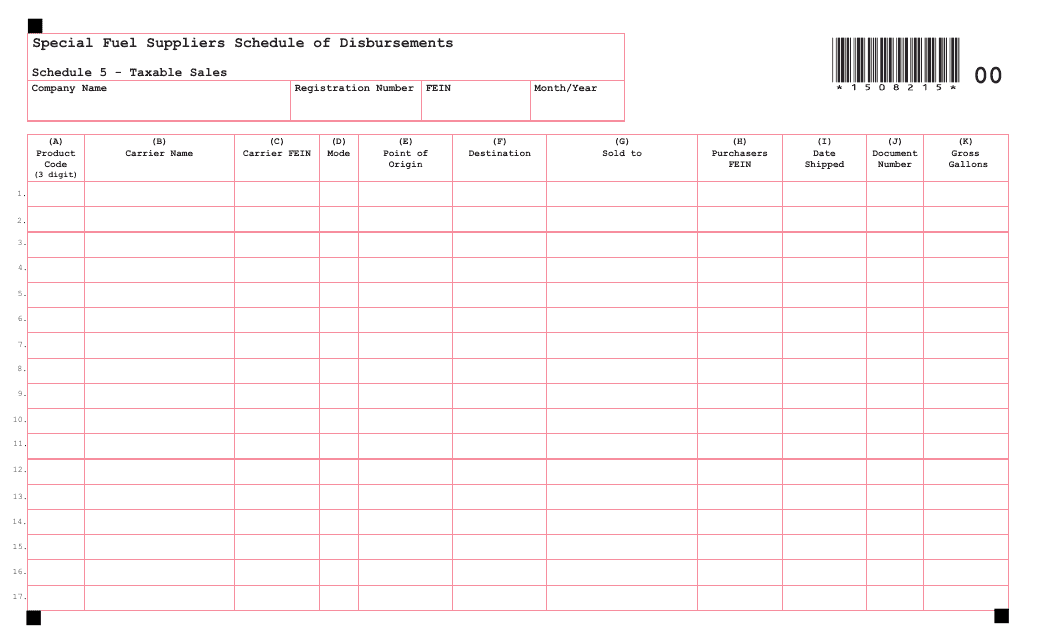

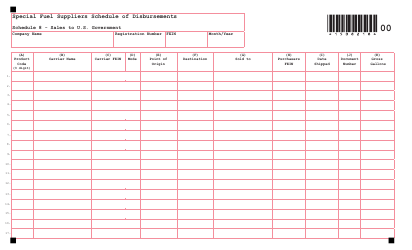

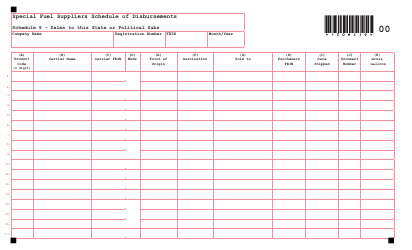

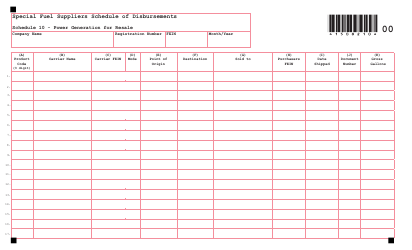

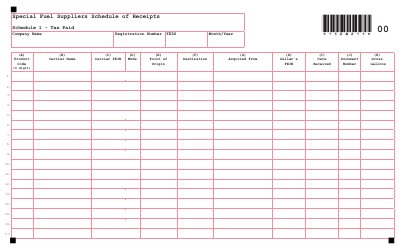

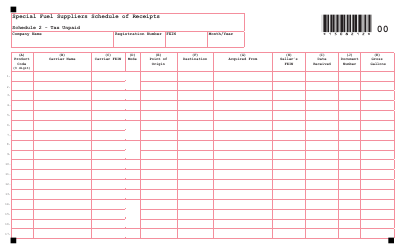

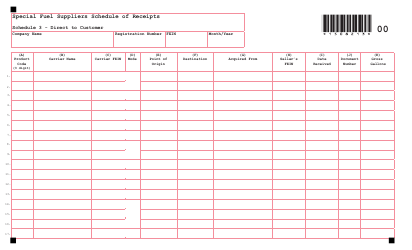

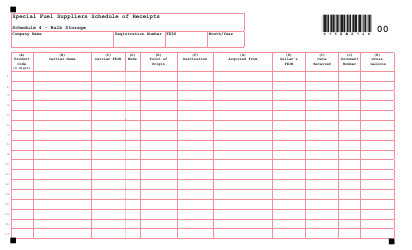

