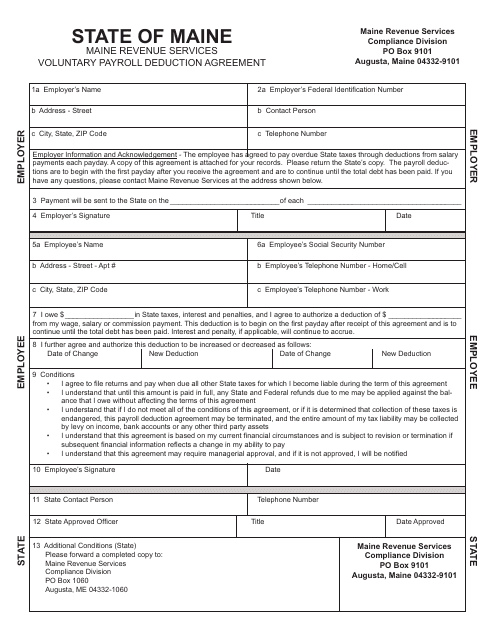

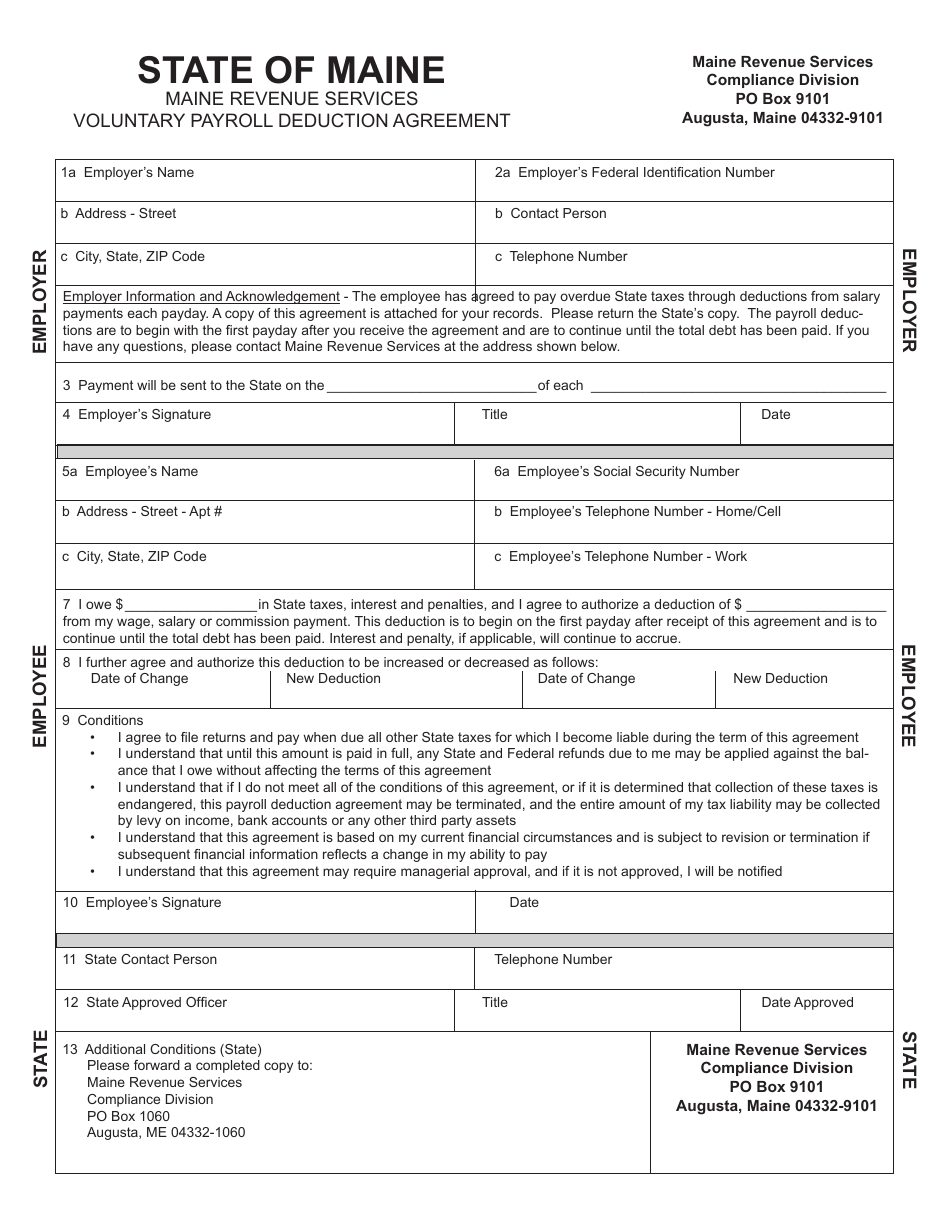

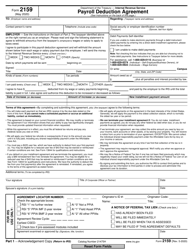

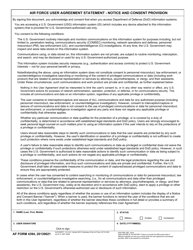

Voluntary Payroll Deduction Agreement Form - Maine

Voluntary Payroll Deduction Agreement Form is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is a Voluntary Payroll Deduction Agreement Form?

A: A Voluntary Payroll Deduction Agreement Form is a document used to authorize deductions from an employee's paycheck for a specific purpose.

Q: Why would someone use a Voluntary Payroll Deduction Agreement Form?

A: Someone may use a Voluntary Payroll Deduction Agreement Form to allow deductions from their paycheck for purposes such as charitable donations or loan repayments.

Q: Is a Voluntary Payroll Deduction Agreement Form mandatory?

A: No, a Voluntary Payroll Deduction Agreement Form is not mandatory. It is a voluntary agreement between the employee and the employer.

Q: How does a Voluntary Payroll Deduction Agreement work?

A: Once the form is completed and submitted to the employer, the agreed-upon deductions will be taken out of the employee's paycheck before it is issued.

Q: Can deductions be stopped or changed after signing a Voluntary Payroll Deduction Agreement Form?

A: Yes, deductions can typically be stopped or changed by submitting a new agreement form to the employer.

Form Details:

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.