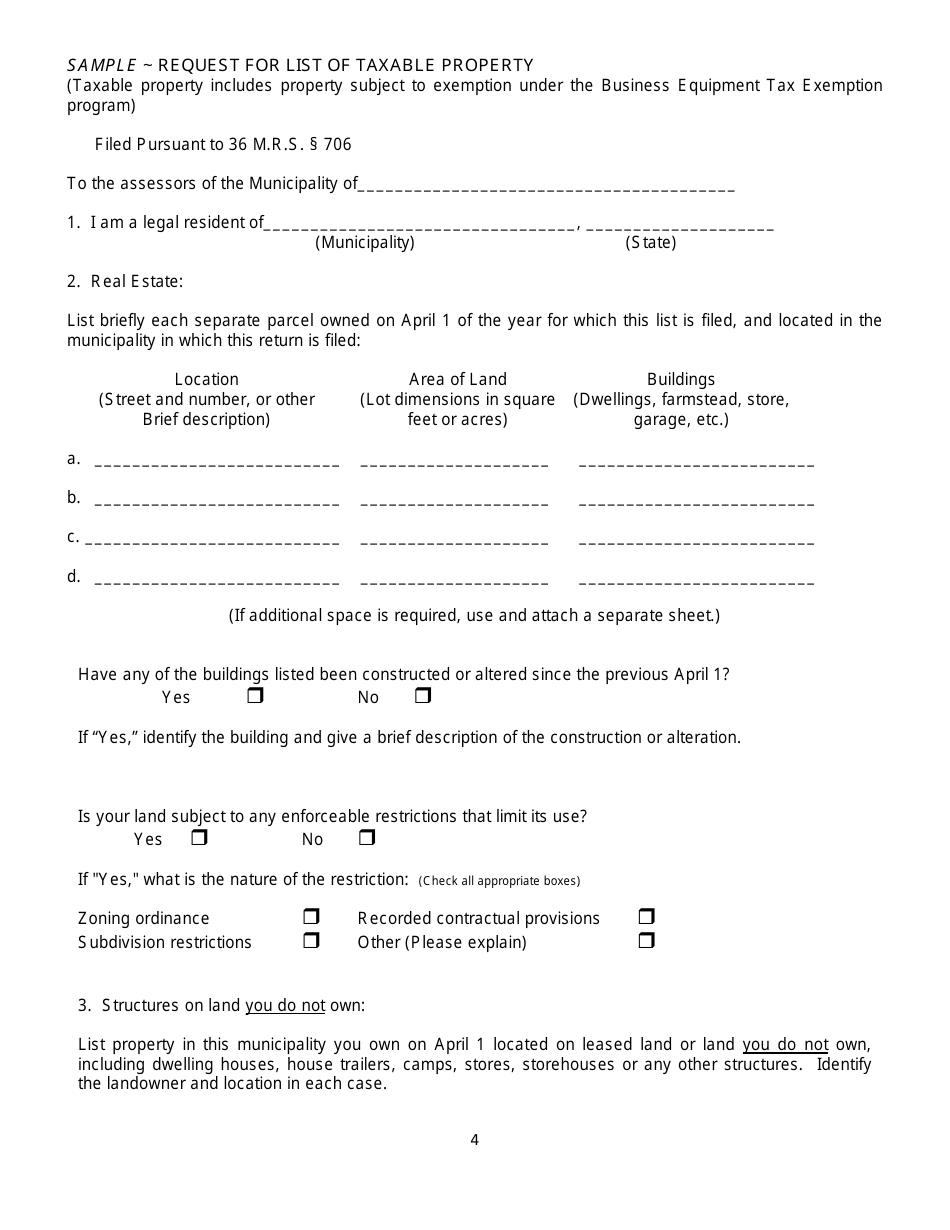

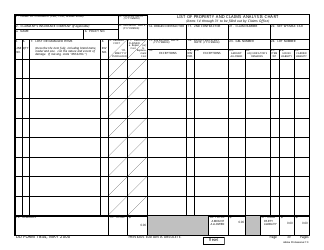

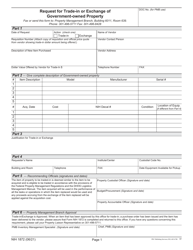

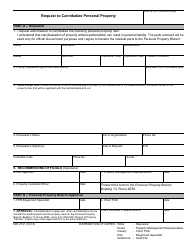

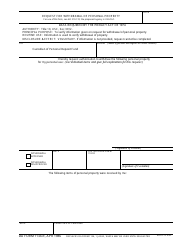

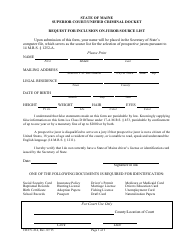

Sample Request for List of Taxable Property - Maine

Sample Request for List of Taxable Property is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is taxable property in Maine?