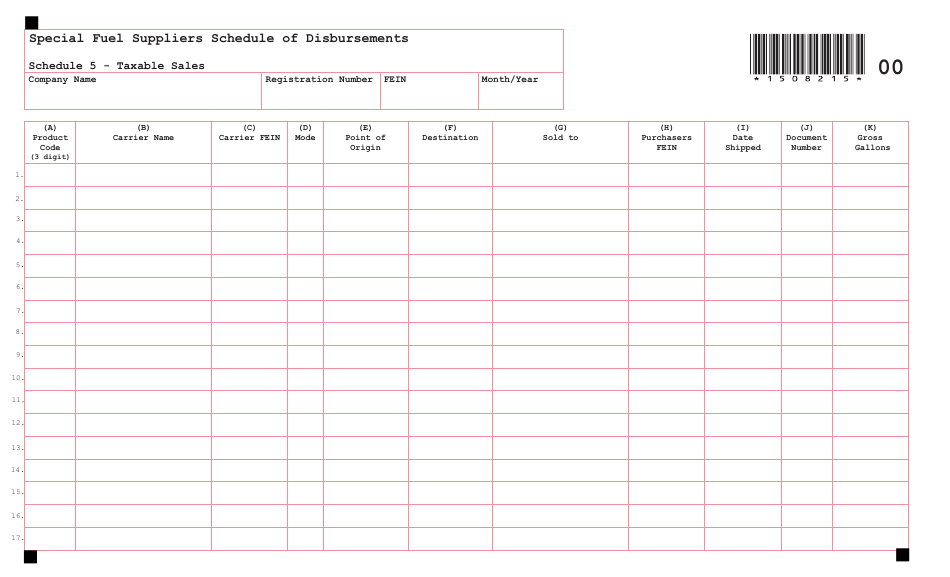

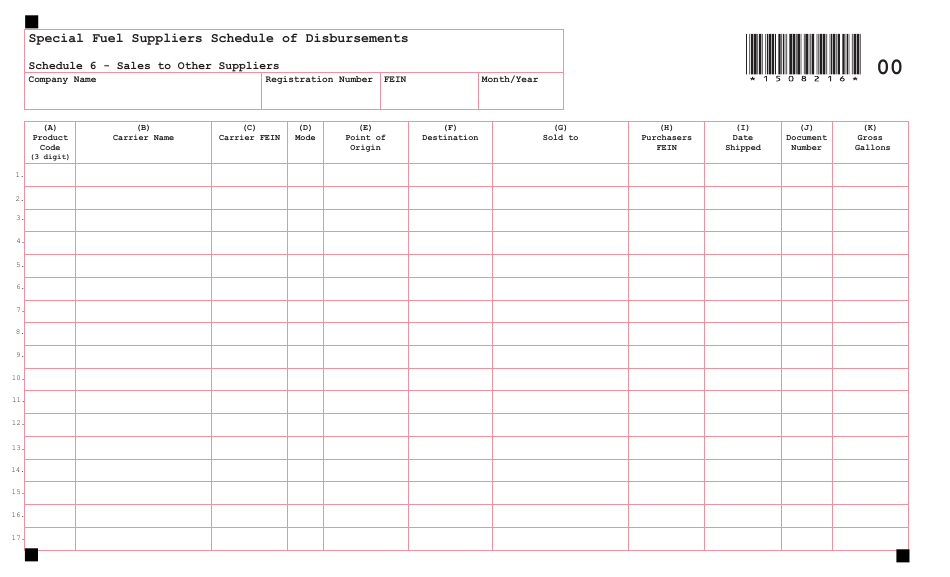

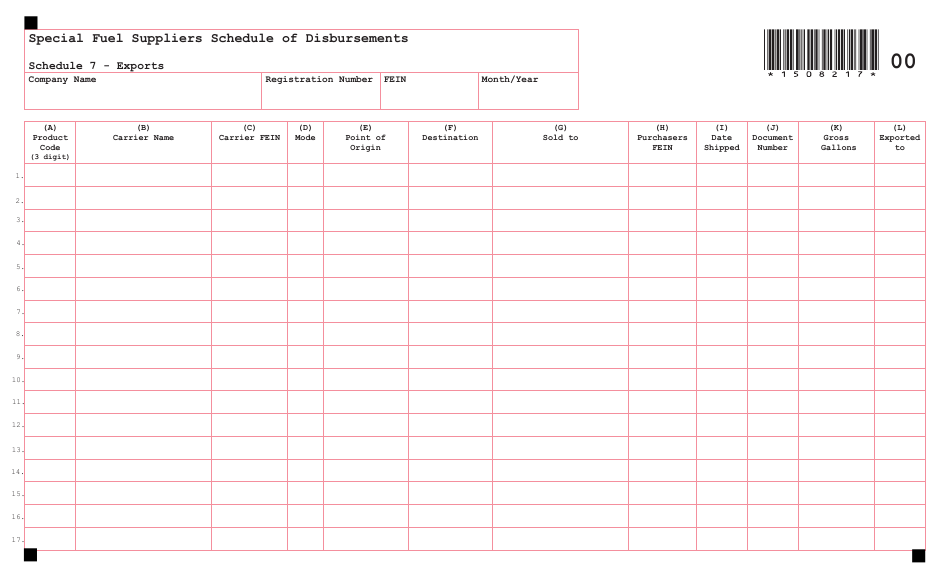

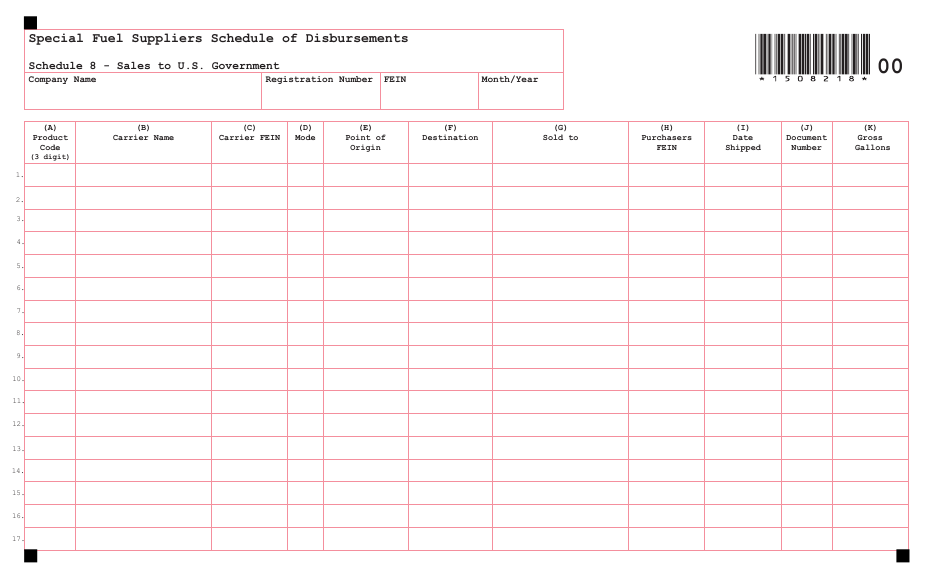

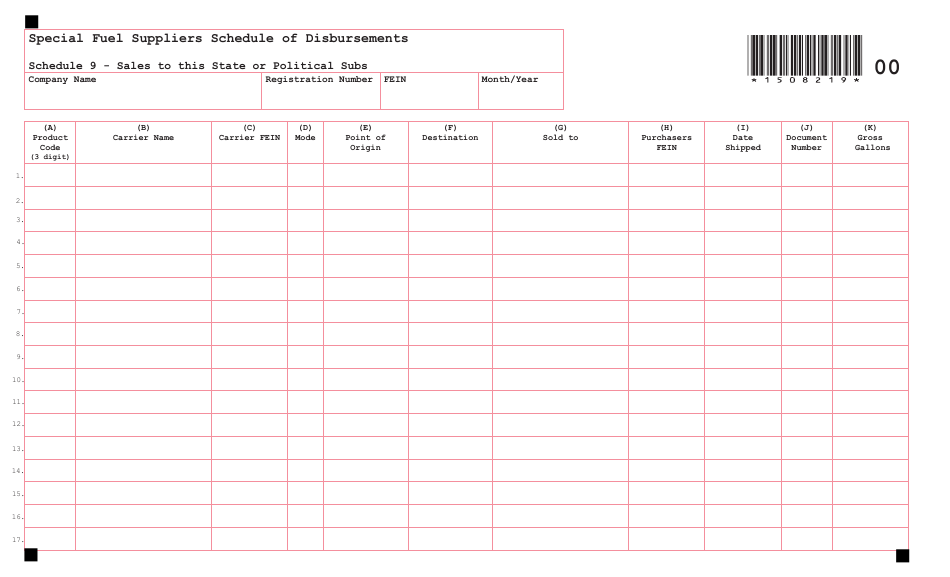

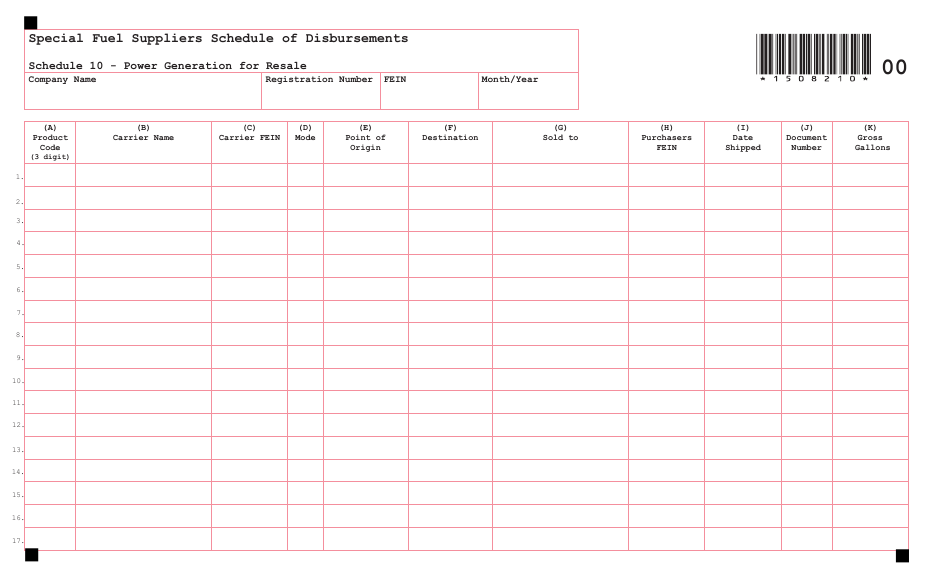

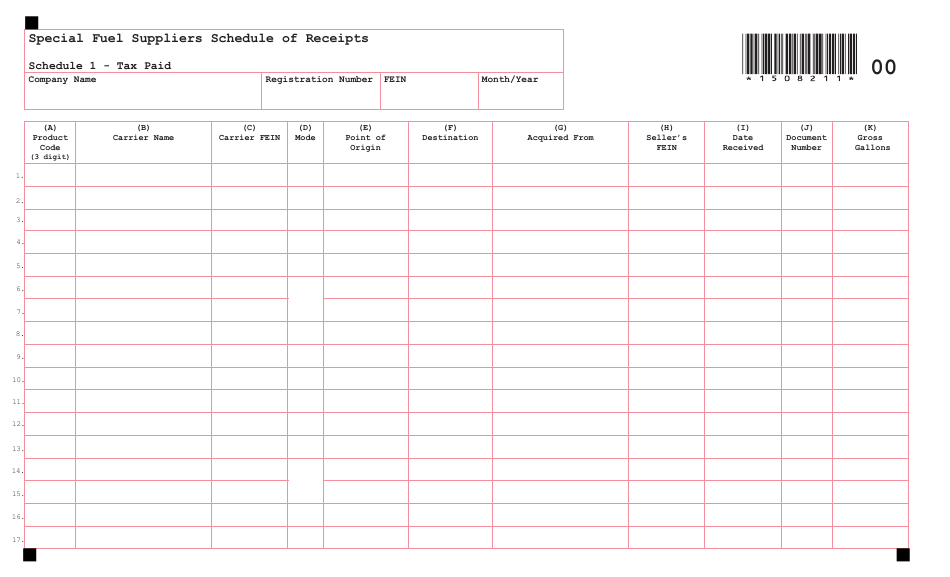

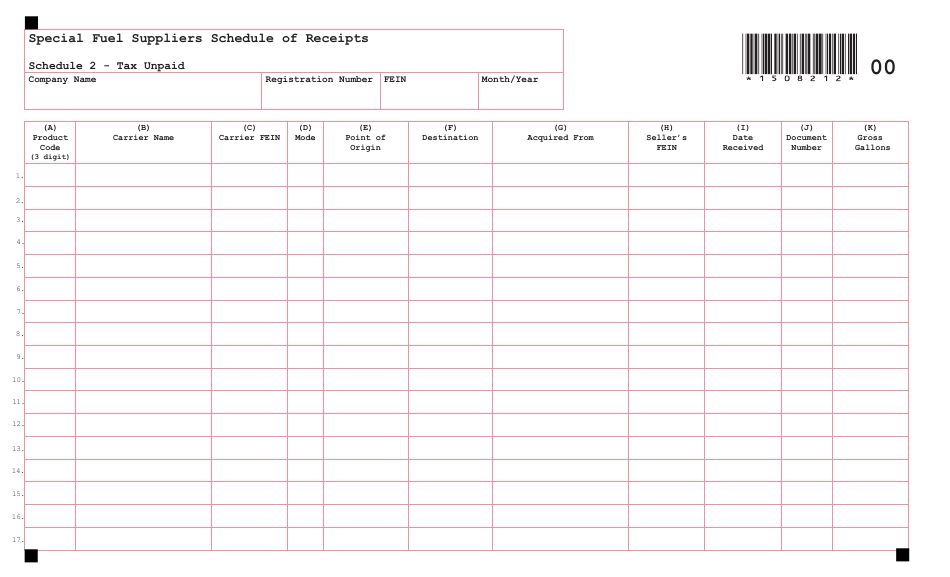

