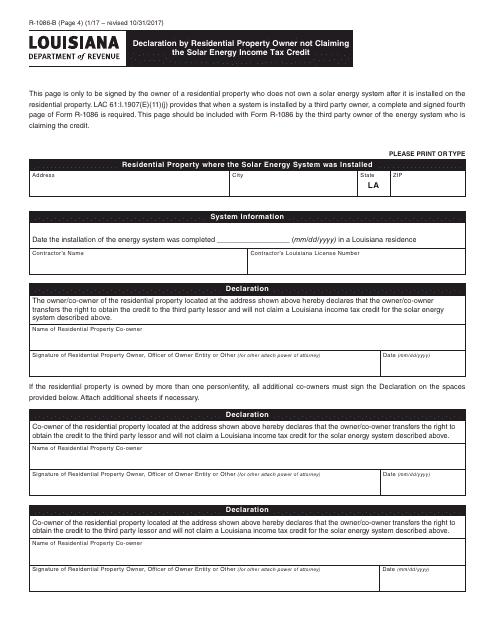

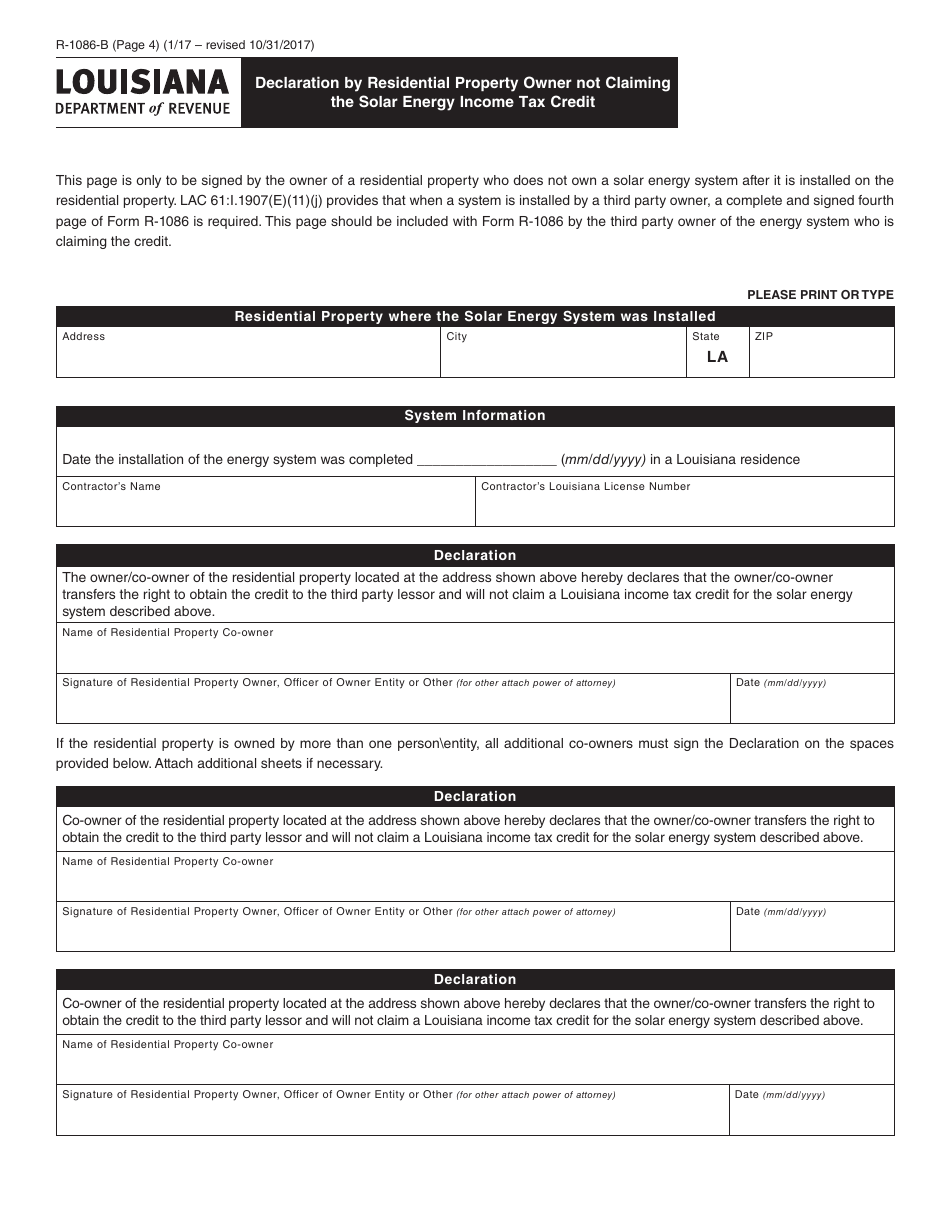

Form R-1086-B Declaration by Residential Property Owner Not Claiming the Solar Energy Income Tax Credit - Louisiana

What Is Form R-1086-B?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1086-B?

A: Form R-1086-B is a declaration form used by residential property owners in Louisiana to declare that they are not claiming the Solar Energy Income Tax Credit.

Q: Who should use Form R-1086-B?

A: Residential property owners in Louisiana who are not claiming the Solar EnergyIncome Tax Credit should use Form R-1086-B.

Q: What is the purpose of Form R-1086-B?

A: The purpose of Form R-1086-B is for residential property owners to declare that they are not claiming the Solar Energy Income Tax Credit.

Q: What is the Solar Energy Income Tax Credit in Louisiana?

A: The Solar Energy Income Tax Credit in Louisiana is a tax credit provided to individuals who install solar energy systems on their residential properties.

Q: What information is required on Form R-1086-B?

A: Form R-1086-B requires the residential property owner's name, address, and signature, along with the declaration that they are not claiming the Solar Energy Income Tax Credit.

Form Details:

- Released on October 31, 2017;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1086-B by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.