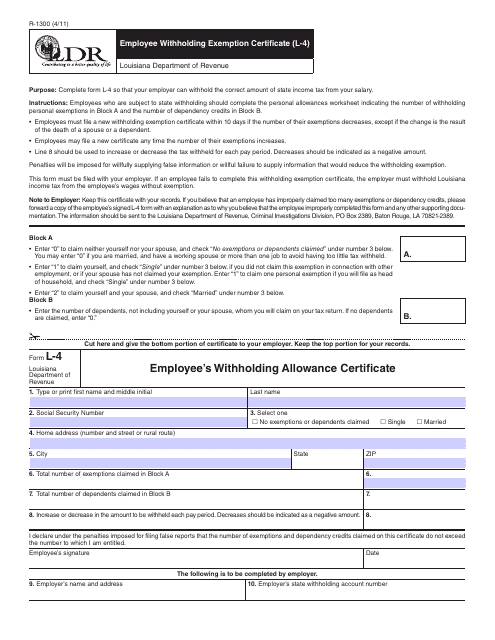

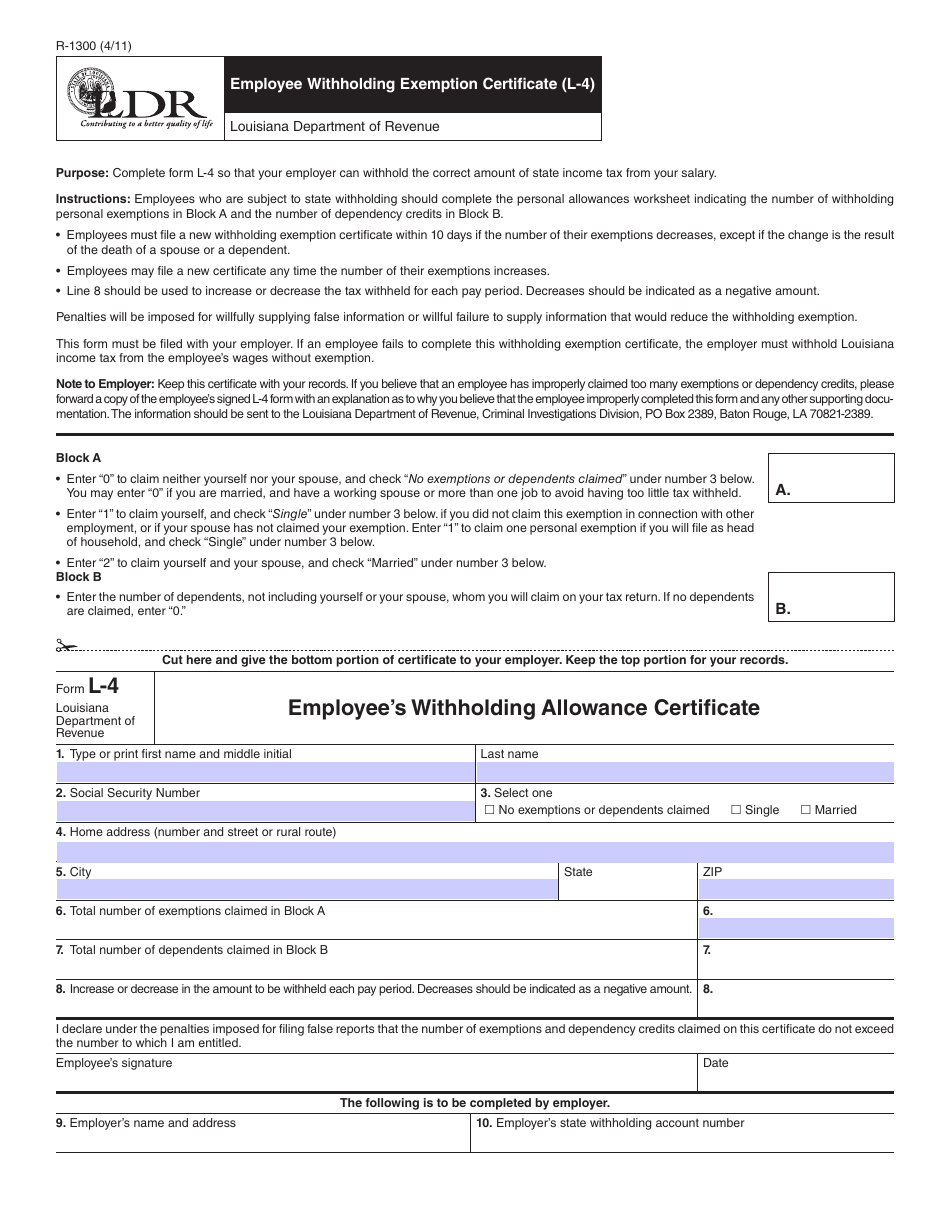

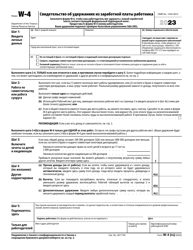

This version of the form is not currently in use and is provided for reference only. Download this version of

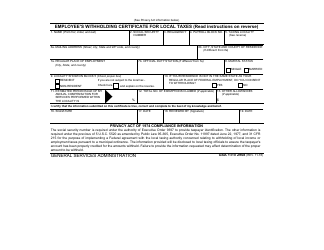

Form R-1300 (L-4)

for the current year.

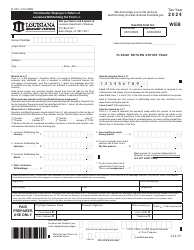

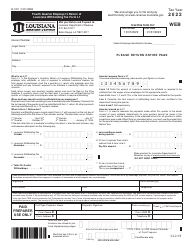

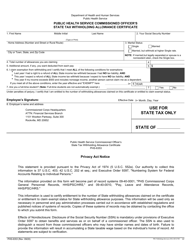

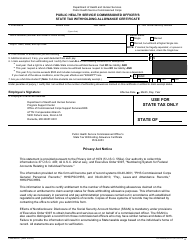

Form R-1300 (L-4) Employee's Withholding Allowance Certificate - Louisiana

What Is Form R-1300 (L-4)?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1300?

A: Form R-1300 is the Employee's Withholding Allowance Certificate in Louisiana.

Q: What is the purpose of Form R-1300?

A: The purpose of Form R-1300 is to determine the amount of Louisiana state income tax to be withheld from an employee's wages.

Q: Who needs to fill out Form R-1300?

A: All employees in Louisiana need to fill out Form R-1300.

Q: When should Form R-1300 be filled out?

A: Form R-1300 should be filled out when you start a new job or when you want to change your withholding allowances.

Q: How do I fill out Form R-1300?

A: You need to provide your personal information, such as name, address, and Social Security number, and then calculate the number of withholding allowances you are claiming.

Q: Can I claim exemptions on Form R-1300?

A: Yes, you can claim exemptions on Form R-1300 if you meet certain criteria.

Q: What happens if I don't fill out Form R-1300?

A: If you don't fill out Form R-1300, your employer will withhold taxes based on the default withholding rate, which may not accurately reflect your tax liability.

Q: Can I change my withholding allowances later?

A: Yes, you can change your withholding allowances by filling out a new Form R-1300.

Q: Do I need to submit Form R-1300 every year?

A: No, you do not need to submit Form R-1300 every year. You only need to submit a new form when your withholding allowances change.

Form Details:

- Released on April 1, 2011;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1300 (L-4) by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.