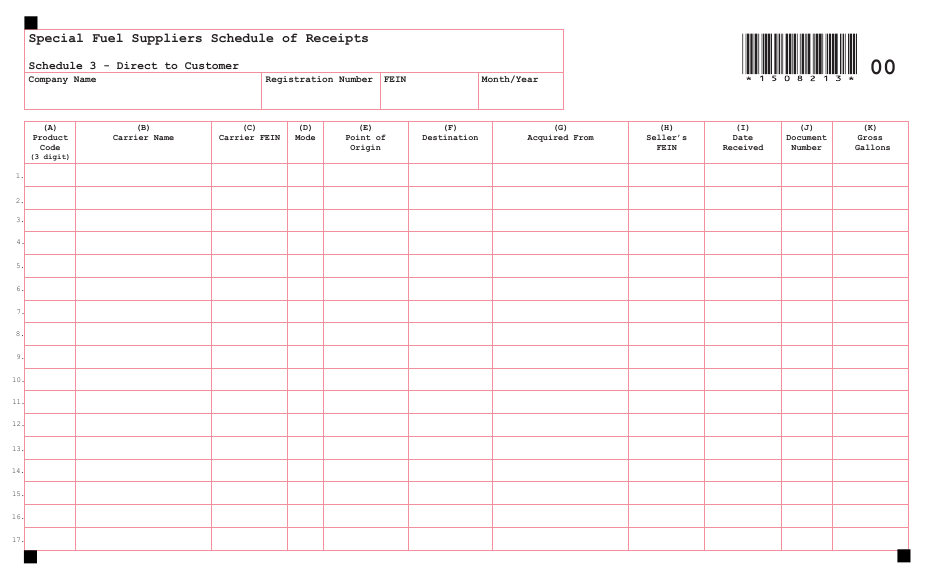

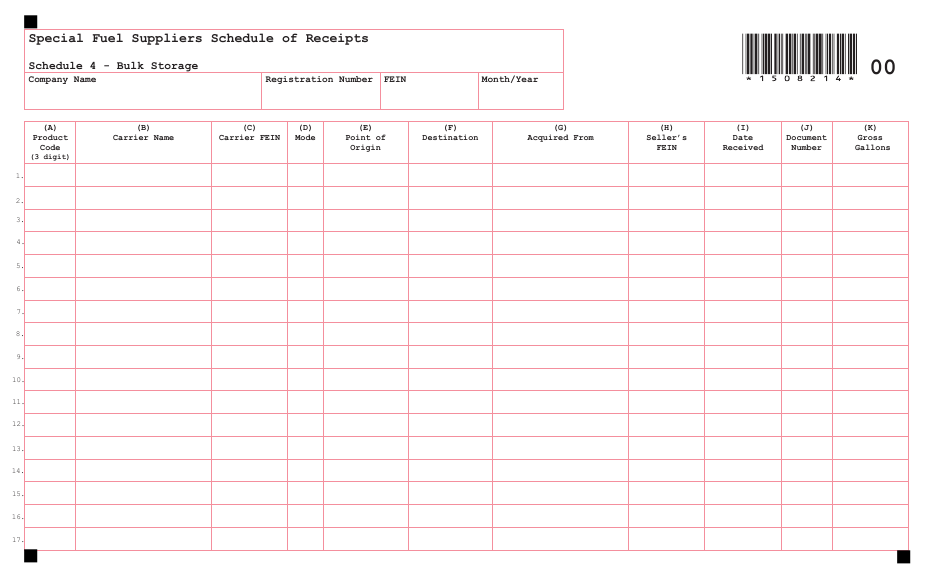

Special Fuel Suppliers Schedule of Disbursements - Schedule 5 - Taxable Sales - Maine

Special Fuel Suppliers Schedule of Disbursements - Schedule 5 - Taxable Sales is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is the Special Fuel Suppliers Schedule?

A: The Special Fuel Suppliers Schedule is a document that outlines the disbursements for taxable sales made by special fuel suppliers.

Q: What is Schedule 5?

A: Schedule 5 is a specific section of the Special Fuel Suppliers Schedule that pertains to taxable sales in Maine.

Q: What are taxable sales?

A: Taxable sales refer to sales of goods or services that are subject to taxation.

Q: Who are special fuel suppliers?

A: Special fuel suppliers are businesses or individuals who sell special fuels, such as diesel or kerosene, for use in motor vehicles or other taxable purposes.

Q: Why is Schedule 5 important?

A: Schedule 5 is important because it provides details on the taxable sales made by special fuel suppliers in Maine, which is relevant for tax purposes and regulatory compliance.

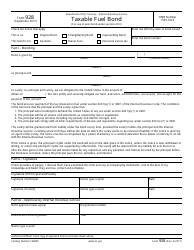

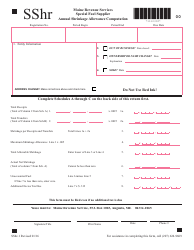

Form Details:

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.