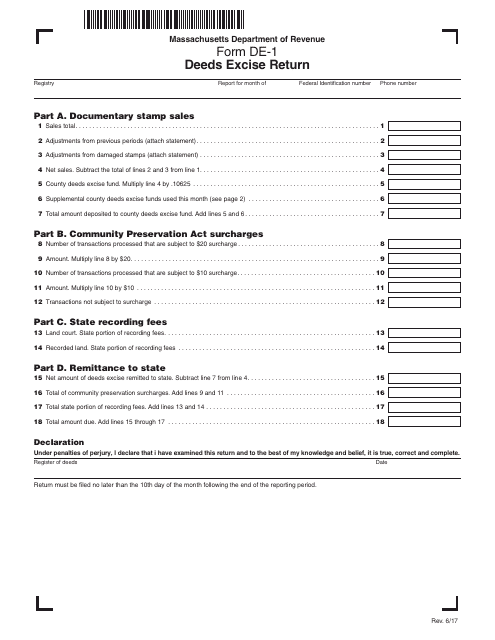

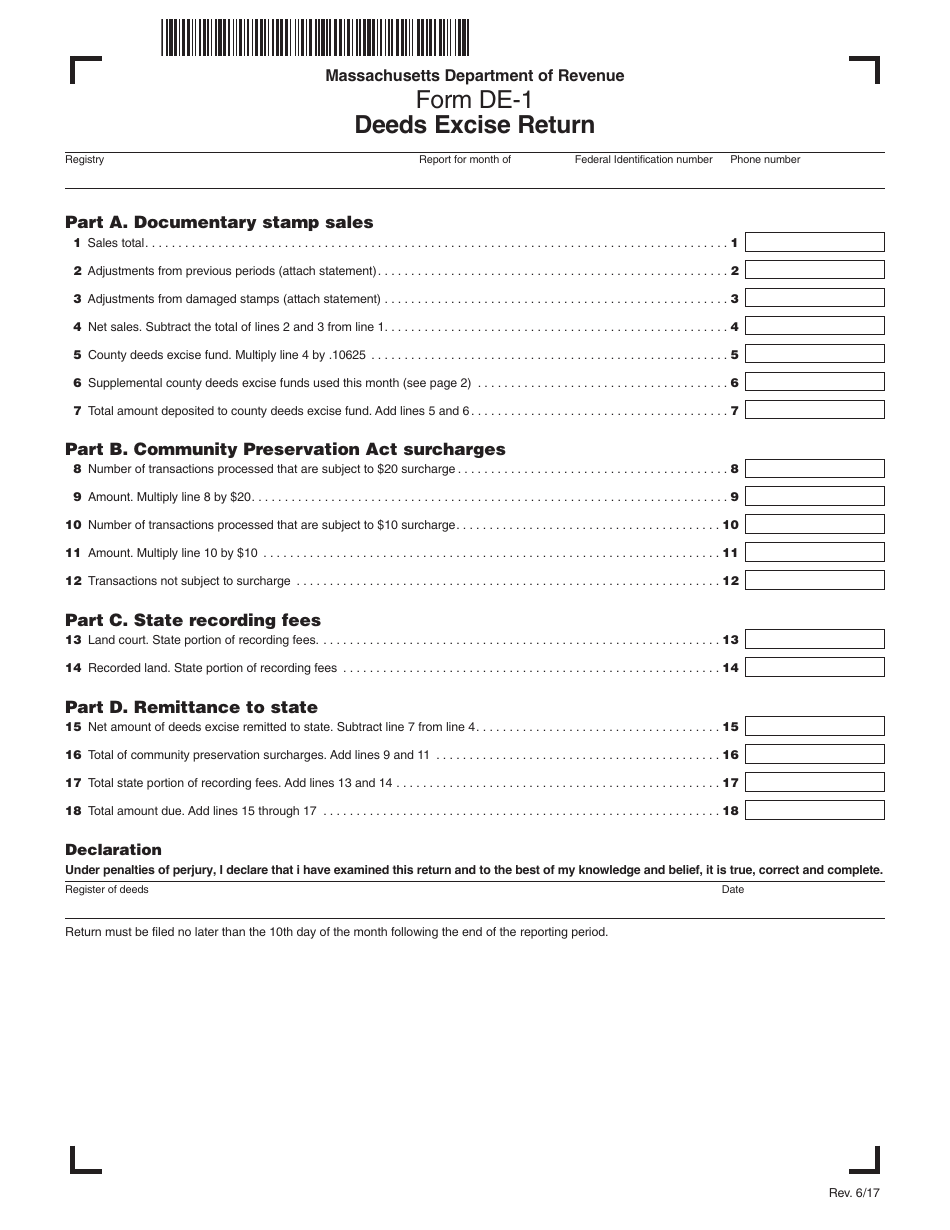

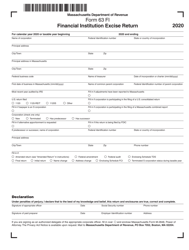

Form DE-1 Deeds Excise Return - Massachusetts

What Is Form DE-1?

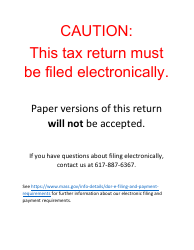

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DE-1?

A: Form DE-1 is the Deeds Excise Return form.

Q: Who needs to file Form DE-1?

A: Anyone who transfers real estate property in Massachusetts needs to file Form DE-1.

Q: What is the purpose of Form DE-1?

A: Form DE-1 is used to report and pay the Deeds Excise tax on real estate transfers in Massachusetts.

Q: When is Form DE-1 due?

A: Form DE-1 is generally due within 10 days of the transfer of the property.

Q: What happens if I don't file Form DE-1?

A: Failure to file Form DE-1 or pay the Deeds Excise tax may result in penalties and interest being assessed.

Q: Is there a fee for filing Form DE-1?

A: Yes, there is a fee for filing Form DE-1. The fee is based on the value of the property being transferred.

Q: Are there any exemptions to the Deeds Excise tax?

A: Yes, there are certain exemptions available, such as transfers to government entities or transfers between spouses.

Q: What supporting documents do I need to include with Form DE-1?

A: You may need to include a copy of the deed or other relevant documents with Form DE-1.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DE-1 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.