Tax Exemptions for Benevolent and Charitable Institutions - Maine

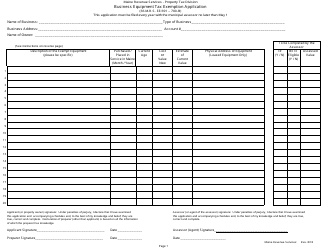

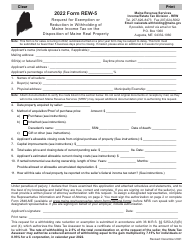

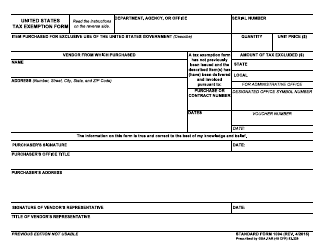

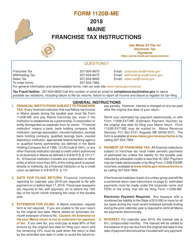

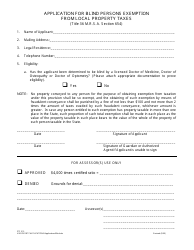

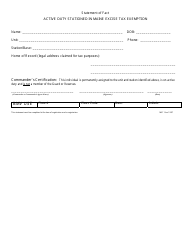

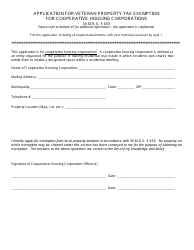

Tax Exemptions for Benevolent and Charitable Institutions is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What are tax exemptions for benevolent and charitable institutions in Maine?

A: Certain benevolent and charitable institutions in Maine may qualify for tax exemptions.

Q: How can benevolent and charitable institutions qualify for tax exemption in Maine?

A: Benevolent and charitable institutions in Maine can qualify for tax exemption by meeting certain criteria set by the state.

