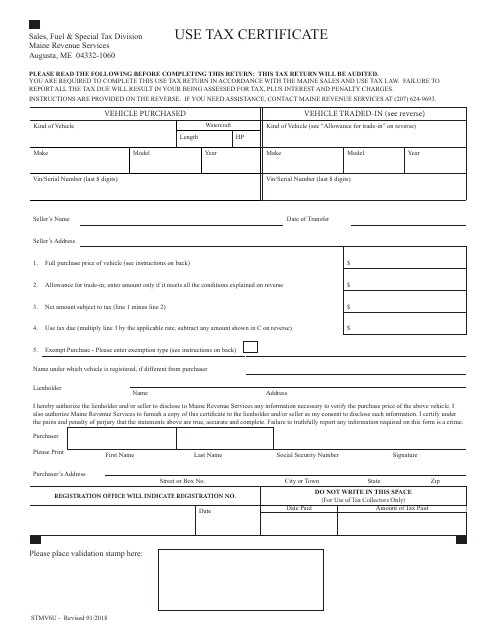

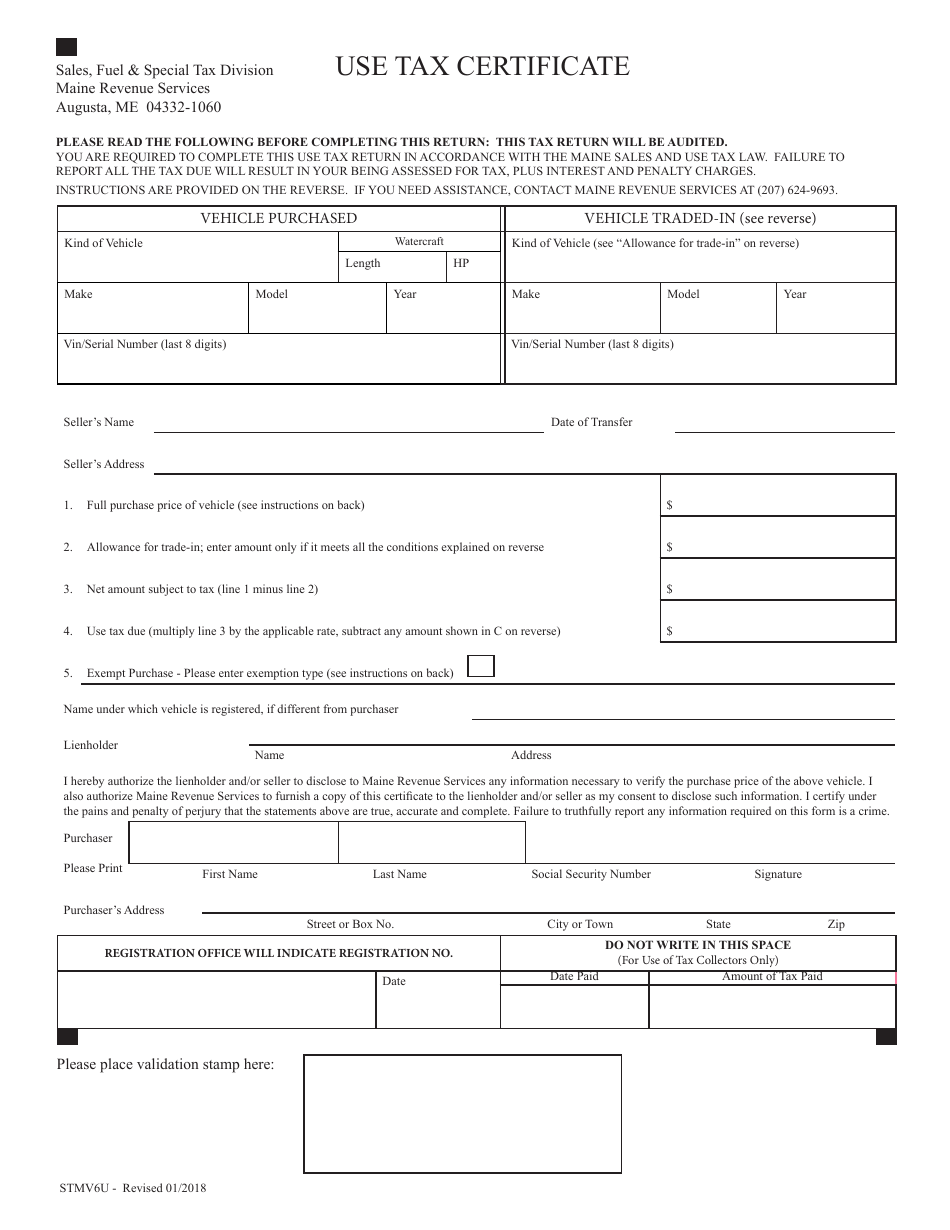

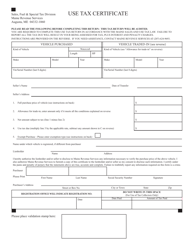

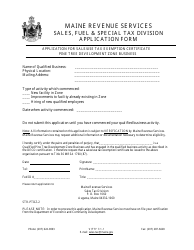

Form STMV6U Use Tax Certificate - Maine

What Is Form STMV6U?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form STMV6U?

