This version of the form is not currently in use and is provided for reference only. Download this version of

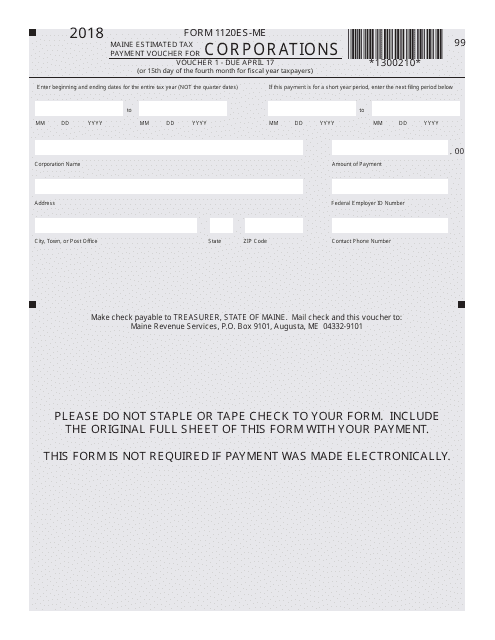

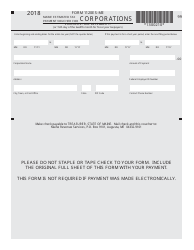

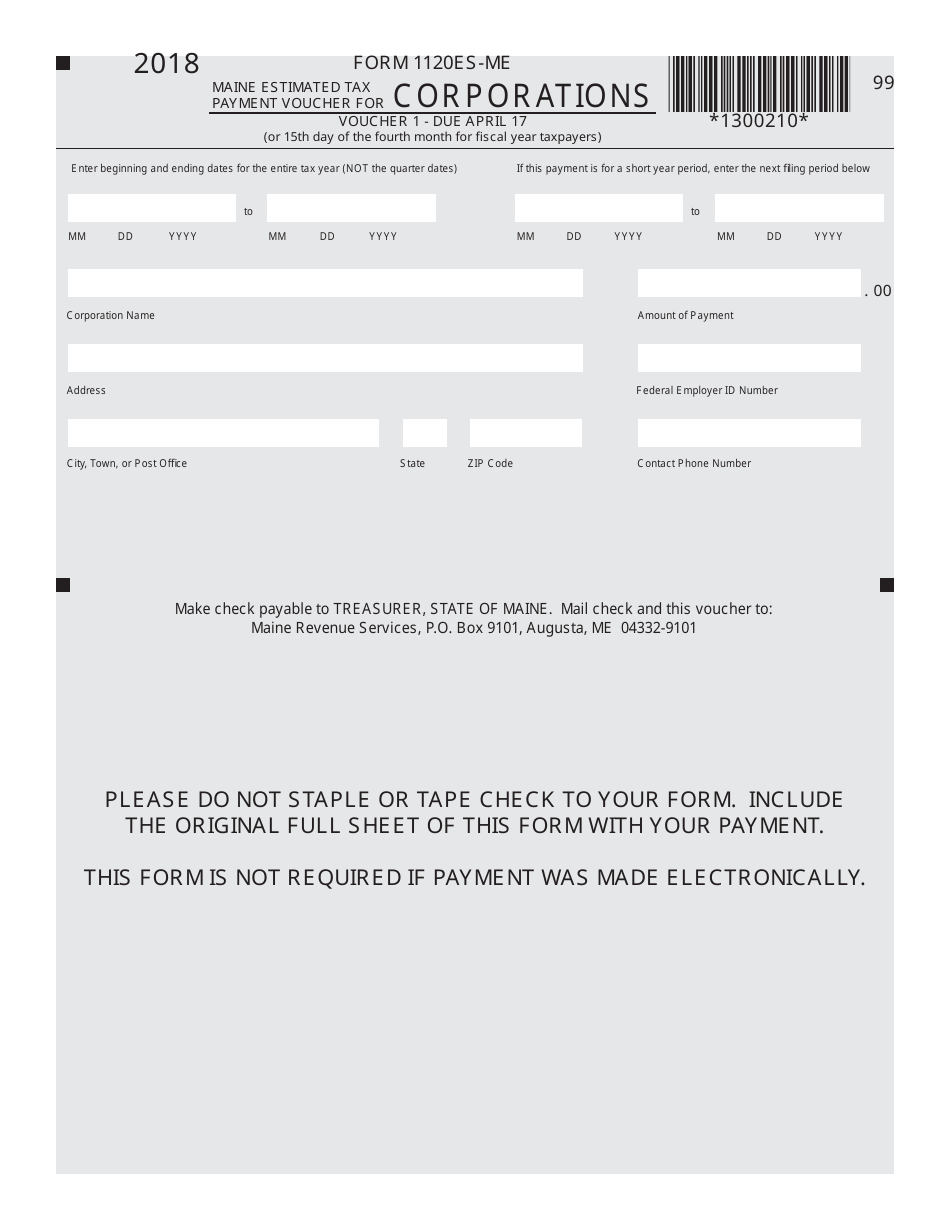

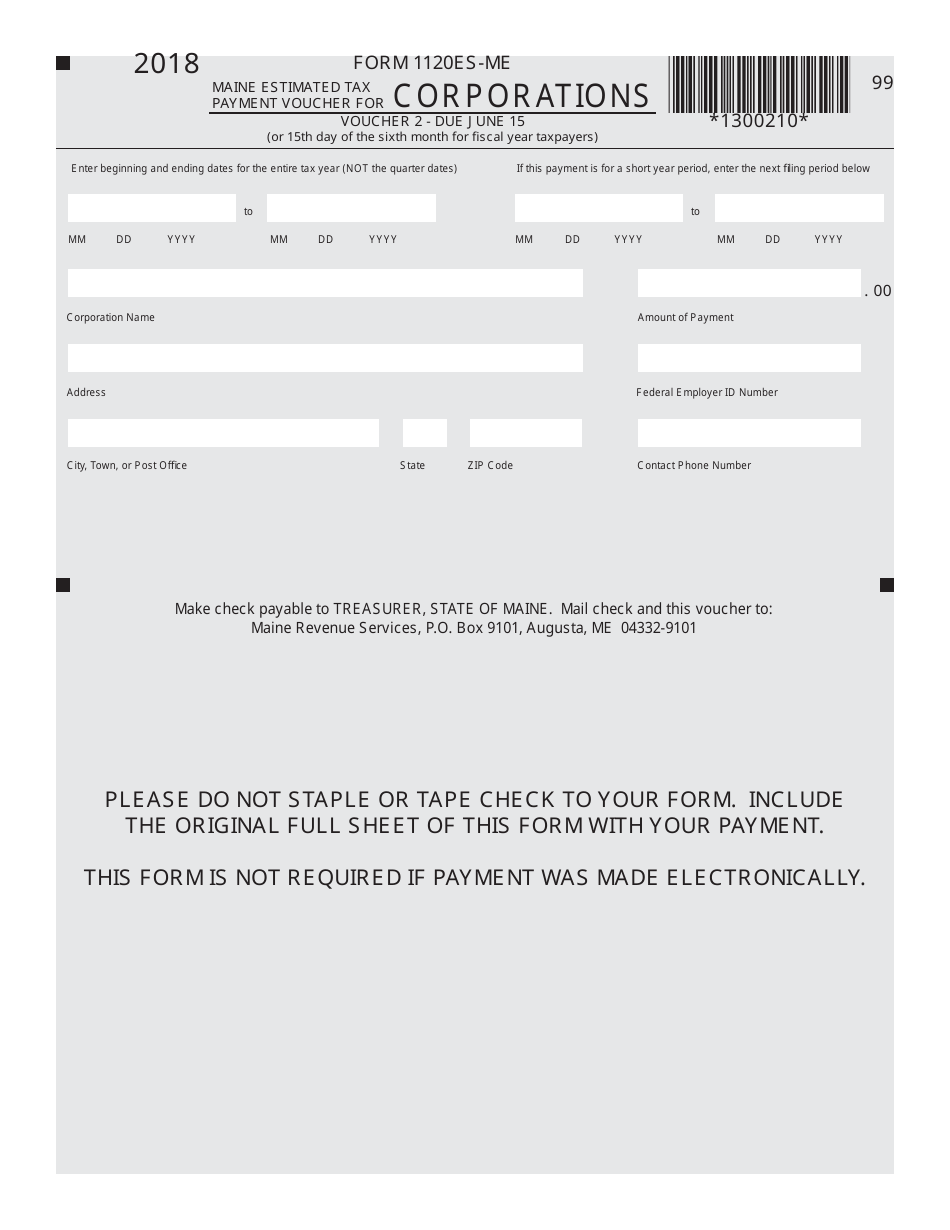

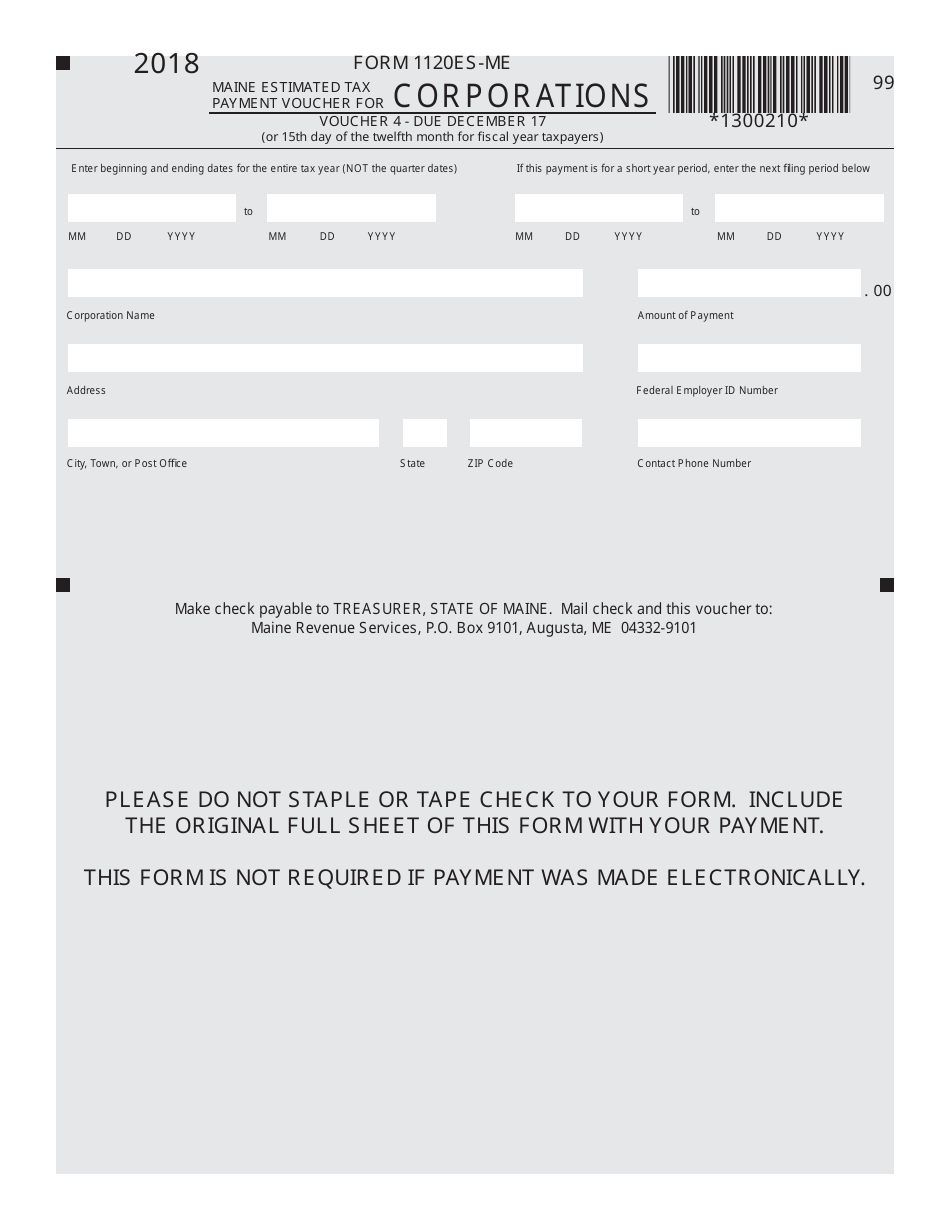

Form 1120ES-ME

for the current year.

Form 1120ES-ME Maine Estimated Tax Payment Voucher for Corporations - Maine

What Is Form 1120ES-ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1120ES-ME?

A: Form 1120ES-ME is a tax payment voucher for corporations in Maine to make estimated tax payments.

Q: Who needs to use Form 1120ES-ME?

A: Corporations in Maine who are required to make estimated tax payments need to use Form 1120ES-ME.

Q: What are estimated tax payments?

A: Estimated tax payments are quarterly payments made by corporations to cover their expected tax liability for the year.

Q: When are estimated tax payments due?

A: Estimated tax payments are due on a quarterly basis. For corporations, the due dates are: April 15, June 15, September 15, and December 15.

Q: How do I fill out Form 1120ES-ME?

A: You will need to provide your corporation's information, estimated tax amounts, and payment details on the form.

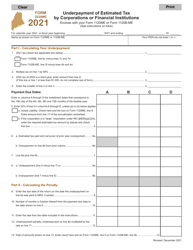

Q: What happens if I don't make estimated tax payments?

A: If you don't make estimated tax payments or underpay, you may be subject to penalties and interest charges.

Q: Is Form 1120ES-ME only for businesses in Maine?

A: Yes, Form 1120ES-ME is specifically for corporations operating in Maine.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1120ES-ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.