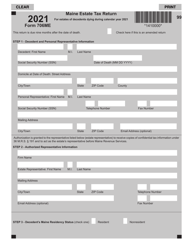

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

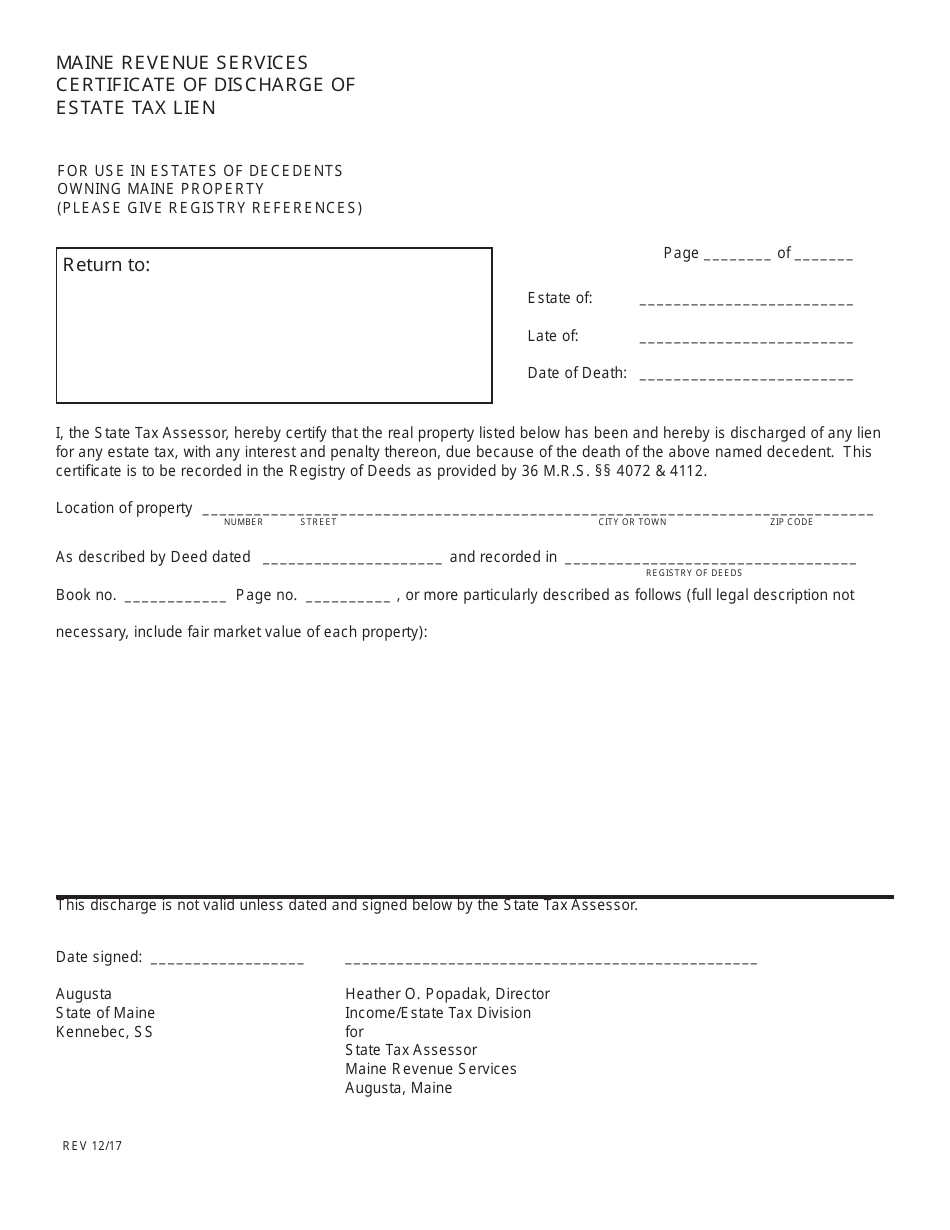

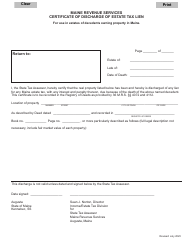

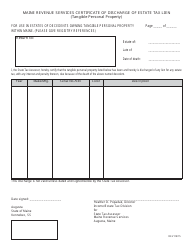

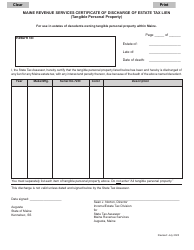

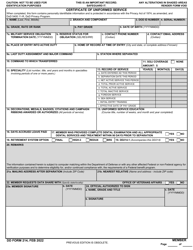

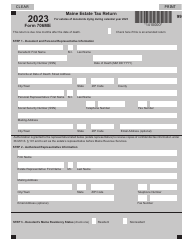

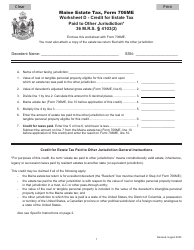

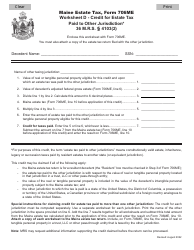

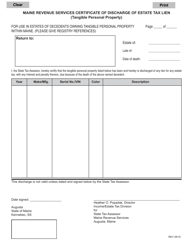

Certificate of Discharge of Estate Tax Lien - Maine

Certificate of Discharge of Estate Tax Lien is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is a Certificate of Discharge of Estate Tax Lien?

A: A Certificate of Discharge of Estate Tax Lien is a legal document issued by the state of Maine that releases a property from a previously filed estate tax lien.

Q: What is an estate tax lien?

A: An estate tax lien is a claim made by the state of Maine against a property to secure payment of any outstanding estate taxes owed.

