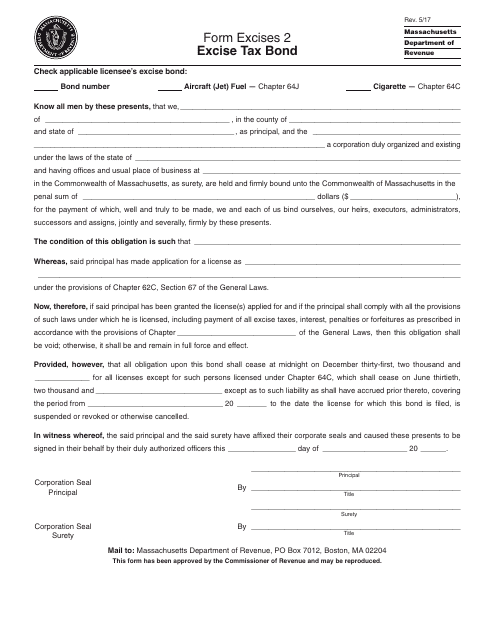

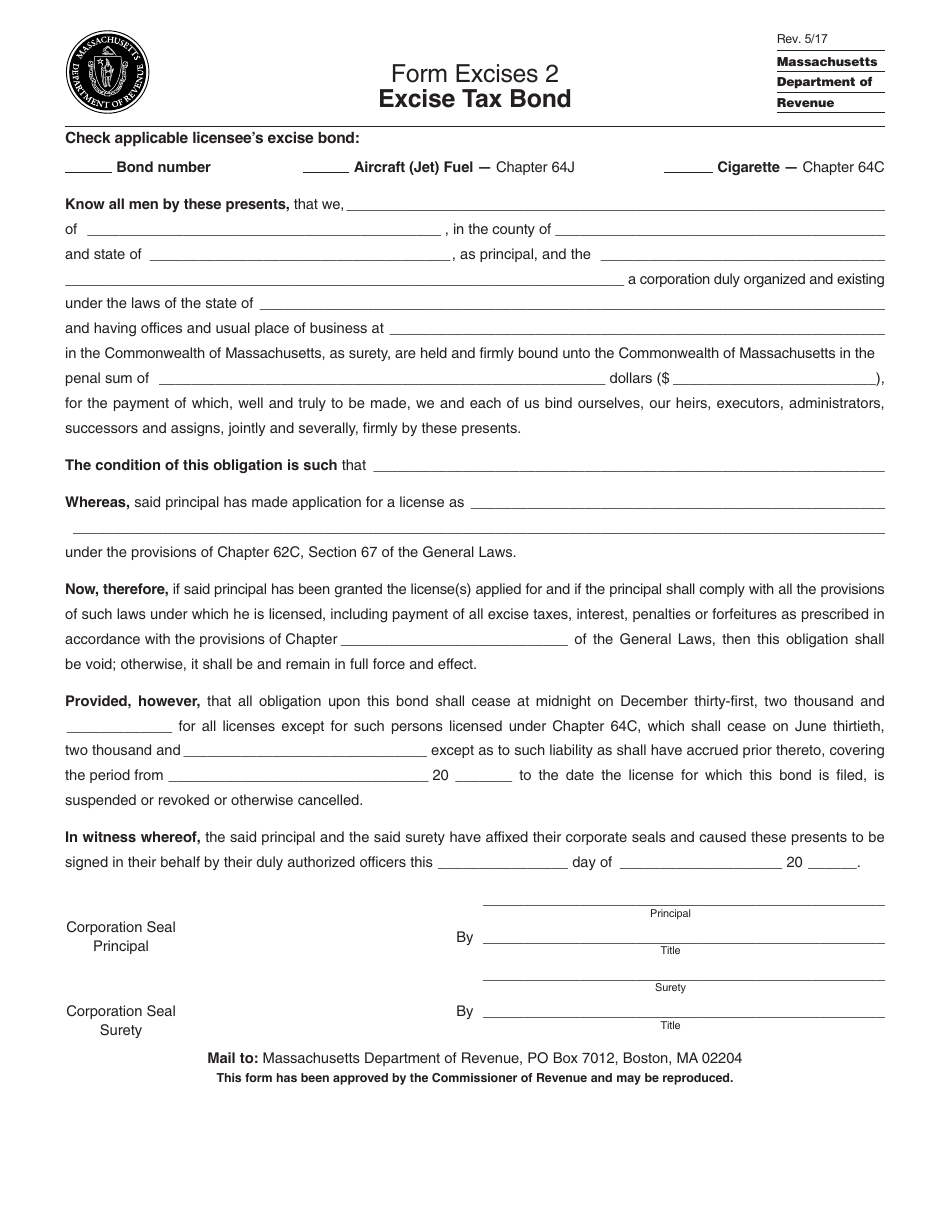

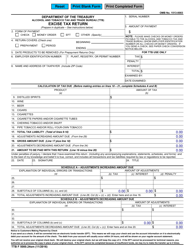

Form Excises2 Excise Tax Bond - Massachusetts

What Is Form Excises2?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

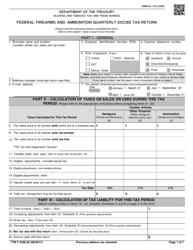

Q: What is an excise tax bond?

A: An excise tax bond is a type of surety bond that guarantees payment of excise taxes by businesses to the government.

Q: Who needs an excise tax bond in Massachusetts?

A: Businesses that are required to pay excise taxes in Massachusetts may need an excise tax bond.

Q: Why do I need an excise tax bond?

A: An excise tax bond is needed to provide financial assurance to the government that businesses will fulfill their tax obligations.

Q: How much does an excise tax bond cost?

A: The cost of an excise tax bond can vary depending on factors such as the tax amount and the business's creditworthiness.

Q: How long does an excise tax bond last?

A: An excise tax bond typically remains in effect until it is cancelled or terminated by the surety company or the government.

Q: What happens if I don't have an excise tax bond?

A: If you're required to have an excise tax bond and fail to obtain one, you may face fines, penalties, or legal consequences.

Q: Can I cancel an excise tax bond?

A: Yes, an excise tax bond can be cancelled. However, the surety company may require advanced notice and may still be liable for claims that occurred during the bond period.

Q: Can I get an excise tax bond with bad credit?

A: Getting an excise tax bond with bad credit may be more challenging, but it's still possible. Some surety companies specialize in providing bonds for applicants with lower credit scores.

Q: Can I renew an excise tax bond?

A: Yes, an excise tax bond can usually be renewed before it expires to ensure continuous coverage.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form Excises2 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.