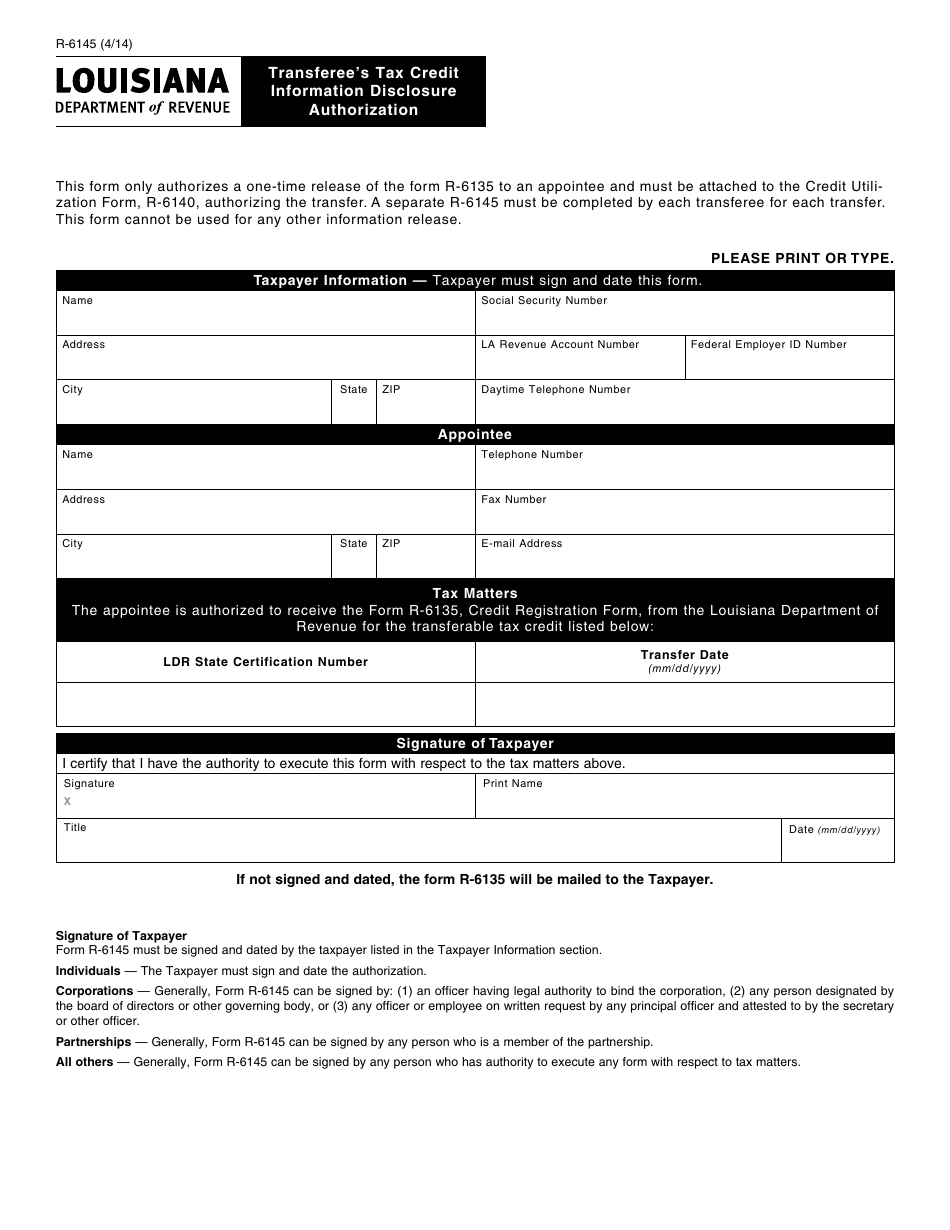

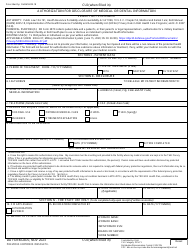

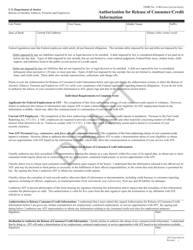

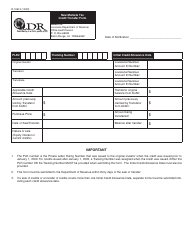

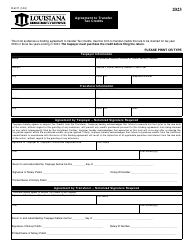

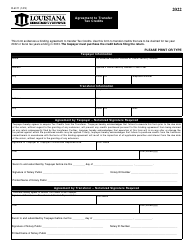

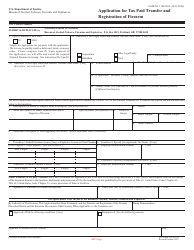

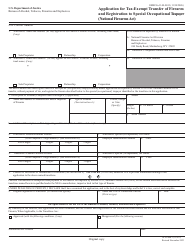

Form R-6145 Transferee's Tax Credit Information Disclosure Authorization - Louisiana

What Is Form R-6145?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6145?

A: Form R-6145 is Transferee's Tax Credit Information Disclosure Authorization form used in Louisiana.

Q: Who can use Form R-6145?

A: This form can be used by transferees in Louisiana.

Q: What is the purpose of Form R-6145?

A: The purpose of this form is to authorize the disclosure of tax credit information to a transferee.

Q: Is Form R-6145 mandatory?

A: No, this form is not mandatory. It is optional for transferees who wish to authorize the disclosure of tax credit information.

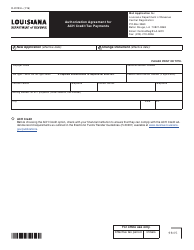

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form R-6145 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.