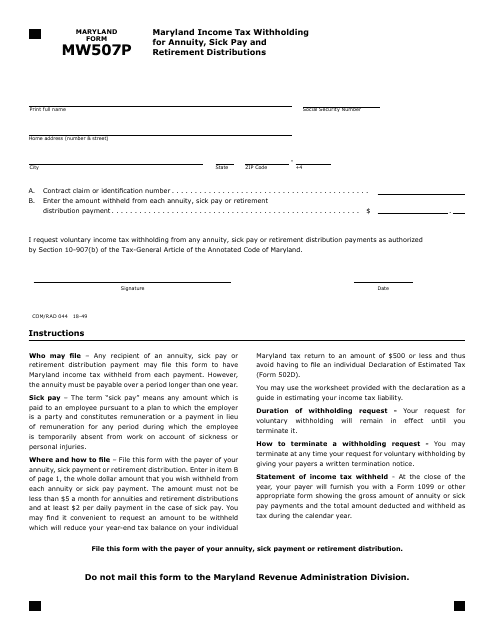

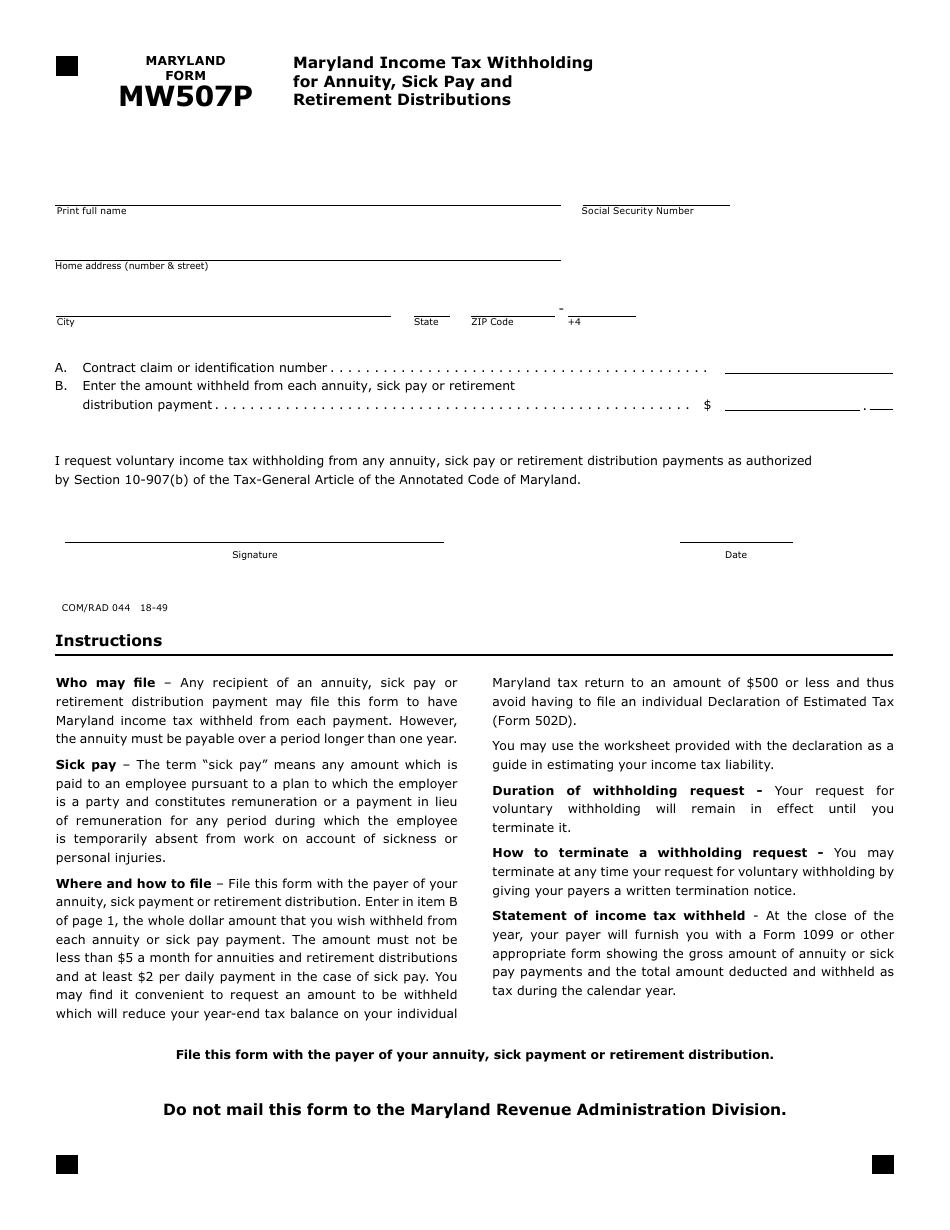

Form MW507P Maryland Income Tax Withholding for Annuity, Sick Pay and Retirement Distributions - Maryland

What Is Form MW507P?

This is a legal form that was released by the Comptroller of Maryland - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MW507P?

A: Form MW507P is a form used for Maryland income tax withholding for annuity, sick pay, and retirement distributions.

Q: Who needs to use Form MW507P?

A: Individuals who receive annuity payments, sick pay, or retirement distributions and want to have Maryland income tax withheld need to use Form MW507P.

Q: Why would someone want to have Maryland income tax withheld?

A: Having Maryland income tax withheld can help individuals meet their tax obligations and avoid owing a large sum at tax time.

Q: How do I fill out Form MW507P?

A: Form MW507P requires the individual to provide personal information, such as name, address, and Social Security number, as well as the amount to be withheld for Maryland income tax.

Q: When should Form MW507P be submitted?

A: Form MW507P should be submitted as soon as possible after receiving annuity payments, sick pay, or retirement distributions, in order to ensure proper withholding of Maryland income tax.

Form Details:

- The latest edition provided by the Comptroller of Maryland;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MW507P by clicking the link below or browse more documents and templates provided by the Comptroller of Maryland.