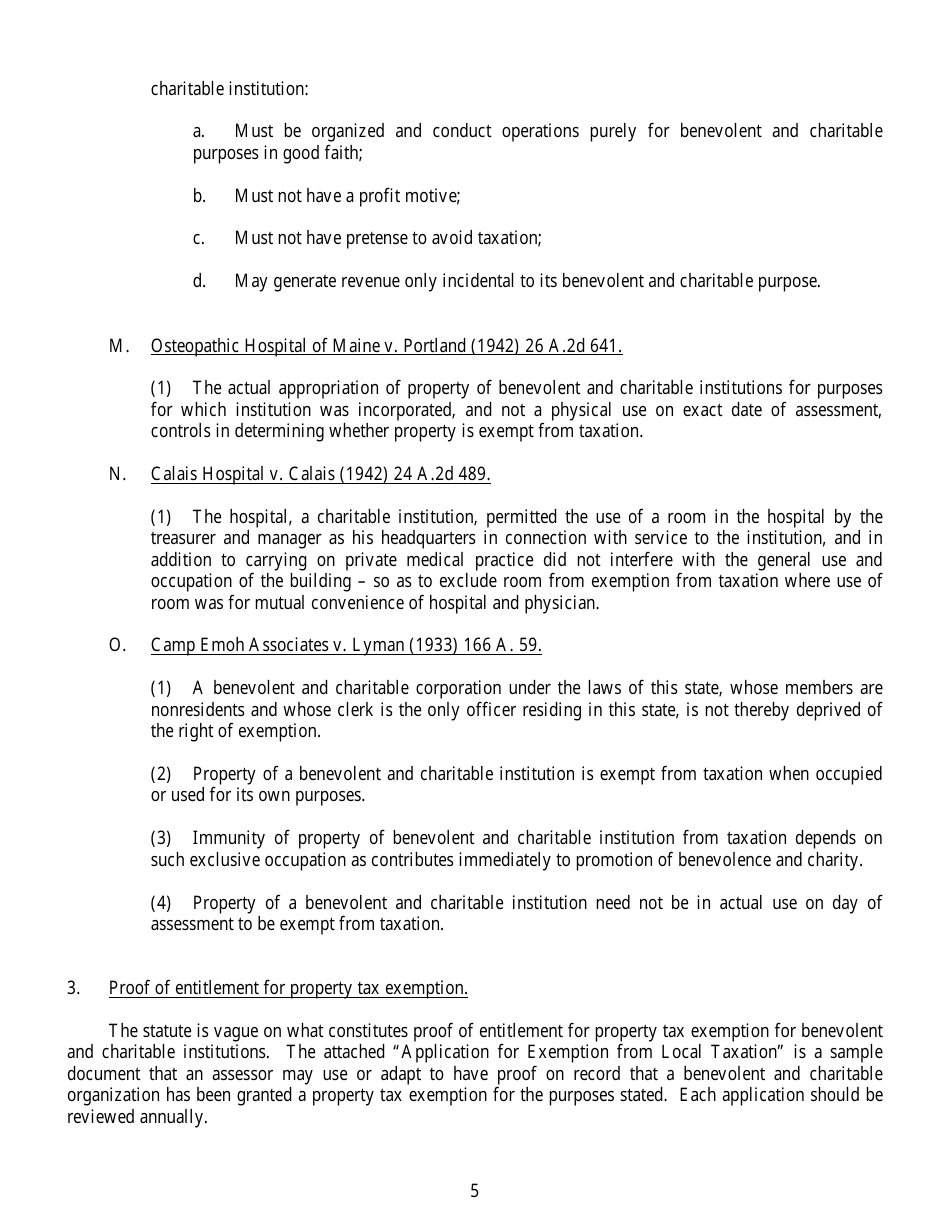

Q: What are the criteria for tax exemption for benevolent and charitable institutions in Maine?

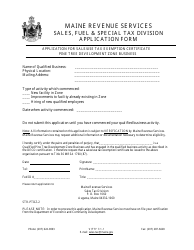

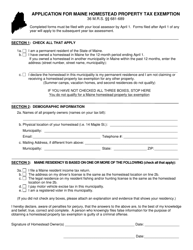

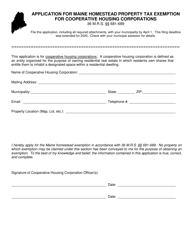

A: The criteria for tax exemption in Maine include being organized and operated exclusively for charitable purposes, obtaining approval from the Maine Revenue Services, and complying with applicable laws and regulations.

Q: What are the benefits of tax exemption for benevolent and charitable institutions in Maine?

A: The benefits of tax exemption for benevolent and charitable institutions in Maine include exemption from certain taxes, such as property tax and sales tax.

Q: Are all benevolent and charitable institutions eligible for tax exemption in Maine?

A: Not all benevolent and charitable institutions are eligible for tax exemption in Maine. They must meet specific criteria set by the state to qualify.

