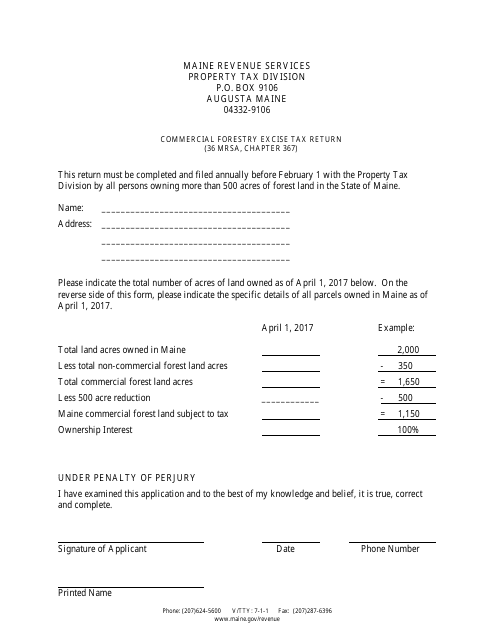

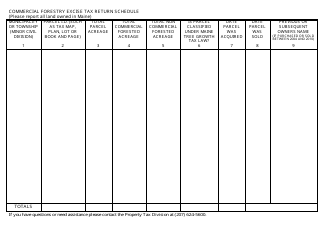

Commercial Forestry Excise Tax Return - Maine

Commercial Forestry Excise Tax Return is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is the Commercial Forestry Excise Tax Return?

A: The Commercial Forestry Excise Tax Return is a tax return filed by commercial forestry operators in Maine.

Q: Who needs to file the Commercial Forestry Excise Tax Return?

A: Commercial forestry operators in Maine need to file the Commercial Forestry Excise Tax Return.

Q: How often do I need to file the Commercial Forestry Excise Tax Return?

A: The Commercial Forestry Excise Tax Return needs to be filed on a quarterly basis.

Q: What is the purpose of the Commercial Forestry Excise Tax?

A: The purpose of the Commercial Forestry Excise Tax is to fund Maine's forestry-related programs and activities.

Q: How is the Commercial Forestry Excise Tax calculated?

A: The Commercial Forestry Excise Tax is calculated based on the volume of forest products harvested during the reporting period.

Q: Are there any exemptions or deductions available for the Commercial Forestry Excise Tax?

A: Yes, there are certain exemptions and deductions available for the Commercial Forestry Excise Tax. These may include smaller-scale operations and certain types of forest products.

Q: Are there any penalties for late or incorrect filing of the Commercial Forestry Excise Tax Return?

A: Yes, there may be penalties for late or incorrect filing of the Commercial Forestry Excise Tax Return. It is important to comply with the filing requirements and guidelines.

Form Details:

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.