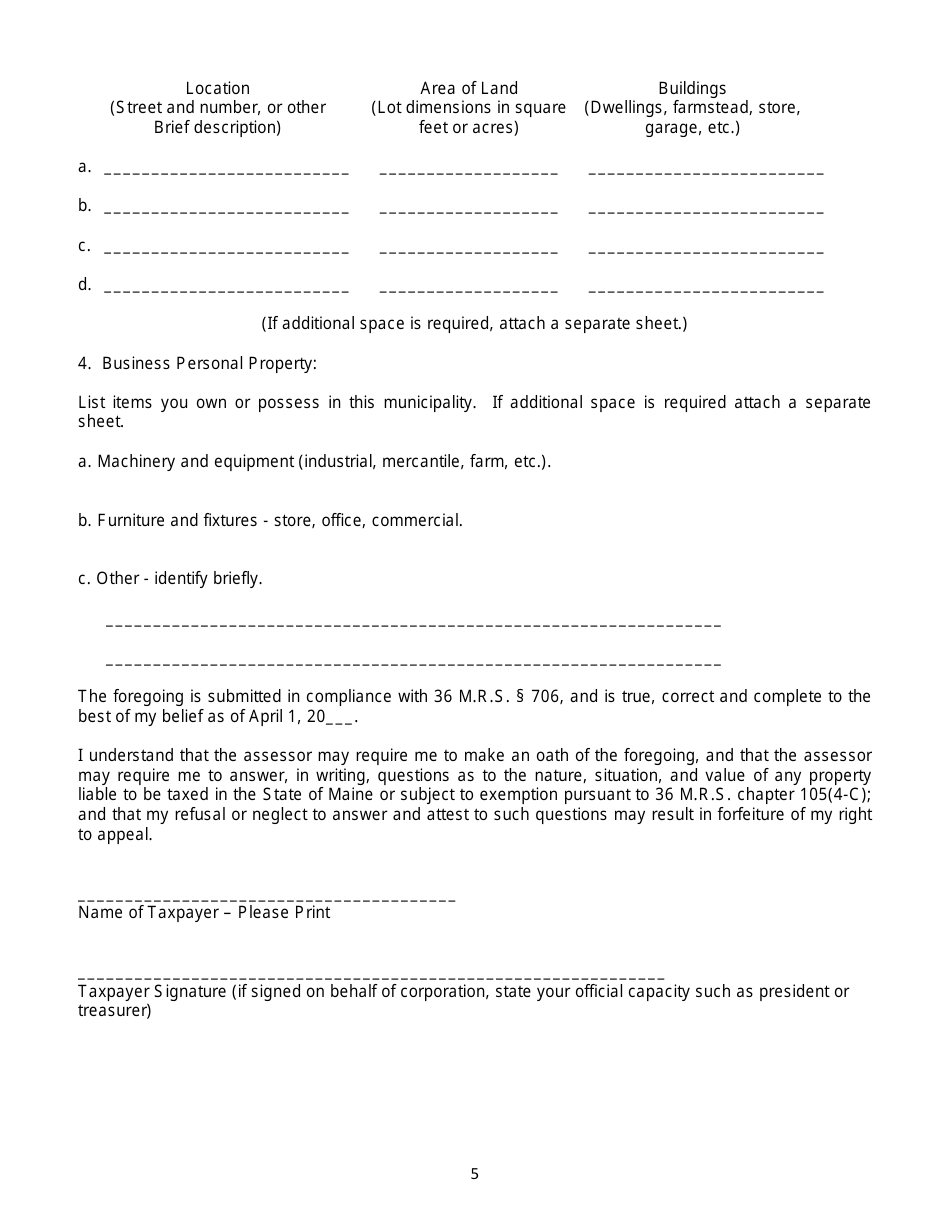

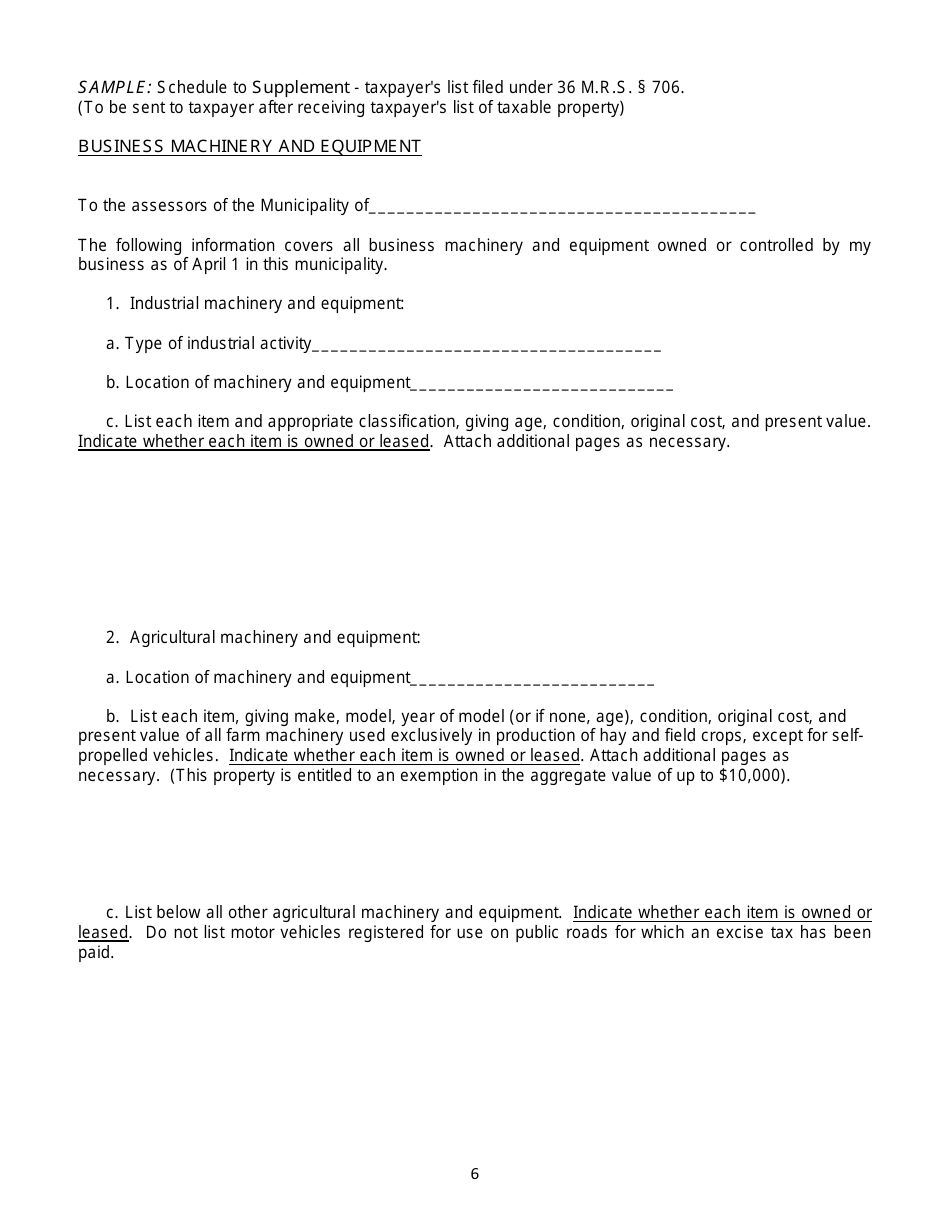

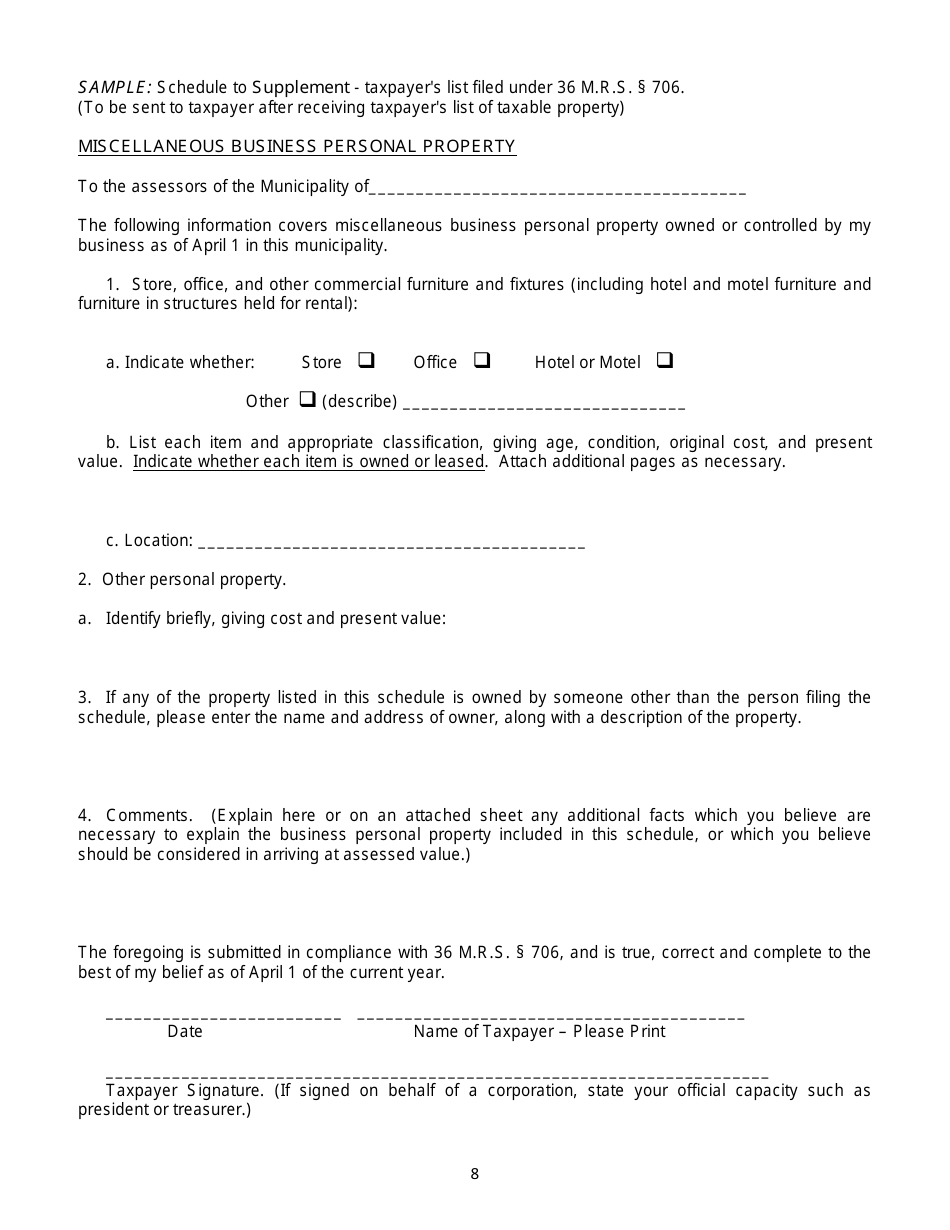

A: Taxable property in Maine includes real property, such as land and buildings, as well as personal property, such as vehicles and business equipment.

Q: How is taxable property assessed in Maine?

A: Taxable property in Maine is assessed by local assessors who determine its value based on factors such as its location, condition, and market value.

Q: What is the process for appealing a property tax assessment in Maine?

A: To appeal a property tax assessment in Maine, you must file an application for abatement or appeal with the local assessors within a certain timeframe. The assessors will then review your application and make a decision.

Q: What is the property tax rate in Maine?

A: The property tax rate in Maine varies depending on the municipality. It is typically expressed as a mill rate, which is the amount of tax per thousand dollars of assessed value.

Q: Are there any exemptions or deductions available for property taxes in Maine?

A: Yes, there are certain exemptions and deductions available for property taxes in Maine. These include exemptions for veterans, senior citizens, and disabled individuals, as well as deductions for agricultural and business properties.

Q: When are property taxes due in Maine?

A: Property taxes in Maine are typically due in two installments: one in September and one in March. The exact due dates may vary depending on the municipality.

Q: What happens if property taxes in Maine are not paid on time?

A: If property taxes in Maine are not paid on time, interest and penalties may be assessed. In some cases, the property may also be subject to tax lien sales or foreclosure.

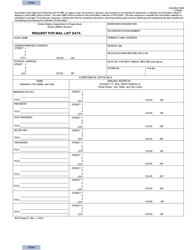

Form Details:

- Released on February 28, 2017;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.