A: Form STMV6U is the Use Tax Certificate specific to the state of Maine.

Q: What is Use Tax?

A: Use Tax is a tax imposed on the use, storage, or consumption of goods purchased outside of the state.

Q: When should Form STMV6U be used?

A: Form STMV6U should be used when you have made a purchase from a seller who did not collect sales tax and you are required to report and pay use tax on the purchase.

Q: Who should use Form STMV6U?

A: Any individual or business in Maine who has made purchases without paying sales tax and is required to report and pay use tax should use Form STMV6U.

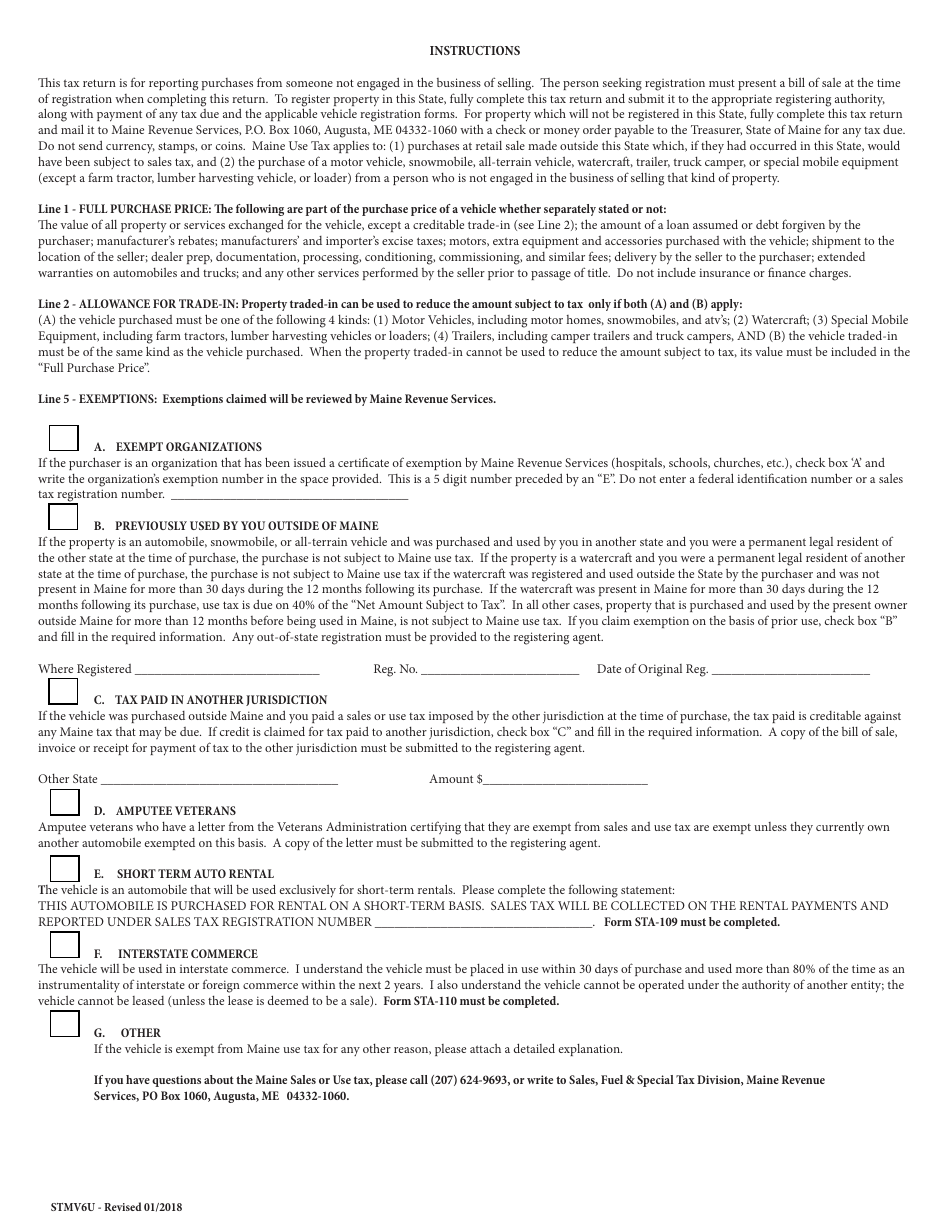

Q: What information is required on Form STMV6U?

A: Form STMV6U requires information such as the purchaser's name and address, description and purchase price of the item, and the amount of use tax owed.

Q: How should Form STMV6U be filed?

A: Form STMV6U should be completed and mailed to the Maine Revenue Services along with the payment for the use tax owed.

Q: Are there any penalties for not filing Form STMV6U?

A: Yes, failing to file Form STMV6U and pay the required use tax may result in penalties and interest being assessed by Maine Revenue Services.

Q: Can I e-file Form STMV6U?

A: As of now, Form STMV6U can only be filed by mail and cannot be e-filed.

Q: Is Form STMV6U only for individuals?

A: No, Form STMV6U can be used by both individuals and businesses in Maine.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STMV6U by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.