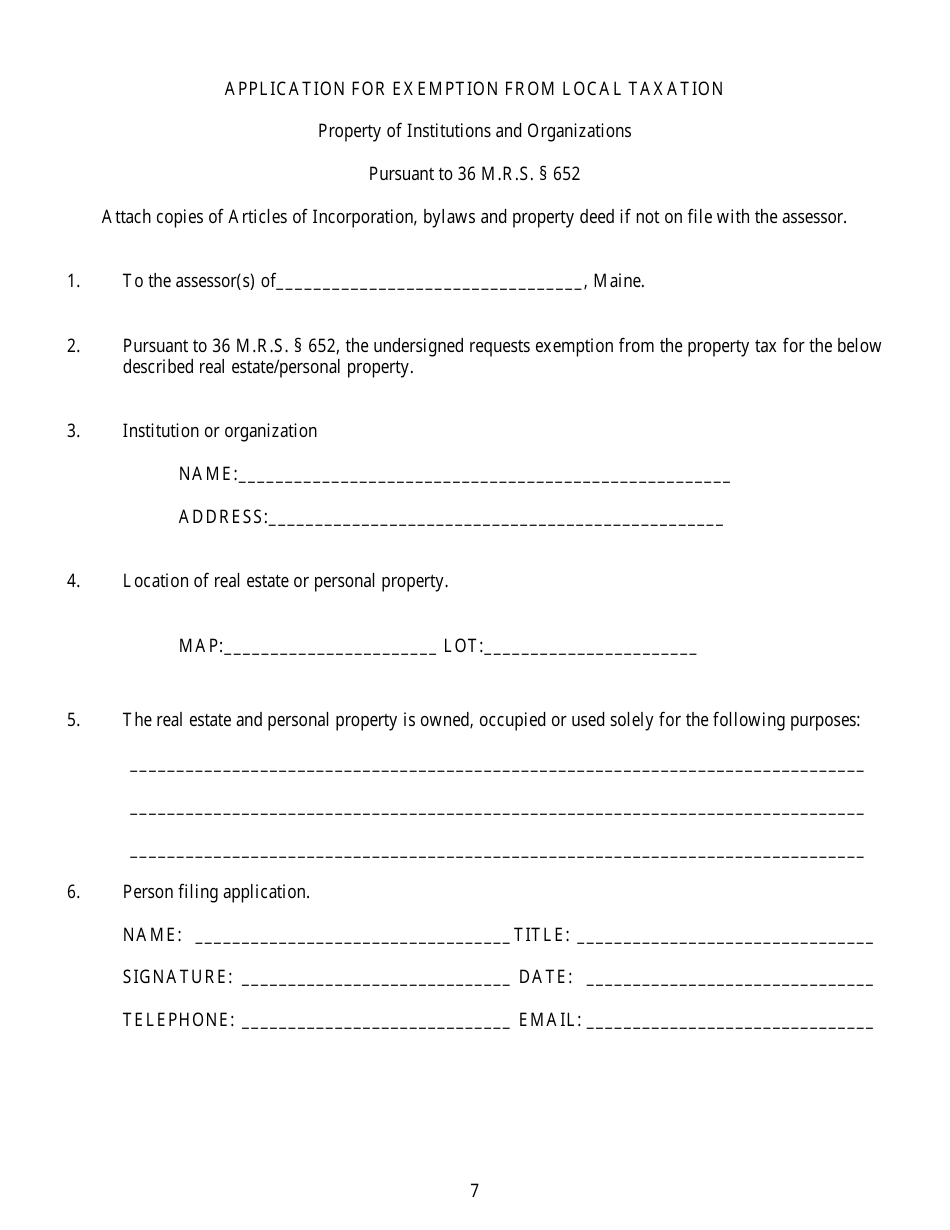

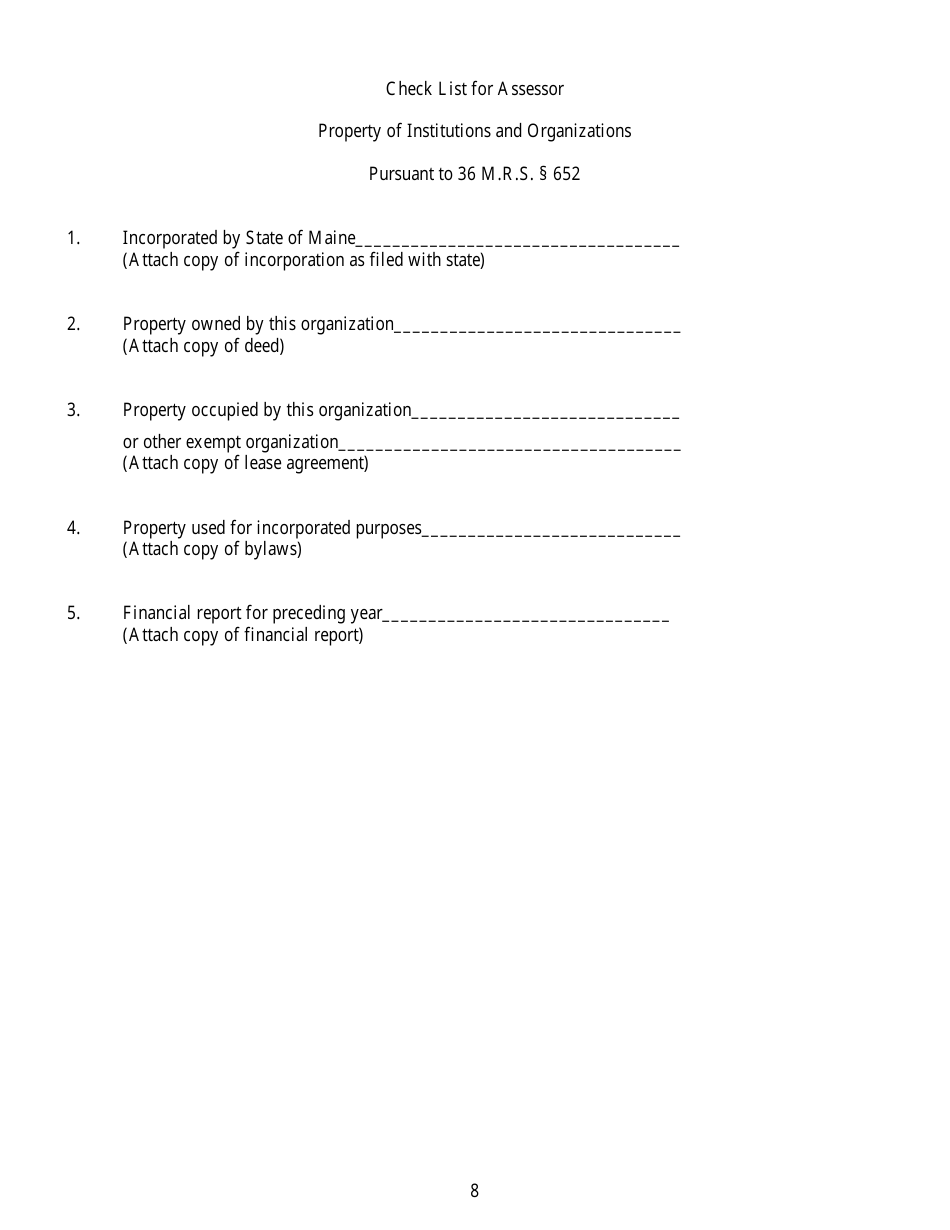

Form Details:

- Released on November 12, 2017;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.