Q: How can I obtain a Certificate of Discharge of Estate Tax Lien in Maine?

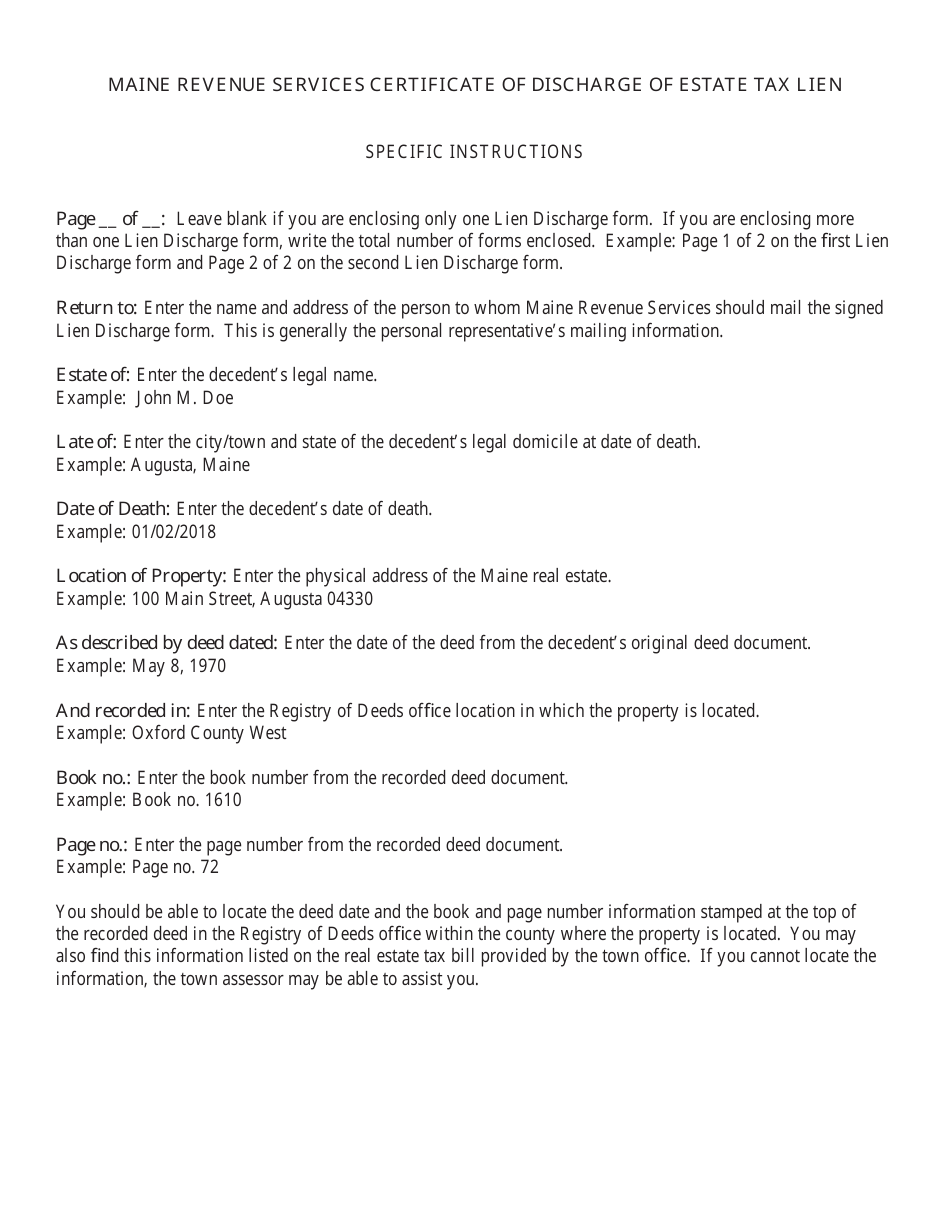

A: To obtain a Certificate of Discharge of Estate Tax Lien in Maine, you need to submit an application to the Maine Revenue Services. The application should include relevant information about the property and payment of any outstanding estate taxes.

Q: What are the requirements for obtaining a Certificate of Discharge of Estate Tax Lien in Maine?

A: The requirements for obtaining a Certificate of Discharge of Estate Tax Lien in Maine may include providing proof of payment of any outstanding estate taxes, submitting a completed application form, and providing accurate information about the property.

Q: What is the purpose of a Certificate of Discharge of Estate Tax Lien?

A: The purpose of a Certificate of Discharge of Estate Tax Lien is to release a property from any previously filed estate tax lien, allowing the property to be transferred or sold without any encumbrances.

Q: How long does it take to receive a Certificate of Discharge of Estate Tax Lien in Maine?

A: The processing time for a Certificate of Discharge of Estate Tax Lien in Maine may vary, but it usually takes a few weeks to receive the certificate.

Q: Can I get a Certificate of Discharge of Estate Tax Lien if I owe outstanding estate taxes?

A: No, you will not be able to obtain a Certificate of Discharge of Estate Tax Lien in Maine if you have outstanding estate taxes. Before applying for the certificate, you must first pay any outstanding estate taxes owed.

Q: What should I do if I have a dispute regarding an estate tax lien in Maine?

A: If you have a dispute regarding an estate tax lien in Maine or believe there is an error in the lien, you should contact the Maine Revenue Services for further assistance and guidance.

Q: How long is a Certificate of Discharge of Estate Tax Lien valid in Maine?

A: A Certificate of Discharge of Estate Tax Lien in Maine is typically valid indefinitely once issued. However, it is always recommended to consult with a legal professional or the Maine Revenue Services to confirm the validity period.

Form Details:

- Released on December 1, 2017;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.