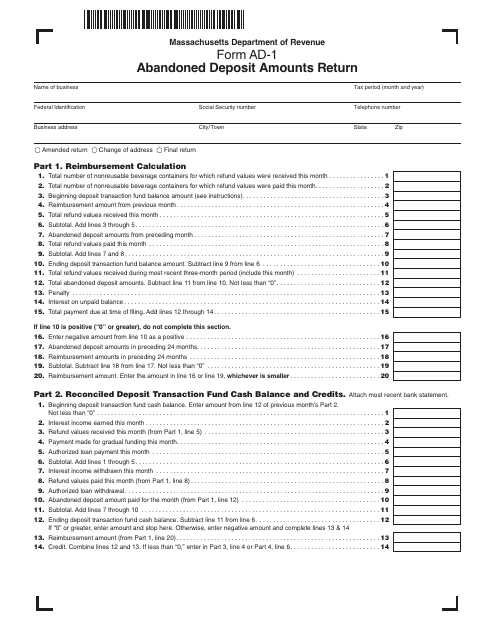

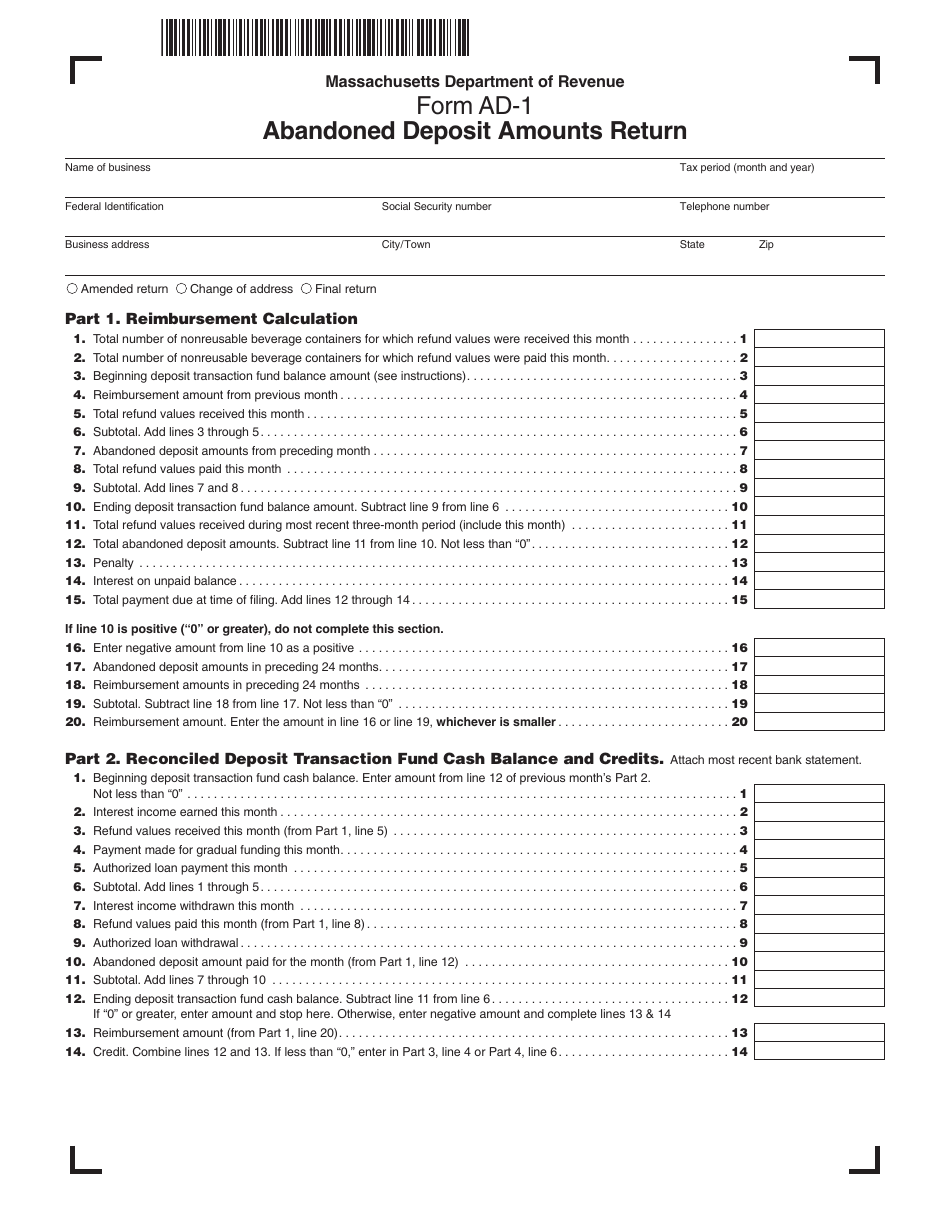

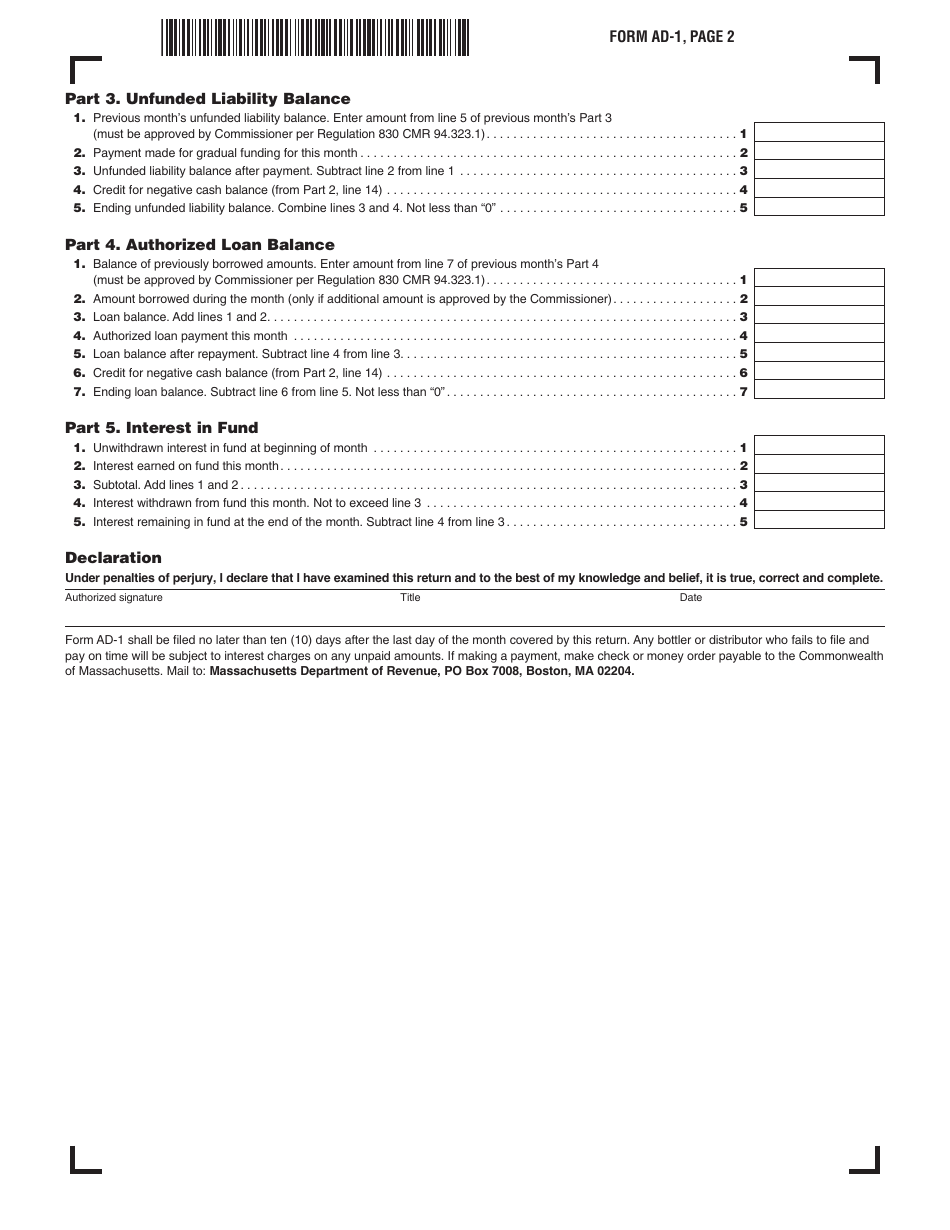

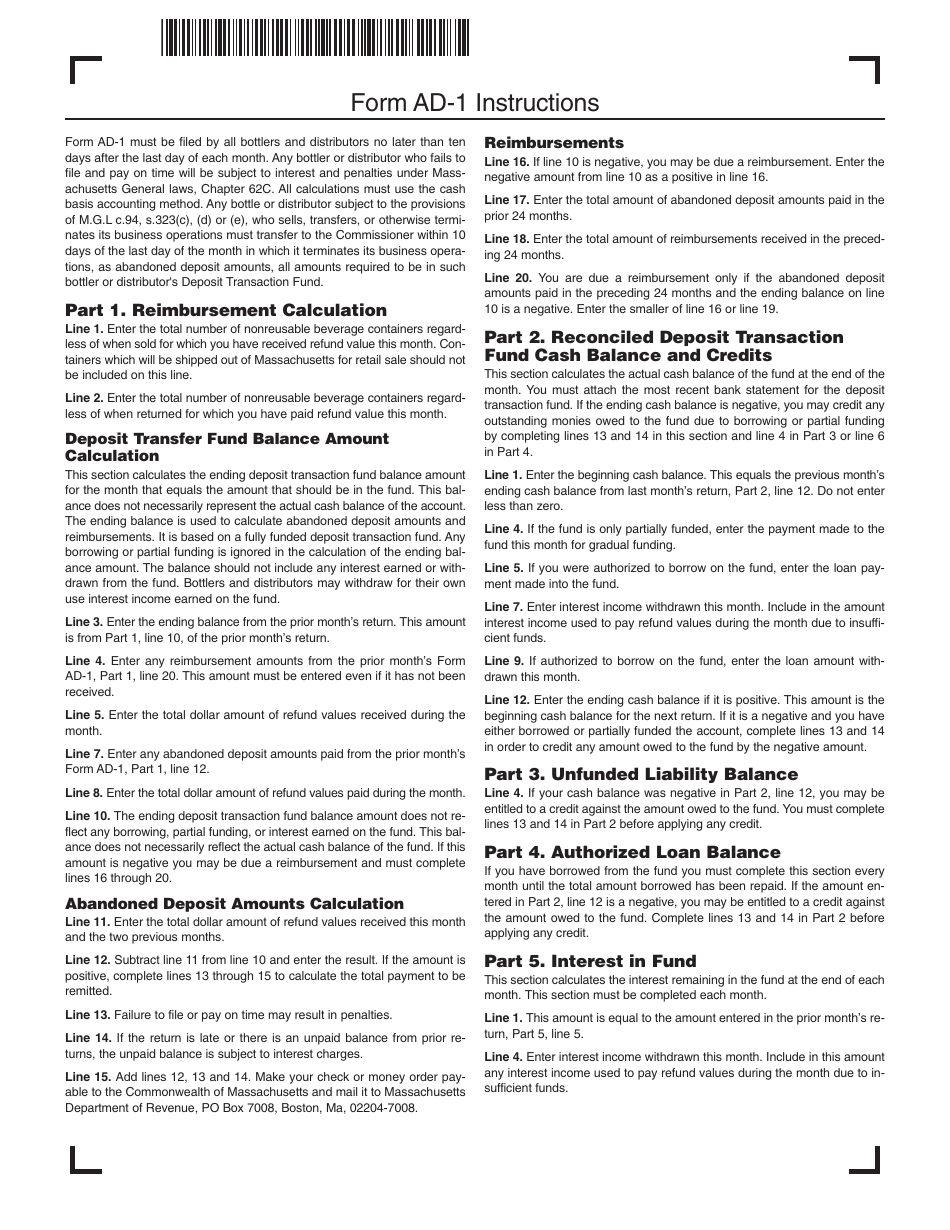

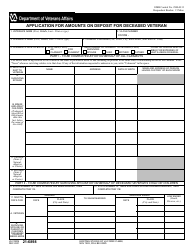

Form AD-1 Abandoned Deposit Amounts Return - Massachusetts

What Is Form AD-1?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AD-1 Abandoned Deposit Amounts Return?

A: Form AD-1 Abandoned Deposit Amounts Return is a form used in Massachusetts to report and remit abandoned deposit amounts.

Q: Who needs to file Form AD-1 Abandoned Deposit Amounts Return?

A: Any person or business in Massachusetts that holds abandoned deposit amounts must file Form AD-1.

Q: What are abandoned deposit amounts?

A: Abandoned deposit amounts are deposits that have been unclaimed for a certain period of time, usually in relation to bottle and can deposits.

Q: When is Form AD-1 Abandoned Deposit Amounts Return due?

A: Form AD-1 must be filed and remitted by May 1st of each year, or within 30 days after the business discontinues or changes ownership.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AD-1 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.